Kuroto Fund, L.P. - Q4 2014 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Kuroto Fund decreased by -7.3% in the fourth quarter of 2014 and by -7.1% for the full year. By comparison, the MSCI Asia Pacific Index was down -1.4% in the fourth quarter and was up +0.5% for the year. The MSCI Emerging Markets Index fell -4.4% in the fourth quarter and was down -2.0% for the year.[1]

Overall, the losses in the portfolio accelerated meaningfully in the last two months of the year as oil prices collapsed and the U.S. dollar strengthened. Falling oil prices renewed the risk-off sentiment that negatively impacts emerging markets’ stock prices in the short term. It’s worth noting, though, that the overwhelming majority of Kuroto’s investments reside in countries that are net importers of oil. As such, should oil prices remain below previous levels, these countries will experience improved current accounts and lower inflation rates, which should benefit our companies over the longer term. We discussed the strength of the U.S. dollar in the previous letter and it continued to impact the portfolio in Q4. Early this year, we elected to hedge certain currencies where we didn’t have a strong view and the cost wasn’t prohibitive.

As we discussed in the previous letter, two investments in particular were material detractors from the fund’s performance. One of the holdings, a marketing services company, derives just over half of its revenue from Russia, a country we’ve generally avoided investing in given our preference for benign macro and political environments. However, we believed the strength of the business, its management, and its growth opportunity combined with an already discounted valuation made the investment attractive despite its exposure to Russia. Unfortunately, the situation in Russia deteriorated more dramatically than we had initially expected it to, something which was further compounded by the decline in the oil price. We continue to think the positives of the investment outweigh the negatives of Russia. It’s worth noting that the company’s non-Russian business continues to perform well, and the company is selling for a not-unreasonable multiple of those non-Russian earnings. That being said, we continue to see plenty of value in the Russia business. The position is currently just over 3% of partners’ capital.

The other investment, a provider of temporary power, was hit by a combination of negative events including management turnover, the loss of its largest contract and the failure to win material new business. We had estimated our downside for the investment to be the company’s asset value considering the nature of its business. It now sells for a material discount to that figure. While we think the market has overreacted given the extent of the decline, we certainly overestimated the company’s ability to consistently win new business, and thus, earn an adequate return on its assets. We now consider it to be a good investment given its large discount to very real, saleable assets. Unfortunately, it had to decline dramatically in price to reach this attractiveness. In this case, we clearly failed to do what we do best: accurately estimate a company’s intrinsic value and assess its ability to generate high returns on capital on a consistent basis. The position is presently 5% of partners’ capital due to additional purchases followed by a recent increase in the stock price.

The largest single contributor to our decline on the year was from the fund’s ownership of Japanese government bond interest rate swaps. The position cost the fund 4.4% of partners’ capital on the year. The fund’s long-standing investment in these swaps was based on Japan’s over-indebtedness, fiscal deficits, and more recently, its inflation-targeting monetary policies, all of which, in the long run, are in tension with its very low interest rates. So far, Bank of Japan Governor Haruhiko Kuroda has been willing to let the yen depreciate significantly while keeping interest rates low in an attempt to reach the BoJ’s 2% inflation target. With its second round of stimulus announced last Halloween, the BoJ is now buying more than 100% of some tenors of the incremental issuances of government bonds.[2] The increased asset purchases are also targeting more longer-dated government bonds than the initial program. This has led to a decline in yield for the 30-year bond from 1.6% at the end of October to roughly 1.4% presently (with intervening rates below 1.1%, a rate not seen since the lows of 2003). Kuroto exited this position in November. While we remain skeptical about the sustainability of these policies and still believe the country’s ultra-low interest rates fail to reflect its underlying fundamentals, we will search for shorts that are more aligned with the fund’s expanded mandate.

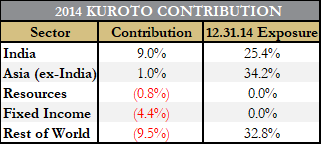

The fund had positive performance in its Asian investments. India contributed 9.0% to partners’ capital for the year, and the fund’s other investments in Asia contributed 1.0%.

In the fourth quarter, we bought one new position in a Filipino consumer company which we have followed for some time. In addition, we added to several positions during the market sell-off in the quarter, particularly a holding in Vietnam, as well as Aramex, which is detailed in our top-five discussion below.

Top-Five Holdings

As a means of better illustrating our investment process to our partners, we disclose the fund’s top-five companies as of yearend. Since initiating this process in the Q2 2014 letter, three of the fund’s top-five positions have changed. This is due to the new opportunities available to the fund as Kuroto transitions from an Asia-only mandate to a global emerging markets mandate as well as a few company-specific issues. As noted at the time, we exited the fund’s holding in Goodpack as it was in the process of being taken private by KKR—a deal which has since been completed. In addition, we exited the fund’s holdings in Orica. While Orica successfully implemented its planned cost efficiencies and is trying to sell more value-added services, the weakness in the markets for coal and iron ore have forced it to pass on those benefits to their customers, thereby making it a less attractive investment. We also trimmed LG Household & Health preferred shares. The increase in valuation combined with the negative impact on earnings growth from the company’s non-cosmetics businesses have resulted in this being a less compelling investment.

Aramex

Aramex is a domestic and international express delivery company similar to FedEx or DHL. The company was co-founded in 1982 by Fadi Ghandour as a Middle Eastern wholesaler, focused on last-mile delivery for global companies like FedEx that didn’t operate in the region. The company’s reputable brand combined with the “network effect” inherent in its industry form a particularly durable barrier to entry. Aramex further differentiates itself through its ability to operate efficiently in the Middle East, its entrepreneurial culture, and its variable cost structure.

Aramex’s strong market share in its geographies constitutes a meaningful competitive advantage as the same basic cost structure is required to deliver one package or a thousand packages. This dynamic is best characterized as a classic “network effect.” The company’s well-known brand is also an essential component of its continued success as shipments are often time-sensitive, high-priority items.

The Middle East’s various geopolitical and cultural issues create an additional barrier to entry for outsiders. Aramex is also a local company with local personnel. So it is better equipped to navigate the region’s issues. In addition, the Middle East is a geographically advantaged region. Positioned between Asia and Europe as well as Asia and Africa, a lot of trade destined for other places flows through the region and, thus, through Aramex.

We also believe the company has a further growth opportunity in e-commerce. Internet access and, consequently, e-commerce are just now taking off in this region of the world. As this happens, Aramex will be delivering more and more online purchases to people’s homes.

Aramex’s entrepreneurial culture and its flexible business model are further advantages. Local Aramex managers have a great deal of autonomy and a strong incentive to best serve their customers. As opposed to most of its global competitors, Aramex has a variable cost structure. For instance, it doesn’t own planes but instead contracts “belly” space from the airlines. The variable cost structure allows the company’s margins to expand when capacity usage is weak. It also allows Aramex to be loyal to its customers, not to its assets or infrastructure.

Finally, the company has a talented management team that is focused not only on preserving Aramex’s entrepreneurial culture and taking advantage of its growth opportunities but also on thoughtfully allocating capital. Management carefully weighs the tradeoffs between reinvesting in the business, making acquisitions, and returning capital to shareholders. With its high return on equity and discounted valuation of 12.1x estimated 2015 earnings, Aramex is emblematic of the high-quality, undervalued operating businesses that we seek to own in Kuroto.[4]

Concepcion Industrial Corporation

Concepcion Industrial Corporation (CIC) manufactures and sells air conditioning, refrigeration and elevator products in the Philippines. More specifically, the company has joint ventures with United Technologies for the Carrier air conditioning and the Otis elevator businesses in the Philippines. Air conditioning is the company’s primary business; it was established in 1962 when the Concepcion family became a Carrier licensee. The company’s first-mover advantage in its air conditioning business allowed it to develop a strong brand and service network. We believe those attributes represent barriers to entry, which will allow CIC to capitalize on the growth potential in the country.

Carrier’s dominant market share in the Philippines is in part a result of its strong brand. The company was the first air conditioning brand in the Philippines and has been operating there for over 50 years. Throughout the country’s tumultuous history, many other brands have entered and exited the market but Carrier has been a consistent player over time. This has built up brand loyalty amongst Filipino consumers and allowed Carrier to charge a premium price for its products. Brand also matters in the country because air conditioning is a large investment relative to disposable income and it’s used intensely throughout the year given the hot climate. As such, brands with a reputation for reliability and quality matter. Carrier is CIC’s premium air conditioning brand and the majority of its air conditioning business. It also has the Kelvinator, Toshiba and Condura brands to compete at lower price points.

In addition to its brand advantage, CIC’s differentiation is furthered by its extensive installation and service network. It has over 2,000 technicians, partnerships with 170 installer companies, 130 service centers and 8 dedicated parts stores[5]. Although service is outsourced, the personnel are exclusive to CIC and branded with the Carrier logo. Air conditioning is something that’s difficult to go without once you have it, especially in a country with temperatures as warm as the Philippines. As such, the ability to get a unit repaired and serviced is critical to customers.

CIC has strong growth potential given the low penetration of air conditioning in a country where it could arguably be called a basic necessity. In addition, CIC has further growth opportunities in refrigeration and elevators, which are also underpenetrated in the Philippines. Management aims to double the company’s earnings from 2014 to 2016 and it currently trades at 16x its 2015 estimated earnings[6]. We are also excited about the company’s relationship with United Technologies. Finally, management is quite strong in not only managing the current business but also positioning it for the future.

Ferreycorp

Ferreycorp, Caterpillar’s exclusive dealer in Peru since 1942, dominates the Peruvian market for mining and construction equipment. The company’s early entry into Peru and its adherence to the Caterpillar business model have led the company to develop a strong service network. We believe this network represents a sustainable competitive advantage which will allow Ferreycorp to profit from Peru’s high, long-term growth.

Parts and service availability is critical in the mining and construction industries. Maximizing “uptime” is important to profitability since a single broken part can potentially shutter an entire operation. To this end, Ferreycorp has developed an unparalleled service network in Peru.

Ferrycorp’s service dominance is in large part due to its over 70 years of continuous operation in Peru. Its competitors, by comparison, have only been present in the country for a decade or two. As such, Ferreycorp’s service locations and personnel dwarf its closest competitor, Komatsu, and create a particularly strong advantage for the company in the more mountainous parts of Peru. Additionally, the company’s service network makes customers more likely to buy new equipment from Ferreycorp.

The company’s emphasis on service and parts availability follows Caterpillar’s “Seed, Grow, Harvest” business model: plant seeds by selling new equipment; grow the business by developing strong customer relationships; and harvest the profits by replacing parts and performing repairs. The resulting focus on service not only creates customer loyalty but also drives much of the company’s profitability. Parts and service invariably have much higher profitability than a new machine sale. These higher margins also provide insulation from the cyclicality typically associated with selling capital equipment and help generate the high-teens returns on capital necessary to fund the company’s long-term growth.

Ferreycorp clearly benefits from Caterpillar’s “partnership” approach to its distributors as well. Caterpillar recognizes that it benefits from having successful dealers. This enables Ferreycorp to earn high enough returns on capital to further invest in its business which generates more sales for both companies.

We also believe the company has a strong growth opportunity. Peru has 13% of the world’s copper reserves and is one of the lowest cost producers, which should insulate it from the recent weakness in the copper price.[7] After two years of subpar mining investment, Peru is expected to nearly double its copper production over the next four years, which should result in meaningful new order growth for Ferreycorp.[8] Despite the aforementioned advantages and growth opportunity, Ferreycorp sells for just 7x 2015 estimated earnings.[9]

HDFC[10]

HDFC was founded in 1977 with the explicit purpose of enabling homeownership among Indian households, and singlehandedly brought the mortgage to India. Now, almost 40 years later, while the mortgage is no longer a novel concept in India, the market is still very underpenetrated with mortgages only constituting 9% of GDP. This has allowed HDFC to grow its loan book at 20% annually, a rate which should continue into the foreseeable future.

HDFC is uniquely positioned to not only grow its loan book quickly but do so very profitably – with returns on equity in excess of 20%. As a non-bank finance company with an AAA credit rating, HDFC’s term funding has a similar cost to banks, yet it has much lower operating costs than a bank because its branches are specifically targeted towards mortgage lending. HDFC’s assets per employee have quadrupled over the past 15 years, which evidences the efficiency of its branch network. This efficiency has caused the company’s cost-to-income ratio to almost halve, to an extremely low rate of 7.9%. At the same time, HDFC maintains a tight control on risk. Cumulative losses-to-disbursements are only 4 basis points. In addition to its mortgage lending business, HDFC also provides corporate and developer lending, a business which has proven difficult for its competitors. All of these factors combine to allow HDFC to generate high returns on capital while offering a reasonable and competitive offering to its customers.

HDFC has also diversified its business by sponsoring a bank in 1994, which is now one of the most profitable and well-regarded franchises in India. Separately, its stake in HDFC Standard Life, into which it has contributed 14.4 billion rupees since its founding in 2000, is now worth roughly 10 times the company’s initial investment.[11] Other ventures, including general insurance and asset management, have been similarly successful.

HDFC is currently trading at 14.5x our estimate of the parent company’s March 2016 earnings. We are comfortable maintaining this as a large position at these valuation levels given the combination of the company’s quality and long-term growth prospects.

Larsen & Toubro

Larsen & Toubro (L&T) is an engineering, procurement and construction (EPC) firm based in India. The company can design and build everything from power plants to toll roads to ports and even nuclear submarines. L&T is differentiated through its culture, reputation and vertical integration. These attributes allow the company to have superior project execution and, therefore, should enable it to capitalize on the sizable infrastructure development opportunity within India.

Two Danish engineers founded L&T in the 1930s. As such, it has always been professionally managed, something which is unique among Indian corporations, which are typically family owned and operated. Professional management has allowed L&T to attract high-quality talent in what is very much a people business. Unlike most companies in India, a young engineer can join the company after graduating from college and potentially one day become its CEO. L&T’s professionalization has also enabled it to develop a strong corporate culture that emphasizes quality and honesty. All of this matters in an industry where completing a project on-time and at-cost is a customer’s key objective. India is a difficult place to do business and customers are often willing to pay a premium for L&T services.

The company is further able to differentiate itself through its vertical integration. Unlike most EPC businesses, L&T manufactures, constructs, and installs a lot of what it designs. India does not have a well-developed supplier base and labor is difficult to manage in the country. The company does a lot of manufacturing and fabrication, making things such as boilers, turbines and power equipment. As an example, L&T has nearly 55,000 employees while Samsung Engineering—a similar-sized company—has just 8,500.[12] The company has said that most EPC companies outsource a majority of a project while L&T insources most of it. Being vertically integrated again allows L&T to finish projects on-time and at-cost, thus enabling it to have superior execution versus its competitors.

The company’s exceptional management team has also allowed it to identify new areas of growth and participate in a variety of business verticals. Management describes L&T as “builders to the nation.” While infrastructure projects comprise the vast majority of L&T’s business, the company is pursuing opportunities in defense, realty, and nuclear power plants among other things.

Excluding the values of its subsidiaries, we estimate that L&T’s core EPC business sells for 15.9x its 2015 estimated earnings. We believe the company’s EPC earnings have the potential to grow meaningfully over the next few years as long as India’s new government restarts the country’s investment cycle. For reference, excluding L&T, EPC orders in India have declined by 44% since 2010.[13] Furthermore, the country’s annualized gross fixed capital formation (GFCF) to nominal GDP ratio has fallen from a peak of 33.3% in Q3 2008 to a nine-year low of 28.3% in Q1 2014 and Q2 2014.[14]

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

ENDNOTES

[1] Performance contribution as stated uses the fund’s dollar-weighted gross internal rate of return calculations derived from average capital and sector P&L. Sector performance figures are derived using monthly performance contribution calculations in US dollars, gross of all fees and fund expenses. Interest rate swaps are included in Fixed Income. Yen puts are netted against long contribution in Asia (ex-India) sector. P&L on bullion, cash, and currency forwards are excluded from the table.

[2] Based on October 31, 2014 Bank of Japan memorandum, “Outline of Outright Purchases of Japanese Government Bonds.”

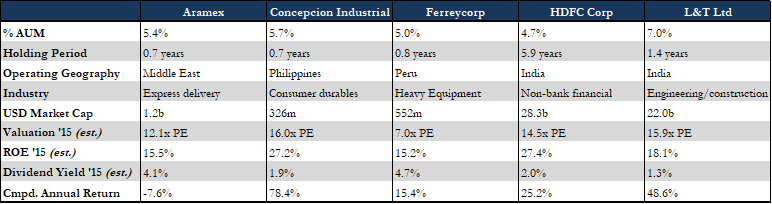

[3] Valuations as of 1.13.2015. Top holdings as of 12.31.14. Estimates derived from internal models. L&T and HDFC: parent company PE and ROE adjusted for subsidiaries. Compound annual return based on monthly gross IRR.

[4] Metrics derived from internal proprietary company model and based on 2015 estimated earnings.

[5] 2014 Company presentation.

[6] Company presentations.

[7] Wood Mackenzie.

[8] Peruvian Ministry of Energy and Mining.

[9] Valuations derived from internal models.

[10] All data presented from company presentation.

[11] Based on December, 2014 third party investment in HDFC insurance business.

[12] From respective company presentations.

[13] Source: Axis Capital.

[14] Source: CEIC Data, Ministry of Statistics and Program Implementation.