Equinox Partners, L.P. - Q4 2002 Letter

Dear Partners and Friends,

Beyond a Bubble

Despite what the Financial Times calls the “worst bear market in 70 years,” conventional equity investors still see the stock market glass as half full and are clearly more worried about missing the next upswing than avoiding the next potential decline. Even professional money managers are myopically fixated on the prospect of a near term bounce. According to Merrill Lynch, US “institutional and retail fund managers’ cash levels are the lowest we have ever recorded (4.2%).”[1]

Investors simply have yet to accept the possibility that the next great investment opportunity may not be identical to the last great investment opportunity. As Dr. Marc Faber explains in his recent book Tomorrow’s Gold, “What is most important to understand is that once a major investment theme goes ballistic (gold in the late 1970’s, Japan’s stock market in the late 1980’s, and the NASDAQ until March 2000) and then ends with a severe bust, the leadership always changes, as investors finally shift into a new sector.” Faber goes on to point out, “In fact the greater the mania in one sector of a market or one stock market, the more likely that neglected asset classes elsewhere offer huge appreciation potential.” Without doubt, the mania in financial assets was great, and commodities as an assets class were neglected. After all, “Never in the history of capitalism have commodities been as inexpensive compared to the CPI or to financial assets than they are now after a 20 to 30 year bear market.”[2]

As pure stock pickers, Equinox does not hold sweeping views about prospective financial market leadership. We simply don’t know if the future will bring deflation, inflation, or not much of either. But, regardless of the rate of change in the general price level, our view that natural resources which sell below the replacement cost of their reserves are unsustainably cheap is now being validated. After years of underinvestment in reserve development, the production of both gold and North American natural gas is declining. Nevertheless, the ensuing price increases in these two commodities are dismissed by most observers as a temporary phenomenon. Given the equity market’s longstanding bias against hard assets, these companies’ stock prices have yet to fully reflect the substantial improvement in their fundamentals. Global precious metals businesses and Canadian energy producers, which although among the best performing market sectors in this post-bubble environment, still have not captured the investing public’s imagination.

Looking back twenty-five years to a previous post-mania environment, “investors—who were by no means less sophisticated in the early 1970’s than they are today—totally overlooked the next major investment theme.”[3] That next major investment theme was natural resources:

[1] Barrons January 2003

[2] Faber, Marc Tomorrow’s Gold

[3] Ibid

THE 1970’s BOOM IN REAL ASSETS

The performance of various investments - June 1970-1980

Annual Return(%) Rank

Oil 34.7 1

Gold 31.6 2

US Coins 27.7 3

Silver 23.7 4

Stamps 21.8 5

Chinese Ceramics 21.6 6

Diamonds 15.3 7

US Farmland 14.0 8

Old Masters 13.1 9

Housing 10.2 10

Inflation (CPI) 7.7 11

Treasury Bills 7.7 12

Foreign Exchange 7.3 13

Bonds 6.6 14

Stocks 6.1 15

Note: Compound annual rates of return. Source: Salomon Inc. (as reprinted in Tomorrow’s Gold, by Marc Faber)

North Korea

For years Equinox has maintained a large exposure to the South Korean stock market. We have held this position despite both the obvious risks posed to that country by the heavily-armed hostile regime to its north and the unappealing economic consequences of the opposite outcome, reunification. South Korea has prospered in this “betwixt and between” environment of unresolved conflict for half a century. Consequently, it is with more than a little concern that we follow the most recent developments on the Korean Peninsula. While the information and expert opinion we have engaged as active New York chapter members of the Korea Society and the Council of Foreign Relations have been of a very high quality, we are not particularly reassured by what we have learned.

It seems like only a few months ago we were feeling moderately encouraged by the halting steps Kim Jong Il had taken to gradually improve North Korea’s relations with the rest of the world. His more recent transformation into “man on a ledge, threatening, not only to jump, but to take the rest of the world with him”[1] is a disquieting change. Perhaps the most that can now be said of “Dear Leader” is that a coherent strategic rationale for his latest actions can be articulated.

The noise of political posturing aside, we believe armed conflict on the Korean Peninsula remains a very remote possibility. Unprovoked, North Korea is not about to attack the South. The most probable conflict scenario on the peninsula would involve an American first strike at Yongbyon, or, if the North Koreans’ are to be believed, the enactment of economic sanctions against the Democratic Peoples’ Republic of Korea. Neither precipitating action is likely because, simply put, the North Korean threat is credible. Kim Jong Il is able, and under the right circumstances might be willing, to turn Seoul in to a “sea of fire”, as the North Korean spokesman Park Yong Soo so memorably put it.

North Korea may want a nuclear weapon capability or just the economic benefits that come from threatening to develop such a capability. In truth, it can probably achieve either outcome. So despite the current US stance of “talking without negotiating,” a diplomatic solution remains likely. Put more bluntly, we would not be surprised if the Bush administration’s policy of ‘hostile neglect’ artfully morphed into ‘expedient coddling.’

In light of all these developments and the near term likelihood of continued brinksmanship, Equinox has allowed our Korean exposure to decline. Through the depreciation of our stocks there, the appreciation of our positions elsewhere, and the inflow of new investor cash, this transition has been close to painless. In the process, we have decreased our net South Korean long exposure to under 23% of partners’ capital. As this “non-crisis” crisis develops, we would expect to add modestly to our Korean positions.

In a broader sense, while Equinox fully acknowledges the risks of investing in Asia, we are frequently at pains to point out that the risks are more than in the price. The world, not just Asia, is far riskier than was suggested by the equity valuations of a few years ago. This unvarnished reality has been fully discounted by most Asian capital markets, which is more than we can say for markets dominated by more complacent investors. From terrorist attacks in Indonesia to North Korea’s bold grasps at nuclear weapons, local security issues weigh heavily on these regional markets. Nonetheless, in a risk-filled world Asia stands out as a unique investment destination, unique in that the risk is already in the price, but also unique in terms of improving corporate governance, stronger financial infrastructure, and prospects for meaningful economic growth.

[1] Financial Times, January 2003

Revaluing the Oil and Gas Business

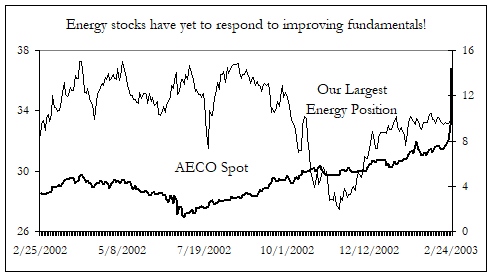

These are the “best of times” for the petroleum industry. High oil and gas prices are translating into substantially higher netbacks and cash flows for these companies. In addition, accepted financial theory suggests that the net present value of those increased future cash flows is higher still in this very low nominal interest rate environment. In spite of this, Barrons reports that “major energy stocks are back to 1997 levels.”[1] In Canada, even the successful exploration and production companies we own continue to get the “Rodney Dangerfield” treatment from the stock market. By pricing E&P companies at about half the valuation afforded the local liquidating royalty trusts, the market gives “no respect” to businesses that reinvest in drilling to grow production.

It would seem that the market’s skepticism is rooted in investors’ virtual certainty that current hydrocarbon prices face imminent collapse. To illustrate, ignoring the lowest US oil inventories in almost three decades and the looming supply disrupting war in the Middle East, stock markets are implicitly (explicitly if you read sell-side analyst reports) discounting near $20/barrel oil prices. Though Equinox knows that global economic, political, and supply uncertainties make short-term oil price forecasts problematic, longer-term we are more sanguine about this particular commodity’s prospects. Consider, for example, our national unwillingness to conserve gasoline. Arianna Huffington’s efforts notwithstanding, US gasoline consumption does not appear to be the object of a serious conservation effort. As prima facie evidence of American complacency about oil and gas supplies, we offer the “concept cars” on display at the recent Detroit Auto Show. Ignoring any environmental concerns and forecasts of an incremental twenty million barrels a day in Asian consumption by 2010, Ford’s vision of the future includes the “Ford 427” which packs an awesome 590 horsepower. Not to be outdone by their cross-town rival, GM’s Cadillac Division offers the “Cadillac Sixteen” which generates a cool 1000 horsepower![2]

Finally upon us is the supply tightness in the North American natural gas market that Equinox has long foreseen. Despite higher prices, a tentative level of gas well drilling continues in the lower “48.” The resulting decline in natural gas production is already underway. Meanwhile, with last year’s aberrant warm winter just a memory and more gas-fired electrical capacity on stream, gas demand is rebounding. Prospectively, gas intensive US industrial production should grow as the dollar declines.

[1] Barrons 2/3/03

[2] Our observation deserves empirical as well as anecdotal backing: “Average new light-vehicle fuel economy continues to decline. Since peaking at 22.1 mpg in 1987 and 1988, average light-vehicle fuel economy has declined nearly eight percent to 20.4 mpg and for 2001 is lower than it has been at any time since 1980. The primary reasons for this decline are the increasing market share of less efficient light trucks, increased vehicle weight, and increased vehicle performance.” Light-Duty Automotive Technology and Fuel Economy Trends 1975 Through 2001, Page 6. The EPA September 2001.

To summarize, the virtual tidal wave of corporate cash flow implied by today’s oil and gas prices has had only a muted effect on our energy shares to date. Equinox fully recognizes that forecasting oil or gas prices in the short-run is a guessing game. But projecting demand for these finite resources out several years highlights a scarcity value not apparent to those investors whose gaze is fixed firmly on the rear view mirror image of the 1990’s.

Sincerely,

Sean Fieler

William W. Strong

Anthony R. Campbell