Kuroto Fund, L.P. - Q2 2008 Letter

Dear Partners and Friends,

Performance: The Asian Bear

Kuroto’s loss for the first eight months of 2008 is surprisingly large. Our conservative stance last year led us to liquidate significant portions of the portfolio and resulted in the lowest net exposure Kuroto has had in our decade long history. The combination of a low net exposure and the attractive valuations of the high quality businesses that we own were no match, however, for the Asian bear market. To make matters worse, even the foreign exchange markets turned against us with several currencies dropping sharply against the otherwise weak US dollar.

Though the pull-back in our portfolio is unpleasant, our companies are continuing to prosper. In fact, with their share prices down and their earnings up, our portfolio is currently trading at less than seven times 2009 earnings.

Inflation, India, and Asian/American Decoupling

In an ironic twist, the “decoupling” that Kuroto was expecting has occurred, but it is the Asian shares that are taking the brunt of the global bear market. The US equity markets have experienced a comparatively modest decline year-to-date. India’s stock index, for example, was down forty percent in dollars for the first six months of 2008, while the S&P 500 declined just eleven percent over the same period. That this decoupling has occurred while Asia continues on a strong growth trajectory and the US economy deteriorates, was not anticipated by Kuroto Fund. Nonetheless, we still maintain that the ultimate financial outcomes will be as we’ve long expected, and we remain confident that stock prices will track company fundamentals over long periods of time.

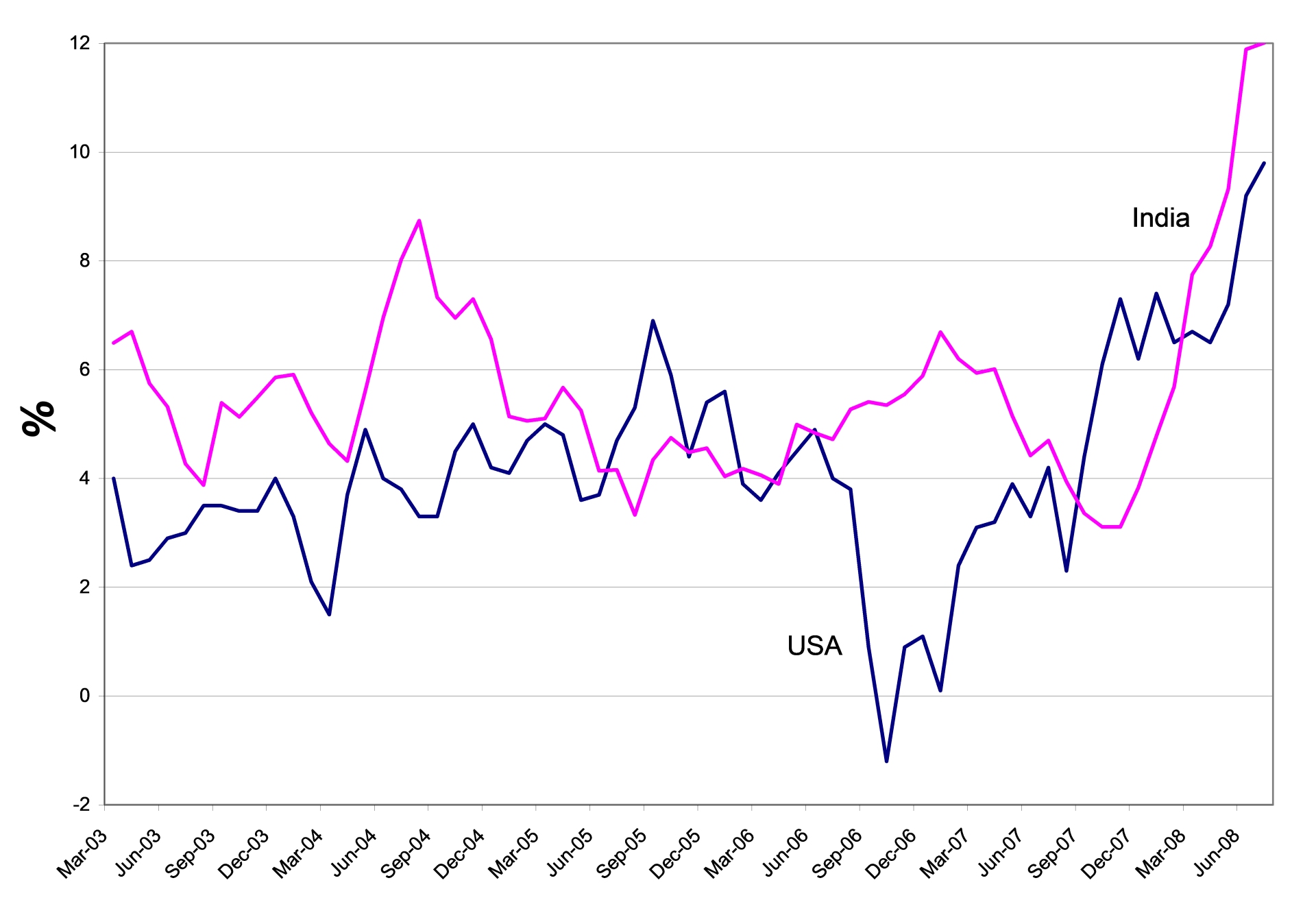

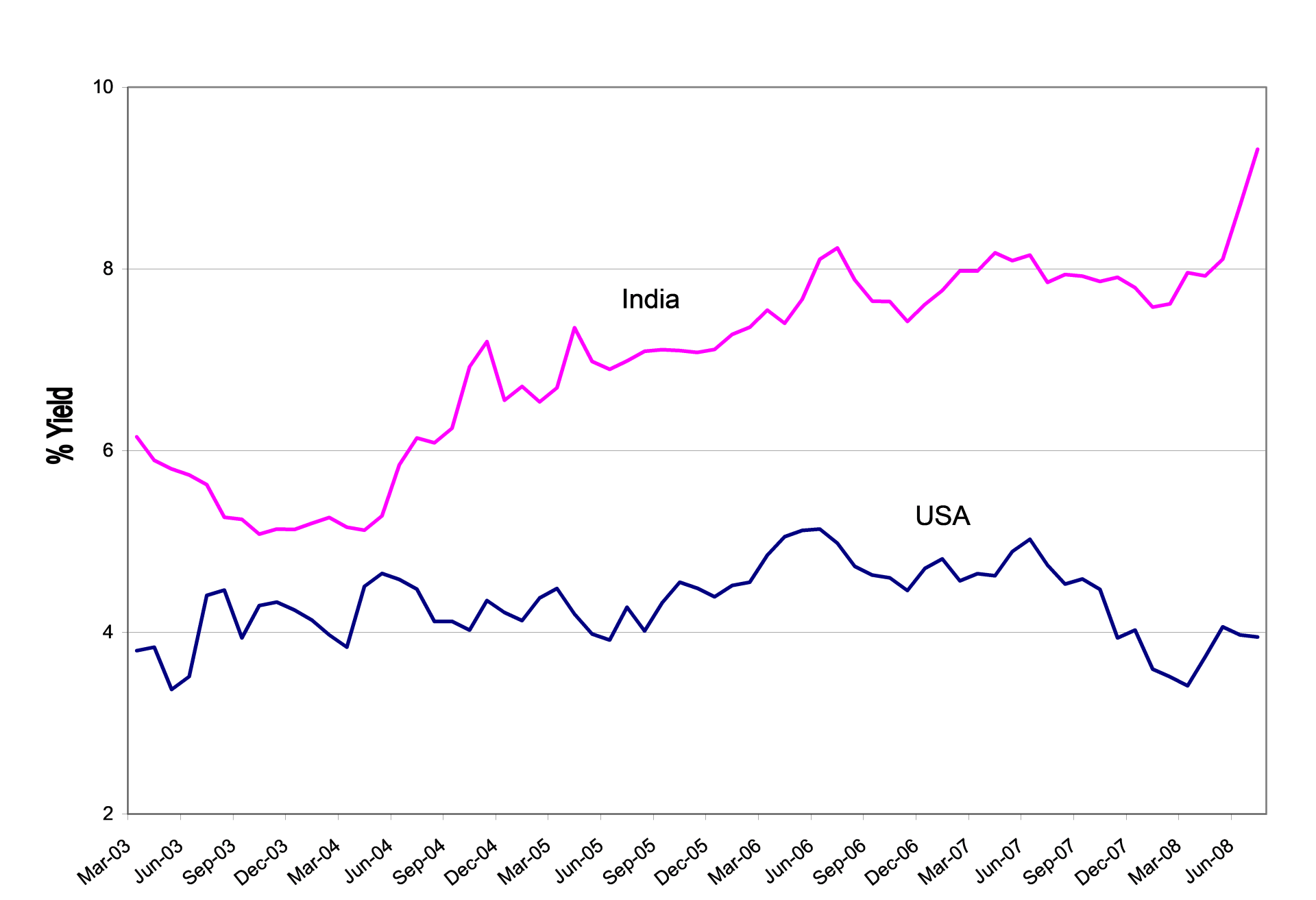

The spiking of inflation in Asia and the dread of the tough monetary policies that will be necessary to reverse it, are clearly a primary concern of most Asian markets. In India, for example, there is plenty of price acceleration to worry investors. Interestingly, a striking similar rise in US prices doesn’t seem to have concerned the US fixed income market one bit, and America’s long bond has appreciated while India’s has traded off significantly.

Wholesale prices in the US and India are up.

But, the US 10 year bond is up while the Indian 10 year bond has traded off 200bps.

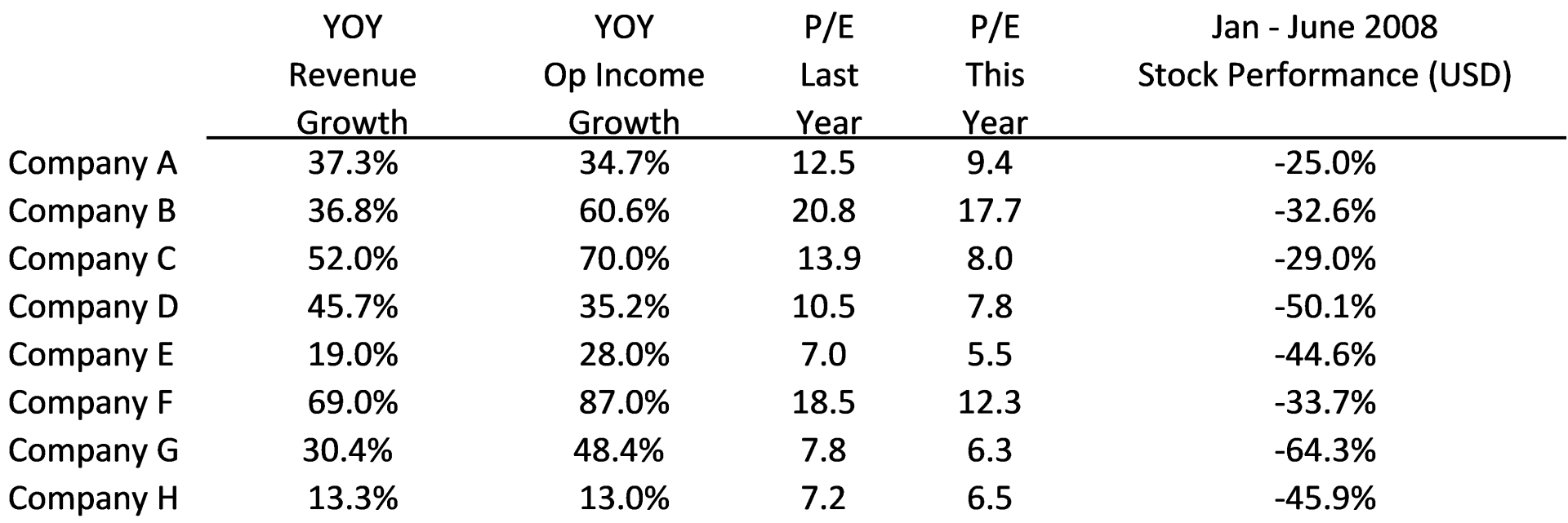

The Indian stock market’s response to building inflation has been dramatic and negative. Indian financial stocks have been especially hard hit. The particular bank stocks we own have been crushed despite little fundamental evidence that they are under any real stress (to the contrary, see below). We surmise that Indian investors are punishing these banks for the anticipated negative mark-to-market of their bond portfolio. That said, the Indian accounting practice of incorporating asset price fluctuations into reported earnings distorts the latter, and we ignore those changes, in both directions. In other words, the sizable decline in the stock prices of our Indian portfolio seems completely out of sync with the fundamentals of the companies themselves. We recognize that the real economic pain of the Reserve Bank of India’s tighter monetary policy may well be ahead of us, but our analysis suggests that even worst case outcomes cannot justify valuations anywhere near current ones. As evidence of this claim, we present the table below featuring the June quarter results for our stocks:

June 2008 Results and Valuations of Kuroto’s India Holdings

Even though, the sales and earnings progress at our Indian companies has been affected by the tighter monetary policy, they are on the whole surpassing our expectations for this year. And, while we certainly do not expect the growth exhibited by our companies to continue at these rates, we note that even substantially slower expansion in the quarters ahead should lead to much higher valuations.

It appears to us that our Indian companies’ exceptional fundamentals have completely disconnected from their valuations and are coming very close to discounting a serious Indian macroeconomic crisis. On the macroeconomic front, we will concede that there are certainly some grounds for concern. In India, for example, fuel prices have not only kicked up headline inflation rates and seriously eroded the purchasing power of poorer Indians, but also played havoc with the country’s current account and budget deficits. India, like the US, imports three-quarters of its petroleum, and consequently higher oil prices have had a negative impact on both countries’ current account deficits. India’s decision to heavily subsidize energy consumption has had the added effect of hardwiring higher oil prices to a worsening budget deficit. That said, in many macroeconomic respects, India is on much more solid footing than the US is:

i. India’s economic growth remains strong.

ii. Indian’s private investment growth remains robust.

iii. Indian savings rates, already high compared to America’s negligible levels, have risen from the mid-20% range to the mid-30% in recent years.

iv. India’s private sector debt remains modest.

v. India’s planned gigantic infrastructure build out is proceeding.

vi. Corporate India’s net share shrinkage is starting to accelerate.

Another positive future development for India involves the massive natural gas reserves discovered in recent years off the east coast of the country. The resource is currently estimated at tens of trillions of mcf’s and is expected to grow dramatically as the D6 project is expanded and several other large new areas are explored.

It is important to note that under the contracts signed by the oil companies, the terms distributing the benefits of this world-class discovery heavily favor the gas consumer and the Indian government over the companies that made the find. First, the negotiated sale price for the gas to consumers such as utilities and fertilizer makers is a deeply discounted $24/bbl of oil equivalent. So, these gas buyers will have a sizable windfall in their costs when they substitute D6 gas for imported oil. This should reduce inflation and help the current account move towards balance. Also, under the fiscal terms of the contract the government will garner the vast majority of the huge profits these discoveries will produce, profits that could reach 10% of GDP at their peak.

In a larger context, the D6 discovery illustrates the hugely important transition that we believe underlies India’s incredible economic acceleration. Prior to the reforms begun in the early 1990’s by the current Prime Minister, Manmohan Singh, petroleum exploration was the sole purview of the large, bureaucratic and corrupt government oil company. In more recent years, free market reform has paved the way for private E&P companies, who with their cutting-edge technologies and sizable risk capital have in relatively short order revolutionized the formerly moribund Indian petroleum industry.

In sum, India’s favorable macro long-term growth story remains intact, and Kuroto is pleased to have a chance to take a second bite of the Indian apple.

Sincerely,

Sean Fieler

William W. Strong