Kuroto Fund, L.P. - Q3 2009 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Kuroto Fund, L.P. appreciated 17.1% in the third quarter and was up 65.8% for the nine month period ended September 30th.

Stimulated Chinese

It is widely known that credit growth in the People’s Republic of China for the first half of 2009 is one for the record books— expanding at an astonishing 7.4 trillion Yuan in the first half of 2009 or a 49% annualized increase in total loans outstanding. Most of the lending was reportedly directed towards domestic investment, especially transportation projects. What is not as well known, however, is that the Chinese banks’ largesse made its way into some unintended assets. For those who doubt the efficacy of monetary policy, we offer the following factoids:

1. September’s “China Week” art auctions in New York City are a stunning example of Chinese reflation. For the auctions, extra Mandarin translators were hired especially for telephone bidding, as buyers were almost exclusively from China. Sotheby’s sale of furniture and carpets from the collection of the highly respected research psychiatrist and entrepreneur, the late Arthur M. Sackler, netted $4.6 million, four times the estimated value. His collection was sold 95.4% by lot and 99.5% by value. Auctions witnessed “results [that] were particularly surprising because not everything on offer was of the highest quality.”[1] At Christie’s, Kang xi-ware (i.e. porcelain vessels manufactured in the Jingdezhen region of China in the 17th century) of imperfect quality was strongly bid. For example, one somewhat discolored amphora that sold for $434,000 had an estimated value of only $8,000-$12,000. Sotheby’s Hong Kong sale in October was likewise dominated by mainland Chinese buyers. In the imperial “Water, Pine and Stone Retreat” collection, a small yellow jade bowl carved for the Qianlong emperor in 1756 sold for four times its estimated HK$2-3MM value.

2. Chinese real estate is hot, with high-end Hong Kong flats, once again, trading at truly lofty valuations. Henderson Land recently sold a 4,671-sq foot duplex for US$57MM, or US$11,350 per sq. foot. To quote Margaret Ng, of CBRE Research, “Rich buyers from mainland China have so much money that they don’t really care. They buy properties in Hong Kong for many reasons—for immigration, for their children, for entertainment.”

3. Finally, in the affluent village of Huaxi—one of the more bizarre architectural destinations in China—the local governor is currently working on three new 72-story towers. While vastly out of proportion to other buildings in the area, the new structures are consistent with the town’s legacy of constructing unusual buildings. In addition to scale models of the Great Wall and Tiananmen, the town has already built replicas of the US Capitol and France’s Arc de Triomphe.

So, only a year after the greatest global financial bust since the 1930’s, Chinese spending is reaching new bounds of zaniness. If “to get rich is glorious,” the People’s Bank of China is doing its part.

Shorting Sovereign Debt

“Western democracies, communistic capitalists, and Japanese deflationists are concurrently engaged in what may be the largest, global financial experiment in history.”[2] Indeed, the massive global monetary and fiscal policy response to the recent debt-deflation is unprecedented, and the dramatic reflation in asset prices in 2009 is most surely a function of these historic policy extremes. But what will be the longer term implications of this huge stimulus? While Kuroto would not claim to be able to answer this question with precision, we do sense an appealing investment opportunity—the ultimate reversal of very low sovereign interest rates in highly indebted countries like the US and Japan.

Unlike most short positions, in the case of low yielding debt, simple arithmetic demonstrates an unusual and attractive asymmetry of risk and reward. For example, if the 1.3% yield on ten year Japanese government bonds (JGB) quickly dropped to its all time low of 0.43%, losses on a short position in this security would be a modest 8%. If, on the other hand, the ten year Japanese sovereign rate rapidly increases to “normal” pre-debt-deflation levels, this position would generate a 20%+ profit. Kuroto started shorting long-dated JGB’s in 2003 at fractional interest rates, and we have maintained the position ever since.[3] Recently, we have increased this exposure.

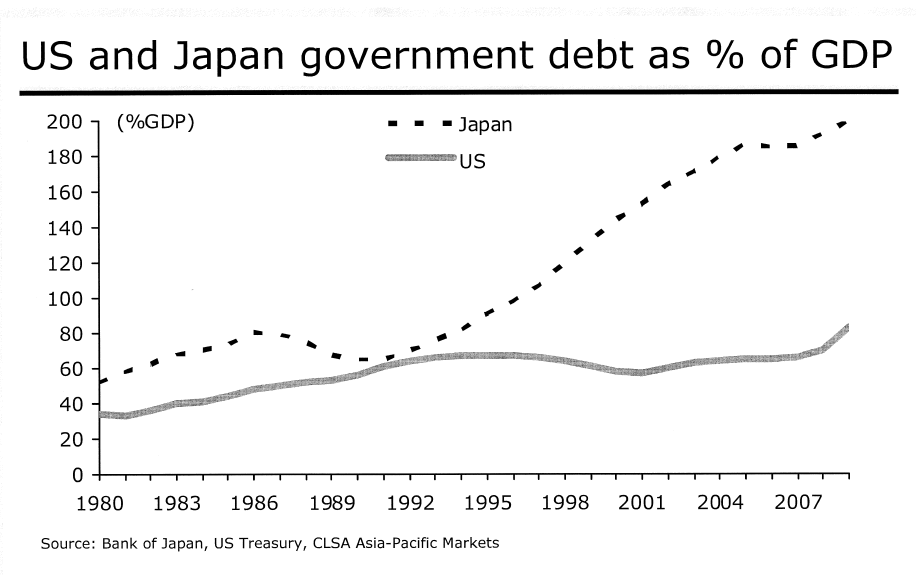

In Japan and America, low government interest rates are coinciding with unprecedented government deficits and monetary stimulus. In this fiscal year, governments in America and Japan will each, on a net basis, borrow about 12% of their GDP (about the same as Greece)—and this on top of an already heavy debt burden. In Japan, net government borrowing will exceed government revenues for the first time, and, unless their economy recovers next year, they may see a similarly large issuance again. As if these amounts were not burdensome enough, both countries are considering further fiscal spending stimulus packages.

| Year-End 3/31 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010(E) | 2011(E) |

|---|---|---|---|---|---|---|---|---|---|---|

| Total Gov Budget | 84.8 | 83.7 | 82.4 | 84.9 | 85.5 | 81.4 | 81.8 | 88.9 | 96 | 90-95 |

| JGB Issuance (net) | 30.0 | 35.0 | 35.3 | 35.5 | 31.3 | 27.5 | 25.4 | 33.2 | 53.5 | 44+ |

| Tax Revenue | 47.9 | 43.8 | 43.3 | 45.6 | 49.1 | 49.1 | 51.0 | 44.3 | 36.9 |

With Japanese rates lower than those in the US, despite the Japanese debt situation being more severe, we continue to prefer our JGB short position. Not only are the Japanese rates the lower of the two, but the prospective deterioration in Japanese government’s credit quality appears to be progressing even faster than it is here in the US. Continued very poor economic performance and an unwillingness to significantly cut spending all but assure a large supply of Japanese government bonds will be coming to market every year for the foreseeable future. Moreover, the pool of prospective liquidity to purchase JGBs is diminishing at an alarming rate as the aging Japanese population is saving much less than in the past. Surprisingly, Japanese now save even less than their American counterparts.

*********************NEED GRAPH FROM Q3 2009 'JAPANESE SAVINGS RATE'***********

Of course with interest rates so low on Japanese debt currently, the debt service component of their government budget is none too onerous at this time. But, if rates rise meaningfully in Japan, debt service would commensurately increase and worsen the fiscal deficit further. Hence, it would appear that sovereign rates in Japan are unstable to the upside. With such limited risk, this position provides Kuroto with a rare asymmetrically appealing shorting opportunity.

Kuroto finds both countries curiously unconcerned about the decline of their governments’ balance sheets. Worrisome as it may seem for Americans, the Japanese seem even less focused on changing their spendthrift ways. Michael Zielenziger, in his fascinating new book Shutting Out the Sun, describes his recent study of what has gone wrong in the Land of the Rising Sun:

The Japan I encountered was unable to rejuvenate itself after a mysterious “lost decade” of financial failure and slowing growth. It seemed without the power or will to overhaul an ossified political system. Indeed, Japan systematically stifled change and resisted innovation … (p. 7, Shutting Out the Sun).

The recent announcement that the upper house of Japan’s legislature voted to reverse the privatization of the massive, corrupt national postal system, the most important reform of the Koizumi administration, is a good case in point. What’s more, the new governing party in Japan seems to be strangely lacking any sense of urgency about their country’s worsening budgetary dilemma. Japan’s sclerotic behavior, of course, adds to the likelihood of much higher domestic interest rates in the years to come.

Sincerely,

Sean Fieler

William W. Strong

ENDNOTES

[1] Economist.com, September 26th, 2009, Homeward Bound. http://www.economist.com/displaystory.cfm?story_id=14530812

[2] Hayman Advisors September 2009 letter

[3] Our actual position is in a swap not the cash bonds