Equinox Partners, L.P. - Q3 2016 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

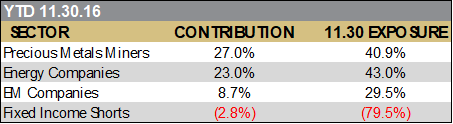

Equinox Partners gained +12.2% in the third quarter of 2016, and +48.2% for the year to date through December 19.[1]

politics of change

Wall Street’s reaction to the recent anti-establishment election and referenda in the West remains unfinished business. To date, the market’s focus has been on discrete, identifiable outcomes, i.e. will the new policies stemming from Brexit, President-elect Trump, and the Italian referendum be good or bad for a specific security or sector? But, the reduction of the recent elections to short-term policy winners and losers badly misses the political moment, in our opinion. We expect a more fundamental change.

Because the future is so opaque at moments of change, assessing the longer-term impact of political turning points often requires an unusual amount of imagination—some would say speculation. The Italian vote on December 4, for example, offers an interpretative puzzle. The vote was ostensibly about a constitutional reform and was clearly a rejection of Matteo Renzi but not necessarily an endorsement of Beppe Grillo’s Five Star Movement. This sort of ambiguity is not resolved even when the electorate votes for a specific policy—as was the case in the U.K. Did the British electorate want to exit the EU at all costs, or was its signal more directional? What is clear in both the Italian and British examples is that the population did not vote for their new leaders. Accordingly, Prime Ministers Paolo Gentiloni and Theresa May are in the awkward position of representing the status quo in the wake of a change-election.

President-elect Donald Trump, by contrast, is the personification of change. That said, his mandate is also complicated. According to CNN’s exit poll, President-elect Trump won handily, 82% to 14%, amongst the 39% of American voters that prioritized change. But, to interpret this outcome solely, or even principally, in economic terms, would be a mistake. According to the same CNN’s exit poll, Secretary Clinton won 52% to 41%, among the 52% of the electorate that listed the economy as their number-one issue. Trump, on the other hand, carried the vote of those who ranked terrorism, immigration, and the Supreme Court as the most important issues.[2]

An intuitive politician, President-elect Trump certainly understands the necessity of change not just from a policy perspective but also from a political perspective. But, to seriously contemplate structural change in the developed world, Trump must grapple with the enormous real impediments to such change. Most notably, the bloated financial architecture of the developed world is not obviously compatible with disruption. Significantly higher bond yields would make sovereign-financing costs unmanageable, and significantly lower stock prices would be recessionary.

Given these very real impediments to structural change, many investors have concluded that bond yields won’t go up much and stock prices won’t go down much, because it would be disruptive. While this investor viewpoint is reassuring, it would be a serious mistake in our view to treat financial disruption as the ultimate constraint on politicians. As America’s President-elect no doubt understands, the ultimate constraint on politicians is politics.

Moreover, lest there be any question about his appetite for change, President-elect Trump has already telegraphed disruption of the status quo on multiple fronts. The tussle between Trump’s incoming administration and the CIA highlights the extent to which opponents of change will be brought to heel. In foreign affairs, Trump’s phone call with President Tsai Ing-wen of Taiwan and the appointment of David Friedman as Ambassador to Israel break with decades of US policy. Given this backdrop, we think it unlikely that monetary and fiscal policy will somehow remain miraculously out of bounds. Accordingly, unlike the market, we expect more volatility to go hand in hand with policy improvements. More importantly, we recognize that mixing financial fragility with the growing electoral appetite for disruption has significantly increased the spectrum of possible outcomes.

Paradoxically, and contrary to our expectations in the wake of the 2008 financial crisis, more debt has made the world both more stable and more fragile at the same time. Specifically, the world’s growing debt burden has resulted in unprecedented short-term financial stability by encouraging an unprecedented coordination amongst policy makers, especially central bankers. But, there is no free lunch, and this highly-engineered short-term stability has come at an enormous long-term cost. Specifically, stability is being purchased with ever more debt, and ever more debt leads to greater long-term fragility.

With policy makers successfully smothering every whiff of instability with more debt for ten years running, most market participants have been reduced to buying the dips rather than thinking about the long-term implications of this policy. This pattern, combined with sustained deflationary forces, has left few concerned that such high debt levels will prevent central bankers from raising rates to head off future inflation. So long as the market remains unconcerned about this still hypothetical constraint, the actual limit to the amount of debt that a society can support will likely remain remote.

Japan, with government debt to GDP over 250% and total debt to GDP well over 500%, is a case study in financial extremes and extreme complacency.[5] In fact, Japan’s dangerous debt load has not only corresponded with lower yields but also with a growing sense that there may be no upper bound to the amount of debt that a country can support. Emboldened by the market’s indifference to Japan’s financial path, the Abe administration recently walked back its plans to balance the budget by 2020 and added a super-dove to the BOJ board that makes Kuroda look hawkish. With the Japanese 10 year bond still hovering at just over a 0% yield to maturity, Japan is the most extreme example of what now passes for normal in the first world.

Even though today’s surreal combination of short-term stability and ever more debt is often treated as inevitable, it remains unwise in our opinion to make investments that depend on this status quo. Accordingly, we continue to broadly avoid heavily-indebted geographies. Our strategy of debt avoidance is prominently reflected in the country weightings on page two of our monthly fund summary. Our two top country weightings, Peru and the United Arab Emirates, are both notably underleveraged.

Our Canadian E&P investments are also well positioned to weather the end of the current debt bubble. While it is certainly true that increasing debt encourages consumption which is positive for oil and gas demand, it is equally true that cheap, abundant debt has also been used to develop marginal oil and gas assets. The development of these marginal reserves with easy money has applied an enormous downward pressure on oil and gas prices in recent years. Bill Thomas, the highly-regarded CEO of EOG, recently speculated that as many as half of the producing wells in North America are not sound full-cycle investments at $50 oil. Given the capital intensity of the E&P sector, it is no stretch to see how more disciplined capital markets could lead to higher energy prices. Moreover, our E&P companies, with conservative balance sheets and some of the lowest costs assets, can continue to grow quickly at current energy prices without any outside capital.

Given these very real impediments to structural change, many investors have concluded that bond yields won’t go up much and stock prices won’t go down much, because it would be disruptive. While this investor viewpoint is reassuring, it would be a serious mistake in our view to treat financial disruption as the ultimate constraint on politicians. As America’s President-elect no doubt understands, the ultimate constraint on politicians is politics.

Moreover, lest there be any question about his appetite for change, President-elect Trump has already telegraphed disruption of the status quo on multiple fronts. The tussle between Trump’s incoming administration and the CIA highlights the extent to which opponents of change will be brought to heel. In foreign affairs, Trump’s phone call with President Tsai Ing-wen of Taiwan and the appointment of David Friedman as Ambassador to Israel break with decades of US policy. Given this backdrop, we think it unlikely that monetary and fiscal policy will somehow remain miraculously out of bounds. Accordingly, unlike the market, we expect more volatility to go hand in hand with policy improvements. More importantly, we recognize that mixing financial fragility with the growing electoral appetite for disruption has significantly increased the spectrum of possible outcomes.

Equinox’s Portfolio Remains The sAme

Our political analysis begs an obvious question: If you view the election/referenda as so significant, then why haven’t you altered your portfolio?

The answer is as straightforward as the question: The elections and the resulting broadening of outcomes do not alter the underlying fundamentals of our companies or the structural forces at work in the global economy. Put differently, we think of the elections as more of an accelerant of financial history rather than an opportunity to plot a course disconnected from the past.

More specifically, the elections offer no clear direction for our positions in emerging markets or our energy producers. We do, however, believe that the resulting policies will accelerate the reawakening of the bond market and the re-monetization of gold and silver.

the opec deal

On November 30, OPEC announced that it would cut its production by 1,200,000 barrels of oil per day (bpd) for six months, extendable for an additional six months if necessary. In addition, OPEC stated that several non-OPEC countries, most notably Russia, would also cut their production by 600,000 bpd for the same period. While a cut of some sort was seen as more likely than not, the actual size of the cut surprised the market. Accordingly, since the OPEC announcement, the oil price has appreciated by 15% to over $52 a barrel today. However, longer-term price expectations changed less, with oil for delivery in 2020 still at less than $55 per barrel.

In our opinion, the market appropriately recognized the significance of the OPEC agreement while remaining skeptical of the actual level of cuts. In assessing the announcement, it is important to point out that most OPEC-member countries have been producing beyond their sustainable peak capacity for several months so as to set a better high-water mark from which to cut. Moreover, there is no precedent of non-OPEC nations cutting production alongside OPEC members. Therefore, we suspect only half of the 1,800,000 bpd target to be realized, with the bulk of the cuts coming from the Gulf nations.

Even if the cuts are only half of the announced target, this is still very significant. 900,000 bpd is one percent of global supply, which, ceteris paribus, is sufficient to put a dent in global oil inventories and help balance the market by the middle of next year. Even with no OPEC action, the market was still on pace to balance by the end of next year. OPEC’s action only speeds this outcome along and, in any case, a longer-term oil price of $55 seems conservative to us. Our companies can grow quite profitably in a $45 oil price environment and will grow even more in a $55 oil price environment.

Sincerely,

Sean Fieler Daniel Gittes

END NOTES

[1] Performance contribution derived in US dollars, gross of fees and fund expenses. Interest rate swaps notional value and P&L included in Fixed Income. P&L on cash excluded from the table as are market value exposures for derivatives.

[2] We credit our friend Jeff Bell with this insight. http://edition.cnn.com/election/results/exit-polls/national/president