Kuroto Fund, L.P. - Q4 2002 Letter

Dear Partners and Friends,

North Korea

Since the fund’s inception, Kuroto has maintained a disproportionately large exposure to the South Korean stock market. We have held this position despite both the obvious risks posed to that country by the heavily-armed hostile regime to its north and the unappealing economic consequences of the opposite outcome, reunification. South Korea has prospered in this “betwixt and between” environment of unresolved conflict for half a century. Consequently, it is with more than a little concern that we follow the most recent developments on the Korean Peninsula. While the information and expert opinion we have engaged as active New York chapter members of the Korea Society and the Council of Foreign Relations have been of a very high quality, we are not particularly reassured by what we have learned.

It seems like only a few months ago we were feeling moderately encouraged by the halting steps Kim Jong Il had taken to gradually improve North Korea’s relations with the rest of the world. His more recent transformation into “man on a ledge, threatening, not only to jump, but to take the rest of the world with him”[1] is a disquieting change. Perhaps the most that can now be said of “Dear Leader” is that a coherent strategic rationale for his latest actions can be articulated.

The noise of political posturing aside, we believe armed conflict on the Korean Peninsula remains a very remote possibility. Unprovoked, North Korea is not about to attack the South. The most probable conflict scenario on the peninsula would involve an American first strike at Yongbyon, or, if the North Koreans’ are to be believed, the enactment of economic sanctions against the Democratic Peoples’ Republic of Korea. Neither precipitating action is likely because, simply put, the North Korean threat is credible. Kim Jong Il is able, and under the right circumstances might be willing, to turn Seoul in to a “sea of fire”, as the North Korean spokesman Park Yong Soo so memorably put it.

North Korea may want a nuclear weapon capability or just the economic benefits that come from threatening to develop such a capability. In truth, it can probably achieve either outcome. So despite the current US stance of “talking without negotiating,” a diplomatic solution remains likely. Put more bluntly, we would not be surprised if the Bush administration’s policy of ‘hostile neglect’ artfully morphed into ‘expedient coddling.’

In light of all these developments and the near term likelihood of continued brinksmanship, Kuroto has allowed our Korean exposure to decline. Through the depreciation of our stocks there, the appreciation of our new positions elsewhere, and the inflow of new investor cash, this transition has been close to painless. In the process, we have decreased our net South Korean long exposure from over 50% of the portfolio to 40%.

In a broader sense, while Kuroto fully acknowledges the risks of investing in Asia, we are frequently at pains to point out that the risks are more than in the price. The world, not just Asia, is far riskier than was suggested by the equity valuations of a few years ago. This unvarnished reality has been fully discounted by most Asian capital markets, which is more than we can say for markets dominated by more complacent investors. From terrorist attacks in Indonesia to North Korea’s bold grasps at nuclear weapons, local security issues weigh heavily on these regional markets. Nonetheless, in a risk-filled world Asia stands out as a unique investment destination, unique in that the risk is already in the price, but also unique in terms of improving corporate governance, stronger financial infrastructure, and prospects for meaningful economic growth.

[1] Financial Times, January 2003

The Asian Investment Case: Review and Update

…Asia will continue to be viewed with suspicion by the many asset allocators who still view the asset class as only a high-beta bet on global growth, or a warrant on global trade. Conversely, the region will be viewed more positively by value investors drawn to the region for the relative and absolute bargains on offer. These bargains are best reflected in the availability of high dividend yields.

(Chris Wood CLSA Oct 02).

Chris Wood’s observations may prove more accurate than prescient, as the market has already begun to take notice of the startling dividend yields on offer in Asia.

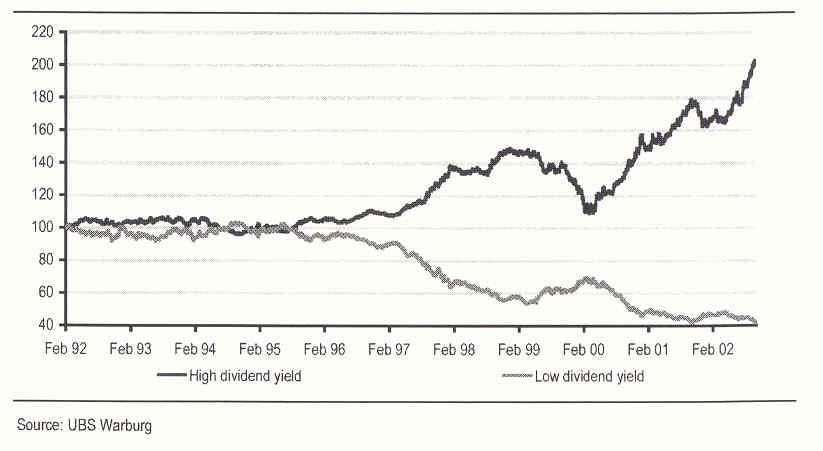

Relative Performance of Asian High-Yield and Low-Yield Stocks

The following table comprised of four Kuroto investments in three separate countries makes clear that we have not sacrificed quality for bargain valuations. Our Asian portfolio offers the exceedingly rare combination of high dividend yields, strong balance sheets, and superior returns on shareholders’ equity (ROE’s).

Core ROE Dividend Yield

as Proxy for as Proxy for

Company Quality Company Valuation

Company A 59% 4.0%

Company B 29% 5.1%

Company C 21% 13.9%

Company D 19% 5.0%

Despite the meaningful decline in US equities over the last several years, valuations of some of the best American companies remain an order of magnitude richer than the valuations of some of their Asian counterparts. As surely as there are excellent mature branded product companies in America that trade on thirty times earnings, there are outstanding growing branded products companies in Asia trading on three times earnings. This large disparity cannot be justified, only rationalized.

The current negative buzz surrounding Asian equity markets calls to mind the American sentiment towards the US stock market during the late 1970’s which was famously captured by Business Week’s “Death of Equities” issue. The American investor of that era, by focusing on the past and current woes of American stocks, missed larger positive developments. Likewise, today’s potential investor in Asian securities remains unduly focused on regional economic and market volatility of the recent past. We, however, as long-term value investors, focus on fundamentals not sentiment, and our company specific research has convinced us that Asia’s real progress on multiple fronts transcends these oft-mentioned issues and the short term pessimism they engender.

For example, a view of Asia as simply “a high-beta bet on global growth,” ignores the region’s important shift away from export driven growth to that of local consumption. Those who fear Korean dependency on exports to a vulnerable American economy presumably don’t know that Korea’s exports to China have now surpassed exports to the U.S. China’s impressive development represents a threat to some Asian companies, but its imports have become a region-wide stimulus to economic growth.

The valuations of most Asian stocks imply that significant improvements in corporate governance, especially with respect to capital allocation, have gone unnoticed by much of the world-wide investing class. Our recent visit to Asia revealed that local companies across the region may be on the threshold of a hugely important change in their capital allocation practices. Many expressed a desire to use their burgeoning cash flow more efficiently, which in most cases involves adopting a more rational (i.e. higher) dividend payout ratio. On a trip to Korea and Thailand, we were surprised by the widespread usage of the phrase, “enhance shareholder value,” by managers with whom we spoke. If words actually become deeds, company specific changes in capital allocation policy will have nothing short of spectacular consequences for our extremely undervalued stocks there. To quote a friend and time-tested Korean market observer:

The absolute level of cash holding (at Korean listed companies) should stand at the historically high level, which signifies the fact that slight improvement in the pay-out could lead to sharp increase in the average dividend yield. Korea’s representative company Samsung Electronics mentioned today that they could cancel a portion of treasury shares toward the year-end; meanwhile POSCO decided to retire 3% of shares outstanding as well… more proactive gesture by Korean management properly distributing free cash could likewise induce a re-rating. Koreans tend to follow a trend religiously … Lets hope that the generous distribution of wealth by KSE-listed companies becomes the fashion in Korea. (Victor Kang, ShinYoung Securities Memo 11/26/02)

Sincerely,

Sean Fieler

William W. Strong