Kuroto Fund, L.P. - Q4 2022 Letter

Dear Partners and Friends,

PERFORMANCE

Kuroto Fund gained 16.8% in the fourth quarter of 2022 bringing the calendar year 2022 return for the fund to -7.9%. By comparison, the EM index gained 9.7% in the fourth quarter of 2022 and declined -20.1% for the full year.

A breakdown of Kuroto Fund's exposures and contribution can be found here.

COMMODITY PESSIMISM PERVADES

Having been out of favor for years, commodities were decimated in the spring of 2020 when global demand collapsed. With almost three years of hindsight, it’s clear that this near-death experience on the back of a lengthy commodity bear market severely traumatized commodity investors and producers alike. Accordingly, even as the commodities have rebounded sharply, pessimism pervades the sector, and commodity producers and investors remain fixated on the return of capital rather than expansion into the nascent bull market in commodities. In our opinion, the prevailing commodity pessimism is not the result of enlightened thinking about supply and demand dynamics but rather the product of the psychological scarring of those invested in commodities and generalist investors who continue to believe that commodity businesses are inherently low return and unpredictable.

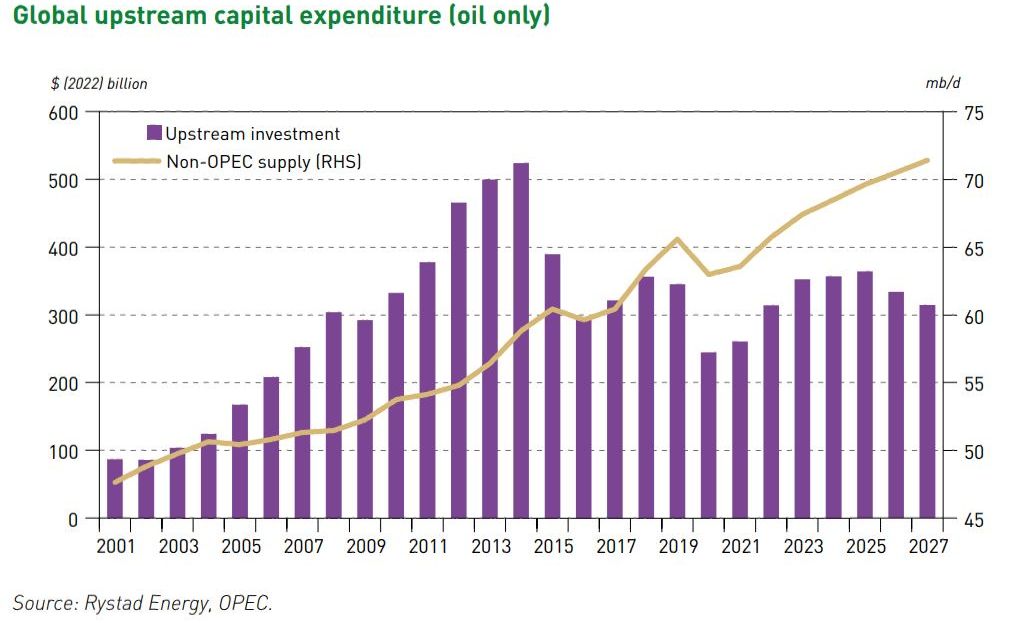

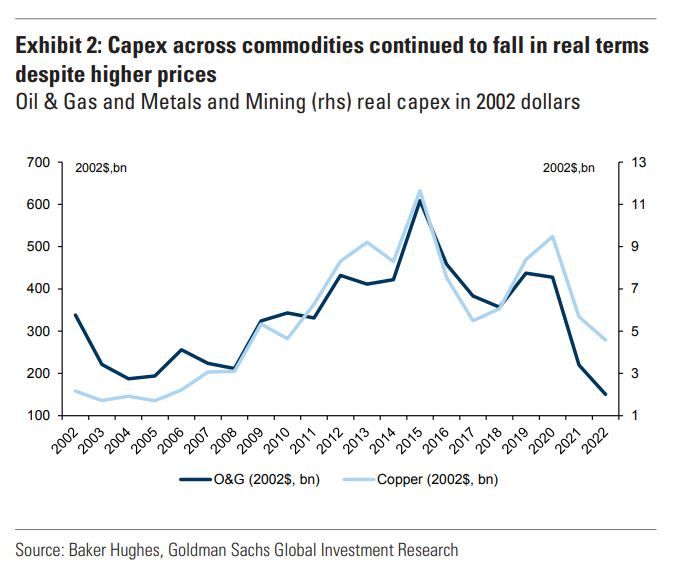

Oil, the largest and most economically important commodity, provides the most glaring example of underinvestment. In 2022, oil producers spent just over $300bn on upstream capital expenditures, down from a peak of over $500 billion. Today’s oil companies are committed to returning the majority of their cash flow to investors who have little faith in the long-term prospects of the businesses. Exxon, the largest of the supermajors, is a case in point. In a December 8th investor presentation, Exxon’s CEO, Darren Woods, reiterated the company’s intention of keeping oil reinvestment well below half of Exxon’s cash flow assuming $60 oil. With a fortress balance sheet and aggressive return of capital, Exxon is preparing for another bear market, not a commodity super cycle.

Exxon and other oil producers regularly pin their underinvestment on the coming energy transition. However, this argument fails to explain why many other commodities are suffering from the same underinvestment as oil. For example, copper, which is slated to play a critical role in the energy transition, has experienced almost equally large percentage declines in capital expenditure over recent years. As a result of the underinvestment in copper, by 2026 there is likely to be a significant shortfall in the global copper supply. Eventually correcting this shortfall promises to be extraordinarily painful for consumers of copper given that the average copper project takes over ten years to bring online.

Generalist investors who don’t want anything to do with commodities deserve much of the blame for the continued underinvestment. Many of these investors were formed by the bull market of the past decade and believe that fortunes are made in tech, not commodities. They point out that there are no trillion-dollar commodity companies and few centi-billionaire commodity companies CEOs because commodity companies don’t lend themselves to differentiation and long-term value creation. Put succinctly, the same investors who were willing to pay any price for tech business also are unwilling to own commodity company at any price. Moreover, even if these investors were to change their mind, many would not know where to begin. An entire generation of investors has never deeply analyzed a commodity business, and most who have, have been turned off by the politics, capital intensity, and cyclicality.

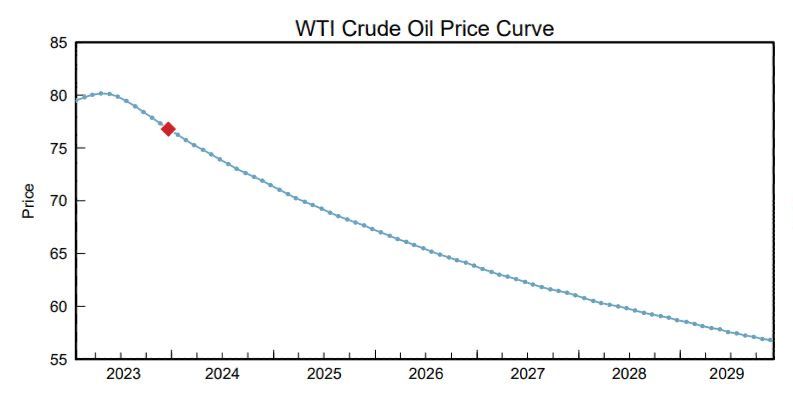

It is not just equity investors who have become skittish about commodity investing; commodity pessimism extends to participants in the futures market as well. Oil, in particular, is in severe backwardation, i.e. futures prices are below the spot price. That said, $60 oil implies an unbelievable pessimism about future oil demand. If this very low price does indeed come to pass, much of the pessimism that prevails in the oil market today is more than justified. Investors in the space own structurally low-return businesses and should extract as much capital as quickly as possible from the sector.

For our part, in contrast to both the stock market and the futures market, we believe that pervasive commodity pessimism has laid the foundation of a massive commodity super cycle. The supply problems are not going to be cured anytime soon and growing resource nationalism ensures increased friction when markets eventually decide to invest. Perhaps the only thing that could prevent much higher commodity prices across the board would be the implosion of the Chinese economy or a prolonged decline in global economic activity. While the likelihood of these bearish outcomes is not driving the prevailing commodity pessimism, some combination of the two events is likely in our opinion. These downside scenarios would likely be positive for gold and silver prices and not particularly bearish for oil given OPEC’s renewed ability to manage supply. Given this view, our Kuroto Fund weighting in hydrocarbon producers in remains high.

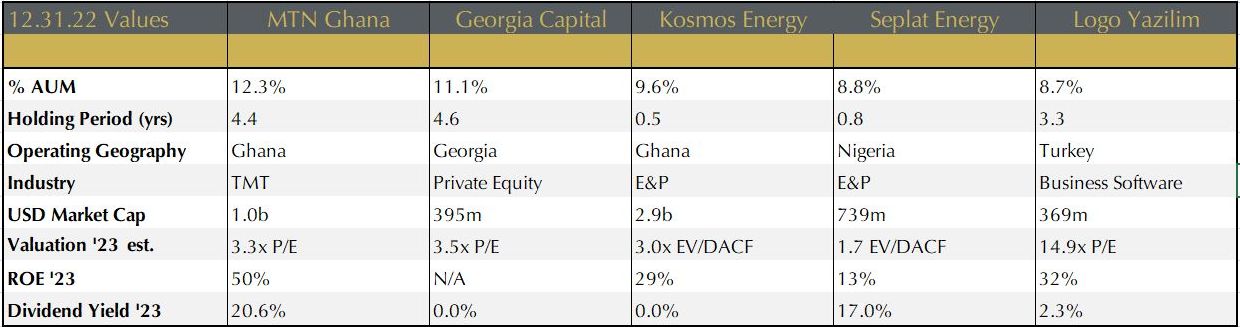

Top 5 Year End Holdings

Please note all figures in above table and below descriptions are in $USD and as of 12/31/2022 unless noted otherwise. Several securities’ prices have moved meaningfully since year-end impacting market capitalization, valuation ratios, etc.

MTN Ghana

MTN Ghana is Ghana’s dominant cellular telecom provider and mobile-money business. The company trades at 3.3x our estimate of 2023 earnings, with a 21% dividend yield, and generates a 50% return on equity. The low valuation is due entirely to the challenge of operating in Ghana. In 2022, Ghana defaulted on its domestic and U.S. dollar debt and targeted MTN with a series of bespoke taxes.

From an operating perspective, MTN Ghana had another strong year. Through the first nine-months of the year, the company grew revenues 28% and earnings 49% in local currency terms. MTN gained market share in mobile telephone, increasing its share to 60% of the country’s voice traffic. In mobile-money, we believe MTN is maintaining its dominant market share.

From a macro perspective, 2022 was a disaster for MTN Ghana. The Ghanaian Cedi declined over 50% as inflation spiked to more than 50%. Ghana reached an agreement with the IMF in December which should give the government new tools to cut spending. That said, we expect the government to remain dysfunctional in the short term. Over the medium term, Ghana should become a more tolerable country in which to operate as it lives within the constraints of the IMF bailout package.

The larger concern for investors in MTN is the series of direct attacks the government of Ghana has levied against the company. In February of 2022, Ghana’s minister of finance announced approval of a 2% tax on mobile-money transfers. While this tax did not name MTN, with a 90% market share MTN was the obvious fiscal target. As could have been predicted, the 2% transaction tax succeeded in disrupting the mobile-money business while not raising any revenue for the government. Accordingly, in December, the government of Ghana reduced the 2% tax to a more workable 1%. Unfortunately, the government followed up this announcement with a politically motivated tax evasion investigation of MTN. While the substance of the tax evasion charge is dubious to say the least, the continued attack on the company is a problem.

In short, MTN is a very healthy company in a very unhealth country. Safaricom—an analogous company in Kenya—trades at three-and-a-half times the valuation of MTN Ghana. If Ghana becomes a more normal, but not high functioning country like Kenya, then we would expect a substantial rerating of MTN shares. If Ghana continues to attack MTN as the deepest pocket in the country, then MTN’s extraordinarily low multiple is not low enough. While MTN Ghana was the largest detractor to our performance in 2022, we still think that Ghana is more likely to become an average, rather than a particularly horrible, African country in which to do business.

Georgia Capital

Georgia Capital is a diversified holding company in the Republic of Georgia. The company owns a listed and observable 20% stake in Georgia’s second largest bank (Bank of Georgia), and its large portfolio companies include the country’s largest hospital network and largest pharmaceutical store network. Additionally, Georgia Capital owns a diverse portfolio of smaller investments in sectors spanning insurance, real estate, hospitality, utilities, renewable energy, beverages, auto service, and digital services. Georgia Capital trades at 3.5x our estimate of its look-through earnings.

The principal reason for Georgia Capital’s low valuation is its $300m 6.125% bond which matures in April of 2024. Even after selling its 80% stake in Georgia’s largest water utility for $180m in February of 2022, Georgia Capital still does not have the liquidity to fully pay its bonds. Our optimism about the company depends upon Georgia Capital’s ability to roll over $200m of the bond or liquidate $200m of its $320m worth of publicly traded securities—or some combination of the two. While the debt does not mature for 15 months, we expect management to execute on a solution in the coming months.

On the back of a solution to its debt rollover, there is good reason to be optimistic about the company’s prospects. The Georgian economy has been on a tear since Russia’s invasion of Ukraine. As we detailed in our Q3 2022 letter, investors were initially concerned about the potential negative spillover that Russia’s invasion of Ukraine could have on Georgia. Instead, the war has had a very positive effect on the country’s businesses, including those owned by Georgia Capital. This environment has given the company a welcome opportunity to sell assets, retire debt, and buy back shares at discounted prices.

Kosmos Energy

Kosmos Energy is an offshore oil and gas company led by Andy Inglis. Andy joined BP in 1980 and rose through the ranks to become the chief executive of BP’s Exploration and Production business. At BP, Andy oversaw a multi-billion-dollar exploration budget and was a plausible future BP CEO. The Deepwater Horizon spill in the Gulf of Mexico in 2010 abruptly changed Andy’s career trajectory. While Andy was not responsible, he along with several of BP’s leaders left or were let go.

In 2014, Andy became CEO and Chairman of Kosmos Energy. For the past eight years he has used his unique skill set and connections to assemble a set of world-class offshore assets in Africa and the Gulf of Mexico. With a market cap of $3.5b and 2022 free cash flow of approximately $700m, the market is giving Andy little credit for his vison or expertise. We think that’s about to change.

In 2023, Kosmos’ flagship Tortue LNG project comes online. The Tortue project is the first of a multi-phase, decade-long natural gas development project in offshore West Africa that is perfectly timed to help Europe meet its newfound need to diversify its natural gas supply. The project is so important that German Chancellor Olaf Scholz paid a visit to Senegal to lobby for Germany’s share of this long-term natural gas supply.

More broadly, Andy continues to take advantage of the global exodus from offshore oil and gas development. This exodus has given Kosmos the opportunity to build a world-class portfolio of offshore assets that generate rapid paybacks. When the oil cycle eventually turns, we suspect that the same sort of E&P companies that have been divesting assets and facilitating Kosmos’ growth will become bidders for the package of world-class assets that Andy is assembling.

Seplat Energy

Seplat is the largest and most professional indigenous oil and gas company in Nigeria. The company was founded by two Nigerian entrepreneurs who continue to own close to 10% of the shares each. Since 2020, the company has been run by Roger Brown, an Irish ex-pat formerly of Standard Bank and PWC, who joined Seplat in 2013 as CFO. The board of directors includes the former head of Shell Nigeria as well as the CEO of Maurel & Prom—a French oil and gas company that owns a 20% stake in Seplat.

In 2022, we estimate that Seplat generated roughly $330m of operating cash flow, $170m of free cash flow, and paid a 12% dividend yield. The company has several projects underway that are scheduled to be completed later this year, including a new gas-liquids development and a new export pipeline. Once these new projects are up and running, we estimate that the company will generate roughly $350m of free cash flow per year starting in 2024. On today’s market cap of $700m, this would represent a 50% free cash flow yield.

In addition to the company’s organic growth plans, Seplat has an agreement to purchase part of Exxon’s Nigeria operations. The outcome of this acquisition is political and therefore uncertain. That said, if completed, the deal would double Seplat’s production and cash flow with no share dilution. As the only respectable indigenous oil and gas company in Nigeria, Seplat is uniquely positioned to acquire additional assets from oil majors who are looking to exit the country.

Logo Yazilim

Logo is Turkey’s leading enterprise-resource-planning software (ERP) provider for small and medium businesses. The company trades at 14 times our estimate of 2023 earnings and is well positioned to grow in Turkey’s underpenetrated ERP software sector. The management, technology, and strategy of Logo continue to impress us. At the same time, since year-end 2022, we have trimmed our weighting in this holding solely on account of the recent political and macroeconomic developments in Turkey.

Turkey’s macroeconomic and political environment has become increasingly unstable. Inflation had been running as high as 85% in October 2022. Moreover, the political and macroeconomic environment will likely come under further stress in the run up to elections on May 14th. We expect Erdogan to pull out all the stops in an effort remain in power, and we anticipate his opposition remains united by their desire to remove him.

While the outcome of Turkey’s election is admittedly unpredictable, either a win for the opposition or Erdogan would likely be a positive for Turkey. The worst-case would be a contested election and/or a coup. An additional non-negligible scenario involves a split government in which Erdogan remains President but loses parliament. Given the surprisingly strong uptick in the Turkish stock market and strength of the Turkish lira in advance of this uncertainty, we decided to trim our position in Logo.

Sincerely,

Sean Fieler Brad Virbitsky

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 12.31.22, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.