Kuroto Fund, L.P. - Q1 2004 Letter

Dear Partners and Friends,

Kuroto Fund to Close to New Investors

Sizeable inflows of new limited partner capital have grown our fund to $100MM. As discussed with many of you already, Kuroto’s focused regional strategy has a limited capacity. Accordingly, after the scheduled opening on 1 October 2004 Kuroto Fund will no longer accept capital from new investors. Investment from current limited partners will be permitted for a while longer until Kuroto reaches its optimal capacity.

“Weighing Machine” vs. “Voting Machine”: When Will Asian Stocks Decouple From Those in the U.S.

“Jakarta fell 7.5 percent to its lowest close since mid-December, recording its biggest one-day fall since October 2002 (the date of the Bali bombing).”

“Seoul dropped to a seven-month low. The composite index shed 5.1 percent.”

“Mumbai led the way as growing political uncertainties prompted the market’s biggest-ever one day fall.” (Financial Times May 18, 2004 p. 29)

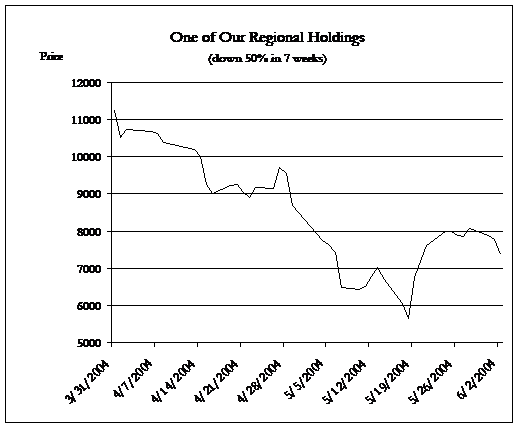

The veracity of Benjamin Graham’s famous dictum that “In the short run the stock market is a voting machine; but in the long run it is a weighing machine,” has been evidenced once again by recent global equity market action. The world over, in the months of April and May, superior liquidity trumped superior fundamentals. As a result, the rapidly growing and very cheap Asian stocks which we own and producers of nonrenewable natural resources declined far more than other more liquid but fundamentally inferior global equitiesthe overvalued American tech stocks and over-levered US financial companies which we are short.

It would have been naive to have expected a portfolio that has generated the excellent returns KurotoEquinox has in recent years to be impervious to sharp corrections. Substantial volatility has always been intrinsic to our strategy, and there exists few attractive means of reducing it (except for our strategy of hedging concentrations of exogenous risk which proved ineffective recently). We have chosen to stomach these rapid changes in the value of our fund only because the fundamentals of the companies in which we are invested are so very compelling.

Those of us who have operated in the region for years have come to expect the region’s markets to undergo periodic bouts of intense pessimism. As fear grips Asia’s markets, liquidity tends to dry up. This combination of fear and limited liquidity makes the region’s markets prone to sharp, cathartic downward moves. Some investors in the region allegeattempt clairvoyance, claiming to anticipate and thus, avoid these corrections. We have no such pretensions. The best we can manage to do is to take advantage of the fire sale prices on offer in the midst of these periodic panic attacks. Kuroto has even come to rely on such disturbances to exaggerate market inefficiencies and provide extreme valuation anomalies. While the sharp decline in the fund’s value has most certainly been unpleasant, picking up shares of dramatically cheaper stocks should bear fruit in the long-run.

We are not market timers, nor are we macro- strategists. We are stockpickers. Our thorough knowledge of the specific businesses in which we are invested provides us the conviction necessary to stay the course in times like these. This patience has enabled us to be truly long term investors, which in turn has enabled us to generate excess returns over long periods of time Patience, especially in down markets, is a necessity rather than a luxury. Jesse Livermore’s (the legendary stock speculator of the early twentieth century) thoughts on the virtue of patience are particularly apt:

“After spending many years on Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made big money for me. It was my sitting. Got that? My sitting tight!

The reason is that a man may see straight and clearly and yet become impatient or doubtful when the market takes its time about doing as he figures it must do. That is why so many men in Wall Street… lose money. The market does not beat them. They beat themselves, because though they have brains they cannot sit tight.

Disregarding the big trend and trying to jump in and out was fatal to me. Nobody can catch all the fluctuations.” (Edwin Lefevre (Jesse Livermore) Reminiscences of a Stock Operator, John Wiley and Sons, 1923)

Implicit in our preference for stocks with superior fundamentals over those with greater liquidity is the assumption that, over time, the former will significantly outperform the latter. In the short run, investors’ yearning for liquidity has steered them to overvalued equity and debt securities in the U.S. and Europe. In the long run, Asia’s compelling combination of valuation and growth will carry the day and force a significant decoupling of our Asian investments from their Western counterparts. “mainstream” conventional equities. Asian stocks will de-couple from their American counterparts.

A warning to our partners regarding a decoupling: - As should be clear from the global market behavior in the last two months, the divergence we are expecting has yet to begin. When the historic decoupling we are anticipating does come, it is unlikely to develop smoothly. Moreover, we do not expect Kuroto’s performance to be immune from a general increase in volatility brought about by a decoupling of the Asian and American capital markets.

KurotoEquinox: Profiting From U.S. Dollar Vulnerability

“…in recent years our country’s trade deficit has been force-feeding huge amounts of claims on, and ownership in, America to the rest of the world. For a time, foreign appetite for these assets readily absorbed the supply. Late in 2002, however, the world started choking on this diet and the dollar’s value began to slide against major currencies. Even so, prevailing exchange rates will not lead to a material letup in our trade deficit. So whether foreign investors like it or not, they will continue to be flooded with dollars. The consequences of this are anybody’s guess.” (Warren Buffet explaining his ownership of $12 bil worth of foreign currency in his 2003 Berkshire Hathaway report)

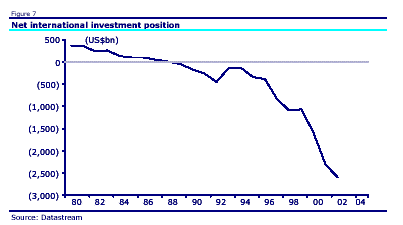

As company specific investors, KurotoEquinox usually does not hold a view on most currencies. We do, however, hold a long term view on the U.S. Dollar—it is going lower. Despite the almost fifty percent decline of our currency against the Euro in the last few years, America’s current account deficit has yet to peak let alone find a sustainable level. Implicit in the extreme position of America’s external accounts is the possibility of further meaningful dollar weakness. The current global monetary order has long lacked a mechanism to automatically nip unsustainable behavior, such as this, in the bud. This shortcoming, in combination with the surprising willingness of foreigners to hold our currency in extremely large size, has allowed enormous imbalances to persist much longer than we thought possible.

“The international monetary system that evolved after the breakdown of the Bretton Woods system in the early 1970’s is badly flawed. It lacks a mechanism to prevent persistent trade imbalances. It has made it possible for the United States to incur enormous current account deficits totaling a cumulative over $3 trillion since 1980. Those deficits have, in effect, become the font of a new global money supply. This near exponential increase in the global money supply (since the demise of Bretton Woods) has been the most important economic event of the last half-century” (Richard Duncan, The Dollar Crisis, p.251, John Wiley and Sons, 2003)

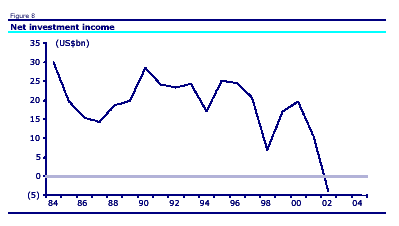

Complacent investors contend that the long running U.S. current account deficit has not really mattered. While true, as far as it goes, this view fails to address the worsening nature of the problem. This includes the larger absolute size of our deficit, the rate at which it is expanding, and the compounding affect higher U.S. interest rates will have on the problem. Until 2001 America’s trillion dollar plus net foreign liability cost us less than nothing to finance on a net basis (see net investment income grap[1]).

[1] CLSA Solid Ground: Going For Broke - February 2004

To make matters (much) worse, if domestic interest rates return to previously “neutral” levels, say 4% - 5%, the implicit effect on the U.S. current account deficit, ceteris paribus, is substantial. The resulting hundred plus billion dollars of incremental interest expense on our global net investment liability would eventually exacerbate the effect of our huge trade imbalance. The resulting pressure on America’s net investment position would appear to be unsustainable and suggests that the dollar remains considerably mispriced.

Should current trends continue, our foreign creditors would someday decide to not only stop accumulating dollar assets, but actually liquidate those they already own. In this case, Kuroto’sEquinox’s long portfolio of domestic Asian company stocks, natural resources could generate much larger profits than those gleaned from astute stock picking alone.

Sincerely,

Sean Fieler

William W. Strong