Precious Metals Fund - Q2 2025 Letter

Dear Partners and Friends,

PERFORMANCE

Equinox Partners Precious Metals Fund, L.P. rose +13.2% in the second quarter of 2025 and is up +39.7% for the first half of 2025. By comparison, the Junior Gold Mining Index GDXJ rose +18.7% in the quarter and is up +58.7% for the first half of the year. Our meaningful year-to-date underperformance relative to the GDXJ reflects the continued discount at which our companies trade compared to peers. Specifically, our portfolio of producing companies trades at an average internal rate of return (IRR) of 24%, roughly double the 11.5% IRR of the broad universe of gold miners that BMO covers.

the gold mining bull market is young

The skepticism that characterizes the gold mining sector stands in sharp contrast to the enthusiasm in the broader stock market. The animal spirits that have propelled popular stocks like Wingstop and Robinhood to an average of nearly 80 times 2025 earnings remain totally absent among gold mining investors. One indication of the sober mood that dominates the gold mining sector is the use of gold price assumptions below spot in net asset value (NAV) calculations. Looking at four important sell-side houses for the sector, their models include an average long-term price assumption of $2,400 per ounce, representing a 28% discount to the quarter-end spot price.

(Sell-side long term gold price assumptions as of June 30, 2025)

Another sign of skepticism is the persistence of low- or no-premium M&A. With acquirers reluctant to pay a fair price based on spot gold, and sellers unable to justify selling out at a discount to spot, low- and no-premium mergers of equals became popular. Barrick and Randgold kicked off the low-premium merger trend in late 2018 with a zero-premium deal, and several of the larger deals in the industry followed with a similar structure. But perhaps the era of zero premium mergers has finally run its course. In February 2025, Equinox Gold announced a $1.8 billion all-share merger with Calibre Mining. The zero-premium offer, while approved by both boards, needed to be increased by 10% to satisfy the Calibre shareholders.

To the extent that equity markets have embraced gold mining deals with sizable premiums, the deals have involved the consolidation of an asset or had clear operational synergy. The Gold Fields acquisition of Osisko Mining last fall which unified ownership of the Windfall project within the prolific Greenstone belt in Quebec is a good example of such a deal. Gold Fields paid $1.6 billion in cash ($3.57/share), representing a 55% premium to Osisko Mining’s 20-day volume-weighted average trading price. The premium was sizable, but the deal entailed zero technical risk.

Paying a large premium for early-stage assets without any strategic logic has remained taboo ever since Kinross’s 2021 acquisition of Great Bear in Red Lake. Kinross was punished not only with a sharp decline in their share price but also with an activist investor in its share registry. On the back of the deal, the always persuasive Elliott Management forced Kinross’ board to announce an about-face to prioritize capital return as penance for their premium-priced acquisition of Great Bear.

Given the potential punishment, deals in the mold of Kinross-Great Bear have remained scarce. Even the apparent exceptions have typically involved extenuating circumstances. B2Gold’s 2023 acquisition of Sabina is a case in point. It is true that B2Gold paid a 45% premium to buy Sabina Gold & Silver, but that premium reflected both how discounted Sabina’s shares were trading at the time as well as B2Gold’s burning desire to diversify out of Mali. B2Gold’s concerns about Mali proved prescient but the jury is still out on its decision to acquire Sabina.

Despite the collective reluctance of gold mining companies to pay up for acquisitions in new jurisdictions, the cash building up on gold miners’ balance sheets will likely force a change soon. As the next M&A cycle heats up, we believe that we are particularly well positioned. We own several high-quality pre-production companies that merit substantial premiums. And while we are beginning to see more reasonable prices for producing mines, the transaction multiples for pre-production projects remain well below historical averages, even before factoring in today’s higher gold price.

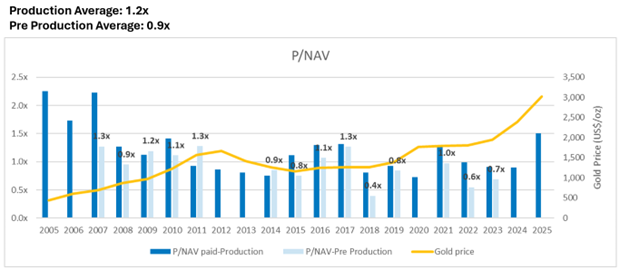

Our review of 141 gold mining deals over the last 21 years shows that the price-to-NAV transaction multiples for assets in production are now comparable to what those multiples were in 2009. By contrast, the multiples on pre-production deals remain depressed, as pre-production gold mines today trade at 0.2x to 0.3x price-to-NAV.

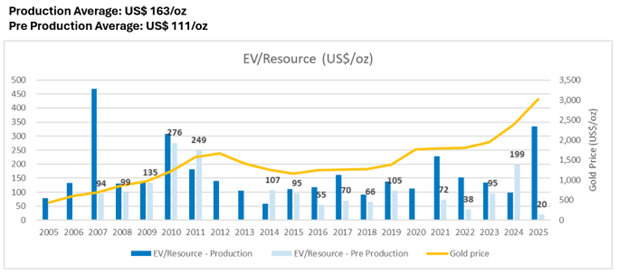

Using enterprise value per gold ounce of resource (EV/oz) is another method to arrive at the same conclusion. As shown in the graph below, the average price per ounce over time has been $111/oz. By comparison, our portfolio of pre-production assets is trading closer to $50/oz.

As investors who have allocated capital through multiple cycles in the sector, we are patient owners of discounted companies with strong fundamentals. We look forward to the forthcoming upward readjustment in the prices of our portfolio companies as the market incorporates the $3,000+ gold price environment into the valuation of high-quality, early-stage gold mining projects.

Sincerely,

Equinox Partners Investment Management

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 6.30.25, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.