Equinox Partners, L.P. - Q2 2008 Letter

Dear Partners and Friends,

shifting to buying mode

Equinox’s reaction to the global market selloff this year has been a transition from last year’s selling (both long and short) to the buying mode—particularly in the dramatic third quarter.

The violent recent decline of gold mining stocks has allowed us to add to our gold companies at very compressed valuations. Despite our purchases, Equinox’s exposure to gold/silver has fallen slightly, and now stands at about 34% of partners’ capital. Though the price of gold has yet to achieve new highs on the back of the Western world’s financial crisis, we believe the ultimate government response to recent events will highlight the attraction of the one monetary asset that is no one’s liability.

Equinox’s energy position has been reduced by the sharp decline in E&P stock prices partially countered by the appreciation of the oil and gas puts that we bought to hedge our exposure. Again, net additions to our favorite oil stocks have not fully offset the decline in their valuation. Our net petroleum position now represents about 18% of our portfolio.

Likewise, our Asian exposure has been reduced by substantial stock price declines. Here we have been particularly aggressive in buying our favorite companies, including a few new names in now cheap Japan. Collectively, our long position in the Far East represents about 22% of capital.

The drop in global stock prices has begun to provide us opportunity to invest in outstanding businesses in new regions. Specifically, smaller Scandinavian companies and some Brazilian businesses are now trading at bargain basement prices, and we have been adding new positions in these countries. Shares from these other regions now comprise 11% of partners’ capital.

Much to Equinox’s surprise, American stock prices in general have not declined nearly as much as the particular shares that we are long---- the Russell 2000, which trades at 27 times next year’s estimated earnings, is off just 7% on the year. The prospective decline in the shares that we are short should allow us to cover these positions and switch more capital to the long side of Equinox in the months ahead.

Lastly, Equinox continues to maintain a substantial level of liquidity, $78 million to be exact, and is well positioned to take advantage of the opportunities provided by this market environment.

staying the long course: what we own, what we are buying and why

Gold

As the official intervention of the past week has made clear, the US government is not going to be tentative in its effort to stave off a massive credit contraction in the Western world. In the past two weeks alone, the US government has assumed responsibility for almost $9 trillion of debt and guarantees, $5.4 trillion from Fannie and Freddie and $3.4 trillion of money market funds. These actions and the actions yet to come collectively call into question the dollar’s viability as the world’s reserve currency. After all, the American government, unlike China, doesn’t have trillions of dollars sitting on the sidelines for use in this type of bailout. The money the US government is spending will come from one of three sources: taxes, increased borrowing, or the printing press. Tax increases are unlikely to generate much in the way of incremental revenues and would weaken our already faltering economy. Increased borrowing will only have the desired simulative effect if it doesn’t drive up interest rates, and with foreign central banks accounting for 95% of recent treasury purchases, we are almost wholly reliant on them for the success of this effort. Perhaps the world’s central bankers will continue to permit us the exorbitant privilege of managing the world’s reserve currency. Or perhaps, they will force us to resort to the printing press. The Fed, with its proposed $100 billion balance sheet increase this past week, has already taken an important step towards the printing press direction.

With the US dollar’s weaknesses becoming more apparent, this could have been the Euro’s moment to displace the dollar as the world’s reserve currency. However, to the extent that the current crisis is also a European crisis, the Euro is poorly positioned to assume this new role. Furthermore, as the widening of the PIIGS (Portugal, Italy, Ireland, Greece and Spain) spread highlights, the debt market continues to harbor doubts about the Euro’s long-term political viability. It is in this context, a world without a clear reserve currency, that gold will regain some of its historical role as money, a process that we believe will result in significantly higher gold prices.

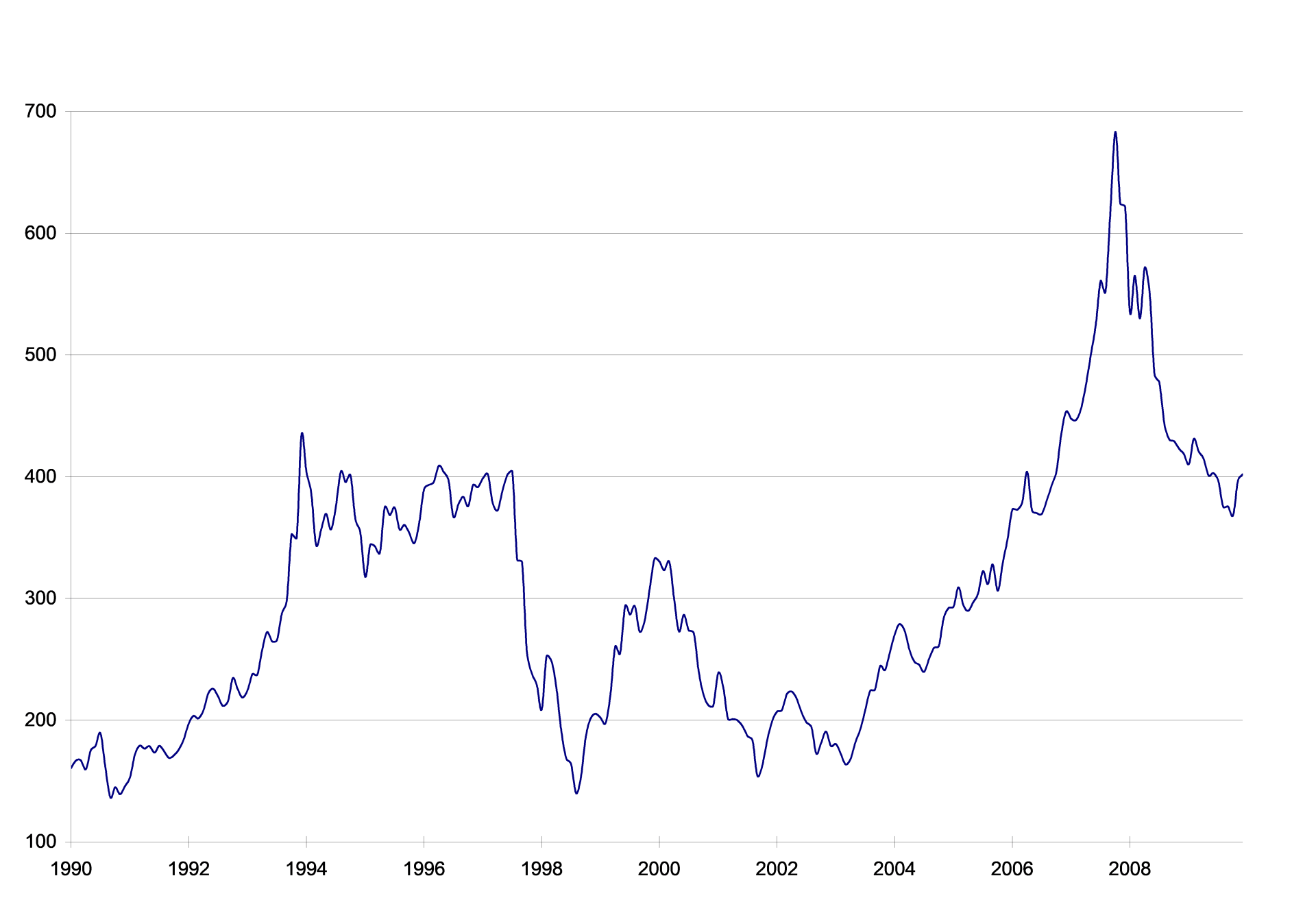

Gold companies, which will be the clear beneficiaries of gold’s remonetization, are trading at multi-year lows. Many of these companies are down more than 50% in the past two months alone. In recent weeks, we’ve been buying companies with sizable reserves at attractive valuations. Even in the current environment, with elevated mining costs and modest gold prices, the ounces we own are reasonably profitable when produced. As the world’s economy slows and gold is remonetized, these companies’ margins should expand several fold as should their stock prices.

Oil

Despite a herculean global effort, it’s been over twenty years since the world’s oil industry has replaced reserves. In recent years, the world’s petroleum geologists have only discovered one barrel of oil for every three produced. As a consequence of the world’s inability to replace reserves, world oil product has begun to flatten out; production has been basically unchanged at 85 million barrels a day since 2005. So, at the same time as the slowing of the world’s economy is making the direction of oil prices uncertain in the short-run, the long-run picture for oil is becoming increasingly clear. The facts are these:

“The largest oil reservoirs are mature, and their production is falling. Approximately three-quarters of the world’s current oil production is from fields that are two or three decades old, past their peak and beginning their declines. Most of the remaining quarter comes from fields that are 10 to 15 years old. New fields are diminishing in number and size every year, and this trend has held for over a decade.

And enhanced oil recovery technology, rather than making ever-greater amounts of oil available, has had the perverse effect of simply allowing us to deplete existing oil basins more quickly. Instead of creating future supplies of cheaper energy, enhanced oil recovery has caused us to sell the supply of those high-quality, nonrenewable resources as quickly and as cheaply as possible- leaving little for the future, and that at a much higher price.”[1]

Oil companies with long-lived reserves and low production costs will be the principal beneficiaries of sustained strong oil prices, and we’ve been buyers of several of these oil companies in recent weeks at very attractive valuations.

Global Great Businesses

The epicenter of the world’s financial crisis is in the US and Europe, but you would never know it from simply observing the world’s stock markets. While stocks in the US and Europe are down, the biggest declines - more than 50% from peak in many cases - have been elsewhere, in countries that have robust fundamentals. Asia, the region that still has the best long-term growth prospects in our opinion, has been particularly hard hit. The MSCI Asia ex-Japan index, a broad measure of Asian stock prices, is now trading at the same dollar price as it did in 1993.

[1] Brian Hicks and Chris Nelder, “Profit from the Peak”, p. 4.

With great businesses on offer at discounted prices, we have been aggressive buyers. Specifically, we’ve been buying high return on capital businesses with superior managements at single-digit multiples to current earnings in India, Indonesia, Brazil, Sweden and Japan. In many cases, we are buying businesses that we’ve owned before and sold as they traded up to high teens multiples to earnings. India, Indonesia and Brazil, are three of the least levered economies in the world, and in the case of India and Indonesia the currencies remain very undervalued relative to the US dollar. Japan and Sweden, while more levered, have fundamentally sound banking systems that should be able to weather the coming deleveraging in the US and parts of Europe.

For the first time in several years, Equinox is committing substantial incremental amounts of capital to the long side of our portfolio at very attractive valuations. For reasons outlined above, we contend the destinations of that capital remain very compelling.

Sincerely,

Sean Fieler

William W. Strong