Equinox Partners, L.P. - Q1 2015 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

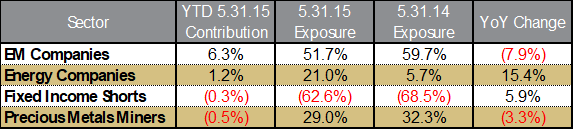

Equinox Partners was down -1.3% in the first quarter of 2015. For the year to date through May 31, the fund was up +5.7%. The strong performance of our emerging market holdings accounted for the vast majority of our gains through the end of May. Our energy positions added modestly to our performance while our fixed income shorts and precious metal miners were a small drag.[1]

Our sector exposures changed slightly during the quarter but substantially year over year, with a significant increase in our energy weighting and a significant decrease in our India weighting. More specifically, we added four new energy investments and increased our energy weighting to 21% from just 6% a year ago. We discussed the fundamentals underlying this decision at length in our last letter. In India, by contrast, we reduced our position from 18% to 9%. The reduction in our Indian holdings is entirely due to valuation.

The substantial year-over-year reweighting reflects shifts in valuation amongst and within various sectors. In summary, we estimate that our operating companies in emerging markets are trading at 14 times this year’s and 11 times next year’s earnings—attractive multiples for the high-quality, high-growth businesses we own. We estimate that our energy companies trade at 11 times this year’s and 8 times next year’s cash flow—multiples which substantially undervalue what we believe is their ability to self-finance high rates of growth for a decade or more. Finally, our precious metals miners are just flat-out cheap. Our producers trade at just 4.9 times our estimate of 2015 cash flow and have all-in sustaining costs of $940 per ounce. Our analysis indicates that our non-producing precious metals companies trade at $110 dollars per measured-and-indicated ounce in the ground.

continued dollar strength is not a foregone conclusion

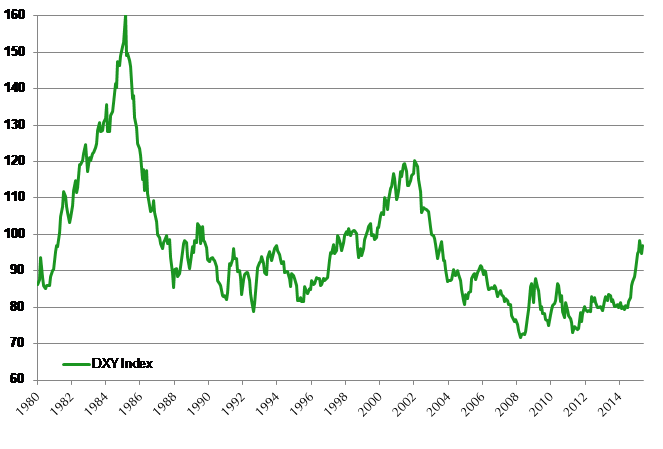

Just about everyone seems to view continued dollar strength as a foregone conclusion. The conventional wisdom goes something like this: the Fed will raise rates a little this year, Europe just restarted QE, Japan may add to their already enormous QE, and many emerging markets are running sizable current account deficits. Therefore, the dollar should continue to strengthen against the Yen, the Euro, and most free-floating emerging market currencies. The unequivocal confidence about the dollar’s strength calls to mind Mark Twain’s famous dictum about knowledge: “It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so.”

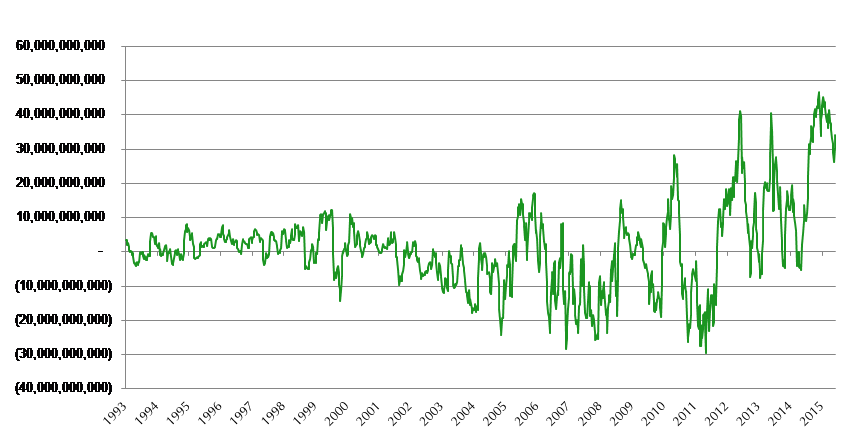

Contrary to the consensus represented in the chart above, we do not think that continued dollar strength is a foregone conclusion. Our skepticism begins with the size and rapidity of the move that we’ve already experienced. To put the dollar’s rally into context, its 25% appreciation in less than a year is one of the sharpest moves in history. One has to go back to the early 1980s to find such sharp dollar appreciation in so short a period of time. This move certainly raises the possibility that we are closer to the end than the beginning of the dollar’s run.

The vocal reaction of the U.S. Treasury and Federal Reserve to the dollar’s spike upward also needs to be considered when forecasting its future path. When addressing the topic of the dollar’s appreciation, U.S. Treasury Secretary, Jack Lew, took the unusual step of publically reiterating the importance of an international agreement repudiating currency wars. Even more significantly, however, is the Federal Reserve’s willingness to broach the topic. Wall Street Journal reporter and Federal Reserve insider, Jon Hilsenrath, characterized the change as follows: “The Fed’s increasingly open discussion of the dollar outlook is unusual. The central bank tends to minimize its comments on the currency to leave discussion of foreign-exchange policy to the U.S. Treasury.”

The Fed’s concern with the dollar’s rise is of particular importance, not because the Fed is going to stop it per se, but because the Fed will face significant compromises as they attempt to influence the dollar’s value. Specifically, central banks committed to free capital flows face constraints; they have to compromise if they attempt to manage their interest rates and exchange rates at the same time. Paul Krugman framed the tension well:

“…[Y]ou can't have it all: A country must pick two out of three. It can fix its exchange rate without emasculating its central bank, but only by maintaining controls on capital flows (like China today); it can leave capital movement free but retain monetary autonomy, but only by letting the exchange rate fluctuate (like Britain – or Canada); or it can choose to leave capital free and stabilize the currency, but only by abandoning any ability to adjust interest rates…”[2]

Despite the aforementioned risks, the Fed’s willingness to include the dollar’s value in the decision to set interest rates is inevitable. New York Fed President William Dudley’s recent comments suggest that the period of unfettered exchange rate volatility is coming to an end, if not already over. His chief “downside risk” for 2015 U.S. growth is the strength of the dollar which “is making U.S. exports more expensive and imports more competitive.”[3] This year’s 14% first quarter decline in U.S. exports certainly brought home the extent to which a strong dollar can weigh on the entire economy. [4]

While the Fed is principally reacting to economic fundamentals, Secretary Lew’s comments about currency wars suggest that the Obama administration sees exchange rates through both a political and economic lens. While it is not clear what Treasury might do to alter the dollar’s path, politicized exchange rates would rapidly constrain monetary policy. Jens Weidmann, of the Bundesbank, was unusually frank when he worried about the “alarming infringements” on central bank independence, that “whether intended or not, one consequence could be the increased politicization of the exchange rate.” While we concede that some compromise between exchange rates and interest rates is possible and surely what the policy makers intend, we wish to point out that such a compromise could quickly become unmanageable, especially if the dollar’s value becomes more political.

While tension about the dollar’s rise is unwelcome news for central bankers, the problems associated with further dollar appreciation is welcome news for Equinox Partners. Anything other than continued dollar strength would be a positive for our portfolio. Specifically, our stocks in emerging markets, our energy companies and our sovereign shorts would all benefit. More important still, a chink in the dollar’s armor would be especially welcomed by our gold and silver miners.

greenlight's fracking shorts

Greenlight Capital’s David Einhorn, whose analysis we respect, recently made his case for shorting U.S. oil companies that employ hydraulic fracturing. Given that our energy exposure consists exclusively of such companies, we read his presentation with great interest. While we broadly agree with the distinction he draws between companies that internally and externally finance their growth, we think that he is meaningfully underestimating the cost and production efficiencies that will accrue to E&P companies as they gain scale in particular geographies.

Moreover, these scale efficiencies are far from theoretical. Our companies, for example, have driven costs down such that we estimate that they can self-finance production growth at 20% a year at current strip prices. The key metric in this regard is their recycle ratio. We conservatively estimate a 1.5 recycle ratio for our businesses in 2016, meaning that they will generate just over $1.50 of operating cash (before corporate costs) for every dollar that they invest. Adjusting their recycle ratios for corporate costs and interest expenses, we believe our companies are self-financing growth stocks that merit meaningfully higher valuations.

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

END NOTES

[1] Performance contribution as stated uses fund’s dollar-weighted gross internal rate of return calculations derived from average capital and sector P&L. Sector performance figures derived using monthly performance contribution calculations in US dollars, gross of fees and fund expenses. Interest rate swaps notional valued included in Fixed Income exposure. P&L on cash excluded from the table.

[2] Paul Krugman, Slate Magazine, October 19, 1999. A Neglected Nation Gets its Nobel.

[3] Jon Hilsenrath, The Wall Street Journal, April 23, 2015. Fed Faces a Strong Dollar Dilemma.

[4] Josh Zumbrun, The Wall Street Journal, June 1, 2015. For Fed, Dollar’s Strength Complicates Rate-Hike Calculus.