Equinox Partners, L.P. - Q1 2014 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Equinox Partners was up +6.0% in the first quarter of 2014 and roughly +16% for the year through June 25.[1]

Gold & Silver Miners: CApitalizing on the Mother of all imbalances

We have assiduously avoided hyperbole when discussing our investments. But in the rare event that the planet of deeply distressed valuation is aligned with that of unprecedented economics we make an exception—especially as the particular investment in question is near universally loathed by the financial community[3]. We are, of course, referring to the current alignment of depressed gold and silver mining companies with the “greatest monetary policy accommodation in human history.”[4] As exceptional as this opportunity is, it is one upon which few investors are prepared to capitalize.

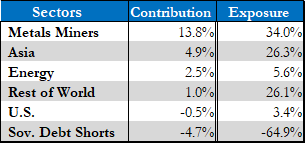

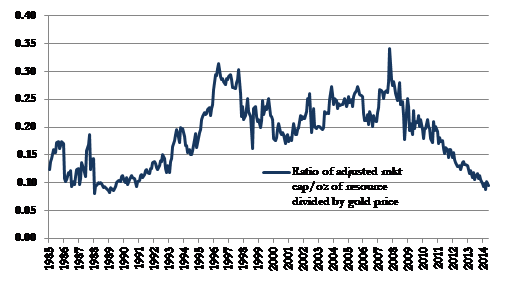

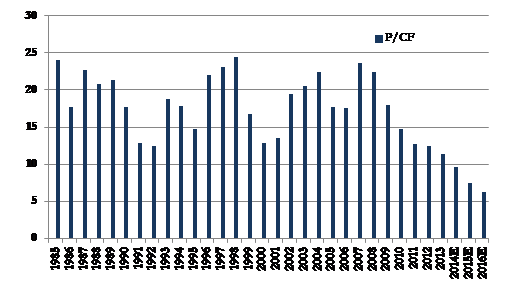

Market Cap per resource oz / gold[5] Miners’ Price/Cash Flow[6]

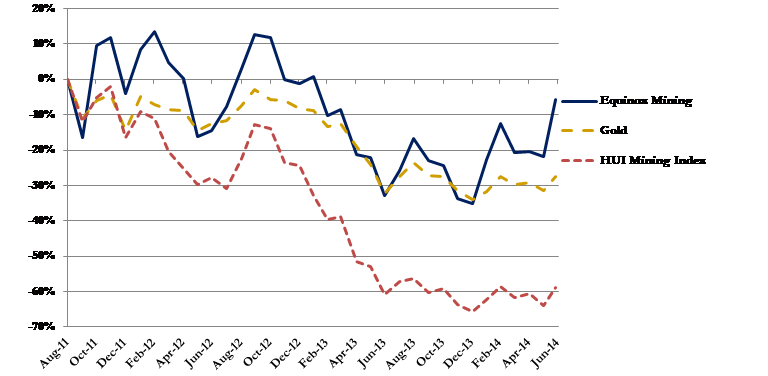

Despite a June rally, gold and silver producers remain deeply depressed in relation to both their current cash flow and their gold and silver resources. While other measures of investors’ outlook for gold and silver prices, such as option volatility, have also traded off over the past three years, it is gold and silver mining stocks that are most clearly reviled. The 60% decline of the HUI gold mining index since the summer of 2011 reflects not just pessimism about the mining companies’ product but also their management, governance, and businesses more generally (see “Gold and Silver Miners”).

While such valuation extremes by themselves can be an indication of a promising investment, today’s discounted mining valuations also coincide with a unique chapter in global monetary policy stimulus. Central banks across the First World have lowered real interest rates to below zero, radically increased excess bank reserves, and promised to maintain this unprecedented monetary stimulus well into the future. In the words of William White, former chief economist for the Bank for International Settlements, “The honest truth is no one has ever seen anything like this. Not even during the Great Depression in the Thirties has monetary policy been this loose… They are making it up as they go along”[7] We believe, such extreme monetary policy, when combined with steeply discounted mining shares, has created an extraordinary long-term investment opportunity.

Gold and Silver Miners

Gold and silver miners, while up meaningfully this year, continue to reflect a plethora of pessimistic assumptions. Amongst the negative factors embedded in their shares is a near certainty that gold and silver prices will not mount a real, sustained recovery. Under this prevalent and pessimistic assumption, gold and silver mines will never generate acceptable returns on capital employed, and, consequently, should not be owned for anything more than a well-timed trade.

The multiple difficulties of the average mining business in today’s environment are well known and lend credibility to the argument that rising metal prices will not be efficiently translated into mining company profits. For example, over the last decade, rising costs of production and increases in tax rates have substantially reduced the leverage to higher gold prices that investors sought in their ownership of the typical gold mining company. Were these cost trends to continue as gold prices remain flat, gold mining margins would compress further.

While the recent cost pressures were not principally of the miners’ own making, mining company managements have proven more hapless than heroic in response. Rather than tackle rising costs with an increased focus on efficiency, most managements were far too lax for far too long in their approach to operating and capital costs. Worse still, instead of re-engineering and improving their processes, management often addressed shrinking margins and cash flows by issuing equity and high grading their ore bodies. The use of debt to finance acquisitions and costly capacity expansions further reduced the industry’s ability to withstand lower metals prices.

Keenly aware of these aforementioned dynamics and the typical challenges of operating a gold or silver mine, we have concentrated our investments in exceptional assets and managements. For example, amongst our largest holdings are Virginia Mines, a royalty company with a zero cost of production (See Q4 ‘13 letter) and MAG Silver (Q2 ‘12 letter), a high-quality and low-cost asset with royalty-like characteristics.[8] To get a sense of the robust nature of these projects, in the case of MAG, the company’s joint venture with Fresnillo is projected to generate a 40% after-tax IRR at $20 dollar silver.[9]

Most mining companies lack Virginia’s and MAG Silver’s economic characteristics and, consequently, have suffered seriously from a combination of rising costs and falling metal prices in recent years. On a positive note, the industry’s struggles have had the benefit of focusing shareholders on sub-par managers. In particular, shareholders have become bolder in demanding management changes. Nearly half of the CEOs of the 30 largest gold and silver mining companies have been replaced in the last three years.[10]

While we welcome this change and the increased appetite of investors to confront the management in this industry, in our experience, the root of most mining management problems lies at the board, not executive level. And at the board level, the changes remain less than inspiring. Too many board rooms remain clubby with too little concern for minority shareholders and returns.

Understanding and managing these governance problems have been central to our precious metal investment strategy. Over the past three years, we have spent significant time researching the boards of the companies in which we are invested. At MAG Silver we worked to help restructure the board, bringing in two world-class directors. This effort has already borne fruit. The revamped board brought in a new CEO last year and removed a founder with a troublesome conflict of interest. This year, we again took a more active role and helped Kirkland Lake Gold fend off an opportunistic activist looking to flip the company. Specifically, we actively lent our support to the chairman and CEO, who are committed to optimizing this unique, long-lived asset.

“NOt Your Father’s Federal REserve” [11]

We have long appreciated the enthusiasm with which central bankers are willing to fight the slightest whiff of deflation. What best distinguishes the current class of central bankers from their predecessors is not their willingness to err on the side of inflation but the absolute magnitude and scope of their activities. The First World’s central banks have been engaged in not just a countercyclical policy but an ongoing stimulus; not just a liquidity injection but an effort to control long-dated bond yields; not just one bout of quantitative easing, but four.

These monetary masters of the universe have no good parallel in history. Their ambitions go well beyond “leaning against the wind.” They are angling for more: a steady annual uptick in prices, financial system stability, and robust economic growth while supporting profligate governments at the same time. And, that’s just their broad macro agenda. Japan’s Kuroda considered offsetting the short-term effects of a sales tax increase. Janet Yellen, whose employment stimulation bias is well known, is targeting stock and bond prices in addition to employment and inflation. The ECB, Europe’s “Whatever it Takes” central bank, has engineered political outcomes in Italy and Greece. In short, an elite class of central bankers is micromanaging developed economies around the world in ways that would have been unimaginable just a few decades ago.

Yellen: inflation fighter?

Chicago, March 31: Janet Yellen (second from front left) observes a welder, and during the prior week, spoke with three unemployed Chicago residents. At a Federal Reserve Bank of Chicago conference she remarked: “It is my hope, that the courageous and determined working people I have told you about today, and millions more, will get the chance they deserve to build better lives.” (NY Times)

The Printing press and market distortions

“[T]he US government has a technology, called a printing press… We can conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.”[12]

—Ben Bernanke

Without question, Bernanke’s ‘government technology’ has successfully inflated a multitude of asset prices. Many bonds, stocks, and works of art trade at historic highs. Spanish and French bonds, for instance, are at 200-year highs while speculative U.S. growth stocks remain a destination of choice for meaningful amounts of central bank largesse. But, it is the high end of the contemporary art market that has posted some of the most eye-popping price increases. In the words of one art dealer, “Prices seem to set the value. Overpaying is almost the best thing you can do…”[13] From the $142 million ticket on Francis Bacon’s triptych, to Jeff Koons’ $58 million “Balloon Dog” or Barnett Newman’s “Black Fire I” at $84 million, bull market geniuses remain firmly in control of the contemporary art market.

While the willingness of the super wealthy to spend so extravagantly is worrisome in its own right, this particular distortion of monetary policy is only one of a series of far more serious, though less sensational, distortions that are afflicting the real economy. That such distortions are already present counters the prevailing wisdom that our monetary adventurism will prove costless if the Fed can just extract us from this problem without significant inflation. It is clear to us that our monetary policy has perverted capital allocation decisions throughout the economy. For example, many investment decisions made against a backdrop of zero rates are unlikely to withstand rate normalization. Moreover, the increasing concentration of wealth undermines the distributed decision making that is the genius of the free market system. So perhaps, it’s premature for central bankers to be patting themselves on the back.

Of course, keeping in mind our own fallibility, it is only fair to note that we failed to predict the precipitous rise in the contemporary art market and the historic rally in sovereign debt. In this same vein, our optimism about the future of precious metals prices could be misplaced. The Federal Reserve is slowing its balance sheet expansion and America’s total debt to GDP ratio has declined modestly from its recent peak. While it is theoretically possible that the over-indebted developed world can gradually deleverage without a financial crisis, we don’t think it is likely. Far more likely, in our opinion, are rising inflationary pressures as capacity utilization around the world tightens. With the unprecedented amount of stimulus already in the system, if central banks hesitate in normalizing—or even reversing—their easing policies, a troublesome acceleration of consumer inflation could ensue. We have theorized that the next and potentially explosive phase of the gold bull market could occur when the authorities don’t tighten enough, as opposed to loosen too much.

Conclusion

After half a decade of the most radical monetary experiment of modern times, investors seem to have lost interest in the subject. Complacency rules the day. Hugely unpopular gold and silver mining stocks are sending this message loud and clear. Of course, no one knows exactly how this extraordinary extension of government economic manipulation will end. Will our massive money experiment end in very high inflation as the economic recovery tightens capacity utilization? Will the Fed reverse course, perhaps touching off another financial crisis which could lead to even more easy money policies? Will the Bank of Japan’s actions trump even the Fed’s bold moves? We don’t know. However, both economic theory and the long sweep of financial history suggest that such policies are laden with unresolved consequences—consequences which will ultimately extract a cost that is proportional to their magnitude. We are convinced that the one asset that we can be confident will benefit is the ancient repository of value that is no one else’s liability—precious metals and the cheaply-valued companies that extract them.

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

END NOTES

[1] Returns stated for Equinox Partners, L.P. Returns will differ for Equinox Fund International, Ltd. June performance is an estimate based on intramonth information which is not yet finalized.

[2] Sector and returns are presented herein on a gross basis and use relevant period P&L and average capital in determining contribution. Cash and equivalents are excluded.

[3] Celestial metaphors are fine but any suggestion that the position or movement of the planets have an effect on asset prices is just plain crazy.

[4] W. Ben Hunt, http://www.salientpartners.com/epsilontheory/notes/When%20Does%20The%20Story%20Break.html

[5] Scotia Bank. Data though May 2014.

[6] Scotia Bank. Data through May 2014. Prior years use historical gold prices. Future periods use Scotia estimates of $1300 2014, $1400 2014, $1500 2016, and $1300 2017+

[7] “I see speculative bubbles like 2007”, Finanz und Wirtschaft, April 11, 2014. http://www.fuw.ch/article/i-see-speculative-bubbles-like-in-2007/

[8] Visit https://www.equinoxpartners.com/letters to view letters since inception.

[9] Based on internal models and company information.

[10] Bloomberg

[11] David Rosenberg

[12] “Deflation: Making Sure ‘It’ Doesn’t Happen Here,” Governor Ben Bernanke speech at National Economics Club, November 21, 2002

[13] “Can art really get any more expensive?” http://www.cnn.com/2014/05/13/world/can-art-really-get-any-more-expensive/