Kuroto Fund, L.P. - Q3 2014 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

In the third quarter, Kuroto Fund declined -4.0% and is down -1.7% for the year to date through October 31. The MSCI Asia Pacific and the MSCI Emerging Markets indices declined -2.7% and -3.4% in the quarter, taking them to +3.0% and +3.8% respectively for the year to date through October 31.

Costing -4.3% of capital year to date through October, Kuroto’s investments in Russia and the Middle East/North Africa have been negatively impacted by the geopolitical tensions in these regions. As such, they have been the primary detractor from the fund’s long performance. While we generally prefer to invest in benign macro environments, our willingness to disentangle company and country analysis has produced a series of valuable insights and successful, non-consensus investments over time. These investments aim to capitalize on that approach, and after the recent declines, we believe that their valuations now more than discount the corresponding geopolitical risks.

We added two new positions in Poland in the quarter. These companies participate in large, fragmented industries and have competitively-advantaged business models which we believe will allow them to consolidate their markets over time. The fund’s other purchases in the quarter were primarily additions to existing investments. In October, we began purchasing two companies in Indonesia as well. We did slightly reduce some of the fund’s India exposure by exiting an underperforming financial company and reducing a couple of other holdings due to their valuation and size.

Tightening Tantrum?

The developed world’s quantitative easing following Lehman’s bankruptcy resulted in a global search for “yield” and drew investors to the higher returns promised by emerging market stocks and bonds. The relative attractiveness of these emerging markets investments ought to decline in a world of higher U.S. real interest rates. While the Bank of Japan continues aggressively monetizing its debt and the European Central Bank has said that they will expand their balance sheet, emerging market yields continue to trade at a spread to the U.S. thanks to the dollar’s role as the global reserve currency. In fact, in the spring of 2013, when Ben Bernanke said that the Federal Reserve might begin to reduce its asset purchases, there was a “taper tantrum,” with the MSCI EM index declining 16% in a matter of weeks.[1]

We are skeptical that U.S. monetary policy will suddenly start to normalize. However, we are not unaware of the risk associated with rising U.S. interest rates, nor is the fund immune to it. The fund’s performance has already been negatively impacted by the recent strengthening of the U.S. dollar. It’s important to recognize, though, that not all emerging markets are the same, and that the countries which would be most affected by rising interest rates started to discount such a policy during the 2013 “taper tantrum.” Moreover, the emerging world’s policy makers are already preparing for the knock-on effects of possible rising U.S. interest rates. Finally, Kuroto has a country- and company-quality bias which should mitigate the negative effect of another U.S. dollar-related market sell-off.

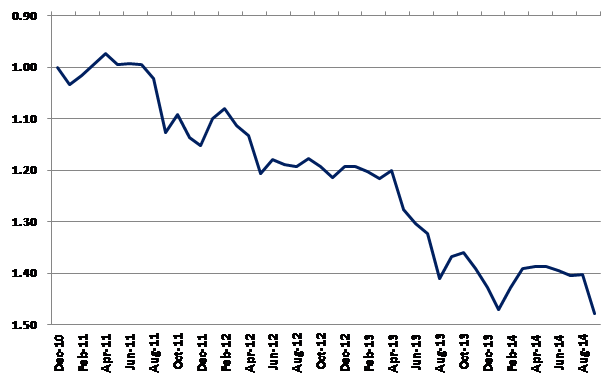

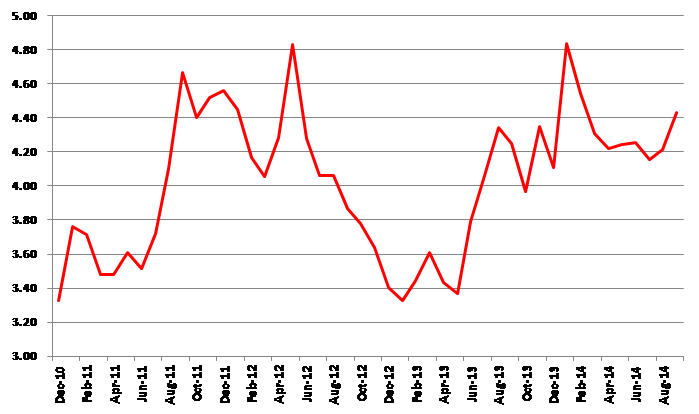

The term “fragile five” was actually coined during the “taper tantrum” to characterize the risk associated with Brazil, India, Indonesia, South Africa, and Turkey. In these five economies, the risk of capital outflows is most acute, as they have the greatest reliance on portfolio inflows or “hot money” to finance their current account deficits. As evidenced below, these countries have already started to discount a reversal of portfolio flows.[3][4]

Most emerging market central bankers are not naïve and have begun to prepare for the impact of tighter monetary policy in the U.S. whenever it might occur. “The prospect of higher rates in the U.S. is the single biggest challenge facing Indonesia’s new government” declared Indonesia’s now former Finance Minister Chatib Basri in late September.[4] Basri has suggested that emerging markets should raise their interest rates to preserve their relative appeal to investors: “Emerging markets may have to choose stabilization over growth. You cannot promote economic growth when dealing with this issue. It will exacerbate the situation…”[5] Mauricio Cárdenas, Colombia’s finance minister, has taken a slightly different approach by trying to shift that country’s borrowing from foreign to domestic buyers, on the view that locals are less likely to sell based on shifts in global monetary policy.

While some investors view emerging markets as a single asset class, in fact each country has different political and macroeconomic realities. We have been mindful to avoid investing in countries whose potential currency weakness might undermine company-specific investment returns. For example, the firm has had difficulty investing in Turkey. Turkey has a fast growing economy driven mostly by domestic demand. However, the natural resources-starved country is heavily dependent on imported energy to grow its economy and does not export value-added goods, thereby creating a sizable current account deficit. It finances this deficit primarily through portfolio inflows rather than foreign direct investment (FDI) which makes it more vulnerable to capital outflows.

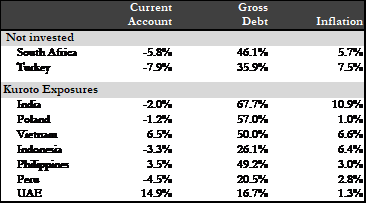

By contrast, Kuroto’s investments are primarily in fiscally healthy countries without large current account deficits and with better overall economic fundamentals than the developed world. Unlike the U.S., these economies have also been less distorted by zero interest rates and quantitative easing.

That said, we are invested in India and Indonesia both of which are part of the fragile five. Like Turkey, India has a fast-growing economy but has limited natural resources. In Q4 2012, India had a current account deficit of 6.7% of GDP. The Reserve Bank of India (RBI) has since set a target deficit of 2.5% of GDP, and actually achieved 1.7% as of June 30,

2014. The RBI has also been actively fighting inflation. Their overall credibility as well as the prospects for reform and FDI following Modi’s election make us comfortable that India isn’t as vulnerable to capital outflows as other fragile five countries. In contrast to India and Turkey, Indonesia historically had a current account surplus but has recently been reporting deficits. The country’s coal and palm oil exports declined while imports rose due to cheaper borrowing and a stronger currency. As a result, Indonesia’s currency has weakened substantially which has reduced imports related to consumption. Additionally, oil accounts for 23% of Indonesia’s imports.[6] The country’s newly elected president, Joko Widodo, has raised subsidized fuel prices which will reduce imports and therefore improve the trade balance.[7]

In addition to investing mostly in sound countries, the fund generally owns competitively-advantaged companies that don’t have over-levered balance sheets, can fund their investments through internally generated cash flow, and have domestic demand as their growth drivers. Excluding the 18.3% of the portfolio invested in financial-oriented companies, the look-through net-debt-to-equity ratio of Kuroto’s holdings is 0.4x. Moreover, our financials are leveraged at an average 10x—far less than their global peers.[1]

Ultimately, should the removal of excess liquidity from the financial system occur, this would create a more normalized investment environment where equity values reflect underlying company fundamentals, not a search for yield or risk-on, risk-off sentiment. Such an environment creates more opportunities for inefficiency and mispricing for value investors such as ourselves.

New Share Class and PArtner

Due to its expanded universe, we reopened Kuroto Fund to new capital as of July 1. As outlined previously, we plan to accept $25m of quarterly net inflows while being careful not to allow our assets to exceed our opportunities. Towards that end, we are pleased to announce a $90m investment from a new strategic investor. Due to the size of the overall investment, we opted to create a new, less-liquid share class in order to mitigate the investor concentration risk. This new Class B (offshore: Class K2 or new-issue restricted K3) also provides the concomitant option to pursue less liquid companies in the fund. Class B has a two-year initial lockup for new capital and a two-year, quarterly investor-level gate with 90 days notice for redemptions (i.e., 1/8 of a capital account can be redeemed in any given quarter with 90 days notice). The performance fee for Class B is 15%. We encourage our partners to consider moving all or a portion of their Kuroto investment to Class B given its favorable mix of performance fee and alignment with less liquid opportunities. Lastly, having capital committed for the next several quarters, we have consequently established a waitlist. Should you want to be added to the waitlist or discuss the new share class, please contact Daniel Schreck.

Deferrals

Deferred tax investments comprise a sizable portion of the internal capital invested in our funds. Prior to 2008, performance fees allocated to a General Partner offshore were able to grow tax free offshore as well. These deferrals are required to be paid out annually at year end through 2017. Moreover, these payments will be subject to ordinary income tax and, thus, nearly 50% will not be eligible to be reinvested into our funds. While this is a fine problem to have, we bring it to your attention because there will likely be a reduction in the General Partner’s capital account over the next three years. After paying the taxes, we will both donate a portion of the proceeds to charity as well as reinvest a portion into Kuroto Fund. We remain committed to having sizable investments in our funds, which also constitute large portions of our net worth.

Organization

We’ve had two research analysts recently depart the firm. Yev Ruzhitsky was with us for five years and focused on tech companies and the Russian market. We wish him all the best as he moves on to work at a long-only emerging markets fund. Tomo Izumi worked at the firm for seven years and was often able to identify Japanese micro-cap better businesses that unfortunately were too illiquid for our funds. Seeing this opportunity we elected to seed his newly-launched fund, Takumi Capital, through Equinox Illiquid Fund, L.P. To bring our team back up to size, we’ve hired recent Reed College graduate, Kevin Gallagher, and we’re actively searching for another analyst as well.

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

ENDNOTES

[1] Index total return 5/08/13-6/24/13

[2] Source: Bloomberg, monthly data. Fragile five: Brazil, India, Indonesia, South Africa, Turkey. Inverted, equally weighted, average index of currencies.

[3] Source: Bloomberg, monthly data. Equally weighted, average 10 year bond yield of fragile five versus 10 year U.S. Treasury. Data not available for Brazilian yields from August 2011-December 2011 and South African yields from November 2011-May 2012. No changes in yield were therefore noted in this analysis during those periods.

[4] http://www.bloomberg.com/news/2014-09-21/asia-may-need-to-sacrifice-growth-to-cope-with-fed-basri-says.html

[5] Ibid.

[6] Source: Maybank Kim Eng, “Indonesia import and export profile”.

[7] Table source: Current account and gross debt as a percentage of GDP. 2013 current account and inflation data from IMF and World Bank. UAE inflation per National Bureau of Statistics, October 2014. Gross debt per respective central bank or finance ministry. Peru has historically run a slight current account deficit and even a surplus in some years. The current figure is impacted by relatively weak mining production and lower commodity prices. Copper represents 19% of the country’s exports. With several mining projects coming into production in the near-term, we expect the current account balance to materially improve.

[8] Exposure as of October 31, 2014 and leverage as of October 7, 2014. Leverage for financials calculated using assets over equity.