Equinox Partners, L.P. - Q4 2022 Letter

Dear Partners and Friends,

PERFORMANCE

Equinox Partners rose +17.3% in the fourth quarter of 2022 and +20.8% for the full year.

Visit our performance page to view the Equinox Partners, L.P. fund summary in more detail.[1]

COMMODITY PESSIMISM PERVADES

Having been out of favor for years, commodities were decimated in the spring of 2020 when global demand collapsed. With almost three years of hindsight, it’s clear that this near-death experience on the back of a lengthy commodity bear market severely traumatized commodity investors and producers alike. Accordingly, even as the commodities have rebounded sharply, pessimism pervades the sector, and commodity producers and investors remain fixated on the return of capital rather than expansion into the nascent bull market in commodities. In our opinion, the prevailing commodity pessimism is not the result of enlightened thinking about supply and demand dynamics but rather the product of the psychological scarring of those invested in commodities and generalist investors who continue to believe that commodity businesses are inherently low return and unpredictable.

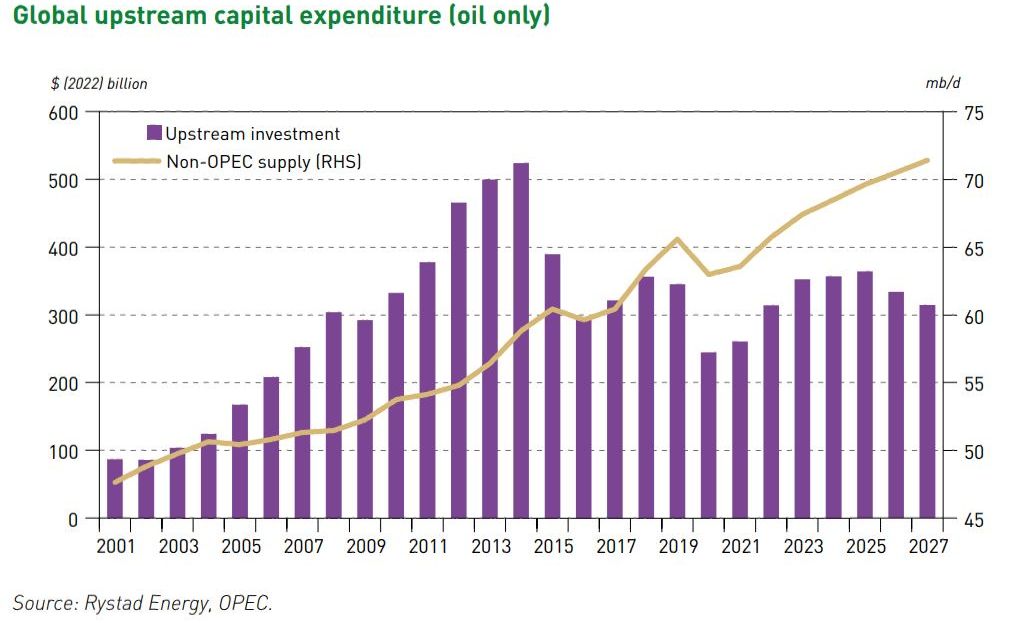

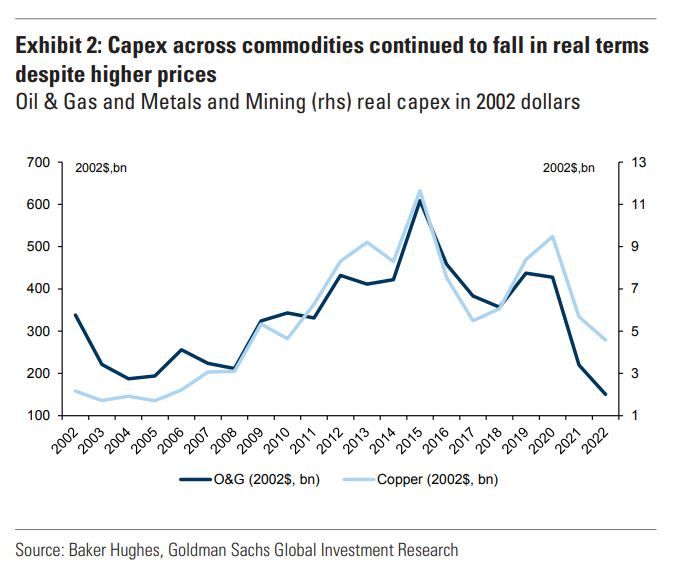

Oil, the largest and most economically important commodity, provides the most glaring example of underinvestment. In 2022, oil producers spent just over $300bn on upstream capital expenditures, down from a peak of over $500 billion. Today’s oil companies are committed to returning the majority of their cash flow to investors who have little faith in the long-term prospects of the businesses. Exxon, the largest of the supermajors, is a case in point. In a December 8th investor presentation, Exxon’s CEO, Darren Woods, reiterated the company’s intention of keeping oil reinvestment well below half of Exxon’s cash flow assuming $60 oil. With a fortress balance sheet and aggressive return of capital, Exxon is preparing for another bear market, not a commodity super cycle.

Exxon and other oil producers regularly pin their underinvestment on the coming energy transition. However, this argument fails to explain why many other commodities are suffering from the same underinvestment as oil. For example, copper, which is slated to play a critical role in the energy transition, has experienced almost equally large percentage declines in capital expenditure over recent years. As a result of the underinvestment in copper, by 2026 there is likely to be a significant shortfall in the global copper supply. Eventually correcting this shortfall promises to be extraordinarily painful for consumers of copper given that the average copper project takes over ten years to bring online.

Generalist investors who don’t want anything to do with commodities deserve much of the blame for the continued underinvestment. Many of these investors were formed by the bull market of the past decade and believe that fortunes are made in tech, not commodities. They point out that there are no trillion-dollar commodity companies and few centi-billionaire commodity companies CEOs because commodity companies don’t lend themselves to differentiation and long-term value creation. Put succinctly, the same investors who were willing to pay any price for tech business also are unwilling to own commodity company at any price. Moreover, even if these investors were to change their mind, many would not know where to begin. An entire generation of investors has never deeply analyzed a commodity business, and most who have, have been turned off by the politics, capital intensity, and cyclicality.

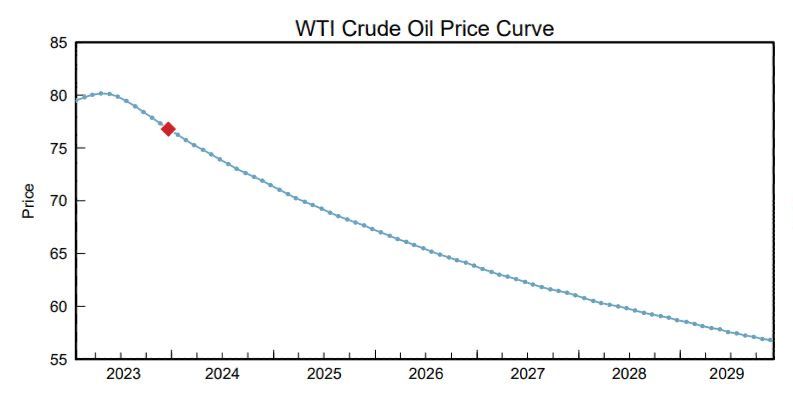

It is not just equity investors who have become skittish about commodity investing; commodity pessimism extends to participants in the futures market as well. Oil, in particular, is in severe backwardation, i.e. futures prices are below the spot price. That said, $60 oil implies an unbelievable pessimism about future oil demand. If this very low price does indeed come to pass, much of the pessimism that prevails in the oil market today is more than justified. Investors in the space own structurally low-return businesses and should extract as much capital as quickly as possible from the sector.

For our part, in contrast to both the stock market and the futures market, we believe that pervasive commodity pessimism has laid the foundation of a massive commodity super cycle. The supply problems are not going to be cured anytime soon and growing resource nationalism ensures increased friction when markets eventually decide to invest. Perhaps the only thing that could prevent much higher commodity prices across the board would be the implosion of the Chinese economy or a prolonged decline in global economic activity. While the likelihood of these bearish outcomes is not driving the prevailing commodity pessimism, some combination of the two events is likely in our opinion. These downside scenarios would likely be positive for gold and silver prices and not particularly bearish for oil given OPEC’s renewed ability to manage supply. Given this view, our weightings in the monetary metals and hydrocarbons remain high.

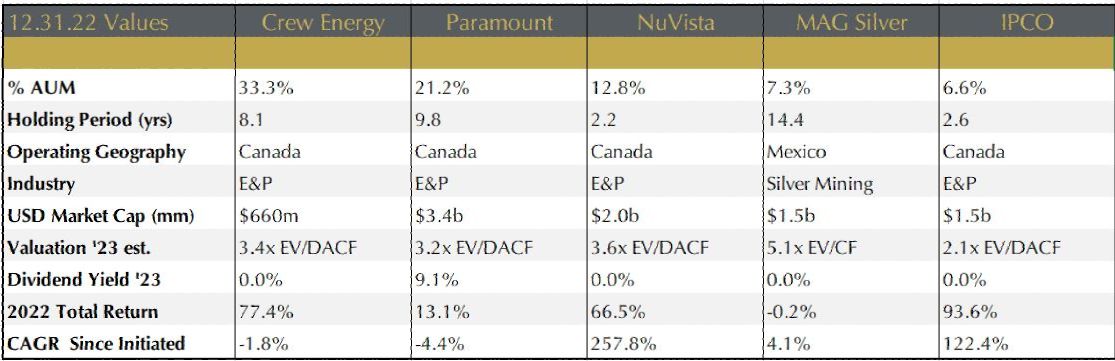

Top 5 Year End Holdings

Please note all figures in above table and below descriptions are in $USD and as of 12/31/2022 unless noted otherwise. Several securities’ prices have moved meaningfully since year-end impacting market capitalization, valuation ratios, etc.

Crew Energy Inc.

Crew Energy is a natural gas producer in British Columbia. With a strong balance sheet, strategic asset base, and still-modest valuation, Crew is well positioned to grow production and achieve a premium multiple in a transaction.

Management’s execution of a countercyclical investment program has put the company on solid financial footing. In the summer of 2022, Crew Energy completed a two-year strategic plan that they embarked on in the depths of the COVID crisis. The results of the program were significantly better than initially forecasted largely due to better than expected commodity prices. In 2022, we estimate that Crew generated $225m in operating cash flow and $74m in operating free-cash flow. Both figures exclude $95m Crew realized through the disposal of a non-core asset.

On the back of the successful completion of this two-year strategic plan, Crew announced another, even larger, countercyclical investment program. Over the next four years, the company intends to double production as its peers focus on returning capital. Crew will outspend cash flow in both 2024 and 2025 while keeping debt to cash flow under one turn. At $4 gas and $75 oil, we estimate Crew’s four-year investment will deliver an IRR of approximately 26%, at which point the company would be trading north of a 30% FCF yield.

While Crew’s expansion plan is sensible, the market is weary of the company’s growth strategy. Key areas of concern are: 1) disagreements between indigenous groups and the BC government which could prevent BC from issuing drilling permits;[2] 2) delays and cost overruns; 3) low natural gas prices; 4) new taxes on oil and gas producers; 5) the inability to achieve a premium multiple in an exit. While we are certainly mindful of all these potential risks, the board is prudently positioning Crew to play a strategic role in the export of LNG to Asia. In our opinion, this unique positioning makes it likely that Crew will achieve a premium valuation in a transaction.

Paramount Resources Ltd.

Paramount Resources is an oil and gas producer based in Alberta. Paramount combines high-quality assets and a net-cash position with a steep discount to our estimate of intrinsic value. Paramount is growing production 15% this year while also generating a 10% FCF yield. We believe the company can keep growing at attractive rates while generating a double-digit free cash flow yield for shareholders. Additionally, at $100 oil prices, this free cash flow yield rises to approximately 20%.

The biggest question for us is how the Riddell family, who controls Paramount, will deploy the company’s free cash flow. The board has committed to paying out a majority of the company’s free cash flow in 2023. The resulting schedule of dividends and distributions should deliver an 8% yield at today’s stock price. Going forward, we expect Paramount to redeploy most of its free cash flow into acquisitions. Given the Riddell family’s excellent long-term track record of value creation and large ownership of the company, we trust them to allocate capital intelligently.

The Riddell’s astute, countercyclical capital allocation strategy has been on display for the past two years. In 2020, at a moment when almost all of Paramount’s peers were paralyzed by the uncertainty in the energy market, Jim Riddell pulled the trigger on Paramount’s acquisition of 20% of NuVista Energy—a company with an adjacent land package. Paramount would have preferred to buy all of NuVista, but NuVista wasn’t a willing seller in the summer of 2020 and Paramount wasn’t willing to go hostile.

Paramount’s 2022 accumulation of land in the Willesden Green Duvernay is a second example of the Riddell’s ability to create value through deals. Last year, Paramount purchased two separate land packages resulting in over 250k acres with over 600 high-graded locations that can support a production plateau of 50k boepd for over 20 years. Given the quality of these well locations, Paramount thinks they should be worth over $1m each. We estimate Paramount paid less than $200k per location. Importantly, Paramount was able to more than offset the cost of the Willesden Green deal by selling its Kaybob Duvernay land package at a valuation of ~$1.3m per drilling location.

NuVista Energy Ltd.

NuVista Energy is an oil and gas producer based in Alberta. Like Paramount, NuVista combines high quality assets, strong free cash flow and a steep discount to our estimate of intrinsic value. And, like Paramount, NuVista is growing production (19% in 2023) while also generating a 10% free cash flow yield at current oil prices. At $100 oil, the company would generate a 20% free-cash-flow yield. We believe NuVista can grow at attractive rates while generating double-digit free cash flow yields for several years. Finally, we expect NuVista to return most of its free cash flow to shareholders.

In 2022, NuVista achieved its ambitious de-leveraging goal and publicly committed to returning ~75% of future free cash flow to shareholders. Having been skeptical of management in the past, we were pleasantly surprised by both outcomes. We attribute management’s newfound clarity and focus to the realization that the company could be taken over. Ever since Paramount took a run at NuVista in 2020, management elected to give investors exactly what they want to get the share price up and stave off an unwelcome bid from Paramount. Given this rationale, it’s not surprising that most of that return of capital will be done via share repurchases. Last year alone, NuVista reduced its share count by 7.8%.

Over the medium term, we think NuVista can grow ~10% per year while returning most of its free cash flow to shareholders. When multiples for E&P companies eventually expand, we expect NuVista to be a seller. The C-suite and board at NuVista own meaningful stock options that will crystallize upon a change of control, and thus are incentivized to transact when the time is right. Until that day comes, we think shareholders of NuVista can expect to receive over a 20% total return per year (free cash flow yield + production growth), in a company with over a decade of top-tier inventory and de minimis debt.

MAG Silver Corp.

MAG Silver is the 44% owner of the world-class Juanicipio silver mine in Zacatecas, Mexico. After four years of construction, the mine was commissioned in the first week of 2023. We expect production to ramp up to 4,000 tonnes per day by the end of this year but never achieve the 8,000 tonnes per day we were anticipating. Accordingly, at $24 silver, we estimate the cash flow from MAG’s 44% stake to be around $100m. As a result, we reduced our position to a more modest weight in January.

The electrification of the Juanicipio mine just before Christmas of last year ends a painful chapter in MAG’s history. This world-class asset, which was discovered over 2003-2006, took a full 16 years to come into production. Initially, conflict between MAG and their JV partner, Fresnillo, was to blame for the delay. But in recent years, the disfunction of the AMLO administration, a drug war in the state of Zacatecas, and the COVID shutdowns across Mexico, were the culprits. Given the challenges MAG and Fresnillo faced completing the Juanicipio mine, both companies will take a cautious approach to further expenditures on the JV property.

Even so, the Juanicipio mine will be expanded beyond 4,000 tonnes per day when additional ore is sent through Fresnillo’s Saucito plant which is just a few kilometers away from the Juanicipio JV. Longer-term, the aggressive exploration of the JV land package and exploitation of additional veins will require a better environment in Mexico. While Mexico is not yet Venezuela, it is on the path to becoming a failed state. This unfortunate reality makes the expansion of the Juanicipio JV to 8,000 tonnes per day unlikely anytime soon.

International Petroleum Corp. (IPCO)

IPCO is a Swiss based oil and gas company controlled by the Lundin family. At $80 oil, we calculate that approximately 20% of the company’s market cap is available for distribution or reinvestment each year. At $100 oil, IPCO’s free cash flow yield is above 30%. Given this wave of free-cash-flow generation, low valuation, and attractive investment opportunities, the decision to reinvest free cash flow or return it to shareholders is top of mind for the Lundin family. Last year, after paying off its remaining debt, the majority of the company’s free cash flow was used to repurchase shares, resulting in a 10% reduction in shares outstanding in calendar year 2022. Over the next two to three years, we expect the majority of the company’s free cash flow to be deployed into a Canadian oil sands project called Blackrod.

IPCO’s Blackrod project is a fully permitted Canadian oil-sands project with over one billion barrels of resource. When IPCO decides to go ahead and develop this asset, the investment will consume $600m of capital, or two years of free cash flow. The investment decision is in essence a prediction about the future oil price. Given the Lundin’s family’s relatively bullish view of the oil price, we believe they will proceed with the investment. When built, we estimate that the project will more than double the company’s production and reserves.

Sincerely,

Equinox Partners Investment Management

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

[2] On Jan 18th 2023, it was announced Province of BC came to an agreement with the Blueberry River First Nations Indigenous group: Canadian province and First Nations reach Montney shale play deal | Reuters

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 12.31.22, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.