Kuroto Fund, L.P. - Q3 2015 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

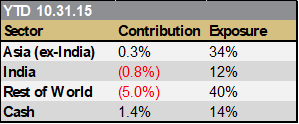

Kuroto declined 10.3% in the third quarter compared with a 17.8% decrease for the MSCI Emerging Markets Index. Year to date through October 31, Kuroto has declined 6.4% versus a decrease of 9.2% for the index. The declines during the quarter were driven by the continued appreciation of the U.S. dollar and the economic weakness in China .[1]

We recently purchased a new investment in Peru and sold a fully-valued financial company in India in order to buy another, more attractively valued Indian financial company. The general emerging market weakness and MSCI’s possible downgrade of Peru’s emerging market status provided us with the opportunity to buy a high-quality company as well as add to Ferreycorp at 65% of book value. We additionally increased several of the fund’s holdings during the quarter as their share prices declined and made them more attractive investments.

China – Insulated but not Immune

Kuroto Fund has a long history of being “underweight” China despite our 17 years in Asia. In fact, our exposure to China has not exceeded 10% in more than a decade. The reason is simple: we have had difficulty analyzing China and Chinese companies. As we discussed in the first quarter 2015 letter: “In China, corporate governance and management quality often prove to be an issue for us. How the business, management, owners, and capital came together is often difficult to discern, leaving us to wonder to what end and to whose benefit the company is being managed.” In addition to this company-specific opacity, China’s macro issues—most notably their aggressive credit growth—have been a perennial concern (see Q3 2009 letter). Since 2007, China has added approximately 130% of its GDP in debt and quadrupled the total amount of its debt outstanding.[2] Moreover, much of the country’s economic expansion over that time has been driven by fixed investment which has approached 50% of GDP in some years. We even speculated that the RMB could depreciate against the U.S. dollar in the face of increasing wage rates and the corresponding reduced cost competitiveness in the country (see Q3 2013 letter).

The composition of the Kuroto portfolio reflects our concerns about China. We have no holdings with material business in China, Hong Kong or Taiwan, and we are invested in only two commodity-oriented companies. The majority of Kuroto’s companies are consumption-oriented businesses with many of them in domestic demand-driven countries like India, Poland, and the Philippines. While the share prices of these companies have been negatively impacted by economic weakness in China in the near term, their financial results are unlikely to be, except in an extreme scenario. The fund also has a 12% cash position and a 2% gold bullion holding. Kuroto only has one investment that does business in China, LG Household and Health Care. In the most recent quarter, LG H&H’s China revenues grew 79% year over year, as Chinese women continue to shift their consumption towards Korean cosmetics. We do have an investment in Ferreycorp, a Peruvian Caterpillar dealer, which is highly correlated to Chinese industrial activity. The company sells mining equipment to copper producers, and even after considerable recent appreciation it still trades below book value—a valuation which more than discounts the economic weakness in China.

Despite not being invested in China, the fund’s poor August performance demonstrates that the companies we own are still exposed to China. After all, China is the second largest economy in the world. Specifically, it significantly impacts commodity-driven as well as export-oriented emerging market countries. For instance, Kuroto does have exposure to Peru, Malaysia, and the UAE—all countries which are heavily influenced by commodity prices. Moreover, the fund has investments in Vietnam, a country which competes with China for exports. In essence, it is possible to insulate an emerging markets portfolio from China, but not to make it entirely immune. This subtle distinction makes our economic assessment of the country imperative.

A Tale of Two Chinas: Investment and Consumption

No less than China’s premier has called its GDP data “man-made.”[3] What the government is reporting, though, is an economy that is certainly slowing but not crashing. The figures seem to indicate that the government is accomplishing its economic goal of moving from investment to consumption. In fact, for the first time ever, in Q3, services and consumption accounted for more than half of China’s GDP, at 51.4%, up from 41.4% a decade ago.

Data that we do trust seems to corroborate this picture. China’s industrial activity is weak and actually began to decline well over a year ago. Excavator sales have been declining at a 20% to 30% rate on a monthly basis since April of 2014. Cement production and steel demand have been declining at a meaningful rate for over a year.[4] All of this is reflected in weaker global iron ore and copper prices, which have fallen by 32% and 20% respectively on a year-to-date basis. This overall weakness is further supported in the results of U.S. industrial companies who do business in China. Cummins reported in Q3 that industry demand for heavy and medium-duty trucks in China was down by 29% year to date. Moreover, United Technologies similarly reported that “the China market has clearly slowed. Real estate investment, new construction starts and floor space sold are all under pressure.”[5]

While China’s industrial activity has weakened dramatically, the country’s retail sales have continued to increase at a low double-digit rate despite the likely impacts from the government’s anti-corruption campaign. This has also been supported by the financial results of many multinational companies doing business in China. For instance, in its Q4 earnings release, Starbucks reported “traffic comps in China accelerated throughout the quarter”[6] with same store sales growth ahead of the 6% reported for the company’s Asia region. Nike’s revenue grew by 30% in China last quarter, and the gains were “driven by strong performance across nearly all key categories.”[7] Apple reported a 99% sales increase in Greater China in Q4 with the company’s CEO, Tim Cook, commenting that China is doing quite well. Not all multinational consumer companies are reporting such stellar results from China, but they are by no means seeing drastic weakness either. For instance, both Pernod Ricard and Unilever describe the environment in China as being stable in their recent conference calls, while Nestle indicated that it “is a little bit softer.”[8] Coca-Cola noted that “we’re growing in China”[9] and McDonald’s said that it experienced a sales recovery. Omnicom, a U.S. advertising conglomerate, commented in its Q3 earnings call that “while our operations in China slowed a bit to mid-single digits… we continue to see strong marketing spend in such categories as telecommunications, travel and personal care.”[10]

According to government and independent data, China has not yet experienced wage declines or increasing unemployment despite the weak industrial figures—though this is a key data point that we continue to monitor. To the degree that the industrial weakness filters over to the consumer, it will clearly undermine these results and the economy overall.

The country’s foreign direct investment (FDI) has also been more oriented towards services and less so to industrial investments. On a year-to-date basis, FDI has grown 9% year over year in total, while FDI to the service sector increased by 15%. Manufacturing actually declined to 33% of total FDI in 2014 from 43% in 2009. The country’s service sector could be an even bigger contributor to China’s economy given that government statistics have difficulty measuring small businesses.

Two very different companies sum up our thoughts on China. Cummins management team remarked, “it’s obvious… that the Chinese economy is going through a change and the government is very serious about making the change. How they’re going to succeed and at what rate, I don’t know, but I also think there’s some stabilization going on in the markets.”[11] While the U.S. staffing firm, Manpower Group, commented, “parts of the Chinese economy are clearly slowing down, notably manufacturing, whereas there are other parts of the Chinese economy that is doing quite well, notably the tech sector as well as the services sector ... it's going through a transformation and as such the growth rate is slowing down.”[12] Our base case remains that China is rebalancing its economy and that its economic deceleration will be gradual and not a sudden economic collapse.

Conclusion

Even with this as a base case assumption, Kuroto maintains its skepticism towards investing in China given the country’s lack of transparency, over indebtedness, and command-driven governance. If the country were to experience a “hard landing,” the government could very well devalue the RMB in order to stimulate its economy. The fund now owns insurance, in the form of put options, to protect against such a scenario. While we should have purchased these options when we initially wrote about the potential for currency devaluation in China, we believe this form of insurance is still prudent.

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

ENDNOTES

[1] Performance stated for Kuroto Fund, L.P. Class A on a net basis. An investor’s performance may differ based on timing of contributions, withdrawals, share class, and participation in new issues. Performance contribution as stated uses the fund’s dollar-weighted gross internal rate-of-return calculations derived from average capital and sector P&L. Sector performance figures are derived using monthly performance contribution calculations in US dollars, gross of all fees and fund expenses. P&L and exposures on bullion, cash, and currency forwards included under Cash. Rest of World is: Brazil, Colombia, Mexico, Peru, Poland, Russia, UAE, U.K. listed EM company.

[2] McKinsey Debt Report, February 2015, page 75.

[3] Li Keqiang per Wikileaks

[4] J.P. Morgan Emerging Market Equity Strategy report, August 2015.

[5] Akhil Johri, United Technologies Q2 2015 Earnings Call, p. 3.

[6] Kevin R. Johnson, Starbucks Q4 2015 Earnings Call, p. 6.

[7] Trevor A. Edwards, Nike Q1 2016 Earnings Call, p.5.

[8] Paul Bulcke, Nestle Q3 2015 Sales and Revenue Call, p. 7.

[9] Ahmet Muhtar Kent, Coca-Cola Q3 2015 Earnings Call, p. 12.

[10] John D. Wren, Omnicom Q3 2015 Earnings Call, p. 2.

[11] N. Thomas Linebarger, Cummins Q2 2015 Earnings Call, p. 7.

[12] Jonas Prising, ManpowerGroup Q3 2015 Earnings Call, p. 12.