Equinox Partners, L.P. - Q2 2011 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Equinox Partners fell -6.9% in the quarter ended June 30, 2011. For the year to date through June, our fund was down -10.0%. In August, we estimate the fund was down -6.2%, bringing our year-to-date return to -14.5% as of August 31, 2011.

Opportunity in Irony: Bad Performance, Good Fundamentals

Capital markets can fool you when you least expect it. Although thorough and reasoned analysis is essential for successful investing, sometimes it can appear counterproductive. Consequently, Equinox recognizes that it is important to understand, or at least appreciate, that markets may have a different rationale for their behavior than the logical one—at least in the short run. Long-term investors shouldn’t let such actions “throw them for a loop,” instead they should take advantage of them.

The “safe haven” rally in US government bonds on the news of the US downgrade is a case in point. While similar bond market rallies on downgrades have occurred several times, most notably in Japan, this one caught us by surprise and has cost us -1.9% of partners’ capital for the year to date.

As Benjamin Graham posited, the short-term market “voting machine” will eventually tie price to fundamentals and become a “weighing machine.” With this perspective, it is a good time to review how such market action increases the opportunity for long-term investors such as Equinox.

Brazil

Brazil stands out for its precipitous decline, with its index down -18.5% as of August 31. We began the year with 19.6% of partners’ capital invested in Brazil and with many of the same names we purchased in 2008-2009. Notwithstanding the fact that our Brazilian companies continue to grow their earnings, our Brazilian portfolio is down -10.0% in 2011. As a local economist said in Sao Paulo after the -9.7% intra-day Bovespa market decline on August 8, “It feels like the end of the world here. We’re seeing contamination from the international markets; it’s got nothing to do with Brazil’s economy.”[1]

We took advantage of the steep declines in early August to add one new company to our portfolio and to increase our holdings in several pre-existing names. Today, our Brazil exposure stands at 20.8% of partners’ capital. We currently estimate that our Brazilian companies’ P/E’s have contracted meaningfully to 12.5x 2011 earnings and 10.8x 2012 earnings.

Gold and silver mining

With 34.7% of our portfolio invested in gold and silver miners, our performance has been hurt by the surprising divergence between the prices of precious metals and the businesses that mine them. Gold and silver entered the year at $1420/oz and $30.92/oz respectively. Using those commodity prices, we valued our producing mining companies at 65% of net asset value (NAV, using a 0% discount rate) and 9.3x cash flow (CF, pre-capital expenditures) and our non-producers at 42% of NAV. Gold and silver are now at $1825/oz and $41.50/oz, and yet, despite 29% and 34% increases in their prices, our mining stocks are down -5.3% for the year to date.

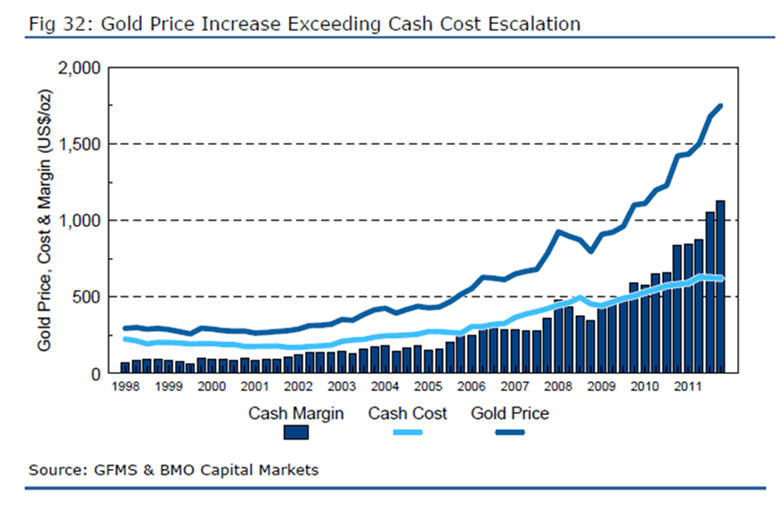

We estimate our producers are now trading at 48% of NAV and 8.4x CF and our non-producers are trading at 34% of NAV. We have not seen mining companies priced at such steep discounts to NAV since the spring of 2009. Although there is no clear answer to this market dislocation, we suspect the accessibility to gold/silver linked ETFs, increasing cost pressures, escalating geopolitical risks, and general skepticism of the metals’ prices have all contributed to the divergence of the miners and the metal. Be that as it may, Equinox thinks that the expanding cash margins in the precious metals mining industry are a good illustration of improving fundamentals (see graph below).

Sovereign Debt Shorts

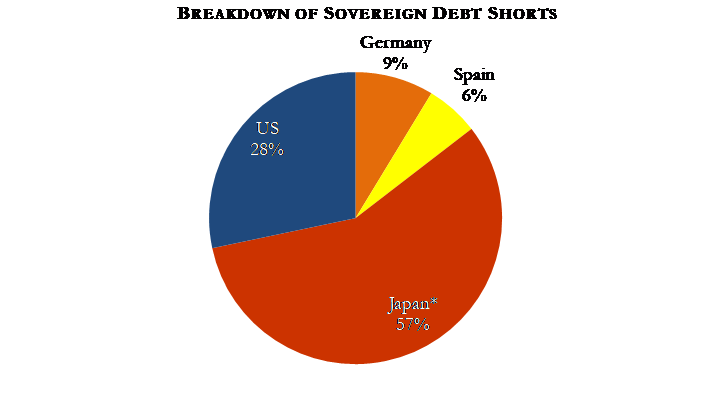

In order to take advantage of the deteriorating credit quality of sovereign debt in developed countries, we began the year with 29.4% of partners’ capital short sovereign debt. Despite governments’ continuing policy of “kicking the deficit can down the road,” we continue to lose money on this short. As these positions have gone against us, they have grown larger as a percentage of partners’ capital. We have also added to them as we believe the rally in the bonds coupled with continuing credit quality deterioration have made them all the more attractive. These positions now represent 52.1% of partners’ capital (see graph right)[2].

Energy

Equinox entered 2011 with an 11.1% net long position in oil exploration and production (E&P) companies and currently has a 7.7% net long position in the sector. While Cushing, Oklahoma-based West Texas Intermediate benchmark oil price is down just -2.4% for the year, the North Sea-based Brent Crude is up 20.3% year to date. However, the stocks of our oil companies have declined -22.6% over the past eight months. While some of our holdings have experienced temporary operational setbacks, on average, production has increased 9.1% from 4Q 2010 to 2Q 2011. Absent a large decline in oil prices, we are optimistic about revaluation of these holdings. We would also direct our partners to our longer-term views on energy as found in the Equinox second quarter 2010 letter.

Conclusion

For some time we have positioned Equinox’s portfolio to benefit from: 1) outstanding operating businesses located outside the developed world; 2) accelerating cash flows from our precious metal miners as a consequence of rising gold/silver prices; 3) the recognition of deteriorating credit quality of sovereign debt in developed countries. All three of these strategies, while seeming to develop favorably, are showing negative results in 2011.

Equinox’s reaction to recent market developments is consistent with our past and our principles: we are taking advantage of the more attractive valuations to add to positions. Going forward, we expect the capital markets to remain quite volatile, but our history demonstrates that volatility has actually been a friend to Equinox as patience and discipline have paid off in the long run.

Organization

We are pleased to announce that Daniel Gittes has agreed to join Sean Fieler and Bill Strong as Portfolio Manager and will take on the title of Head of Research. Daniel’s contribution to the research process over the last seven years has been exceptional and in recent years he has played an active role in investment decisions. Furthermore, Bill Strong will assume the title of Chairman and Sean Fieler that of President in order to reflect the ongoing development of our firm. We are also happy to announce new additions to our research team and our administrative staff. Brad Virbitsky, a recent graduate of Princeton, joined our firm in July and Rosemary Schneider recently accepted a full-time position with us as an executive assistant.

Sincerely,

Sean Fieler

Daniel Gittes

William W. Strong

END NOTES

[1] Financial Times, August 8, 2011, “Aversion to risk batters emerging markets”. Quoting Flavio Serrano from Banco Espírito Santo.

[2] As calculated by the notional value exposure to Japanese government bond interest rate swaps and the market value exposure to US, German, and Spanish sovereign bonds.