Equinox Partners, L.P. - Q4 2014 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

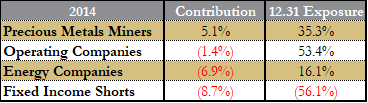

Equinox Partners fell -4.0% in the fourth quarter and -26.4% for the full year of 2015. Our fund has declined an additional -10.6% in 2016 through January 28.

Our recent performance was one of our worst on record, with Equinox Partners declining -30% from a June 2014 peak to a January 2015 low. As highlighted in our third quarter letter, our precious metals miners and newly-purchased energy companies suffered significant declines during the period. In the face of these declines, we increased our energy exposure substantially to 16% and maintained our precious metals-related exposure at 35%. These weightings reflect the opportunity that we see in the depressed shares of superior North American E&P and mining companies. Equally attractive, but not equally depressed, our non-resource operating companies are trading at just 11x our estimate of this year’s earnings and generate mid-teens per share earnings growth and returns on equity.[1]

Our recent struggles call to mind a similar period of underperformance in the last phases of the 1990’s speculative mania. While the bond market, not the stock market, is the center of today’s serious “irrational exuberance,” the uninterrupted rise of U.S. stocks should also give investors pause. For the first time in the S&P’s 90-year history, the S&P 500 closed out a calendar year without posting four consecutive days of decline. Valuations are also high by any objective measure. Specifically, the median price-to-earnings multiple of U.S. stocks is the highest since World War II.[2] Such valuations are particularly worrisome given the unusually high profit margins enjoyed by U.S. companies in the aggregate.

As tempting as shorting such overvalued stocks can be, experience has taught us that the best opportunities during a bubble can be the outright ownership of great companies in unloved sectors. This was certainly true in the late 1990s. We, for example, made far more money owning out-of-favor longs than we did on our tech bubble-related short positions. RJR, for instance, doubled from 2000 to 2002, a period during which the NASDAQ declined roughly 70%. In this spirit, we have increased our holdings of commodity-related businesses that are trading at cyclical lows. Specifically, we own businesses that can profitably extract commodities in today’s price environment while their peers hemorrhage cash. This superior economic characteristic, when combined with low absolute levels of valuation, creates an extraordinary return opportunity in our opinion.

We have also applied the lessons of the late 1990s to our short exposure. During the final years of the last century, lower volatility shorts that offered an attractive risk/reward generated better full-cycle returns than more volatile shorts that offered the real possibility of going to zero. We believe the same is true today. Accordingly, we’ve concentrated our short portfolio in historically low-yielding government bonds that can decline far more than they can appreciate. While the path to record low yields has generated greater losses than we expected, the risk/reward has continued to improve as these positions have gone against us.

In sum, Equinox’s long and short exposures offer contrarian investors a fundamentally sound alternative to the increasingly manic environment in U.S. stocks and bonds.

on sale: shale revolution growth stocks

The large decline in the marginal cost of production for North American hydrocarbons and the corresponding massive, new North American energy resources resulting from the “shale revolution” will come to be seen as a watershed event of the early 21st century. The step-change down in costs and increase in resources is a result of hydraulic fracturing and horizontal drilling. Developed by a good ol’ Texas boy, George Mitchell, in the Fort Worth Barnett Shale, these new techniques offer fundamentally better ways of extracting hydrocarbons that are particularly well suited to North American geology and land rights.

Given the very low demand elasticity for these fuels, these cost declines have now manifested themselves in both the much lower North American natural gas price and in the last year’s stunning drop in global oil prices. We have referenced this “energy game changer,” in previous letters. That said, at $50 dollar oil and $3 dollars gas, North American energy prices have dropped to a substantial discount to their long-run equilibrium when accounting for their marginal replacement costs. Thus, we believe energy prices will rise over the next few years.

The “Shale Revolution” has not only lowered the prices of petroleum, but it has also transformed the structure of the industry itself. To wit, there are now a handful of companies—dominant in the “sweet spots” of the shale rock—that have ascended to defensible, long-term, high-return businesses over a pricing cycle. Moreover, many of these same companies have a decade or more of very lucrative drilling opportunities in which to reinvest the cash flow from their wells. As they grow production very rapidly, their cash flow and hence, intrinsic value should compound at similarly high rates. As a consequence, those few well-positioned businesses have become true “growth stocks” and thus are very valuable financial assets. Despite this transformation, these companies are still on sale at deeply discounted valuations. We highlight one such company, Paramount Resources, as part of our yearend Top-5 holdings discussion below.

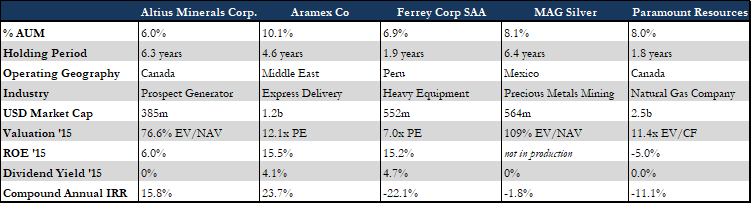

Top-five holdings[3]

paramount resources - 8.0% of the fund

Paramount Resources is the one of the most attractive companies that we own. Its liquids-rich Montney acreage in the Musreau/Kakwa region of Alberta generates rates of return that are on par with the best in North America. As detailed by the company, at $55 WTI Oil and $3.50 AECO gas, investment in Paramount’s Montney wells produces a 65% IRR.[4] While these are technically natural gas wells, they also produce liquids which have a much higher sales value than the natural gas itself. Accordingly, in our current commodity price scenario, over 70% of Paramount’s revenue comes from liquids. To the west of Paramount’s acreage is dry gas that does not contain such high liquids rates and to the east of their acreage are less productive oil wells. In short, Paramount is in an economic sweet spot.

Furthermore, Paramount’s management is very much aligned with shareholders. Paramount has been the holding company of the Riddell family’s oil and gas interests for over 30 years. Clay Riddell, the CEO and founder of Paramount, sold a significant amount of the company for five million dollars when he IPO’d the business in 1978. He quickly learned that he didn’t like dilution and, combined with other officers and directors, retains over 50% of the company today. This truly differentiates Paramount from most other global oil and gas companies.

Over the years, the Riddells have remained faithful to two fundamental strategies. First, they have captured large resources cheaply with the idea that at some point either technology or the price of the commodity would make these assets much more valuable. This strategy worked wonders with the company’s oil sands leases, and has again proved successful in their early entry into the Musreau/Kakwa region. Second, the Riddells control the relevant infrastructure so that their play economics tend to improve over time as their companies gain scale. In Canada, where midstream capacity is very tight, control of the route to market can make the difference between dominating a play and being a forced seller. Both of the aforementioned strategies initially result in years of small losses and require a level of patience and long-term thinking made possible by the Riddell’s large insider ownership.

Paramount is busy putting the finishing touches on the first phase of their Montney liquids rich project that will give them a long-term strategic advantage in the region. When this facility comes on line in the first half of this year, Paramount will be producing over 70k barrels per day.[5] At today’s energy prices, and once the facility comes on line, Paramount will trade at approximately 8x depressed cash flow.[6] This valuation is extraordinarily attractive given our confidence that Paramount can self-fund multiples of their current production.

Mag silver - 8.1 of the fund

MAG Silver is a precious metals miner with a joint venture in one of the highest-grade silver mines in the world—the Juanicipio Joint Venture in Mexico. We wrote about MAG in 2012 after we concluded a process that resulted in the appointment of Rick Clark and Peter Barnes to the MAG board. Our decision to engage in board-level restructuring was motivated by the unique characteristics of the Juanicipio Joint Venture.

Two and a half years later, it is safe to say that MAG has undergone a very positive transformation. Most importantly, in 2013, MAG’s board appointed a new CEO, George Paspalas, to oversee the company’s transition from an exploration to a development company. George’s strong background in mining operations has lent MAG greater credibility in its relationship with its joint venture partner, Fresnillo. Under George’s leadership, development of Juanicipio is proceeding steadily, and we anticipate a low-friction relationship between MAG and Fresnillo as the mine goes into production. The improved relationship with Fresnillo has other benefits. Importantly, the joint venture is now drilling prospects that have been on hold for years.

While the aforementioned improvements have added substantially to MAG’s intrinsic value, there have been negatives as well. Most notably, the Mexican government raised tax rates on the mining industry, transforming a very competitive jurisdiction to a high-tax jurisdiction overnight. Additionally, MAG’s exploration property, Cinco de Mayo, has faced an extended hiatus as the company attempts to come to an access agreement with local landowners. Cinco de Mayo, which could become an important second asset for the company, remains stuck.

Happily, MAG’s flagship asset, its 44% stake in the Juanicipio JV, is not stuck. [7] Currently under construction, it is expected to go into production in 2017. At a “base case” $23.39 silver price, the company expects $100 million dollars of after-tax free cash flow will be credited to MAG’s account annually for the first six years. And even at $15 silver, the project still generates a 28% IRR.[8] Importantly, with the high grade of the resource and Fresnillo’s operational expertise, Juanicipio’s development risks are as low as can be found in the mining industry. Factoring in their gold, lead, and zinc by-products, the silver ounces produced at Juanicipio will be almost entirely profit for the joint venture, making this cash-flow stream akin to a precious metals royalty. Precious metals royalties garner very lofty multiples, and we believe that the market will eventually view MAG’s ownership in Juanicipio through this lens.

altius minerals - 6.0% of the fund

Altius Minerals remains a top-5 holding. This company has compounded its share price at 21.7% over the past 17 years; it’s one of the best records we’ve ever seen. Notably, this compound has continued during both up and down cycles in the mining business. Altius’ strategy is simple: sell mining companies attractive drilling targets. When their partners have success, Altius retains exposure through equity and royalty interests. When, however, their partners don’t have success, Altius preserves its capital.

Last year provided an excellent case in point of Altius’ risk-mitigating model. A year ago, an iron ore project staked by Altius and vended into a sister company, Alderon, looked as though it would add substantially to Altius’ intrinsic value. Unfortunately, Alderon was unable to complete the permitting needed to finance the project before iron prices started to decline. As a result, the project has been put on care and maintenance until the next iron ore cycle and we lost out on an important source of growth for the company—in full production the royalty on this project would have nearly doubled revenues for Altius. That’s the bad news.

The good news is that beyond the initial money needed to stake the property, carry out some exploration activity and structure the spinout of Alderon, Altius did not invest another dollar in the project. In pure financial terms, Altius spent just over $2m of its own money. And, despite the decline in Alderon’s value, Altius’ equity stake in Alderon is still worth more than $2m. Moreover, Altius still retains the option value of the royalty should the project be revived in the next cycle.

Mining is a notoriously volatile business, featuring repeating cycles of boom and bust in commodity prices and extreme changes in asset valuations. So much so, that volatility is about the only thing that can be predicted with confidence. Surprisingly, very few companies in the mining industry have business models that capitalize upon this inherent cyclicality, but Altius does. While we are disappointed that Alderon did not produce the growth we had hoped for, our appreciation for the strength of Altius’ business model has been enhanced by the experience.

Downturns, such as the one we are currently experiencing, create numerous opportunities for companies like Altius. As the industry faces financial pressure due to a lack of access to capital and falling asset prices, Altius is poised to create value. Brian Dalton, Altius’ CEO, will use the low points in the cycle to stake claims that other companies drop, and perhaps find opportunities to acquire additional royalties at bargain prices. In this vein, on March 4, Altius announced the acquisition of a smaller royalty company at an attractive price. At some point in the future, when the current hard times are a memory, Altius will be a seller of assets to companies with less foresight. Brian and his team run Altius with the same contrarian streak that we strive for in our investments at Equinox. Our similar investment style gives us a deep appreciation of his approach.

aramex – 10.1% of the fund

Aramex remains one of Equinox’s top-5 holdings. The company is a domestic and international express business similar to FedEx and DHL. Aramex operates primarily in the Middle East and increasingly in Africa. The company currently sells for 12.1x our estimate of its 2015 earnings, an absolute bargain given the company’s quality and growth prospects.

Aramex increased earnings by 15% last year.[9] This substantial improvement is largely due to stronger growth in the higher-margin express segments. Management expects further improvements in its freight forwarding business due to the decline in oil prices and an increase in overall global trade. In addition, management remains optimistic about making additional acquisitions which would further the company’s geographic expansion. Their business remains focused on their core countries of U.A.E. and Saudi, which have not been materially affected by the continued strife in the region.

ferrycorp - 6.9% of the fund

Ferreycorp continues to be an Equinox top-5 holding. This long-tenured Caterpillar dealer in Peru is perfectly positioned to benefit from the growth opportunity in mining and infrastructure in that country. Its competitive advantage lies in its higher-margin, dominant parts and service network. Ferreycorp is currently selling for 1.1x its tangible book value and 7x our estimate of its 2015 earnings.

2014 was a difficult year for Ferreycorp as both revenue and earnings declined by 8%. The weakness was driven entirely by mining sales which fell by 60%.[10] Going forward, however, copper production is expected to double in Peru over the next 4 years, and the country anticipates doing a lot of infrastructure spending.[11] As such, we remain very positive on the company’s prospects, and are surprised that it continues to sell at such an enormous discount to its intrinsic value.

Top-Five, Year-Over-Year Subtractions: APR & Virginia Mines

APR, a provider of temporary power, dropped out of our top five as its stock was hit by a combination of negative events, including management turnover, the loss of its largest contract and the failure to win material new business. We had estimated our downside for the investment to be the company’s asset value. APR now sells for a material discount to that figure. While we think the market has overreacted, we certainly overestimated the company’s ability to consistently win new business, and thus, earn an adequate return on its assets. That said, we still consider APR to be a good investment given its discount to very real, saleable assets. Unfortunately, it had to decline dramatically in price to reach this attractiveness. In retrospect, we clearly failed to accurately estimate the company’s intrinsic value and assess its ability to generate high returns on capital on a consistent basis. The position is presently 5% of partners’ capital due to additional purchases followed by a recent increase in the stock price.

Virginia Mines was acquired late last year by Osisko Gold Royalties. We long suspected that the company would be acquired by a larger royalty company. When Osisko Gold Royalties was created last year as a spin out from the acquisition of the Canadian Malartic mine, it became apparent that combining the two premier royalties on Quebec mines made sense. The larger scale and diversification of the combined entity has already resulted in a rerating of the merged company.

Energy Webinar: MArch 24, 2:30-3:00 PM (Eastern time)

We’re hosting a “webinar” on March 24 from 2:30-3:00 PM for our partners and friends in order to discuss our energy investments in greater detail. Viewed online, the webinar will combine our in-depth commentary with corresponding graphics. By way of update, our newly-launched Equinox Energy Fund—which holds many of the same core energy positions as Equinox Partners—has attracted $40m thus far. With so much attention in the sector and with our large investment therein, we think this presentation is more than merited.

To participate, register in advance as follows:

1. Click here to go to our WebEx site.

2. Once there, click “register” to complete the short process.

3. You will then get a confirmation email with the details to join the webinar on March 24 at 2:30 PM.

Note: If using the Chrome browser, you may need to run a simple application. Having issues? Use Explorer instead.

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

END NOTES

[1] Performance contribution as stated uses fund’s dollar-weighted gross internal rate of return calculations derived from average capital and sector P&L. Sector performance figures derived using monthly performance contribution calculations in US dollars, gross of fees and fund expenses. Interest rate swaps included in Fixed Income. Yen puts including in Operating Companies. P&L on cash excluded from the table.

[2] Graph and data source: Wells Capital Management, January 8, 2015, James W. Paulson, Ph. D., “Median NYSE Price/Earnings Multiple at Post-War RECORD”

[3] Top holdings as of 12.31.14, using pre-yearend redemption AUM. Aramex and Ferreycorp valuations as of 1.13.2015. MAG, Paramount, and Altius valuations as of March 2015. Estimates derived from internal models. Paramount CF and ROE adjusted for subsidiaries. Compound annual return based on monthly gross IRR from inception to February 2015.

[4] Company presentation, January 2015

[5] Company presentation, January 2015

[6] Valuation derived from internal model

[7] MAG Silver joint venture ownership documentation

[8] Company presentation

[9] Company press release

[10] Q4 MD&A

[11] Peruvian Ministry of Energy and Mining