Equinox Partners, L.P. - Q2 2025 Letter

Dear Partners and Friends,

PERFORMANCE

Equinox Partners, L.P. rose Equinox Partners, L.P. rose +11.6% net of fees in the second quarter and is up +24.1% for the year-to-date 2025. By comparison, the S&P 500 index rebounded +10.9% in the second quarter and is now up +6.2% for the year-to-date 2025.

Our portfolio has performed well across the board this year, with our gold miners, oil and gas producers, and emerging market businesses all appreciating. We were particularly gratified by the long-overdue outperformance of several of our earlier stage gold companies in the first half of this year.

With markets and complacency on the rise, we think it prudent to address the non-negligible risk of an economic downturn.

Beware the Next Recession

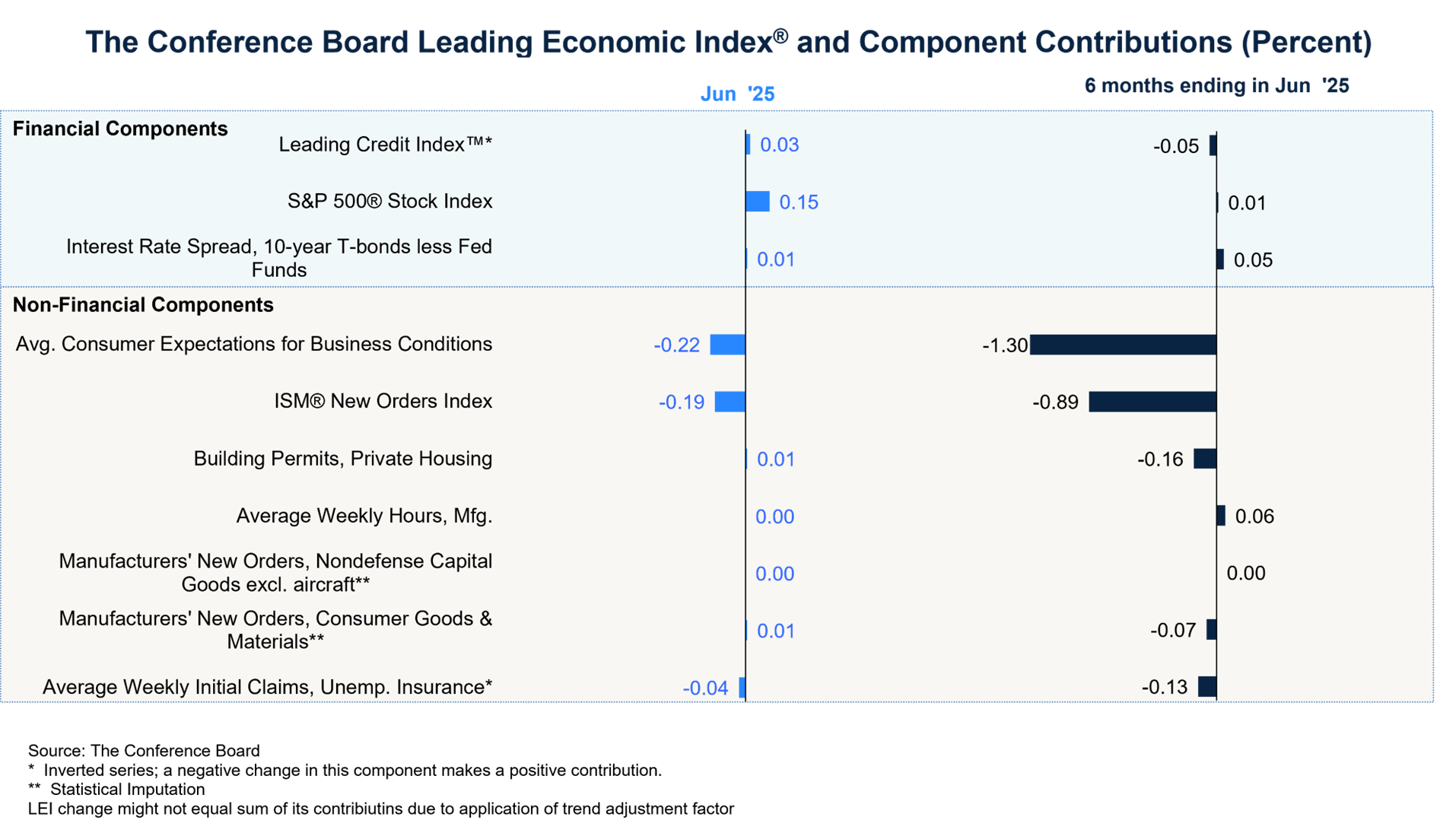

The American economy has been growing without manifesting several of the traditional signs of economic health. As a result, for the third time in three years, The Conference Board Leading Economic Index (LEI) has turned negative, an event that has occurred before every U.S. recession since the 1970s. While The Conference Board gave up on its recession call last year, investors dismissing the persistent weakness in the leading economic indicators do so at their own peril as there is substantial downside risk to markets if the U.S. economy does turn over.

Critics of the LEI argue that the index is outdated. One of the oft-cited problems with the index is its over-reliance on manufacturing and underemphasis on services. 4 of the 10 leading economic indicators are specific to manufacturing, while services, which constitute a majority of the U.S. economic activity, are only indirectly represented. We acknowledge this criticism, but the persistent weakness of American manufacturing is worrisome, especially given the massive manufacturing subsidies in the Inflation Reduction Act and protection that the sector is receiving from Trump’s tariff policies.

We expect American manufacturing will pick up as Trump’s tariffs take effect, but that improvement will be a double-edged sword as higher tariffs will also be a drag on overall economic activity. While there’s not a recent historical analogue for Trump’s massive tariff increases, the Smoot-Hawley tariffs of 1930 which increased America’s tariff rate from 10% to 17% certainly didn’t work out well. America’s current tariff increase, from 2.5% to approximately 20%, is a larger increase at a time when imports as a percentage of GDP are roughly twice what they were in 1930. It will take time for the first- and second-order economic impacts of tariff increases to flow through to broad indicators, but it seems possible to us that massive tariff increases tip an already weakening U.S. economy into recession.

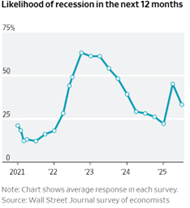

Given the policy backdrop, we were surprised by the Wall Street Journal’s recent survey of economists which placed a 33% probability of a U.S. recession in the next 12 months. This strikes us as borderline Pollyannaish. That said, even if a recession is only a 33% probability, investors should still be prepared for this scenario given the damage a recession would cause. Recessions are punishing affairs for equity investors and anyone using too much leverage. Given today’s lofty valuations and tight credit spreads, the next recession could be much worse than average.

Today’s frothy stock market calls to mind the stupidity of the late 1990s tech bubble which ultimately ended in a 49% decline in the S&P 500. Equity investors are lapping up the hype of a "golden age of margin expansion" due to AI-driven productivity improvements and overpaying for junky meme stocks. The credit market, which is less obviously frothy, is equally scary. The non-investment grade bond index currently trades at a 2.8% spread to U.S. Treasuries despite cyclically weak covenants on new issuance. The lack of caution in the credit market reminds us of the complacency that preceded the 2008 global financial crisis.

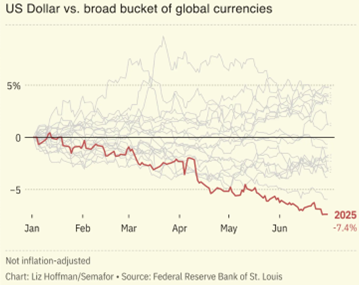

The next downturn has the potential not just to be much worse than average, but to be qualitatively different than the last four American recessions, i.e. 2020, 2008, 2001, and 1990. Not only are stocks overpriced and credit risk underpriced, but the dollar’s reserve currency status will be in play in the next downturn. If U.S. treasuries do not benefit from the flight to safety that has characterized the last four American recessions, the policy options will be bad for capital. Specifically, we would expect the federal government to impose meaningful negative real rates, such that even if investors manage to keep their dollars, they will be worth less in real terms. With the U.S. dollar posting its weakest first half return in years, the market appears to already have sussed out this possibility.

Source: The US dollar is on track for its worst year in modern history | Semafor

As we game out the possible paths of escalating financial repression in the United States, it is important to make clear why we believe our federal government would pursue such a policy in a downturn. The answer is straightforward: a dysfunctional U.S. government bond market is a red line for policymakers. The overwhelming consensus view in Washington, D.C. is that a disorderly bond market poses a threat to the smooth functioning of government and would impair America’s ability to defend itself. Accordingly, a sizable bipartisan majority of federal officials believe themselves to be morally justified in doing whatever it takes to quell disorder in the government bond market.

When speculating about incremental financial repression, it is worth noting that America has yet to fully exit the soft financial repression that followed the 2008 global financial crisis. The Fed’s balance sheet remains seven times larger than in 2007, and Secretary Yellen aggressively termed-in new U.S. debt issuance as the Fed balance sheet began to contract. As a result, America’s government bond market today is structurally more fragile than it was just five years ago. Combining rollover and net new debt, U.S. annual gross issuance is nearly $11 trillion this year. By comparison when Trump left office in 2021 during the COVID crisis, that figure was $7 trillion.

The Trump administration is acutely aware of the risks posed by our fragile government bond market, as they demonstrated in their reaction to this April’s sell-off. Bessent, Hassett et al. understand that a five handle on the 10-year treasury would derail Trump’s second term, and they are busily working to prevent that from happening. Their plan is as follows: get the Fed Funds rate down, create a U.S. dollar-backed stablecoin ecosystem to absorb U.S. Treasuries, grow the banking system’s balance sheet, and negotiate foreign investment into U.S. dollar assets. Absent a recession, these measures will likely generate sufficient demand for U.S. Treasuries. In the event of a recession, however, the few trillion dollars of incremental treasury demand they are ginning up will likely prove insufficient.

Recessions are characterized by a simultaneous decline in tax revenues and an increase in spending via fiscal stimulus. In the post-war period, this combination has increased America’s fiscal deficit by 5% of GDP on average. This 5% increase has historically proved manageable because the average starting point of the fiscal deficit during past American economic expansions has been less than 3% of GDP. The problem with the next recession is that America would be starting from a deficit of more than 6% of GDP. The typical 5% fiscal response would put deficits at over 10% of GDP. A 10% fiscal deficit coupled with negative GDP growth would quickly push the national debt to 130% of GDP, an obviously unsustainable fiscal trajectory. This unsustainable path raises the specter of rising, rather than falling, 10-year bond yields in the next recession. If such a scenario unfolded and the U.S. government bond market traded like an emerging market bond market, the U.S. dollar’s reserve currency status would be over.

For our part, we do not intend to be among the victims of the next U.S. economic downturn. Accordingly, we have increased our gross short equity exposure to 10% of partners’ capital to partially offset the initial declines in markets that have historically corresponded to an onset of a recession. Our long equity positions remain concentrated in sectors that we believe will be largely immune to financial repression, namely gold miners, oil and gas producers and high return on capital “Better Businesses” in emerging and frontier markets further detailed below:

- Gold Miners: Gold has been the principal beneficiary of the market’s effort to find an alternative to the U.S. dollar. This effect should accelerate in the next recession. Our portfolio of gold miners is well-positioned for rising gold prices and weak economic activity.

- Oil and Gas Producers: Oil is an economically sensitive sector that has historically been hard hit in recessions. However, given their low starting point, we believe oil prices will prove resilient in the next recession. The sector has demonstrated good capital discipline in recent years, and our companies need only $65 oil to generate strong returns on capital.

- Emerging Market Equities: After 15 years of underperformance, emerging and frontier markets are poised for their moment as a viable alternative to overpriced U.S. growth stocks. If the dollar does decline in the next recession, emerging markets should outperform.

Since the market trough of the GFC in March 2009, investors in the S&P 500 have compounded their wealth at roughly 16% per annum, a significant premium to the long-term American stock market average of 10% per annum. As a result, investors and asset owners have accumulated pools of wealth of an unprecedented size and scale. Given this accumulation, it would be imprudent for stewards of capital to not at least prepare for a recession scenario. In that preparation, there is considerable risk in being exclusively exposed to U.S. dollar denominated strategies, as many investors are. Accordingly, investors should ensure they have adequate exposure to assets that will generate attractive real returns and provide a portfolio ballast in the scenario U.S. financial repression worsens.

Beware the Next Recession

We are pleased to announce the addition of Rafael Mendoza Grendi to our team as our Director of Research.

Rafa brings over 20 years of experience as a seasoned fundamental stock picker and leader of investment research teams focused on Latin America and smaller-cap companies across Emerging Markets. His prior roles include senior investment positions at Vinci Partners (formerly Compass Group), PineBridge Investments, Bice Inversiones and Moneda Asset Management.

Rafa was born and raised in Chile and now lives with his wife and family in Stamford, Connecticut. We look forward to introducing him to many of you in the coming months.

Sincerely,

Equinox Partners Investment Management

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 6.30.25, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information and is subject to change in future periods without notice.