Kuroto Fund, L.P. - Q4 2016 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

In the fourth quarter, Kuroto declined -0.6%, bringing the fund’s full-year return to +14.9%. In comparison, the emerging market index declined -4.1% in the fourth quarter and appreciated +11.5% for the year. For the year to date through February 14, Kuroto appreciated +5.1% while the EM index was up +8.4%

[1]

From a geographic perspective, Peru and the United Arab Emirates were the largest positive contributors to our performance, with Russia, Vietnam, India, and the Philippines also providing significant positive contributions. This was encouraging as not only were these amongst our largest country allocations, but also many of our best performing companies were in these locations. Brazil, surprisingly, was our largest detractor from performance last year despite its market rally.

In the fourth quarter, Kuroto initiated four new investments: financial companies in Georgia and Bangladesh, a service company in India, and an infrastructure company in Vietnam. During the same period, we exited a consumer company in India, a financial in India, a retailer in Russia, and a consumer company in Vietnam as these businesses all reached full valuations late last year. A fifth exit came from a consumer company based in the Philippines whose management team was too deliberate in rolling out its new strategy at the same time that competition was intensifying.

In total for the year, we exited 10 investments, which is a meaningful amount of turnover for the fund. The developing world continues to be a challenging environment in which to find new investments. That said, over the course of the year we were able to add stakes in 8 new companies.

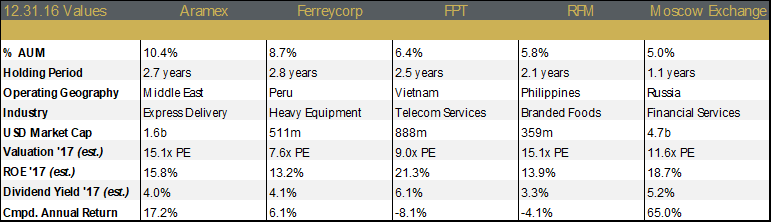

As of year-end, the portfolio consisted of investments in 26 companies trading at an average of 12x our estimated earnings for 2017 and generating an ROE of 17% and a 3% dividend yield. These metrics are roughly on par with portfolios over the last few years.

Top-Five Holdings

Aramex – 10.4% of the fund

Aramex is a UAE listed express-delivery company similar to FedEx or DHL. The combination of the company’s reputable brand and the network effect inherent to express delivery form a particularly durable barrier to entry. The company continues to generate nearly a 50% adjusted return on equity (excluding cash and goodwill), making it one of the highest-return businesses we own.

Throughout the first three quarters of 2016, the company faced persistent headwinds in the Middle East. While stated revenues grew 15% for the period, after adjusting for a one-time revaluation gain, operating income was only up 2%. Some of the margin contraction was caused by the acquisition of a lower-margin business, but most of the margin contraction came from declines in its core domestic-express business in the Middle East. Despite the weakness, the company was hesitant to cut too hastily into its manpower.

Strong fourth quarter numbers suggest that the worst of the recent weakness in the Middle East may have passed. Longer-term, the growth prospects for Aramex remain very attractive. In particular, the business about which we are most optimistic (e-commerce) continues to grow faster than the overall company and now represents close to 30% of revenues.

In 2016, Aramex consummated a particularly important strategic joint venture with Australia Post to provide e-commerce delivery services globally via post offices. This joint venture is fundamentally different from Aramex’s past corporate transactions. While the joint venture is still in its infancy, there is the opportunity for this to be as large as their existing business. As with any new venture there is much uncertainty, but the market isn’t making us pay anything for the option, nor for the world-class management team at Aramex.

Ferreycorp – 8.7%

Ferreycorp, the exclusive Caterpillar dealer in Peru, delivered as expected in 2016 despite a weak environment for both construction and mining investment. From 2015’s record levels, sales were down 9% and adjusted earnings per share were down 6% in 2016.

It has been a challenging operating environment for Ferreycorp: mining investment in Peru has declined by more than 50% from its 2013 peak, and the recent election added a further economic headwind. That said, Ferreycorp was buttressed over this period by its high-margin service business, and we expect the company to benefit from increasing mining/infrastructure investment and political certainty going forward.

President Pedro Pablo Kuczynski (PPK), who won the runoff election in June, has laid out an ambitious program of reforms and projects to revive economic growth. Infrastructure investments form a major part of this program and should help generate new demand from the construction industry for Ferreycorp. Many of these projects have been planned for years and we expect to see the impact in 2017.

Mining investment should also see some improvement as the industry moves out of the downturn of the last few years. Copper, zinc, gold, and silver prices have all recovered from their recent lows and Peru (which is globally very competitive on the cost curve) should start to see investment dollars flowing into new projects again. PPK’s government should help here as well. Under former president Humala, social conflicts with local communities became intractable for several companies. PPK understands that his economic agenda requires mining investment and will push his ministries to help mining companies obtain the social licenses needed to operate. While mining investments will likely take time to revive, we believe that we are through the worst of the downturn.

Finally, and perhaps most importantly, we believe that there is ample room for Ferreycorp to improve its margins, use its balance sheet more efficiently, and reduce investments in non-core subsidiaries. The company’s directors stand for election on a three-year cycle; we expect a meaningful shakeup, with several board seats turning over this March. We think that this injection of fresh thinking will lend some urgency to the company’s efforts to generate financial returns on par with its very strong competitive position.

FPT – 6.4%

A Vietnamese technology and telecom conglomerate, FPT continues to concentrate its efforts on customer service and returns on capital: a highly unusual focus for a Vietnamese corporation. Importantly, this emphasis enabled the company to generate a 21% return on equity in 2016 even while some of its businesses struggled.

For the full year, sales grew 4% and earnings 3%. The numbers, however, are clouded by problems the company faced in its distribution-of-IT business. In the latter part of 2015, Apple decided it had enough scale in Vietnam to distribute its products directly to retailers rather than through FPT. This decision by Apple resulted in a painful, albeit onetime, loss of sales for FPT last year.

Excluding the impacted distribution business, FPT’s revenues would have grown 18% with operating income up 16% in 2016. These numbers are particularly impressive when you consider that FPT’s internet-service-provider business continued to amortize large investments as it upgrades its network from copper to fiber optic cable over just two years. Additionally, the company’s domestic IT services faced headwinds as some projects were deferred by state-owned companies that put spending on hold around last year’s elections.

Importantly, FPT has begun the process of streamlining their businesses. We believe this will result in a more valuable, high-return company. More specifically, they are currently negotiating sales of their retail and distribution businesses. The company will likely use the proceeds of either transaction to increase their ownership in the ISP business. The result should focus management and the company’s balance sheet on one of its highest-return business lines. With the stock trading at 9x our estimate of this year’s earnings, the positive evolution in the company’s structure has obviously not been discounted by the market.

RFM – 5.8%

RFM is a food company listed in the Philippines with dominant market share in the underpenetrated branded categories of ice cream (76%) and pasta (39%). Their crown jewel—an ice cream JV with Unilever—accounts for over 50% of earnings and more than 75% of the company’s value. In addition to the strong Selecta brand and a wide distribution network of 60,000 self-owned freezers, RFM’s joint venture with Unilever benefits from Unilever’s global management expertise in the ice cream business.

In the first nine months of 2016, the company’s revenue growth slowed to the single digits, weighed down by a roughly 10% revenue decline in the commoditized institutional-flour business. However, earnings growth remained on track at 10%, mainly driven by strong double-digit growth in ice cream and pasta. The resulting mix shift away from flour had the silver lining of overweighting the higher-return branded-foods business and improving the company’s ROE to roughly 20%.

Going forward, ice cream will remain the key driver of growth and value as RFM targets expansion of its distribution network from 60,000 to 100,000 freezers within the next three years. The company also expects to see higher growth in pasta sales with the launch of consumer-friendly, single-serving packets. We believe that these businesses more than account for the current enterprise value.

To maintain an efficient balance sheet the company announced a higher dividend payout ratio of 50% and plans to continue their share buyback program.

Moscow Exchange – 5.0%

Moscow Exchange is a uniquely dominant financial services franchise. Imagine combining the U.S. operations of the NYSE, NASDAQ, Chicago Mercantile Exchange, Intercontinental Exchange, the bond, FX, and repo desks of all the large banks and brokers, and the Depository Trust & Clearing Corporation into one company: in a nutshell, that is Moscow Exchange.

While all of Moscow Exchange’s markets are underdeveloped and therefore represent an exceptional long-term opportunity, it is important to recognize that the company is not yet on a durable growth trajectory. Despite this and the challenging macro environment in Russia, Moscow Exchange did grow its core exchange business 16% during the first nine months of 2016. That said, this improvement was largely offset by falling investment income. Going forward, we expect interest income to continue to decline and consequently we are expecting flat earnings for 2017.

The company’s largest shareholder remains the Central Bank of Russia and the chairman of the board is still the well-respected former finance minister, Alexei Kudrin. It is worth noting that Russian oligarchs have steered clear of the exchange. To their credit, the oligarchs realize that they cannot exercise any influence over the exchange without running the company’s franchise. This take-it/break-it dynamic provides an extra layer of insurance against some of the worst of Russia’s behavior.

The company is trading at 12x our estimate of this year’s earnings, which represents a significant discount to other global exchanges. While we wait, the company pays a 5% dividend. This valuation greatly undervalues a premiere franchise not to mention any further development of Russian capital markets, from which Moscow Exchange would benefit handsomely.

Sincerely,

Sean Fieler

Daniel Gittes

ENDNOTES

[1] Performance stated for Kuroto Fund, L.P. Class A on a net basis. An investor’s performance may differ based on timing of contributions, withdrawals, share class, and participation in new issues. Performance contribution derived in US dollars, gross of fees and fund expenses. Sector performance figures are derived using monthly performance contribution calculations in US dollars, gross of all fees and fund expenses. P&L and exposures on cash and currency forwards included under Cash. Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, or Bloomberg. Company exposures expressed as a percentage of 12.31.16 pre-redemption AUM. Valuations as of January 2017.