Equinox Partners, L.P. - Q3 2014 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

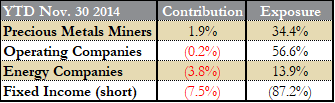

Equinox Partners was down -10.2% in the third quarter of 2014 and we estimate -19.0% for the year to date through December 12.

faith in the fed: an inflection point

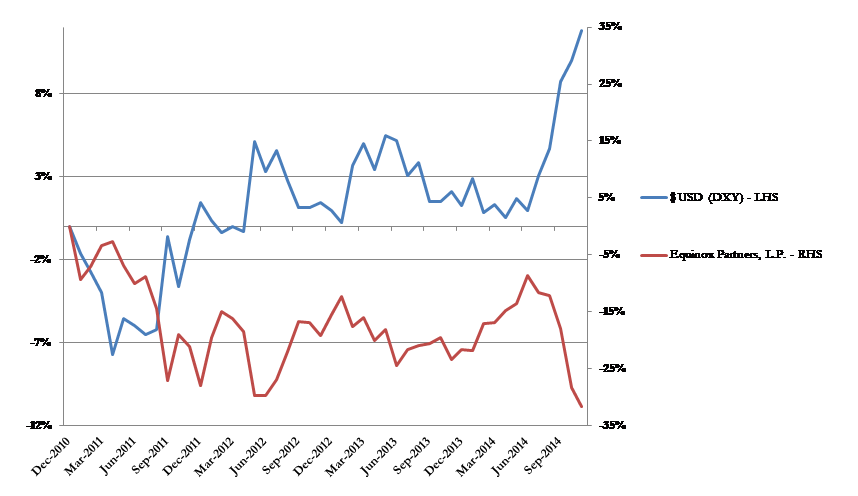

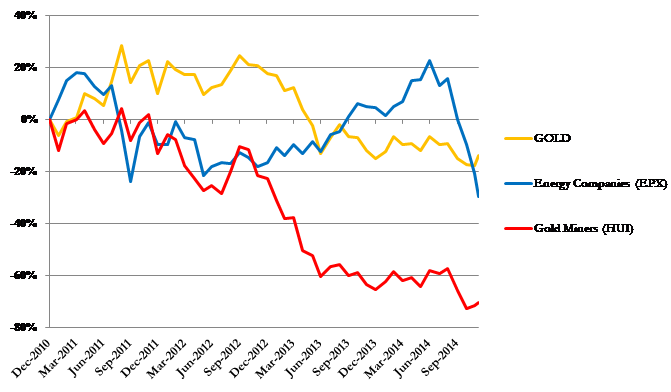

Shortly after writing to you about our bullish outlook for shares of precious metals businesses (see Q1 2014 letter), our gold and silver miners began a sharp reversal of their first half appreciation. Our miners, having been up 45% at midyear, were up only 4% as a group through November.[1] Compounding this loss, in the early fall we began expanding our ownership of extraordinarily profitable North American petroleum producers (even at today’s energy price), just as oil declined sharply due to a modest oversupply; we will discuss these companies in our next letter. Clearly, we are not market timers. The renewed weakness in emerging markets and foreign currencies also contributed to the painful volte-face in Equinox’s performance—a decline of 30% from our half-year peak of +16%. How did we achieve this combination of money losing outcomes—the forceful rise of the almighty U.S. dollar.

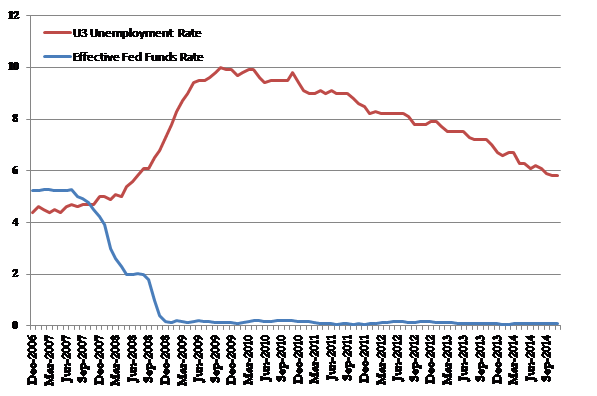

The dollar rally—the common link amongst our recent losses—reflects the accepted view that America has passed a critical monetary inflection point. In the eyes of the market, we’ve already crossed over from monetary loosening to tightening. Investors see the U.S. as well ahead of other developed economies on the path to normalization and accept the notion we will be able to exit our six-year monetary experiment without triggering another financial crisis. To our minds, not only is this conclusion premature, but it is flat out wrong.

We maintain that—despite the Fed’s protestations to the contrary—a return to meaningful positive interest rates, i.e., historically normal monetary policy, is extraordinarily unlikely. Our basis for this view rests on our confidence that meaningful real rates would put too great a burden on the still over-indebted Developed World economies. Central banks will, therefore, not normalize rates so long as the Developed World’s mountain of debt remains in place. This failure to normalize will in turn unmoor inflationary expectations and erode confidence in central banks like the Fed. Needless to say, with the expectation of normalization fully priced into our portfolio, we look forward to the translation of our theory into reality in the near term.

We find ourselves once again in a lonely position: Equinox is heavily concentrated in several investments reviled by the world around us. We submit that our clear-eyed recognition of the current extraordinary financial environment and the likely consequences of attempting to exit it, has positioned us in out-of-favor investments valued at extremes. We take this position confident that America’s true financial predicament should soon become undeniable and that Equinox will then reap substantial profits.

deflation is yesterday's story: an inflection point in prices

A historic episode of debt deflation undergirded the brief but rapid rise of the dollar against everything during the turbulent months of late 2008 and early 2009. This credit contraction-driven deflation predictably produced a desperate effort to re-liquefy the system on the part of the Federal Reserve. Think the collapse of Bear Stearns, Fannie Mae, Lehman Brothers, AIG, and money market funds followed by quantitative easing.

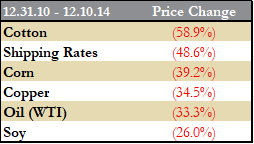

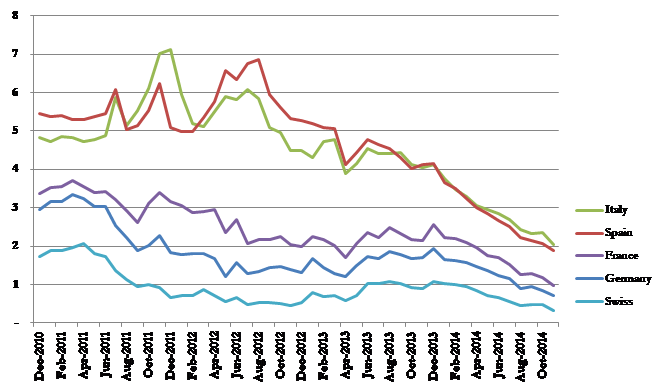

It is important to note that the aforementioned type of credit-driven deflation is fundamentally different from the deflation produced by the most recent dollar strength and supply-side driven commodity weakness (see graph below). The First World’s central bankers, however, have treated both types of deflation with the same medicine. Moreover, the Fed certainly has the tool (the printing press technology as described by Ben Bernanke) to avoid even the hint of deflation.

Thanks to half a decade of the Fed’s super-aggressive zero-interest-rate policy (aka ZIRP) and QE, the proximate threat of the Great Recession’s debt-deflation is behind us. Importantly, and more controversially, we also think that the sui generis causes of commodities price declines are now yesterday’s stories. Almost all have run their logical course.

For example, the new shale technology which has driven large and impressive improvements in production-cost declines is now fully priced into the oil and gas market. In fact, the substantial drilling declines resulting from today’s much lower oil prices may no longer even be enough to offset shale wells’ very high decline rates. Similarly, the post recession’s bust in shipping rates was caused by the massive supply response to much higher rates six years ago. But, rates can’t fall below shippers’ operating cost—the level reached last year. In the case of several agricultural prices, bumper crops grown on record acreage motivated by previous record-high prices have overwhelmed demand. Consequently, farmers are already cutting back.

Furthermore, we do not expect the deflationary forces stemming from weaker currencies abroad to continue. For the year to date, the dollar has appreciated more than 10% against the Euro and the Yen. Again, this is yesterday’s story. While Europe and Japan may be happy to depreciate their currencies further, such competitive devaluations have proven to be politically sensitive (and contagious) over time. If this is correct, and the 1930’s style “beggar thy neighbor” declines in the Yen and Euro are mostly behind us, the ECB’s and BOJ’s new rounds of QE will prove inflationary rather than deflationary in the international context.

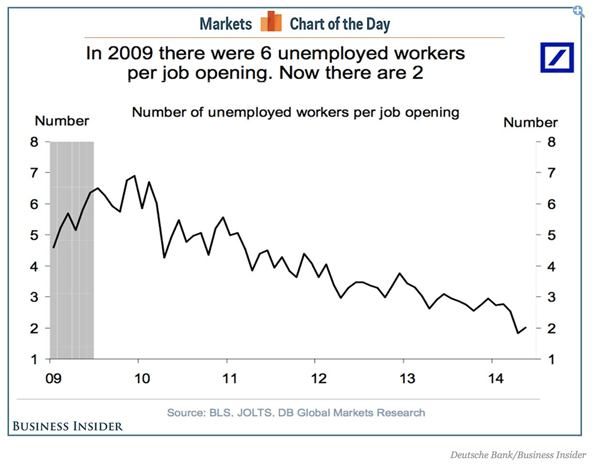

The final, and by far most critical, piece in the long-term “flationary” puzzle is the rate of wage increases. Abroad, wage rates in the emerging world continue to rise. At home, job vacancies are up across the board suggesting that the reduced unemployment rate may be a better indicator of labor market tightness than the labor participation rate. The recent high in job openings—comparable to pre financial crisis openings in 2006—further supports the idea that the U.S. labor market has tightened to near full employment (see graph below).[2] In sum, there are an increasing number of jobs for every qualified worker—a dynamic indicative of prospective wage inflation.

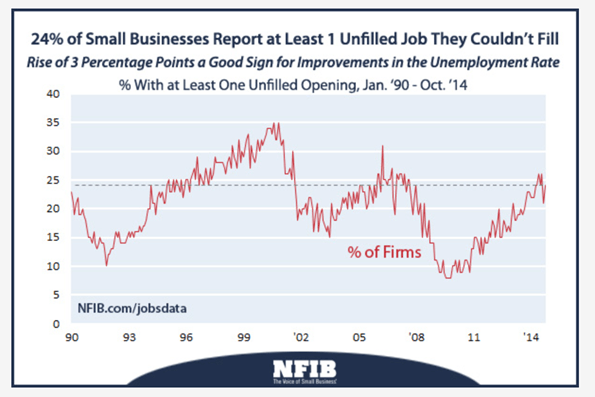

Tellingly, voluntary employment separations have climbed back to 56% of total separations as of October–meaning current workers are more willing to leave their jobs to find new ones.[3] At the same time in October, 24% of small businesses reported job openings they could not fill, continuing the recent trend (graph below).[4]

In short, deflationary pressures are not only a story of the past but we contend that the U.S. is at the critical point at which the seeds of problematic inflation have been planted and may soon begin to germinate. Mindful that we posited this same thesis four years ago (see Q3 2010 letter) and have suffered accordingly because of our failure to account for the extent of the supply-side deflationary shock, we nevertheless believe that the headwinds our portfolio has faced are now behind us.

Interestingly, several members of the Federal Reserve System have also openly hinted that more rapid price increases lie ahead. Bill Dudley, president of the NY Fed and member of the ruling triumvirate on the FOMC, seems oddly unfazed by the prospect of the economy “running a little hot.” By contrast, Richard Fisher, the Dallas Fed president, sees the same inflationary future and has expressed his deep concern about the Fed’s ability to contain inflation once it gets hold: "I believe we are at risk of doing what the Fed has too often done: overstaying our welcome by staying too loose too long." [5]

Fisher presumably takes little comfort in the knowledge that a solid majority of his peers on the FOMC have never participated in a rate increase at the Fed. It is hard to argue that the current board of the FOMC is well suited to deal with an unwelcome uptick in inflation.

When markets realize the Fed will not raise real interest rates to normal levels, we think that faith in the Fed will likely suffer a precipitous decline from its current lofty perch. Accordingly, our portfolio is configured confident that the Developed World central banks, such as the Fed, will not normalize.

our deeply discounted portfolio

The prices of our holdings assume that this extraordinary period in monetary policy is clearly behind us. The 70% decline in the major gold mining indexes since the end of 2010 through December 10, 2014 gives a sense of the headwinds we’ve faced as normalization has been priced into the market. In fact, silver and gold themselves are off 65% and 35% respectively from their 2011 peaks[6]. The energy company indexes, similarly, are off 30% over four years despite the significant increases in their per share production. Moreover, bond yields of heavily indebted developed nations are near unfathomable lows. Finally, emerging markets have underperformed the U.S. S&P for four years running as capital has flowed back to the perceived safety of America.

From gold and silver, to oil and gas, prices are already discounting the permanent victory of the Federal Reserve over inflation, and our resource-oriented companies are discounting permanent disinflation. We, however, think that in a world of ever expanding fiat money, inflation is the natural outcome. Therefore, to sell depressed shares of our extraordinary attractive commodity-oriented companies at this point would be to snatch defeat from the jaws of victory.

Conclusion

As we look back on Equinox Partners’ first twenty years, we cannot help but reflect upon the enormous market swings that have characterized the period. From the mid-1990’s Scandinavian Banking Crisis, to the Asia Crisis, the Russia Crisis, the Internet Bubble, the Housing Bubble, and the Global Financial Crisis, the frequency and magnitude of booms and busts is truly stunning and their amplitude seems to keep getting bigger. We’ve not only survived these ups and downs, but as value-based investors we’ve prospered while enthusiasm for particular assets has ebbed and flowed to spectacular excess. Exploiting such excesses has compounded our profits from specific stock picking to produce a good, if volatile, return over the long run. But one extreme, today’s faith in central banking, has continued to build as others have come and gone.

While we are inured to unpopular investment venues, in one other respect today is different. The scale and scope of today’s financial imbalances are unprecedented in modern history. The First World’s collective decision to continue papering over, rather than addressing fundamental reform and change, has produced a global policy anomaly of immense proportion. To imagine that the Federal Reserve can and will now uneventfully dismantle America’s monetary stimulus of the last six years strains credibility.

Stock pickers at heart, we did not choose the current world in which we must operate. But given the situation in which we find ourselves, we will not shirk from aligning our portfolio with the financial reality. Surely, we look forward to the inflection point in U.S. monetary history in the coming year which will test our thesis that normalization is not an option.

organization

We’ve had two research analysts recently depart the firm. Yev Ruzhitsky, who focused on tech companies and the Russian market, has moved on to work at a long-only emerging markets fund. Tomo Izumi, a small-cap Japanese specialist, has launched Takumi Capital which we’ve seeded through Equinox Illiquid Fund, L.P. As a replacement, we’ve hired native Japanese and Reed College graduate, Kevin Gallagher.

Deferrals

Deferred tax investments comprise a sizable portion of the internal capital invested in our funds. Prior to 2008, performance fees allocated to the General Partner offshore were reinvested on a tax-deferred basis. These deferrals must now be paid out each year end through 2017. Importantly, these payments will be subject to ordinary income tax and, thus, nearly 50% will be taken by the government. After paying the taxes, we will both donate a portion of the proceeds to charity as well as reinvest a portion into Equinox Partners. We bring this to your attention because these mandatory distributions will likely reduce the General Partner’s capital account over the next three years. We, nevertheless, remain committed to having sizable investments in our funds, which also constitute large portions of our net worth.

Taxes

The pain of this year’s losses will be compounded by a sizeable tax bill for our onshore partners. Given our own sizeable ownership of the fund, we likewise share in this pain. We have, however, taken steps to mitigate the fund’s 2014 tax impact without substantially altering the portfolio. We expect these steps will reduce the figures as reported in the YTD Q3 2014 tax estimates. Our intention remains to own securities for long periods of time and, as a consequence, produce a relatively tax-efficient fund in the long run.

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

END NOTES

[1] Performance figures are monthly gross IRRs.

[2] Job openings per http://www.nfib.com/Portals/0/PDF/sbet/sbet201412.pdf

[3] http://www.bls.gov/news.release/pdf/jolts.pdf

[4] http://www.nfib.com/Portals/0/PDF/sbet/sbet201412.pdf

[5] Monetary Policy and the Maginot Line (With Reference to Jonathan Swift, Neil Irwin, Shakespeare's Portia, Duck Hunting, the Virtues of Nuisance and Paul Volcker) Monetary Policy: Debate, Dissent and Discussion with Richard Fisher; University of Southern California, Annenberg School for Communication and Journalism ; Los Angeles, July 16, 2014.

[6] Peaks of April 28, 2011 and September 5, 2011 for silver and gold respectively.