Equinox Partners, L.P. - Q4 2009 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Equinox Partners appreciated 14% in the fourth quarter and was up 138% for the twelve month period ended December 31, 2009.

Where are we?

While the vast bulk of our effort is focused on company specific research, we have found it helpful to think about the thematic context in which financial markets are operating. It is only by combining these thematic observations with company specific insights that we can uncover the most anomalous investment opportunities. In this effort over the past decade, we have studied the massive imbalances in America’s external accounts, the stock market and housing bubbles, and the contrast in productivity growth between the developed and emerging economies. One theme, however, has stood out far above the others: the indebtedness in the developed world—there is simply far too much of it.

Though the events of 2007-09 seemed like the climax of this saga at the time, it now appears that yet another crisis looms on the horizon. Because of the success of extreme counter-credit contractionary government policy, the western world has not suffered the coup de grâce expected by some. Today, government borrowing has replaced that of the private sector. From a short-term perspective, this process has worked to stem or even reverse asset deflation. For several years our portfolio has reflected our conviction that the authorities will stop at nothing to keep a deflationary dollar rally from progressing, and our partners have been rewarded by that stance.

Despite economic disaster having been temporarily averted, the current chapter in financial history is not yet over. Now that the excessive debt creation of the private sector has been replaced by massive and continuing government budget deficits—and the monetary support thereof—we believe the drama has moved from the business and financial world to that of politics. It therefore astounds us that politicians from Athens to London to Tokyo to Washington seem to be tone-deaf to this critical issue.

Historian Niall Ferguson recently observed that the current sovereign debt problem in southern Europe “is more than just a Mediterranean problem with a farmyard acronym. It is a fiscal crisis of the western world. Its ramifications are far more profound than most investors currently appreciate.” Furthermore, the “idiosyncrasies of the eurozone should not distract us from the general nature of the fiscal crisis that is now afflicting most western economies.” In this vein, Ferguson saves his most foreboding predictions for the US economy:

Yet even a casual look at the fiscal position of the [US] federal government (not to mention the states) makes nonsense of the phrase “safe haven”. US government debt is a safe haven the way Pearl Harbor was a safe haven in 1941. Even according to the White House’s new budget projections, the gross federal debt in public hands will exceed 100 per cent of GDP in just two years’ time. This year, like last year, the federal deficit will be around 10 per cent of GDP. The long-run projections of the Congressional Budget Office suggest that the US will never again run a balanced budget. That’s right, never.[1]

State and Municipal Fiscal Woes

Many US states and municipalities have been grossly mismanaged over the last two decades. Although politicians often blame budget deficits on the economy, the inconvenient truth is that the economic crisis merely accelerated the inevitable. State and local governments expanded services and promised generous pensions and other post employment benefits (OPEB) that now appear to be well in excess of their revenue raising abilities. Until the current crisis, a combination of favorable demographics and strong economic growth masked the impact of these growing liabilities. Furthermore, the unhelpful cash accounting system employed by public entities conveniently allowed politicians to keep their ballooning promises from showing up in budget numbers, and aggressive pension and OPEB fund return assumptions (on average, state pension funds assume an 8% annual return) abridged the true size of the stated liabilities. Thanks to the crisis and a decade of no returns in the stock market, this charade is finally coming to an end.

Today, states are finding themselves in the midst of their most serious financial crisis ever, and the baby boomers are only now starting to retire. According to the National Conference of State Legislatures, between December 2007 and November 2009, states projected a combined budget deficit of $304 billion.[1] Shortfalls for 2009 were addressed through a combination of revenue increases, spending cuts, and the use of federal stimulus dollars. Despite these efforts, the Center on Budget and Policy Priorities January 2010 report estimates a whopping $194 billion in 2010 state budget shortfalls, or 28 percent of state budgets, the largest budget gap on record. The report also suggests that even after taking into account the federal Recovery Act dollars that are likely to remain available for fiscal year 2011 (approximately $40 billion), states still have to close shortfalls of some $260 billion for fiscal years 2011 and 2012 combined.[2]

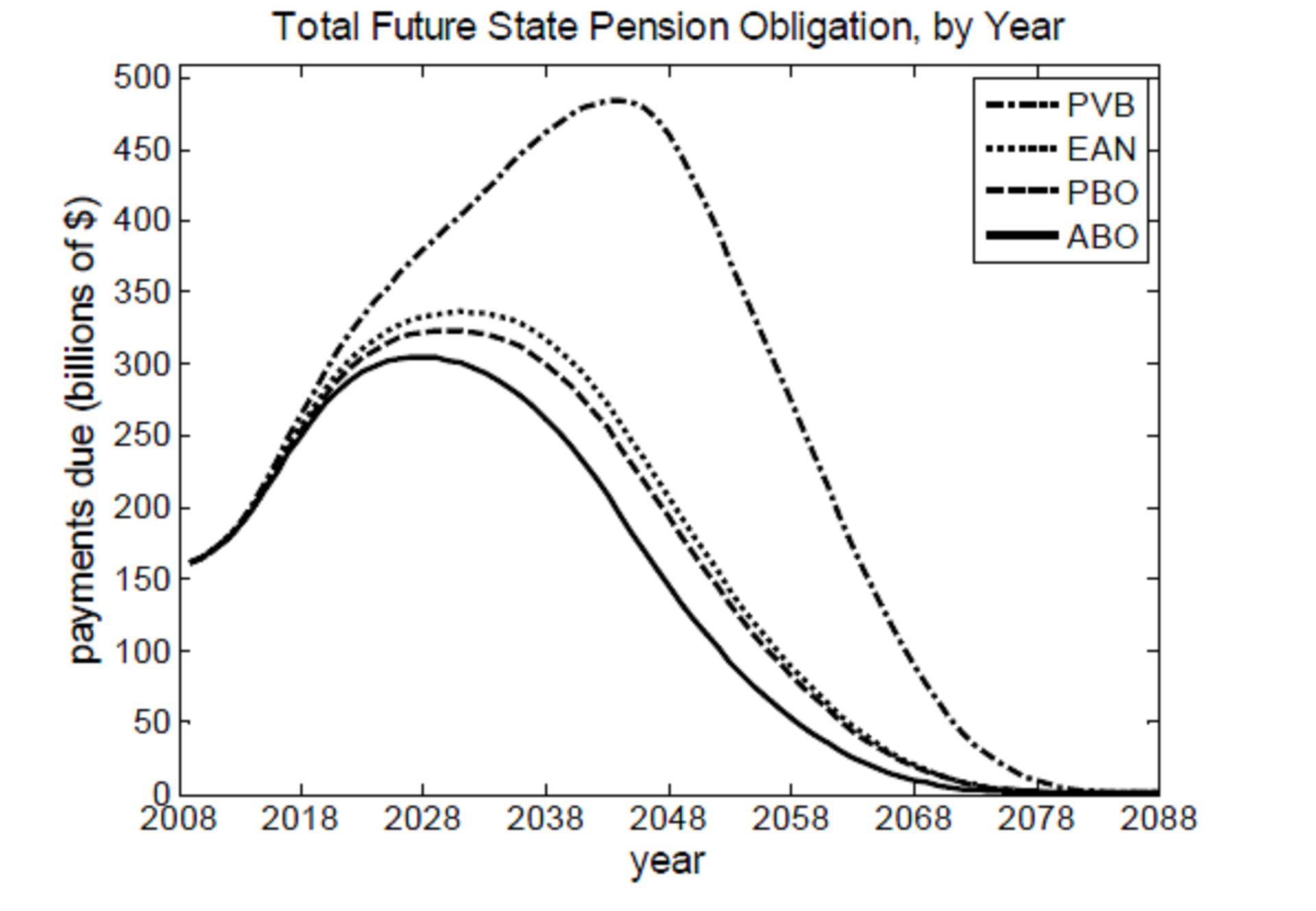

Driving the structural deficits are significant unfunded pension and OPEB liabilities, which if left unaddressed, will only worsen states’ annual scramble to balance their budgets. Based on states’ own projections, the unfunded pension and OPEB liabilities for states and participating municipalities are over $1 trillion, split approximately 45/55 between pension and OPEB, respectively.[3] Under more reasonable discount rate assumptions, however, the unfunded accrued pension benefits portion alone—which assumes all pension benefits are frozen at that point in time—were between $1.3 trillion and $3.3 trillion at the start of calendar year 2009.[4] Worse still, the cash flow obligations from these unfunded obligations are just beginning to ramp up (see the graph, below and the legend, right).

Accrual Methods

ABO: Accumulated Benefit Obligation – accounts only for benefits already promised and accrued.

PBO: Projected Benefit Obligation – accounts for future salary increases, but excludes future years of worker’s service.

PVB: Projected Value of Benefits – accounts for full projection of benefits for current employees, including salary increases and expected time of retirement.

EAN: Entry Age Normal – Accounts for benefits accruing as a fixed percentage of a given worker’s salary throughout a worker’s career. EAN is a measure between PBO and PVB.

California is providing a glimpse into what is to come. The state is facing a $20 billion projected budget deficit (24% of its general fund) in the coming fiscal year, and the California Legislative Analyst’s Office projects deficits of over $20 billion for the next four years despite using some unrealistically optimistic assumptions. Furthermore, California’s debt service burden is projected to reach 9% of general fund revenue next year, and this in a state where taxpayers already have one of the nation’s highest tax burdens.[6]

As much as some states are struggling, many municipalities across the nation are in even worse shape. Vallejo, CA grabbed headlines last year by filing for Chapter 9 bankruptcy in hopes of restructuring its debt and labor contracts, and many more municipalities will almost certainly follow Vallejo into Chapter 9. Take San Diego for example. Today, the city has $2.7 billion of debt, $3.3 billion of unfunded pension and OPEB liabilities, and $800-$900 million of deferred maintenance piled up. This is quite a load, considering the city’s general fund is just over $1 billion. San Diego City Councilman, Carl DeMaio, recently wrote that pension payments are 42% of city payroll and all the retirement benefits makeup 69% of city payroll.[7] The Office of the Independent Budget Analyst estimates upwards of 20% budget deficits through 2015 and wrote in their review of the proposed 2010 budget: “We remain concerned that there is no clear path to the city’s financial health over the long term.”[8] It seems that in San Diego and in many towns across the country legislators are simply running out of options.

So where does it get us? Unfortunately for taxpayers, a wave of state and municipal workers are beginning to retire. With Chapter 9 bankruptcy as a possible option for troubled municipalities, we would be especially cautious about buying municipal debt. With respect to state obligations, even in the case where they owe far more than they can pay, we think it is in the best interest of the public employees unions to concede just enough every year to keep states out of bankruptcy. In this way the unions can extract the maximum economic benefit from the state, while not forcing a crisis of non-payment that may result in a more precipitous adjustment in state employee benefits. So, expect reduced services, higher taxes and some Federal assistance, but unless the unions misplay their hand, not actual state defaults.

Given the mess that states, municipalities, and the federal government are in, we’d remain hesitant to invest in US businesses even if their valuations were attractive, and valuations aren’t attractive. Instead, we’ve opted to own foreign stocks in countries characterized by modest levels of debt. We also remain long gold, with the belief that the world’s troubled reserve currencies will continue to generate demand for the one currency that is no one else’s liability.

Investment Philosophy

At Equinox, we do our best to provide our friends and partners with thoughtful and relevant communication. Toward that end, we have composed a one page statement which articulates the core principles of our investment philosophy. The document is attached.

Sincerely,

Sean Fieler

William W. Strong

END NOTES

[1] Niall Ferguson, A Greek crisis is coming to America. Financial Times, February 10, 2010.

[2] National Conference of State Legislatures, State Budget Update: November, 2009. December, 2009.

[3] Center on Budget and Policy Priorities, Recession Continues to Batter State Budgets; State Responses Could Slow Recovery. January 28, 2010.

[4] The Pew Center on the States, The trillion dollar gap. February 2010.

[5] Robert Novy-Marx and Joshua Rauh, Public Pension Promises: How Big Are They and What Are They Worth? December 18, 2009.

[6] California Legislative Analyst’s Office, The 2010-11 Budget: California’s Fiscal Outlook. November 2009.

[7] Carl DeMaio, Finishing the job of pension reform. The Daily Transcript, January 19, 2010.

[8] Office of the Independent Budget Analyst City of Sand Diego, IBA Review of the Fiscal Year 2010 Proposed Budget. April 29, 2009.