Kuroto Fund, L.P. - Q1 2009 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Kuroto Fund declined 11% in the first quarter of 2009. Subsequent to the quarter end, the fund has rebounded sharply. As of the writing of this letter, Kuroto Fund is up approximately 46% for the year-to-date.

Asian ascendency

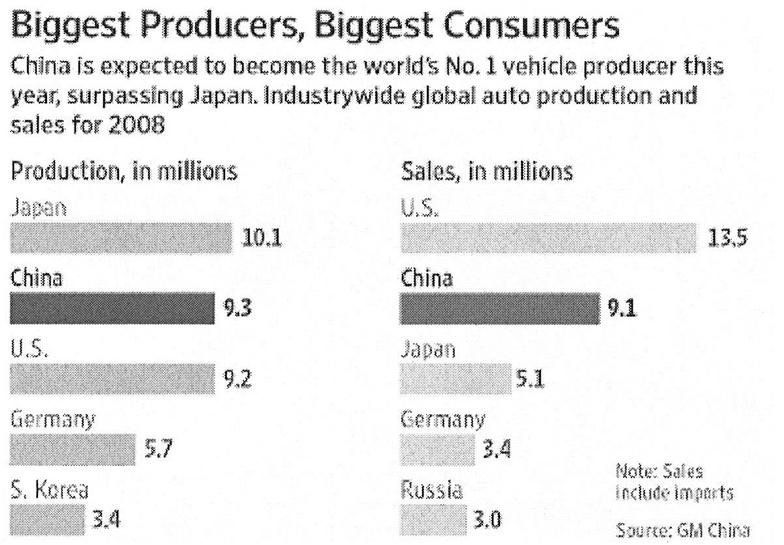

Whether the world economy is up or down, emerging Asia continues to close the gap with the developed world. China produced more cars and light trucks than America last year and is expected to surpass Japan this year.

Asian Bear Market Opportunity

Kuroto’s almost 60% decline from its peak, in spite of having the lowest net investment exposure in the Fund’s history, has been a particularly disquieting experience. With a few notable exceptions, the operating performance of our holdings has been only modestly affected by the recent global economic slowdown. As the Fund’s sharply reduced aggregate Price/Earnings ratio shows, the bulk of Kuroto’s stocks’ enormous price decline was a result of valuation compression.

As nature abhors a vacuum, so too large-scale aggregate equity mispricing rarely lasts long. However, Kuroto has not viewed the recent dramatic decline of our companies’ stocks as simply a trading opportunity. Rather we have viewed this extraordinary market episode as a chance to position our Asian portfolio so as to maximize our returns for the next decade. Consequently, it is no surprise that Kuroto’s shares are enjoying a big bounce. Accordingly, we have completely committed our uninvested capital to the ownership of outstanding Asian businesses. More significantly, we have been able to concentrate the entire portfolio in the very best long-term investments we can imagine: high return on capital businesses with an extensive growth profile into which companies can reinvest cash flow very profitably for years to come. Despite trading at ‘value stock’ multiples, such businesses represent the very definition of ‘growth stocks.’ We believe that when Asian corporations’ growth opportunities become apparent to global investors, the companies we own will be so positively distinguished from their Western peers that their valuations will soar far beyond those of developed country businesses - in contrast to their current discounts.

To emphasize the superior qualitative features of the businesses that make up the Kuroto portfolio, we’ve once again broken with our usual policy of non-disclosure of company names in order to explore the core businesses of two representative companies in our portfolio. In our previous letter, we talked about the defensive characteristics of these two financial companies. In this communiqué, we shall discuss the profitability these companies enjoy in their incremental investments into their core businesses and the potential scale of their reinvestment opportunities.

Housing Development Finance Corporation (India)

Housing Development Finance Corporation (HDFC) is far and away the best mortgage finance company in India (The company also owns several subsidiaries in other excellent financial business which we shall ignore in this discussion). From its founding in 1977 until today, HDFC has boasted a world class management and one of the highest long-term returns on equity among Asian financials. HDFC’s returns, unlike some of its very profitable financial peers, are not dependent on the premium pricing of credit. In fact, the mortgage company generates pedestrian lending spreads in the 2.1-2.3% range, comparable to those of its competitors. Rather, HDFC achieves its outsized profitability through operational efficiency and a superior credit underwriting process.

| Indian Banks: Cost to Income Ratio | |

|---|---|

| HDFC | 12.5% |

| LIC | 23.7% |

| Dewan Housing Finance | 39.0% |

| Axis Bank | 43.6% |

| Yes Bank | 44.2% |

| Punjab National Bank | 45.1% |

| Bank of Baroda | 45.4% |

| HDFC Bank | 50.2% |

| State Bank of India | 51.9% |

| ICICI | 74.8% |

As the above table shows, the company maintains a cost/income ratio in the low teens, against a more typical range of 40-60% for its bank competitors. For almost two decades, HDFC has been constantly improving the productivity of its branches and employees. Over the last 19 years, HDFC has increased its assets per employee 20.7% CAGR. This incredible long-term improvement cannot solely be attributed to internal efficiency measures; it also is a product of HDFC’s ability to attract higher-end borrowers that generate ever larger loan sizes. With origination and service costs a constant whether the loan is larger or smaller, ever-growing loan sizes have been a significant tailwind for HDFC’s efficiency ratios over time.

Another important nuance to take special note of is HDFC’s status as a housing finance company. This status imposes a slightly higher and less stable cost of funds, but it allows HDFC significant regulatory advantages vis-à-vis its banking competitors. Banks in India, as they are in much of the world, are subject to a mind-numbing array of government regulations and restrictions. The full cost of compliance with these regulations more than offsets the benefit that banks receive in lower funding costs and explains a large part of the efficiency gap between HDFC and its bank competitors. This advantage can best be captured in the 37 percentage-point cost advantage that HDFC has over its sister company, HDFC Bank.

Efficiency is a necessary but not sufficient requirement for a superior lender. Underwriting is equally, if not more, important. Here again, HDFC’s track record is unambiguous: since its inception 32 years ago, HDFC has maintained a cumulative credit loss history of a stunningly low 4 basis points. To our knowledge, this is the best long-term cumulative loss figure anywhere in the world.

With Indian mortgage penetration at 6% of GDP, as against 12% for China, 32% for Singapore, 41% for Hong Kong, 80% for the US and 83% for the UK, HDFC has a substantial growth fairway in front of it. HDFC is one of those rare, truly special companies with the business model, market opportunity and management capability to execute a return on equity (ROE) of 25-30% and organic growth of 20-25% for decades to come.

Our reinvestment in the company last fall (after our sale of the company two years ago) was simply a reflection of its much diminished valuations and reflects our willingness to buy excellent stocks when others are panicked sellers.

Bunas Finance (Indonesia)

Bunas Finance (BFI) is a small Indonesian microfinance company that has found an efficient way to serve a previously unaddressed corner of the Indonesian market, providing small merchants the working capital they need for their business through vehicle financing. These financed vehicles, which in the case of BFI’s loan book are mostly vans and small trucks, are the only asset a small business has that a creditor can actually repossess. Uncollateralized small businesses loans, the logical alternative, are a non starter as these small firms invariably lack the formal books and records necessary for a normal underwriting process.

BFI began its business twenty-five years ago financing the purchase of commercial vehicles from used car dealers. Recognizing a larger and more profitable opportunity, over the years BFI built up a network of agents, current/former customers, repair shops, etc. that could originate identical vehicle loans. While the collateral quality, loan/value ratios and ultimate credit performance are the same whether BFI is financing working capital or a vehicle purchase, the yields are higher on the former. Furthermore, BFI’s unique proprietary network, which took years to build, now serves as a very formidable barrier to a new entrant that might show an interest in BFI’s clients.

While establishing a network that identifies businesspeople in need of working capital is tricky, determining which of prospective borrowers are credit worthy is even trickier. That BFI approves just 20% of the loan applications its agents generate speaks volumes to the rigor of the process. A rigor with results – even during the current global crisis they have non-performing loans of only 1.3%.

| BFI After-Tax Returns 2004-2008 | |||||

|---|---|---|---|---|---|

| 2004 | 2005 | 2006 | 2007 | 2008 | |

| Return on Assets (ROA) | 8.7% | 7.7% | 12.1% | 10.1% | 7.7% |

| Return on Equity (ROE) | 13.8% | 10.7% | 16.6% | 17.8% | 18.1% |

The high ROAs shown above would be good for a manufacturing business, but are truly spectacular for a finance company. What’s more, with such little leverage (assets/equity 2.4x), BFI’s returns on equity are actually depressed. With the leverage seen in other finance companies in Asia, the ROEs of this business could easily be north of thirty percent. This low leverage and the high returns generated by its assets mean BFI has the ability to grow its balance sheet without the need for external capital. Furthermore, given the growth of the Indonesian economy and the current low credit penetration among BFI’s customers, we believe that market demand growth will easily match, if not outpace, the growth of BFI’s supply of credit. With the stock still trading at a significant discount to book value, the intrinsic value of this business is several multiples of its current market value.

BFI would be a fantastic strategic asset for a bank to acquire in the coming years. A bank’s lower cost funds and BFI’s superior marketing and underwriting are an obvious combination. Given this prospective synergy, a bank could pay a high multiple to current earnings, but immediately boost those earnings to make the real valuation they paid much less. In fact, an Indonesian bank has done just that with a BFI peer – this bank bought a stake in another microfinance company to profit from the special combination we have just described – and paid a fancy price to do so.

Our investment thesis is in no way dependent on the aforementioned type of transaction. In fact, our principal concern is that management may accept a price which we would view as inadequate. As long-term shareholders of BFI, we expect to profit as this business’ intrinsic value compounds at very high rates for as far as the eye can see. Should a strategic acquirer want us to part with this franchise, our exit price would need to be a very full one.

Sincerely,

Sean Fieler

William W. Strong