Equinox Partners, L.P. - Q2 2002 Letter

Dear Partners and Friends,

Performance

The simultaneous appreciation of our Asian and energy long positions in combination with profits in our technology and other short positions accounted for much of the partnership’s gain. Additionally, a modest rise in precious metal prices during the quarter produced a sharp upswing in the limited universe of gold and silver mining stocks. Though our shares in precious metal companies were up significantly, they are still valued at small fractions of most other mining stocks.

The US Dollar: The Ultimate Bear Market

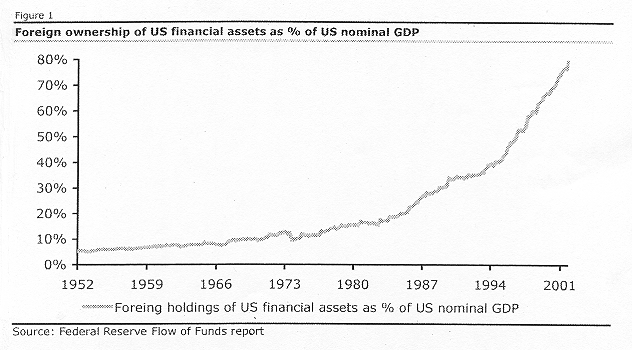

America’s “miracle economy” of the last decade did not just capture the imagination of American investors; its appeal was global. Correspondingly, the unprecedented demand for US assets did not stop at the shores of the US. For much of the 1990’s, foreigners were major net purchasers of technology stocks, whole companies, corporate bonds, and residential mortgage securities. Indeed, the rest of the world was so enthralled with the prospect of investing in our economy that their demand for dollars even overwhelmed America’s large and expanding current account deficit. This seemingly insatiable foreign demand for our assets produced a significant dollar bull market that resulted in a severely overvalued US Dollar, an unsustainable American trade imbalance equal to almost five percent of GDP, and the appearance that Americans were no longer bound by the limits of conventional economics.

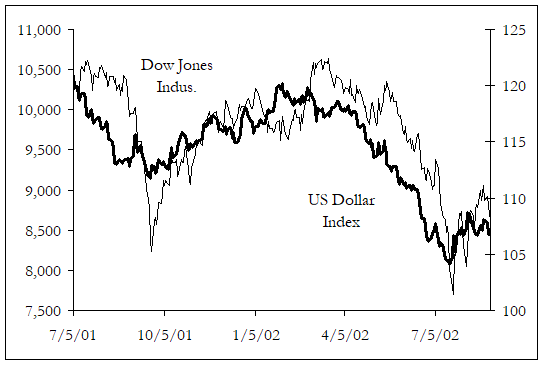

Interestingly, US dollar appreciation continued for almost two years after the peak in our stock market. Only once the myth of American economic invincibility had been debunked did the dollar start its decline. From the tech/telecom bust of the last two years to the recent revelations of corporate malfeasance, American financial assets have lost much of their former sheen. With our imperfections now glaring, is it reasonable to expect that we can continue to capture the same level of massive capital inflows which drove the dollar up fifty percent in just six years time?

To the extent that past large scale capital inflows become future large scale capital outflows, America will experience the virtuous cycle in reverse. The mere slowing of demand for our currency this year has already produced a meaningful depreciation, approximately ten-percent, in the US Dollar’s foreign exchange rate, a decline which coincides almost perfectly with the bear market in domestic stocks this spring and summer.

The dollar’s decline has made the ownership of US financial assets especially painful for foreigners, an experience which may produce even less demand for dollar assets going forward.

If the strength of the dollar was the linchpin of America’s 1990’s bull markets, then its recent loss of altitude is an ominous sign—the implications of which transcend our still overvalued equity markets. Should the slowing of demand for dollars turn into an actual liquidation of dollar denominated assets, America’s apparently limitless propensity to live beyond its means may well be in jeopardy. Equinox is well positioned for such an outcome.

The Housing Bubble

For three consecutive years, the value of the average home in America has appreciated between six and eight percent. In some areas, the average rate of appreciation has been much higher. On Long Island New York, for example, the median home rose just over twenty-nine percent during the past twelve months. In light of these rates of appreciation, it is not surprising that residential housing values and activity continue to break records. What is surprising, however, is that this record breaking appreciation has occurred in the midst of a national economic downturn.

The combination of a low fed funds rate, a flight to quality in the bond market, and tame inflationary expectations has pushed the yield on the ten year government benchmark bond, off of which the thirty year fixed mortgages are priced, to remarkable lows. So remarkable, in fact, that mortgage rates are now at a forty-one year nadir. The more than two hundred basis point decline in the average rate on a conforming thirty year fixed mortgage in the past two years alone, not only pushed up housing prices, it also prompted a massive refinancing boom which has greatly moderated the current recession’s impact. The size of the housing boom wealth effect on the American consumers’ balance sheet is nothing short of staggering: “Over the past two years, home-price growth alone has added nearly $2 trillion in wealth to U.S. households’ balance sheets – not a trivial amount in a $10 trillion economy.” (Barron’s April 15, 2002)

Even the most enthusiastic housing market bull would agree that the current rate of housing price appreciation is not sustainable. In the long run, housing values will correlate very closely with personal income. While recent dramatic declines in mortgage rates and credit standards have temporarily suspended this relationship, these were one off events the effect of which is now behind us: “For housing prices to continue rising, either incomes are going to have to move up at an unrealistic rate, or interest rates are going to have to fall sharply. Because ultimately, home prices can only rise as fast as people’s ability to pay for them.” (Barron’s April 15, 2002)

The housing bubble buzz grows while the conventional observers, from Alan Greenspan to Time Magazine, continue to argue that the housing marketing does not show any of the obvious signs of speculative excess. We positively disagree with their analysis. The mathematical impossibility of housing values rising more rapidly than personal income in perpetuity aside, what we find most unnerving about American’s current investment enthusiasm for housing is the eerie familiarity of the arguments used to rationalize this behavior:

1) “At worst you can expect a slow down, but not a dramatic softening.” The housing market has an even more consistent record of appreciation than did the stock market prior to its peak in 2001: “not once since the 1960s, when records were first kept, has the nation’s median home price declined in a calendar year.”(Time July 28, 2002)3 The belief that housing values cannot fall is the essential ingredient in the current housing boom, and the quality that makes housing appear to be a clearly superior investment in comparison to stocks. Of course, only a few years ago the average American investor believed that there wasn’t much, if any, risk in the stock market. Remember the mantra: stocks always appreciation in the long run?

2) “The supply demand picture is favorable.” The combination of household formation, immigration, and zoning regulation will ensure that demand continues to outstrip the supply of housing in America. This argument is almost identical to the now less often referenced supply demand theory of American common stocks: Aging baby boomers with growing savings, a significant portion of which would have to be invested in the stock market, would continually push up US stocks which were themselves becoming increasingly scarce on account of corporate share buybacks.

3) “Unreasonably high expected future returns.” Six to eight percent returns don’t sound unreasonable. But keep in mind, given the average down payment for second time homebuyers of 23%, a seven percent appreciation in home values generates a return of 28%. Alternatively, given the average down payment for a first time homebuyers of 3%, a seven percent appreciation in home values generates an absolutely irresistible return of 118%. Prior to march 2001, the expectation of a 20% annual return in the stock market was not believed to be unreasonable. 4

Of course if we are in the midst of a housing bubble which does eventually deflate, the economic repercussions are likely to be much worse than anything we have experienced to date as a consequence of the recent stock market collapse. Unlike stocks, which only half of all American households owned at peak, almost 70% of all American households own their own home. Moreover stocks, at their peak 14 trillion dollars in value only supported margin debt of 300 billion. Conversely, America’s 10 trillion dollars worth of residential housing has approximately 4.5 trillion of debt against it. “…..Most American homeowners have little margin of safety should home prices stop levitating or, heaven forbid, actually decline. According to the latest available census data, of the 38.6 million homeowners with one or more mortgages, two million, or more than 5%, had no equity or negative equity while another 2.6 million, or the next 7 % of mortgage holders, had less than 10% equity.” (Barron’s April 15, 2002). Despite these meager levels of equity and correspondingly high levels of risk, a wall of credit continues to chase the U.S. mortgage market:

“Last year, combine credit growth from the GSEs, mortgage-backed, and asset-backed securities surpassed $1 trillion for the first time and was four-fold higher than 1993’s level. In fact, the $1.003 trillion borrowed was not only up from 2000’s level of $647 billion, but it jumped to 91% of total U.S. non-financial borrowings. This is an amazing statistic.” (Prudent Bear Fund Shareholders’ Letter, 5/22/2002)

Any number of events could bring a rapid end to the speculative excesses in the American housing market. A material yield rally in the ten year government bond, which would be consistent with a declining dollar, is perhaps the most likely scenario. A materially higher unemployment rate resulting from a double dip recession is another strong candidate. A GSE funding crisis or sensible policy action could prick the bubble, but are unlikely. One especially weak link in the residential real-estate appreciation story which never gets much attention is the persistence of miraculously low loss experience on mortgage loans. As of the end of the second quarter, Fannie and Freddie were on pace to provision less than one basis point of their mortgage portfolio for losses this year. Materially higher provision charges would restrain the growth of these two institutions which are the indispensable source of financing in the American housing market. These two entities, which together purchase over 80% of all conforming mortgages originations, helped pump an incremental 471 billion dollars of credit into the US economy last year alone. Whichever the cause of this bubble’s demise, Equinox stands to benefit handsomely, as we have a large short position in the most vulnerable housing related names.

3 “There have been plenty of regional busts, as in Texas following the ‘70s oil boom and in New England during the last ‘80s.” (Time July 28, 2002)

4 3% closing cost assumption.

Waiting for the Other Shoe to Drop

According to one observer, “What we are experiencing is not so much an economic recovery as it is the last gasp of a terribly maladjusted bubble economy.” (Prudent Bear Fund Shareholders’ Letter, 5/22/2002) We believe that the continued surge in debt financed consumer spending, much of it on non-essential durables in the face of an economic downturn, constitutes the “other shoe” of the 1990’s bubble. With luxury auto sales such as BMWs surging (up 16% from last year’s record level), California condo sales volumes up 38.5% from one year earlier, and one company’s $80,000 recreational vehicle backorders up over 100% in recent quarters, the pain of the recession is hard to find in the consumer spending figures. Moreover, stock valuations incorporate little concern about unsustainability of this debt-financed binge.

Even though the tech/telecom sectors have lost three-quarters of their stock market value, Equinox continues to find attractive short selling opportunities. We have positioned a significant portion of our short portfolio to profit from the eventual rebalancing of the credit excesses currently fueling residential real estate and consumer spending. With the market decline earlier this summer, Equinox both reduced our net short exposure and modified its composition. We have covered some of our tech/telecom shorts and sold short a diversified basket of housing/consumer/financial stocks. As in the past, risk control remains our primary focus on the short side of Equinox. We are confident that we will continue to profit from the abatement of the financial excesses of the recent era.

Sincerely,

Sean Fieler

William W. Strong

Anthony R. Campbell