Kuroto Fund, L.P. - Q1 2015 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Kuroto increased +7.3% in the first quarter and was up +7.6% through April 30. This compares to a +2.2% gain for the MSCI Emerging Markets Index through the first quarter and a +10.1% gain through April 30.[1]

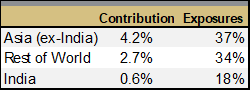

A large portion of the gains in the quarter resulted from one of our top-five holdings, Concepcion Industrial Corp., which increased by 48% during the quarter. Another significant contribution came from a rebound in the share prices of the event marketing company and the temporary power business which caused much of Q4’s negative performance and were discussed in that quarter’s investor letter. The fund’s investments in India were slight performance contributors while those in Latin America were moderate detractors.

In the quarter, Kuroto continued to hedge certain currencies for which we didn’t have a strong view as long as the cost wasn’t prohibitive. We now have hedged over 20% of the fund’s currency exposure. The fund exited its investment in Orica in Australia because Ian Smith, the CEO who was hired to improve the business, decided to leave the company. We also continued to trim some of our appreciated securities in India while adding to several of our existing investments in Malaysia, Vietnam and Indonesia. Lastly, we initiated a new Brazilian position during the quarter.

kuroto v. emerging markets

“By definition, you can’t outperform the market if you buy the market”

- Sir John Templeton

Our partners should not be surprised that the MSCI Emerging Markets Index has no influence on our investment decisions. However, we are aware that the benchmark can be a convenient means of evaluating Kuroto’s performance. As such, we thought that it would be a useful exercise to compare the weightings of the MSCI Emerging Markets Index to those of Kuroto[2]. Not unsurprisingly, the EM index and Kuroto are markedly different portfolios for a variety of reasons which we’ll discuss below. We believe that these differences result in a Kuroto portfolio which is superior due to its emphasis on quality, relative concentration, and a broader focus.

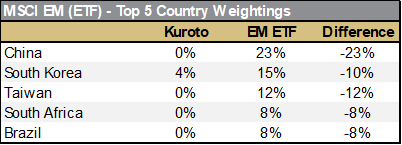

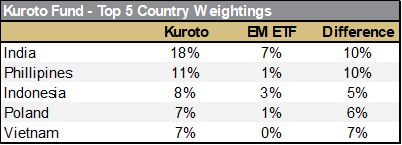

To begin with, the country exposures of the two funds are exceedingly different (see table below)[3]. The EM index is largely comprised of export-oriented North Asian countries, while Kuroto’s investments reside in countries whose economies are more driven by domestic consumption. Therefore, many of the index’ holdings are more dependent on growth or demand from the developed world than from the developing world. With that being said, we do look for domestically-oriented investments in all of these markets. However, we tend to encounter additional quality issues in North Asia. In China, corporate governance and management quality often prove to be an issue for us. How the business, management, owners, and capital came together is often difficult to discern, leaving us to wonder to what end and to whose benefit the company is being managed. The domestically-oriented businesses in South Korea and Taiwan often have difficulty generating enough growth to produce an attractive return for us. Additionally, capital allocation is so notoriously bad in Korea that last year the government decided to tax net income if companies didn’t spend enough of their profits on investments, salaries, and dividends.[4]

In addition to having different country exposures, there is a stark difference in the level of concentration between the Kuroto portfolio and the EM index. As of March 31, Kuroto owned shares in 30 businesses, whereas the MSCI EM index comprised over 800 securities. As part of our investment philosophy, we consider ourselves to be business owners and believe that a proper owner mentality is only possible with a low-turnover, concentrated portfolio. The ownership approach allows us to have a long time horizon in order to maximize our returns. We also believe that very few high-quality investments generally exist at any one time. Therefore, we concentrate our capital in those special few.

The above differences exist in part because the EM index, as stated in its marketing documents, “aims to provide exhaustive coverage of the relevant investment opportunity set” and even boasts that it “covers approximately 85% of the free float-adjusted market capitalization.” To paraphrase, the index is targeting companies that are large in market capitalization and liquid in terms of daily trading values. The index does not focus on business quality or valuation. It does not take into account where a company does business; it only reflects where a company is listed.[5]

Kuroto is also using a broader definition of what an emerging market is than the MSCI. The MSCI has a market classification framework that focuses on a country’s economic development, size, liquidity, and market accessibility. If a market is not large enough in terms of liquidity or has ownership restrictions, then MSCI classifies it as a frontier market. Kuroto is happy to ignore the distinctions between emerging and frontier, instead we focus on whether country dynamics are benign enough not to overwhelm our investments. We will also capitalize on illiquidity if we believe the opportunity is attractive enough. Furthermore, we are willing to invest in companies which have listings in the developed world but whose businesses are in the emerging world. We will not ignore the Alibaba’s of the world simply because they are listed in New York.

“Active Share” is another means of comparing a portfolio to an index. As defined by an academic study, active share is the proportion of stock holdings that are different from the composition found in its benchmark.[6] So, for example, a mutual fund with an active-share percentage of 60% means that 60% of its assets differ from its index, while the remaining 40% mirrors the index. The study found a positive correlation between a fund’s active share and that fund’s performance against its benchmark. As you might expect, Kuroto’s active share is 98.5% and only four of Kuroto’s holdings are even in the MSCI EM ETF, representing a scant 1.3% of its holdings.

One reality of the substantial difference between Kuroto and the index is that should one of the large representative EM markets rally over a given time period, we will underperform the index. A perfect example of this is the recent, dramatic increase in the China H-share market. The relaxed restrictions by the China Securities Regulatory Commission on domestic mutual funds investing in H shares pushed the MSCI China Index up 16.7% in April. This performance, in part, pulled the MSCI EM Index up by 7.7% in April. Kuroto, obviously, missed the entirety of this rally.

Kuroto is not opposed to owning companies in the index as long as they fit the following three criteria: meaningful undervaluation, high returns on capital, and superior management. Currently, we believe the more compelling investment opportunities aren’t in the index.

Kuroto is investing in the emerging world and so the comparisons to relevant indices are inevitable. But, as we’ve shown here, the portfolios are very different. Over short periods of time, the performance of the two may be similar as capital flows into and out of these markets in risk-on/risk-off gyrations. However, over the long run, we believe that Kuroto’s emphasis on quality, relative concentration, and a broader focus should produce a portfolio of high-quality, undervalued businesses which outperform the index.

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

ENDNOTES

[1] Performance stated for Kuroto Fund, L.P. Class A on a net basis. An investor’s performance may differ based on timing of contributions, withdrawals, share class, and participation in new issues. Performance contribution as stated uses the fund’s dollar-weighted gross internal rate of return calculations derived from average capital and sector P&L. Sector performance figures are derived using monthly performance contribution calculations in US dollars, gross of all fees and fund expenses. P&L on bullion, cash, and currency forwards are excluded from the table. Rest of World is: Poland, U.K. (EM company), UAE, Peru, Russia, Chile, Colombia.

[2] MSCI EM Index positions are not publically available. Thus, the MSCI EM ETF (EEM) is used herein. Given the ETF largely mirrors the index, we’ve used the two interchangeably.

[3] Kuroto exposures as of 3.31.15. MSCI Emerging Market Indext ETF (EEM) used for analysis. EEM holdings as of 4.8.15.

[4] http://www.wsj.com/articles/south-korea-unveils-tax-on-corporate-cash-hoards-1407301382

[5] However, MSCI is currently working on a proposal to add businesses, like Alibaba, which do not have local listings

[6] “How Active is Your Fund Manager? A New Measure That Predicts Performance,” by K.J. Martijn Cremers and Antti Petajisto of the International Center for Finance at the Yale School of Management, August 2006.