Equinox Partners, L.P. - Q3 2011 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Equinox Partners fell -18.9% in the quarter ended September 30, 2011. In October, the fund was up +11.0%. In November we estimate the fund was down -2.8%, bringing our year-to-date return to -21.3%.

Downgrade!

“… [T]he downgrade reflects our view that the effectiveness, stability and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges… The outlook on the long-term rating is negative.”

—S&P announcement of US debt downgrade August 5, 2011

With these fateful words, Standard & Poor’s Corporation announced the fall of the world’s reserve currency from “risk-free” grace. Thus, America joins a growing list of developed countries whose government balance sheets are being called into question. A recent Bank for International Settlement working paper sums up the well known reasons for the rash of developed country downgrades:

“Since the start of the financial crisis, industrial country public debt levels have increased dramatically. And they are set to continue rising for the foreseeable future. A number of countries face the prospect of large and rising future costs related to the ageing of their population… Our projections of public debt ratios lead us to conclude that the path pursued by fiscal authorities in a number of industrial countries is unsustainable.”[1]

If history is any guide, so long as financing costs of government debt remain low, any effort to rouse the requisite political will to reverse the process will fail. This outcome is unfortunate for America and Japan because these countries’ low-cost financing contradicts potential proximity of a sovereign debt crisis. In quick succession, investors’ concern about their credit quality could translate into higher interest rates and those higher rates would in turn exacerbate the very problem investors are worried about by increasing government interest expenses.

America and Japan continue to benefit from a major, and we believe temporary, distinction that bond investors are making between financially-stretched nations with government printing presses and those without. Those with printing presses have seen their interest rates stay low or even decline as worried investors flee countries that lack a printing press. But, while central bank printing may be able to prevent a bad bond auction, it is no panacea. After all, the newly printed money is highly inflationary and in the medium term at least as bond bearish as a failed auction. Accordingly, Equinox’s short sovereign debt position remains largely focused on countries with a central bank, specifically U.S. and Japan. Because it is our largest and, we believe, the most compelling short, we will focus on the Japanese fiscal/credit situation in this letter (please also see our Q3 2009 and Q2 2003 letters on this topic).

Equinox’s Sovereign Debt Shorts

Equinox has had a long and usually profitable legacy of recognizing large-scale global financial imbalances. Our long-running, large precious metals exposure, our preference for emerging markets, and our shorting various companies involved in the U.S. housing bubble are examples of successful themes. Our short of the late 1990s tech bubble is an unsuccessful example.

In recent years we have ramped-up the Japanese Government Bond (JGB) short—a position we initiated in 2003. As of November 30, the position is 32% of partners’ capital.[2] Our investment rationale is as compelling as it is simple: As bond yields collapsed in the aftermath of the 2008 Credit Crisis, and government deficits exploded, the asymmetry of risk and reward with this short became extremely positive. While we have been early, it is our judgment that we dare not miss such a lopsidedly attractive investment opportunity.

“A Bug in Search of a Windshield,” is the colorful metaphor that John Mauldin and Jonathan Tepper use to describe the credit condition of Japanese Government Bonds. With over 200% government gross debt/GDP, developed over their 20 years of Keynesian spending to compensate for economic weakness, and government spending still more than double tax receipts, Japan is by far and away the most indebted sovereign. Ironically, Japan also has the lowest interest rates in the developed world in the face of massive fiscal deficits. This combination makes JGBs a particularly compelling short.

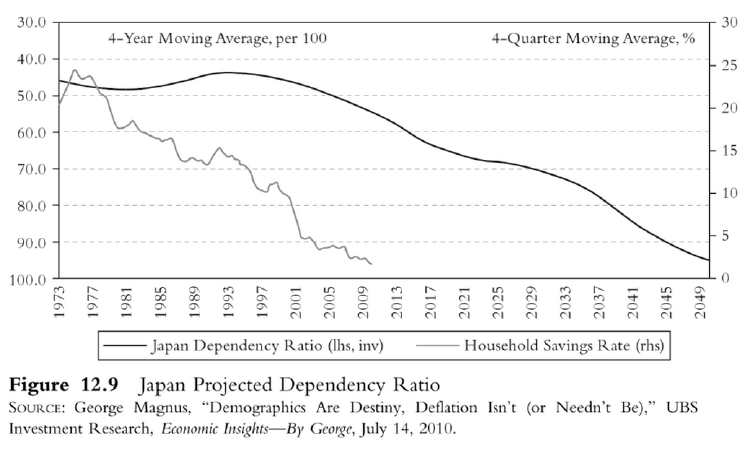

In addition to their very high price, there are two particularly attractive aspects of shorting JGBs. The first is the reflexivity referenced above. As Kyle Bass—a fellow JGB short seller—points out, a mere 2 percent increase in the extremely low JGB interest rates, would mean that, “their debt service alone could easily exceed their entire central government revenue—checkmate.”[3] Additionally, Japan’s previously abundant source of cash inflows is drying up rapidly. The high savings rate of its population that was a hallmark of Japan’s development is collapsing as the aging population retires (graph below).[4] Given the asymmetric nature of this investment—and choosing two scenarios we feel have similar probabilities—if the JGB yield curve were to drop -0.5% across the curve we would stand to lose -$50m while if the curve increased +5.0% we would make +$167m.[5] And with the low annual carry cost of about 0.4% of partners’ capital, we have time to wait.

Mea Culpa: Healthcare Locums

The business of identifying and placing people looking for work requires industry expertise and a good network, but needs little capital. Consequently, these businesses tend to generate high returns on capital and attract our interest. In September 2008, we had our first meeting with Healthcare Locums (HCL), a temp staffing company based in London. HCL was particularly interesting because it focused exclusively on healthcare professionals, and it was cheap.

As we continued our work during the ensuing weeks, we were encouraged by what we learned. Although only founded in 2003, HCL had become the UK’s market leader in providing temporary doctors, allied health professionals and social workers, building the business both through organic growth and a number of bolt-on acquisitions. We found HCL’s market strategy particularly compelling: focusing on staffing specialists in harder-to-fill positions. As a result, they were able to earn a higher margin while also being able to pay their locums more. Because of their dominance in the harder-to-find specialties, HCL could fill jobs that other firms could not; consequently, they were able to charge more. This dynamic created a network effect for their business.

In addition to this domestic business, HCL was expanding into permanent placement of healthcare professionals outside the United Kingdom. By using the same recruiting network as the existing domestic business, the margins on the international business would be significantly higher than the temporary placement business. While this expansion was still developing, HCL had already won a large contract with Emaar Healthcare that sell-side analysts estimated to be worth 38 pence per share, on a stock trading at around 120 pence. Even without this international business as a significant contributor to earnings, the stock traded at a P/E of 9.6x 2008 and 5.8x 2009 consensus earnings.

Our enthusiasm for Healthcare Locums was tempered by two restatements of earnings related to capitalization of expenses by the CEO’s previous business a decade earlier. But, HCL had just hired two new senior executives, one as Executive Chief Operating Officer and one as Executive Finance Director, with lots of industry experience and untarnished resumes. Given the purported fundamentals, combined with our historic success with such businesses and the length of time that had transpired since the former incident, we decided to give HCL’s management the benefit of the doubt.

Our reservations about management were hastily confirmed in early 2011, when the board of directors suspended trading in Healthcare Locums’ stock shortly after consummating a major acquisition of an Australian Healthcare business. As the board was looking over the end-of-year results, it became clear to them that the management had made false representations about the state of the business. On January 25, 2011, concurrent with the suspension, the board announced the following: “Serious accounting irregularities have been brought to the attention of the Board as a result of which the Company will be carrying out an immediate investigation to consider the financial implications. The Company also announces that both Executive Vice Chairman, Kate Bleasdale, and Chief Financial Officer, Diane Jarvis have been suspended pending the outcome of the investigation.”

During the suspension, which lasted until September 13, HCL replaced its entire board and management. After completing a lengthy investigation, the new executive team found that the company had not only capitalized expenses they should have expensed, but had also recognized fictitious revenues in the previous three years.

As a result of the investigation, the board concluded that the remaining business simply could not handle the amount of debt that the company owed. In response, the new board was forced to do a large equity raise at 10 pence per share, some 90% below the last traded price. The dilutive equity raise virtually wiped out existing shareholders.

The mistake of investing in HCL cost us about 2.9% of capital this year and reinforced a lesson that we long ago learned: the best predictor of future behavior is past behavior. In this case, we were attracted by the investment opportunity and made the mistake of giving less credence to one of our fundamental investment tenets. Our experience with Healthcare Locums was a painful reminder that we should only invest with the most principled managers.

Sincerely,

Sean Fieler

Daniel Gittes

William W. Strong

END NOTES

[1] Stephen G. Cecchetti, MS Mohanty, Fabrizio Zampolli, “The Future of Public Debt: Prospects and Implications,” Abstract of BIS Working Paper No. 300, March 2010.

[2] Stated percentage is the notional amount of JGB swaps as a percentage of partners’ capital.

[3] Hayman Capital Management, L.P. Investor Letter, “The Cognitive Dissonance of It All”, February 14, 2011.

[4] Dependency ratio shows the number of non-workers per 100 workers.

[5] This does not factor in possible Yen currency devaluation which would likely offset some of the gains or losses.