Equinox Partners, L.P. - Q4 2016 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Equinox Partners declined -3.6% in the fourth quarter of 2016 and gained +55.0% for the full year. Through February 14, the fund is up 12.5% for the year-to-date 2017.[1]

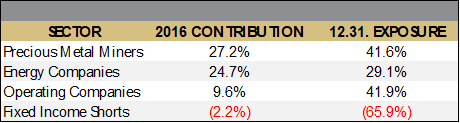

The major positive contributors to 2016 performance were our E&P and mining investments which rebounded sharply last year: our E&P companies appreciated 130%, our miners gained 90% on the year, and our collection of superior, global operating companies rose 20% in 2016. Our fixed income short positions were the sole detractor from our performance. As rates rose in the latter half of the year, we recouped the vast majority but not all of the losses we recorded earlier in the year.

We began 2016 with 24 companies and ended the year with 27, purchasing eight new companies and selling five. More specifically, we purchased one new mining company and sold three due to an acquisition, a full valuation, and an operational disappointment. We also added two, undervalued, high-return Canadian E&P companies. Finally, we sold an Indonesian financial and our remaining position in APR. We also initiated positions in a fintech company, two holding companies, a Russian financial, and a Brazilian outsourcing company.

TOP-FIVE HOLDINGS

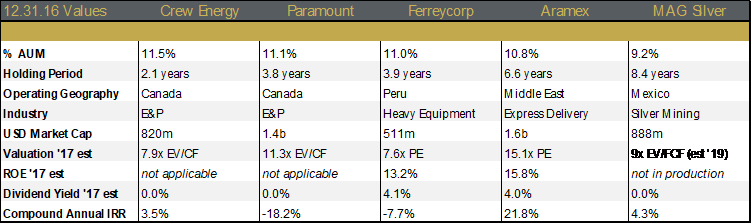

As is our practice, this fourth-quarter letter reviews the fund’s top-five, year-end holdings. Taken together, our top-five positions accounted for 54% of partners’ year-end capital. The portfolio’s top positions are similar to last year’s with only one change: Paramount Resources replaced ITE.

Crew - 11.5% of the fund

Crew Energy, a Canadian oil and gas producer based in British Colombia, currently trades at ~7x this year’s cash flow and is on track to more than double production by the end of decade.

We expect Crew to grow daily production from 24k barrels of oil equivalent in 2016 to over 60k by the end of 2019. This impressive growth will only touch the surface of the production potential of the company. Importantly, over this time period, operating margins should increase as the company scales fixed costs. As such, cash flow should grow faster than production. The management believes it can achieve these targets without additional capital, but they would prefer to sell a non-core asset to accelerate the growth.

In sum, Crew controls an absurd amount of high-quality inventory for a company of its size. The result is a rapidly growing, self-financing company. And, this ability to self-finance a high rate of growth is simply not in the company’s current share price.

Paramount - 11.1% of the fund

Paramount underwent a dramatic corporate transformation in 2016. A year ago, Paramount had over $1.8 billion CAD in debt while generating just $200 million CAD in annual cash flow. As a result of this over-leveraging, the market abandoned the company and the shares traded below $4 CAD in January 2016. As the stock declined in the second half of 2015 we added to our position and remained heavily invested in Paramount as the stock bottomed. We believed that even though the company was over-leveraged on a cash flow basis, Paramount could quickly sell its assets for much more than its debt even in a weak pricing environment for oil and gas.

Over the course of the year, Paramount sold a midstream asset for over $500 million CAD and later sold approximately half of its core asset on an acreage basis for over $2 billion CAD. They also raised $100 million CAD through a royalty deal on oil sands assets. In the process, they eliminated their debt and now have approximately $1 billion CAD in cash and investments.

Paramount’s current capital plan focuses on the development of its core acreage, which consists of nine different plays, six of which are clearly economic. In particular, the company is focusing on Karr/Gold Creek, which has economics similar to the assets they sold to Seven Generations last year. They are expecting ~70% IRRs and 1.5 year payouts from these wells. Production at the company is in the process of ramping up from 10k boepd to 30k boepd by midyear. At 30k boepd, the company would be trading at around 7x cash flow.

At 30k boepd, Paramount will have over 20 years of inventory from just one of the company’s nine plays. The market remains skeptical of its production ramp up given the company’s execution problems in prior years. The bigger question, in our opinion, is what the company does with all of its newfound liquidity.

Ferrycorp - 11.0% of the fund

Ferreycorp, the exclusive Caterpillar dealer in Peru, delivered as expected in 2016 despite a weak environment for both construction and mining investment. From 2015’s record levels, sales were down 9% and adjusted earnings per share were down 6% in 2016.

It has been a challenging operating environment for Ferreycorp: mining investment in Peru has declined by more than 50% from its 2013 peak, and the recent election added a further economic headwind. That said, Ferreycorp was buttressed over this period by its high-margin service business, and we expect the company to benefit from increasing mining/infrastructure investment and political certainty going forward.

President Pedro Pablo Kuczynski (PPK), who won the runoff election in June, has laid out an ambitious program of reforms and projects to revive economic growth. Infrastructure investments form a major part of this program and should help generate new demand from the construction industry for Ferreycorp. Many of these projects have been planned for years and we expect to see the impact in 2017.

Mining investment should also see some improvement as the industry moves out of the downturn of the last few years. Copper, zinc, gold, and silver prices have all recovered from their recent lows and Peru (which is globally very competitive on the cost curve) should start to see investment dollars flowing into new projects again. PPK’s government should help here as well. Under former president Humala, social conflicts with local communities became intractable for several companies. PPK understands that his economic agenda requires mining investment and will push his ministries to help mining companies obtain the social licenses needed to operate. While mining investments will likely take time to revive, we believe that we are through the worst of the downturn.

Finally, and perhaps most importantly, we believe that there is ample room for Ferreycorp to improve its margins, use its balance sheet more efficiently, and reduce investments in non-core subsidiaries. The company’s directors stand for election on a three-year cycle; we expect a meaningful shakeup, with several board seats turning over this March. We think that this injection of fresh thinking will lend some urgency to the company’s efforts to generate financial returns on par with its very strong competitive position.

Aramex – 10.8% of the fund

Aramex is a UAE listed express-delivery company similar to FedEx or DHL. The combination of the company’s reputable brand and the network effect inherent to express delivery form a particularly durable barrier to entry. The company continues to generate nearly a 50% adjusted return on equity (excluding cash and goodwill), making it one of the highest-return businesses we own.

Throughout the first three quarters of 2016, the company faced persistent headwinds in the Middle East. While stated revenues grew 15% for the period, after adjusting for a one-time revaluation gain, operating income was only up 2%. Some of the margin contraction was caused by the acquisition of a lower-margin business, but most of the margin contraction came from declines in its core domestic-express business in the Middle East. Despite the weakness, the company was hesitant to cut too hastily into its manpower.

Strong fourth quarter numbers suggest that the worst of the recent weakness in the Middle East may have passed. Longer-term, the growth prospects for Aramex remain very attractive. In particular, the business about which we are most optimistic (e-commerce) continues to grow faster than the overall company and now represents close to 30% of revenues.

In 2016, Aramex consummated a particularly important strategic joint venture with Australia Post to provide e-commerce delivery services globally via post offices. This joint venture is fundamentally different from Aramex’s past corporate transactions. While the joint venture is still in its infancy, there is the opportunity for this to be as large as their existing business. As with any new venture there is much uncertainty, but the market isn’t making us pay anything for the option, nor for the world-class management team at Aramex.

MAG Silver – 9.2%

MAG Silver is the minority owner of the world’s highest-grade undeveloped silver mine. Its Juanicipio Joint Venture is controlled by Fresnillo, the world’s largest silver producer.

The development of MAG’s joint venture proceeded steadily over the course of the year. With the working ramp now at the top of the ore body, 2017 will see the preparation of stopes for underground mining as well as the initiation of work on surface facilities to process the ore. The economic studies done on the deposit envisioned a plant processing 2,400 tonnes per day. That said, based on the expansion of the orebody, we expect that the operating partner, Fresnillo, will mirror the plant they built nearby at their Saucito mine, which is rated at 3,000 tonnes per day and operates at 4,000.

At 4,000 tonnes per day throughput, MAG’s share of production from the Juancipio Joint Venture will be 10 million ounces annually. At current silver prices, we’d expect after tax cash flow for MAG’s 44% interest to exceed $125 million per year. This cash flow profile more than justifies MAG’s $1.2 billion enterprise value and the company remains meaningfully undervalued.

The higher rates of production are supported by the ongoing exploration success directly beneath the main Juancipio vein. In early 2016, the JV released twelve more holes on the deeper mineralization. While not all the holes repeated spectacular grades, the mineralization was consistently 3-4x wider than the upper portion of the deposit. These holes also intersected a new vein running parallel to the existing veins. Importantly, the discovery at depth remains open in multiple directions, and should exploration success continue, the JV will likely decide to increase capacity beyond 4,000 tonnes per day. In fact, we expect that certain development decisions—such as the sizing of underground crushing and conveying equipment—may be taken to allow for easier expansion in the future.

Sincerely,

Sean Fieler Daniel Gittes

END NOTES

[1] Sector exposures calculated as a percentage of 12.31.16 pre-redemption AUM. Performance contribution derived in US dollars, gross of fees and fund expenses. Interest rate swaps notional value and P&L included in Fixed Income. P&L on cash excluded from the table as are market value exposures for derivatives. Short proceeds held in local currency from cash bond shorts lost $1.4m in 2016. Sector performance figures derived using monthly performance contribution calculations in US dollars, gross of fees and fund expenses. Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, or Bloomberg. All values as of 12.31.16 unless otherwise noted.