Kuroto Fund, L.P. - Q2 2014 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Kuroto Fund increased +2.6% in the second quarter of 2014 and is up +3.7% for the year through July 31. By comparison, the MSCI Asia Pacific Index was up +7.1%, and the MSCI Emerging Markets index rose +8.3% for the year through July 31.

Kuroto's investments in India contributed 7.3% to partners’ capital through July 31. Following Narendra Modi’s resounding victory in May, public intellectual Gurcharan Das described the election result as the third most important event in the country's post-colonial history as Modi is the first commoner to serve as Prime Minister. We hope this reform-minded, market-friendly leader, who has a demonstrated track record of making government work (see our Q4 2013 letter), can restart the investment cycle and reaccelerate India’s growth. His election has already renewed investor optimism in India with its stock market rallying 26% this year in $USD. While the valuations of Kuroto's investments in India have also increased, we continue to think that the attractive investment opportunities there justify it being our single largest country weighting at 28% of partners’ capital as of July 31.

The fund's short exposure detracted from performance in the first half of the year, costing 4.5% of partners’ capital. Roughly one-third of the loss came from time decay on our Yen puts; we have since exited this position. The other two-thirds of the loss derives from the fund’s Japanese government bond interest rate swaps. Japan’s over-indebtedness, fiscal deficits, and inflation-targeting monetary policy are at odds with its very low interest rates and a stable currency. We remain convinced that this lopsided risk/reward merits our long-standing investment.

Going Global

With the new global emerging markets mandate, 21% of the fund has been invested outside of Asia as of July 31. As part of this allocation, the fund has purchased Aramex, an express delivery company based in Dubai, as well as Ferreycorp, a Peruvian industrial business.[1] The firm’s global long/short fund, Equinox Partners, discussed its ownership of both companies as part of its top five holdings disclosure earlier this year. If interested, please contact Daniel Schreck for copies of those investment write-ups. Kuroto has also added new positions in the Philippines, India, Chile, Colombia, Russia, and a business listed in the UK with operations concentrated in the emerging world.

Generally, we are seeing opportunities in the Andean region of South America, India, and Southeast Asia. We have previously discussed the attractiveness of India and Southeast Asia. Much of the Andean region offers better economic growth and a more benign political environment than its South American neighbors that border the Atlantic Ocean. The Andean countries also generally have independent central banks and even offer real interest rates. However, concerns about their commodity exposure—given the fears of slower economic growth in China—have led some investors to question these countries’ growth prospects. We think some of the company valuations more than discount this issue.

New Transparency Policy & Top Five Holdings

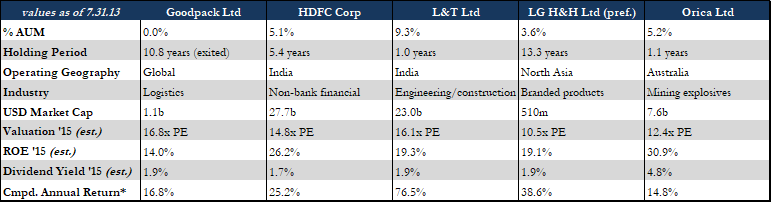

We have disclosed a brief summary of our top five holdings as of December 31, 2013 below (note: four out of the five are still material holdings).[2] This disclosure was delayed due to our recent focus on the mandate expansion. We’ve initiated this practice as a means of better illustrating our investment process to our partners. These holdings are reflective of the fund's Asia-only mandate as of the end of last year. Going forward, we will update this disclosure annually at yearend.

· Goodpack

Goodpack owns and operates the world’s largest fleet of steel Intermediate Bulk Containers (IBCs). The company leases its IBCs to customers that ship natural rubber, synthetic rubber, food, and other chemicals globally. As Goodpack expands its customer base, it should be able to reduce the amount of time and number of trips that each IBC spends empty. This, in turn, reduces Goodpack’s cost to offer its service, increases its pricing advantage, and expands its network—all of which add to its competitive advantage and returns on capital. KKR is in the process of buying Goodpack for $1.1 billion. Given the likely acquisition, we have exited the position.

· Housing Development and Finance Corporation

Housing Development and Finance Corporation (HDFC) is a housing finance company in India founded with the explicit purpose of enabling middle-class Indians to achieve home ownership. It operates an extremely lean and low-risk business as evidenced by its low operating costs and loan losses. HDFC's position as a finance company (and not a bank) allows it to run a more efficient balance sheet, and its AAA credit rating has resulted in attractive funding costs over time. HDFC also owns a large stake in the most profitable bank in India (HDFC Bank), as well as controlling interests in successful insurance and asset management businesses. HDFC has excellent long-term growth potential given the low mortgage penetration in India. We expect the HDFC mortgage business to continue to grow its earnings at 15% to 20% while generating a 25% ROE.

· Larsen & Toubro

Larsen & Toubro (L&T) is an engineering, procurement and construction (EPC) firm based in India. L&T designs and builds everything from power plants to toll roads to even nuclear submarines. The company is differentiated through its culture, reputation, and vertical integration. These attributes allow the project execution of L&T to be superior to its competitors and should enable it to capitalize on the sizable infrastructure development opportunity within India. We estimate that the EPC business should grow its earnings at a 15% to 20% annual rate over the longer term and generate a 20% ROE over a business cycle.

· LG Household & Health Care (preferred stock)

LG Household & Health Care (LG H&H) is part of the larger LG group and manufactures, markets, and distributes many cosmetic, personal care, homecare, and beverage products. Historically, the company focused too much on market share, negatively impacting its pricing and profitability. In early 2005, the LG group hired Suk Cha, a former P&G executive, to run the business. Since taking over, Mr. Cha has grown revenues at a CAGR of 18% while increasing operating margins from below 6% to over 11%. This performance has come from improvements in operations, focus on branding, and smart acquisitions. While the market for the common shares has largely recognized Mr. Cha’s incredible performance, the non-voting preferred shares trade at a 48% discount to the common shares.

· Orica

Orica is an explosives manufacturing and servicing company based in Australia. Orica’s competitive advantage lies in its local manufacturing sites and last-mile delivery network, both of which allow it to provide mining and construction customers with a consistent supply of high-quality explosives. Orica is well positioned to benefit from the long-term growth in commodity consumption in Asia. Demand for its explosives should grow faster than mineral consumption, as declining ore grades require miners to remove more earth for each ounce of mineral produced.

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

ENDNOTES

[1] Ex-Asia EM currently includes UAE, Russia, UK listed EM company, Colombia, Chile, and Peru.

[2] Holding period, percent AUM, market cap, and estimated 2015 valuations as of 7/31/2014. Top five positions as of 12/31/13. In all cases where fiscal yearend differs from calendar yearend, the closest fiscal yearend is used. Orica ROE is ex-goodwill. L&T and HDFC as presented use parent company data and are adjusted to exclude subsidiaries. * Stock performance is total return (price appreciation and dividends) not adjusted for stock in/out flows, and is derived directly from Bloomberg using the initial position inception date and ending date 7/31/14. Goodpack performance through 7/30/14.