Kuroto Fund, L.P. - Q1 2025 Letter

Dear Partners and Friends,

PERFORMANCE

Kuroto Fund, L.P. appreciated +7.3% in the first quarter of 2025, while the broad MSCI Emerging Markets index rose +3.0%. Kuroto performance for the quarter was driven primarily by the strong performance of our operating companies in Georgia and Ghana.

A breakdown of Kuroto Fund exposures can be found here.

Returning to Brazil

Though the Kuroto Fund didn’t invest outside of Asia until 2014, as a firm we began investing in Brazil in the late 1990s and made our first sizable investment there in 2004. We have followed the market ever since.

Given our love for the country of Brazil and admiration for many of the companies there, it has been challenging for us to remain mostly absent from Brazilian capital markets for the past decade. We stayed away for a variety of reasons, but primarily because we didn’t like the valuations on offer. So it is with more than a bit of enthusiasm that we were able to make two substantial investments in Brazil this January, taking our portfolio weighting in the country from 0% to 10%.

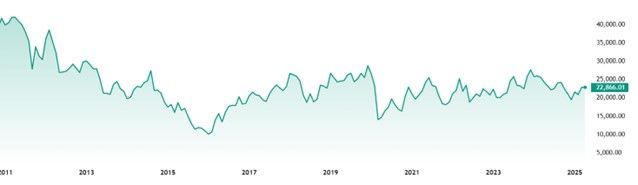

Brazil remains a macroeconomic and political adventure, but today’s valuations are incredibly attractive. The Brazilian stock market is down over 40% in US dollars over the past 14 years.

Chart of BOVESPA USD Total Return 2011 - Present

This decline has been driven both by a de-rating of the earnings multiples of Brazilian equities and the depreciation of the Brazilian Real relative to the USD. Brazil’s BOVESPA index, which traded at 11 times earnings in 2011 and then as high as 18 times earnings in 2017, now trades at just 8 times earnings. On the currency side, in 2011 the Real traded at 1.5 to the USD, while today the Real trades at 5.7.

As the Brazilian Real weakened last year, we began refreshing our analysis on our favorite Brazilian companies in earnest. Over the past fifteen months, we have spoken to several dozen management teams and done deep dive research projects into about a half dozen industries in Brazil. We visited the country last month in March and will be returning this upcoming June. We have identified several interesting investment opportunities in addition to the two new positions we initiated.

What we have always liked the most about Brazil remains true: the best Brazilian companies have wholeheartedly adopted Western corporate governance standards, and the best Brazilian executives are world class. We are never surprised to see Brazilians running some of the world’s largest companies, such as AB InBev and Kraft Heinz.

The sheer size of Brazil allows talented entrepreneurs and managers to go to scale within their domestic market. Unlike smaller Latin American markets where companies quickly run out of room for growth, Brazil offers its local businesses a country of over 210 million people to grow into. We have seen many instances of domestically dominant Brazilian companies growing into world-class businesses.

In our experience, the problem with investing in Brazil has never been the companies or the management teams, it’s been the macroeconomy, and more specifically the economic policies championed by the country’s political leaders. The best that can be said of the current situation is that Brazil has been down macroeconomically destructive paths so many times before that the politicians and markets know the drill.

Brazil’s federal fiscal deficit was 8.4% of GDP in 2024 and is projected to be approx. 9% again in 2025. Government debt to GDP was 76% last year and is forecast to grow to 81% by the end of 2025. This weak fiscal discipline has been the main driver of the currency weakness we saw in 2024 and ultimately forced the central bank to raise policy rates 375 bps to 14.25%. In an environment with inflation at 5.5%, the government is offering debtholders a sizeable 8.5% real rate, indicative of the market’s views on Brazil’s creditworthiness outlook.

President Lula’s own Minister of Planning and Budget, Simone Tebet, recently confided to GloboNews that the country is on an obviously unsustainable path: "In 2027, whoever is president will not be able to govern under this fiscal framework without fueling inflation, increasing public debt, and derailing the economy". We appreciate Simone’s honesty and political realism as she went on to say, “Congress is unlikely to approve any fiscal adjustment measures before the 2026 general election, as lawmakers will be focused on their re-election prospects.”

Regardless of the outcome of next year’s election, Brazil’s next President will have to end the profligate spending that has characterized Lula’s second term. As in past cycles, Brazil will likely pull back from the brink. The question is: Can Brazil do better than simply avoiding default this time? On this point we are increasingly optimistic.

Brazil’s two main export industries – oil and gas and agriculture – will be the biggest drivers of economic growth over the next decade, and the fundamentals of both appear solid. Brazil produces over 4 million barrels of oil equivalent per day from world-class offshore fields, and it is the world’s largest and lowest cost producer of soybean, sugar, and coffee. Both oil and gas and agriculture in Brazil have grown significantly in the last decade and that trend is likely to continue given the high quality of the country’s natural resources.

Furthermore, as the US reshuffles its economy and foreign allies, there is no more natural ally for America than Brazil. Brazil, like the rest of Latin America, has been largely spared from Trump’s tariff war. This is reflective of the current balance of trade between America and Brazil. If a political alignment between the two countries were to occur, we could see a mutually beneficial deepening economic and trade relationship. Brazil, for example, is the most realistic incremental source of rare earths for the United States. Brazil is already home to a large mining industry and is the second largest producer of iron ore, but its rare earth potential is largely untapped. Brazilian rare earth projects are far more feasible than the currently discussed proposals for projects in Greenland, the Ukraine, or the DRC.

Of the two Brazilian investments we made thus far, one is an exporter whose business is unaffected by the deteriorating Brazilian macro but whose stock has sold off anyway due to forced liquidations by local Brazilian equity funds. The second is a business services company that is mostly geared towards servicing exporters. Investing in consumer-focused companies is a higher hurdle for us given the large fiscal adjustment the country needs, but at current valuations a large part of that is already priced in.

Sincerely,

Sean Fieler & Brad Virbitsky

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 3.31.25, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.