Equinox Partners, L.P. - Q4 2008 Letter

Dear Partners and Friends,

Equinox Is Open

Having converted from a 3(c)1 to a 3(c)7 fund, Equinox Partners is now accepting new subscriptions from “qualified investors.” The minimum investment is five million dollars.

Reassessing the locus of risk

Equinox submits that we are at the beginning of a watershed moment in the perception of global risk. Heretofore, developed markets, like the US, have been designated “safe” because of their legacy of economic stability, political steadiness, accounting reliability and management integrity. With the recent economic crisis, however, the world has been turned upside down. In the post sub-prime, post-Madoff , post-Bear Stearns, -Lehman, -AIG, -Northern Rock -Fannie Mae/Freddie Mac, -Wachovia, -Washington Mutual, -Citigroup, -Bank of America, -Royal Bank of Scotland etc. world, Equinox believes that America and its European cousins will come to be viewed as riskier than historically more turbulent but well capitalized emerging economies like India and Brazil.

With respect to political risk, we acknowledge that the fragmented democracies of our favorite emerging markets do raise the possibility that fringe parties might gain powerful influence in forthcoming elections. That said, America’s stable two party system has certainly not insulated the US economy from political uncertainty. A year ago, who could have guessed the extremes to which government intervention in our economy would soar? The response to the future stages of our financial problems can only be imagined.

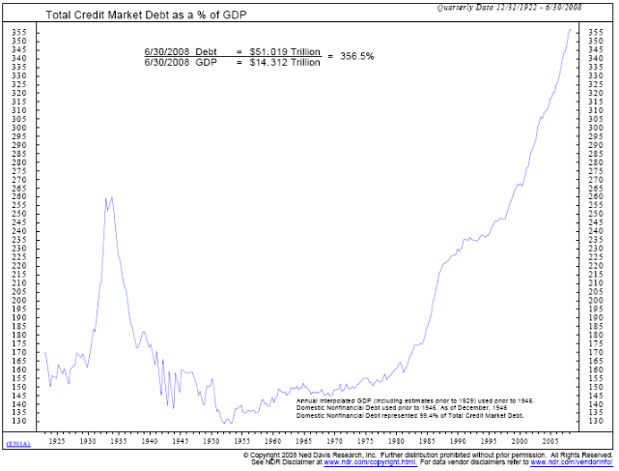

The key point to be made is that the calculus of risk can no longer ignore the most salient factor in assessing the locus of risk—aggregate national debt. The ever growing parade of bankrupt US financials is just one symptom of America’s over-levered economy, an economy with too many liabilities, many of which can’t be fully met. Counting only reported debt and excluding other promises such as defined benefit plans, contingent government liabilities, and derivatives, America is more than twice as indebted as it was at the start of the last major debt deflation in 1930. The US’s most recently reported debt figure is a whopping 360% of GDP. India and Brazil, two countries in which we are heavily invested, by contrast, carry total debt burdens less than 100% of their GDP.

In an asset inflationary environment such as the housing or stock market bubbles of recent periods, America’s leverage was barely manageable. But, with the current deflation, the arithmetic of American debt simply cannot work. Add on the potentially unknowable risks posed by the massive aggregate derivative positions in the US, and one can see that something big has to give.

The valuation implications of the risk perception flip-flop are profound. If “to be early is to be wrong,” then count Equinox as initially mistaken. We still maintain, however, that in the end, the safe haven, the capital “bunker” for skittish investors, will be the very venue in which we are currently concentrated—under-leveraged, high-saving, very cheap emerging markets.

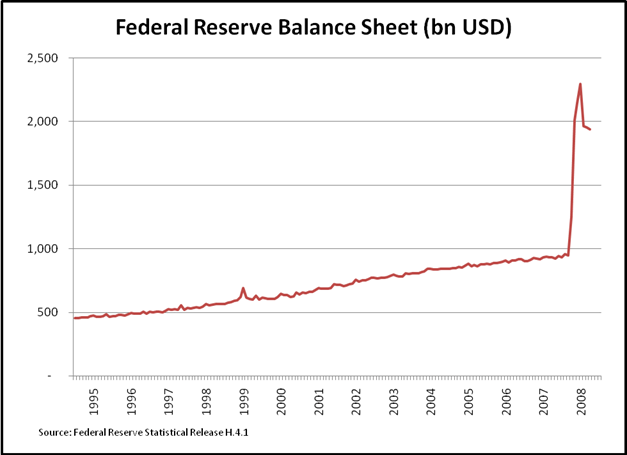

A Pulitzer Prize for a fellow gold enthusiast

James Grant[1], the best financial writer in at least a generation, has proclaimed the start of a new era for America’s Federal Reserve. In his usual incandescent prose, our fellow precious metals devotee declared Ben Bernanke’s congressional testimony of early December to be, monetarily at least, a defining moment in American history. According to Mr. Grant, the current post-interest- rate-lowering-expansionary phase in America’s monetary policy, known as “quantitative easing,” simply means that the Federal Reserve “intends to debase its own paper money.”[2] Doing its darnedest to reverse the current debt deflation, the United States government central bank has finally and formally begun implementing this debasement by initiating a radical expansion of its own balance sheet in recent months.

[1] Sadly, Grant’s writings in his Interest Rate Observer appear to be ineligible for submission to the Pulitzer Committee, as the committee requires that the winning article be printed in a weekly publication.

[2] Wall Street Journal Weekend edition, December 20, 2008, page W1.

Equinox would not be surprised if Mr. Grant, the indefatigable chronicler of the “era of leverage,” viewed this radical extension of central bank easing as the culmination of his career. During his working years, US monetary policy has run the entire gamut from the tight-fisted Fed of Paul Volcker to ‘helicopter Ben’s’ December testimony. Now it appears as if Mr. Grant’s most dire warnings about our potential abuse of the dollar’s elasticity have come to fruition.

Were it in our power, we’d give Mr. Grant the Pulitzer for his prescient discussion of the structured finance boom, but we won’t quibble with the Pulitzer Committee if they award Mr. Grant the prize for one of his many other insights. His financial reporting has been, after all, cutting edge for decades.

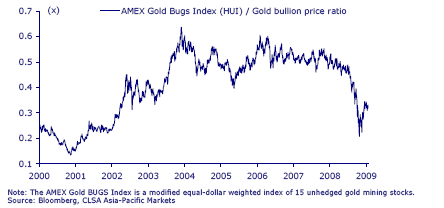

As for our partnership, Equinox submits that our long running gold strategy, like Grant’s reputation, appears to be reaching a climax. For close to a decade, we have partially forgone the obvious appeal of owning outstanding businesses at reasonable prices to make room for our outsized position in gold mining stocks. We did this despite our recognition of the inferior financial characteristics of mining companies, persevering in this decision only because of the leverage mining offers to the price of the metal and our conviction that the ever-escalating spend/borrow behavior of Americans would eventually result in a historic monetary crisis. Certain that, “what cannot continue, will stop,” we wagered that the US debt pyramid would ultimately fall over and that the authorities would respond aggressively. The Federal Reserve’s new extreme policies of the last year and a half represent precisely the kind of potential dramatic growth in money supply that we have been anticipating for years.

Ironically, the prices of our gold mining stocks fell precipitously just as their long-term prospects began improving. As the credit crisis worsened last year, investors sold these and other capital intensive businesses with abandon. The resulting precipitous decline in the price of gold mining stocks simply reflected the general stampede to liquidate almost all asset classes, regardless of their fundamental merit. However, with the gold index already having made back half of last year’s fall while most other stocks have continued to decline, the market is apparently already starting to appreciate the positive impact that higher gold prices and lower costs will have on the industry.

Equinox is optimistic about our long running precious metals investment. From Bernanke’s “quantitative easing” to extremely cheap valuations, all the pieces are finally in place for our precious metals strategy to succeed. And, the payoff could make all the years of waiting worthwhile.

Addendum

Without moderating our current enthusiasm for the investment merit of gold and silver stocks, Equinox wishes to make it clear to all of our limited partners that if gold continues to rise, especially if this appreciation occurs as outstanding businesses fall to depressed prices, Equinox will, at some point, happily liquidate mining stocks to buy great businesses.

Sincerely,

Sean Fieler

William W. Strong