Kuroto Fund, L.P. - Q2 2011 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Kuroto Fund, L.P., was up +3.2% in the quarter ended June 30,

2011. Through September 12, based on our estimates, the fund was down -6.2% for the year to date. This compares to the MSCI Asia Pacific index which declined -12.5% for the same period.

Banking in Europe & Asia: A Study in Contrasts

“The most recent proposals for a mandatory recapitalization of the European banking sector, for example, were hardly helpful and, by the way, materially unjustified.”

—Joseph Ackermann, Chairman of Deutsche Bank, September 2011

Every banking crisis has its Joseph Ackermann—a pragmatist who argues perception, not reality, must be managed. According to this view, those in the know should pretend insolvent banks are solvent so as to avoid aggravating banks’ financial position and increasing the costs of bailing them out. This pragmatic willingness to sacrifice the truth for money is a theme common to banking crises the world over, and Europe is proving to be no exception. In Europe’s case, however, there is one particularly embarrassing additional wrinkle that prevents policy makers from coming clean. By bailing out the banks, European policy makers concede that their efforts to save the weak Eurozone sovereign credits will fail. Or, in the words of Joseph Ackermann, “It would be somewhat strange or even worse risk undermining the credibility of these packages, if politicians themselves were to now send out the signal that they do not believe in the success of these measures” that they have enacted to save sovereign credits.[1]

While the idiosyncrasies of the European banking crisis merit careful study, the key lesson to be drawn is not unique. Specifically, banks can only be voluntarily reformed before they have serious problems. Once banks have real problems, regulators change the rules in order to benefit bank financial statements, in an effort to protect themselves and their governments from large, unpopular bank bailouts. This unhealthy dynamic, driven by bureaucratic and political self-interest, can only be avoided by preemptive intervention, a lesson the European Central Bank (ECB) has not put into practice.

The Asian countries that suffered banking crises in the 1990s, however, have learned the importance of preemption. For this reason, many Asian financial regulators have been doing the smart thing and acting before problems arise. From Jakarta to Delhi, Asian central bankers are choosing to impose tough, corrective measures while worrying trends are still nascent. Specifically, Asian central banks have: 1) raised rates to head off inflation; 2) increased risk weighting on asset classes perceived to be risky, and; 3) used their bully pulpit to constrain credit growth.

The stock market response to the Asian central banks’ virtuous management of the financial sector has, for the most part been negative and short sighted. In fact, Asian financial institutions have declined -17% for the year to date as measured by the FTSE Asian Banks Index. We believe that declines in prices across the region of fundamentally sound companies is an investment opportunity, albeit a selective one. Selective, because, despite the combination of high returns and low valuation found in Asian financials, a sound investment in the sector must discount the likelihood that the central banks in the region will continue to interfere with the credit cycle and actively seek to hold credit growth down in the years to come.

The wisdom of the resolve of Asian central bankers, which stems from the Asia Crisis, is being confirmed and strengthened by the ongoing struggles in Europe. Even though Europe’s banking crisis is having little direct impact on Asia’s financial institutions, the prolonged banking crisis in the developed world is changing the way in which Asian central banks are regulating their own financial systems. Specifically, regulators recognize that extreme over-leverage in either the public or private sector is an insoluble problem. Therefore, they will seek to keep system-wide loan growth close to nominal GDP growth. Furthermore, regulators will be even more proactive in restricting the growth of certain asset classes. The danger of not acting is much greater than the risk of over reacting.

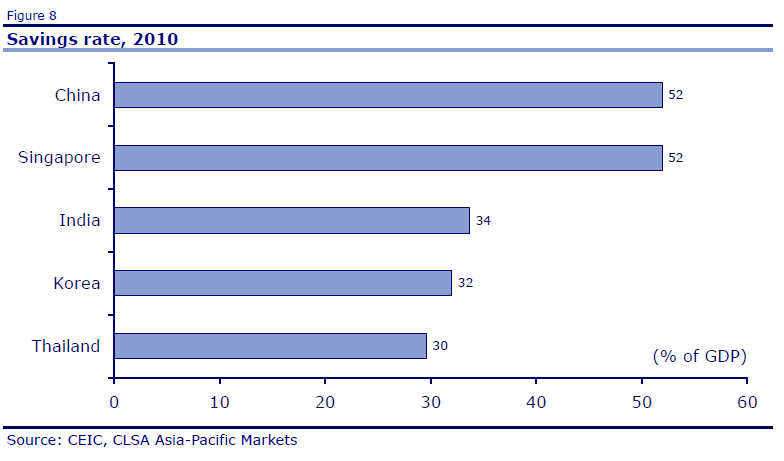

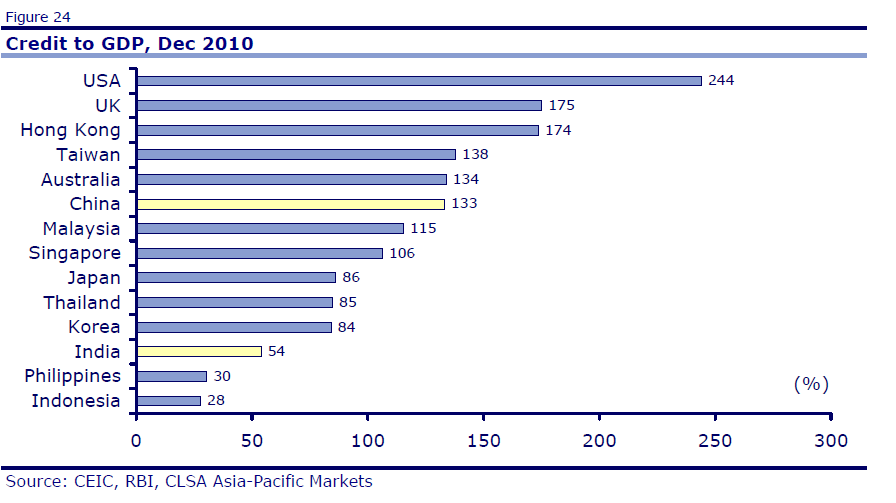

While more central bank intervention and management is the new normal in Asia, there are some clear positives that are being overlooked by the stock market. First, the short-term tightening cycle appears to be over. With Europe lurching from crisis to crisis and the US economy weakening, global inflation forces have receded, leaving Asian central banks room to loosen monetary policy in the short term. Secondly, while Asian financials will continue to be tightly managed for some time to come, they will not be turned into low growth utilities. Rather, they will remain the financial intermediaries positioned between two favorable Asian dynamics: very high domestic savings rates and under-penetrated credit markets with extremely productive uses for that credit (see graphs below). Just to keep up with nominal GDP growth in many Asian countries, financial system assets will have to grow by 15% per annum. Moreover, the better banks with higher returns in productive lending areas that we own should be able to grow 20% or more in some cases. Additionally, demographic trends in these markets will ensure the continuance of these dynamics over time.

In sum, despite a long-term likelihood of continued government interference in the banking sector, we believe that the well-capitalized, growing, high-return Asian banks and non-bank finance companies that we own are worth considerably more than the 9.9x PE for which they currently trade. We remain optimistic about the long-term returns that Kuroto Fund will generate from its 27.5% investment in Asian financials.

Organization

We are pleased to announce that Daniel Gittes has agreed to join Sean Fieler and Bill Strong as Portfolio Manager and will take on the title of Head of Research. Daniel’s contribution to the research process over the last seven years has been exceptional and in recent years he has played an active role in investment decisions. Furthermore, Bill Strong will assume the title of Chairman and Sean Fieler that of President in order to reflect the ongoing development of our firm. We are also happy to announce new additions to our research team and our administrative staff. Brad Virbitsky, a recent graduate of Princeton, joined our firm in July and Rosemary Schneider recently accepted a full-time position with us as an executive assistant.

Sincerely,

Sean Fieler

Daniel Gittes

William W. Strong

ENDNOTES

[1] Dr. Joseph Ackermann, New overall conditions for the banking business. Handelsbatt Annual Conference, Frankfurt/Main, September 5, 2011.