Kuroto Fund, L.P. - Q2 2015 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

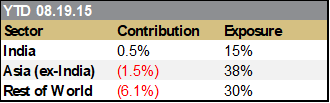

Kuroto declined by -8.2% in the second quarter compared to a +0.8% increase for the MSCI Emerging Markets Index. Year to date through August 19, we estimate Kuroto declined -7.4% versus -10.4% for the index.[1]

The declines during the second quarter were driven by the continued appreciation of the U.S. dollar, general emerging market weakness outside of China, and the fund’s investment in APR Energy. We discussed APR in the Q4 letter. After renewing much of its existing contract base and renegotiating its debt covenants in the first quarter, APR appeared to be reestablishing its business. Subsequently, the company lost a contract with an industrial customer and had to exit another one due to political turmoil. Those events—combined with a continued lack of new contract wins—have put the company on a path to violate its recently negotiated debt covenants. The stock market is questioning whether the company is now a going concern. While we believe that it is one, we have certainly erred immensely in our analysis of this investment. APR is currently a 1.7% position and we are looking for a more favorable exit point.

During the quarter, the fund invested in three new companies and completed the purchase of a fourth. These new investments are manufacturers in Brazil and India, a financial company in Mexico, and a consumer company in the Philippines. We also exited five investments in the quarter: a Colombian company and four appreciated Indian securities.

On Monday, August 20, the MSCI Emerging Markets Index closed at its lowest point since August of 2009. After appreciating steadily throughout the beginning of the year, the index has fallen 21% since April. Moreover, many emerging markets currencies are at decade lows. Kuroto’s recent performance has obviously not been immune to this downturn. The fund currently has a 17% cash position and we are beginning to see encouraging investment opportunities.

Poland is one of Kuroto’s top country exposures, with 8% of partners’ capital presently invested in the country. A detailed discussion is warranted given Poland’s relative importance to us and its lower visibility within emerging markets more generally.

The biggest reason for our large overweight in Poland is its class of local entrepreneurs. While many smaller Polish companies do not have an investor relations departments, quarterly earnings calls, or in some cases, financials in English, our numerous visits to Poland in the last few years have shown us that many of these same companies do have strong managers who understand Western business models and adhere to Western business practices. They have a level of forward strategic thinking that we do not often encounter in the emerging world. Several of them have intelligently extended their businesses into adjacent markets as well as throughout the Central and Eastern European region. Moreover, many of them are disciplined capital allocators.

This productive entrepreneurial spirit was allowed to thrive after the end of communist rule thanks, in part, to a radical program of reforms called the Balcerowicz Plan. The plan aimed to rapidly transform the country into a market economy and became widely known as “shock therapy.” It reduced inflation, disposed of most price controls, made the zloty convertible at market rates, ceased subsidizing many state enterprises, and removed most restrictions on foreign trade. In the short term, these reforms led to some pain and a lot of criticism. However, by 1992, the economy was growing again and by 1994 private companies accounted for at least 40% of Poland’s GDP.[2] Over the past 20 years, Poland has expanded its economy without a recession and was the only EU economy to avoid one during the 2008 financial crisis. Poland’s GDP per capita has increased from approximately 5% of the average GDP in Western Europe to 70% presently.[3] All of the above makes Poland one of Europe’s biggest economic successes over the last 25 years.

While it is the entrepreneurs that attract us to investing in Poland, it is important to note that the political backdrop that they operate in has become less certain. For the last eight years, the center-right Civic Platform (PO) party has governed Poland in what markets have viewed as a pro-business manner. PO deregulated industry, promoted labor law reform, improved the country’s fiscal accounts, and reduced pension benefits. This political status quo unexpectedly ended in May when the leading opposition party, Law and Justice (PiS), surprised both markets and pollsters by winning the presidential election in a runoff. The PiS candidate for President, Andrzej Duda, tapped into the sense that many have been left behind despite Poland’s broad economic success and that the PO party had lost touch with the populace after so many years in office.

Based on current polling, we expect PiS to lead a coalition government after October’s parliamentary election. As a party that traces its history back to the Solidarity movement in Poland, PiS is socially conservative, pro-labor, and supports increased state intervention in the economy. As such, the party would be more inclined to protect consumers, workers, and strategic industries than the previous administration. Also, PiS is likely to run a comparatively expansionary fiscal policy to finance higher social benefits similar to its previous period of leadership almost a decade ago.

While we are skeptical of any government that favors some industries over others, we do not think that the PiS agenda is broadly anti-business. However, the outcomes will vary from sector to sector. The banking and retail sectors could be negatively impacted by the PiS platform while small businesses and resource companies could benefit from reduced bureaucracy, lower taxes, and improved regulations. Overall, our initial impression of their proposals is that they might detract from but should not drastically undermine Poland’s business environment. As such, we do not believe that the policies contemplated by the PiS are likely to overwhelm the ability of our investments to continue to grow their intrinsic values. Incidentally, our hedge of the zloty earlier in the year was simply a result of the low cost of doing so and our agnostic view towards its future value—not from any political analysis.

To conclude, we have invested in Poland because of the local entrepreneurs and attractive valuations. We currently own two service businesses in Poland and are in the process of buying a third one. All of the companies were founded by local entrepreneurs and resemble proven, developed-market business models. Through a combination of quality service, timely acquisitions, and smart management, each company is now the largest player in what are still unconsolidated industries. This allows them to grow both from Poland’s underutilization of these services and from consolidating their respective industries. Furthermore, they are all adding adjacent businesses that bolt onto their existing operations. Two of our investments have underlying demand drivers that are not economically sensitive. And, two of our investments have used the strength of their domestic operations to build a regional presence that significantly increases their addressable markets. All of them stand to succeed regardless of the upcoming electoral outcome.

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

ENDNOTES

[1] Performance stated for Kuroto Fund, L.P. Class A on a net basis. An investor’s performance may differ based on timing of contributions, withdrawals, share class, and participation in new issues. Performance contribution as stated uses the fund’s dollar-weighted gross internal rate-of-return calculations derived from average capital and sector P&L. Sector performance figures are derived using monthly performance contribution calculations in US dollars, gross of all fees and fund expenses. P&L on bullion, cash, and currency forwards are excluded from the table. Rest of World is: Brazil, Chile, Colombia, Mexico, Peru, Poland, Russia, UAE, U.K. listed EM company.

[2] Harvard Business Review, March-April 1995, Starting Over: Poland After Communism.

[3] Guardian, April 10, 2015, Poland’s warning to Europe: Russia’s aggression in Ukraine changes everything.