Precious Metals Fund - Q1 2025 Letter

Dear Partners and Friends,

PERFORMANCE

Equinox Partners Precious Metals Fund, L.P. rose +23.4% in the first quarter of 2025. Over the same period the price of gold rose +18.9%. The fund’s performance was driven by strong returns from both the producing and exploration stage companies as gold crossed $3,000 per ounce.

Trump's New Economic Policy

Trump’s New Economic Policy has roiled markets and bolstered investor gold buying globally. While the violent market gyrations remain a focus for our team, we have also been thinking through the long-term effects of Trump’s policies. In this latter endeavor, Nixon’s 1971 New Economic Policy has proven an invaluable guide.

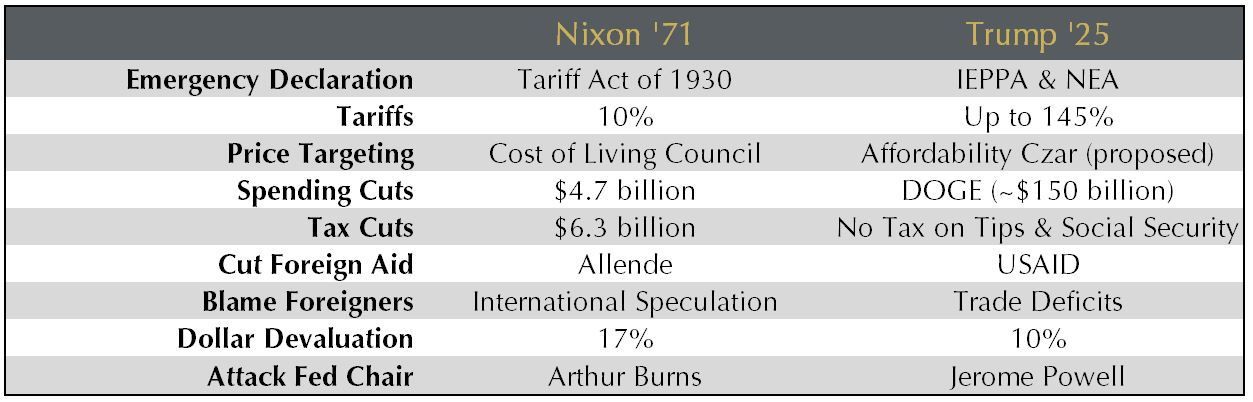

The policy similarities between Nixon’s first term and Trump’s second are striking. Both presidents declared emergencies, raised tariffs, cut spending, reduced foreign aid, blamed foreigners, devalued the dollar , proposed tax cuts, attacked the Federal Reserve chair, and directly managed consumer prices. There are, of course, also meaningful differences. Most notably, Trump has raised tariffs more, devalued the dollar less, and has not imposed formal wage and price controls. Nevertheless, the policy resonance is striking.

The parallels between 1971 and 2025 are no coincidence. They stem from Nixon’s and Trump’s shared preference for strong, decisive action. Both presidents declared national emergencies during an economic expansion with low unemployment and low inflation to secure the legal authority to implement their agenda. Both recognized that their preferred combination of loose fiscal and monetary policy risked higher inflation. And both opted for price controls or price targeting to mitigate this side effect of their policies.

If America needs stable prices to secure popular buy-in for an economic restructuring, why beat around the bush? Get oil prices down by pressuring OPEC to produce more. Get egg prices down by extending one billion dollars of subsidies to the poultry industry . And, if domestic manufacturers threaten to increase prices in response to tariffs, pick up the phone and call them just as Trump threatened to do to any US auto manufacturer that raises prices on the back of the tariff increases. While Trump has not embraced price controls per se, he is not showing much deference to market forces.

Price targeting is not a viable long-term strategy, but it can work temporarily. It is often forgotten how popular Nixon’s 1971 price controls were. When they were relaxed after 90 days, inflation remained subdued, interest rates came down and Nixon won a historic victory in November of 1972, carrying 49 states. Of course, economic history didn’t stop on election day in 1972. Following the election, prices began to rise and by June of 1973 price controls were reimposed. This second round of price controls resulted in shortages, forcing Nixon to reverse course and lift them. Inflation predictably spiked, and America struggled economically for the balance of the decade.

Trump’s price targeting policies will also fail, but when they do, we do not expect a replay of the 1970s. The result of price targeting in 2025 will likely be more profound. Despite the serious economic problems of the 1970s, America’s balance sheet was fundamentally sound. When inflation spiked over 12% in 1974 , America rode out the shock without bankrupting the federal government or destroying our banking system. America’s debt to GDP at the time was just 31% . The country was well enough capitalized that Nixon could step back and let the market sort things out, which is exactly what he did. George Shultz cast Nixon’s policy reversal in the best possible light, telling the President, "At least we have now convinced everyone else of the rightness of our original position that wage-price controls are not the answer."

With America’s current debt to GDP of 124%, Trump will have no such luxury of stepping back and allowing the bond market to adjust when inflation picks up. While the prices of consumer goods will have to adjust to avoid shortages, Trump cannot allow bond yields to spike up as Nixon did in 1973 and 1974. Nor can Trump afford a recession that causes wider fiscal deficits and makes the US fiscal path obviously unsustainable. Instead, Trump will have to exert more control over the bond market. The Trump administration is already laying the groundwork for this eventuality. The relevant policy proposals include expanding Treasury-led buybacks of US debt , amending the Basel III supplementary leverage ratio calculation to enable American banks to hold more US Treasuries, promoting stablecoins that own US Treasuries, and replacing Jay Powell with a more pliant Federal Reserve chair.

The bond market senses that America is on a new economic trajectory. Beginning with the April 7th trading session, US government bonds and stocks traded together for several days as they commonly do in emerging markets. Gold has also continued to methodically move higher even as US markets have calmed down. This price action is signaling that our level of concern is not an outlier. The status quo has been disrupted. We are on a new path.

TRUMP’S NEW ECONOMIC POLICY AND THE PRECIOUS METAL MINING PORTFOLIO

Since the November 2024 election, the gold price is up over $500 per ounce. After peaking in January of this year, the trade weighted dollar has now fallen -9.5%. While Trump has not officially devalued the dollar against gold, his policies are encouraging America’s trading partners to recycle their trade surpluses into non-dollar assets. Gold, a $22 trillion dollar asset that is no one’s liability, is one of the few markets capable of absorbing these global trade surpluses.

The benefits of Trump’s policies for our portfolio extend well beyond a rising gold price. They have delivered a surprising amount of regulatory change abroad, and our mining investments in Canada and Mexico have been early beneficiaries. Exploration permits that have been stalled for years in both countries are moving forward as both Canada and Mexico seek to reduce their reliance on America.

In Mexico the change has been stark. President Claudia Sheinbaum took office last fall as her predecessor, Andres Manuel Lopez Obrador (AMLO), was trying to force through a constitutional ban on open pit mining as a capstone to his six-year Presidency. Not only did she stop the ban, but she has replaced ALMO’s anti-mining activists with technically competent bureaucrats. President Sheinbaum understands that Mexico needs economic alternatives to exporting manufactured products to the US, and domestic mining fits the bill. We expect her to reverse a slew of the regulations that strangled the mining industry during AMLO’s presidency and ultimately begin to permit open pit mines in Mexico again.

Canada’s reaction to Trump’s New Economic Policy has also been broadly positive for our investments there. Trump saved Trudeau’s liberal government from certain defeat. Mark Carney, Canada’s new Prime Minister, is eager to reduce Canada’s dependence on America. This will entail a federal fast track for mining permitting which would bring positive direct and indirect consequences for our pre-production portfolio of quality mining projects across the country.

Sincerely,

Equinox Partners Investment Management

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 3.31.25, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.