Kuroto Fund, L.P. - Q3 2001 Letter

Dear Partners and Friends,

Performance

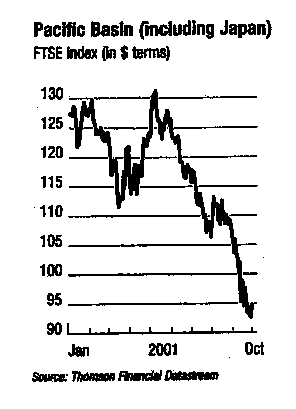

Kuroto Fund’s third quarter performance, up four percent, compares favorably with the MSCI Asia Pacific Index‘s negative nineteen percent return during the same period. Throughout the Asian market declines, both before and after September 11, the stocks of the defensive businesses which Kuroto owns benefited from a local flight to quality. This, in combination with our hedges and shorts, produced a modest gain for our partners during the third quarter.

Year-to-date our Asian portfolio has gained 30 percent. With other Asian stock funds declining by almost as much, Kuroto’s 2001 outperformance is currently over fifty percentage points. As we stated last quarter, our relative success continues to be a function of the quality of the businesses we own as evidenced by their earnings stability (even growth in some cases) in the face of Asia’s current difficult economic environment. It is also a function of the extreme undervaluation of our shares as demonstrated by their very low earnings multiples, deep discounts to asset values, and high dividend yields.

Economic Value Added (EVA) in Asia

In September of this year, the Dow Jones and the Nikkei indices traded at parity for the first time since 1957. This represents quite a change from the last trading day of 1989 when the Japanese Nikkei reached its peak of 39,000 and the Dow Jones closed near 2,700. The recent epochal shift in these relative equity valuations illustrates the breathtaking extremes to which speculation can carry security prices on either side of the Pacific. It also demonstrates the ability of corporate managements to either enhance or eradicate shareholder value.

The EVA management craze of recent years brought the concept of shareholder value creation to the far reaches of the globe. Our experience, however, with Asian businesses, particularly in Japan, suggests that many local managers remain uninspired practitioners of the EVA model. The continued misallocation of Japanese capital, Economic Value Destruction (EVD), is perhaps as much to blame for the seventy-five percent erosion of their stock market value in the 1990’s as is the speculation which permeated their “bubble economy” during the previous decade.

The profitable investment of retained earnings is one of the most vexing issues we face in selecting Asian stocks. As we have stated repeatedly, a fundamental tenant of Kuroto’s investment strategy is the insistence on owning businesses that consistently generate superior returns on capital. Our media, consumer branded products, financial, and other holdings invariably earn excellent returns, far in excess of the local hurdle rate for corporate capital. As a result, incremental investments back into these businesses, by definition, grow the intrinsic value of the enterprise, thereby permitting us to patiently wait for the shares to become more reasonably or even richly valued.

The majority of our businesses are so profitable as to generate cash flow in excess of that which they can absorb in growing their companies internally. During the Asian Crisis, this proved to be a particularly positive characteristic of our holdings. Our companies used their abundant liquidity to reduce their excessive and, at the time, very expensive indebtedness. Today, many of these same companies have completely paid off their debt and have begun piling up cash. With local interest rates having fallen substantially in many of these countries (see our last letter regarding Korean rates), the return on this excess cash has fallen to a very low level. Thus, the issue of what these companies will do with their retained earnings going forward looms large.

Because of their very low stock valuations and correspondingly high cost of equity capital, share repurchase is our overwhelming preference for the use of retained earnings of the companies that we own. Unfortunately, this practice is alien to most Asian managements, who only view buybacks as a temporary stock price boosting measure. Second in our preference is a sensible dividend policy which allows us the opportunity to reinvest the capital at high rates of return. As stated before, a number of Kuroto’s stocks sport high single digit and even double digit dividend yields. A third option, internal investment, either through a new business initiative or acquisition, can be value enhancing but in practice is difficult to implement.

As long-term owners of superior Asian businesses, we recognize that the skill and motivation with which the managements of our companies reinvest retained earnings will have a very significant impact on the ultimate returns of these stocks. The range of reinvestment options, as with so many managerial decisions in Asia, is wide and has a commensurately large scope of potential outcomes. At Kuroto, we strive to invest only with managements who are adding significant economic value and thereby avoiding Japan-like outcomes.

Lumpy Investment Returns

While the inherent value of Kuroto’s companies tends to increase in a predictable almost stair-step ascension, their stock prices, have not mimicked this pattern—a short-run outcome that can be disconcerting to investors who lack conviction about the underlying businesses. Accordingly, we understand why so many of our competitors attempt to respond to the concerns of clients by managing their portfolios with a heavy focus on smoothing out the lumpy equity returns of Asian markets. Such suboptimal portfolio practices as paying substantial premiums for large liquid businesses and rigid pair-trading hedging strategies have muted their potential returns while so distorting valuations as to open up large opportunities for stock pickers, such as ourselves.

The far from perfect relationship between the prices of the stocks we own and the intrinsic value of the businesses which underlie them cuts to the heart of our investment process. That our businesses trade for a small fraction of their real value is precisely the reason Kuroto finds Asian markets so appealing—such shares have outstanding prospective returns and little risk of the ultimate loss of capital. It also suggests that the opportunity cost of capital allocated to dissipating the volatility of such naturally volatile markets is very high. At Kuroto we have consciously chosen another path. Though we do employ a modest amount of short selling and other hedging techniques when the transaction appears to be attractive on its own merits, we refuse to compromise the exceptional opportunities we have discussed in these letters simply in order to reduce the lumpiness of our returns. We expect our long-term track record will validate our different approach to Asian investing.

Sincerely,

Sean Fieler

William W. Strong

Gifford Combs