Kuroto Fund, L.P. - Q2 2009 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Kuroto Fund, L.P appreciated 58.7% in the second quarter and was up 41.6% for the six month period ended June 30th.

America’s Increasingly High Tax Environment

The United States’ tax receipts are plunging. Federal receipts are down 20%+ year-on-year as are New York State’s tax revenues. Declining receipts, however, have done nothing to curb government spending. To the contrary, even excluding the Federal Reserve’s balance sheet expansion, Federal appropriations are up 34% for the year-to-date. In addition, the current administration is proposing large new government programs that will substantially increase the already huge budget deficits.

In response to the resulting massive budget shortfalls, government has elected to significantly increase marginal taxes on the rich. These increases are coming despite the fact that the top 1% of Federal income tax payers already pay the largest percent of total income taxes in history, over 40% (up from 24% in 1987[1]). It appears that the already highly progressive American tax system is going to become even more so. According to our new President, “In order to save our children from a future of debt, we will also end the tax breaks for the wealthiest 2% of Americans. If your family earns less than $250,000 a year, you will not see your taxes increased by a single dime. I repeat, not one single dime.”[2]

With all the taxing and spending that the federal government is doing, it is easy to forget that states, counties, and municipalities can also be very important in the calculation of an American individual’s tax rate. In fact, states and municipalities have been the first movers in the rush to increase taxes. Some states like New York, New Jersey and California, where approximately 40% of our taxable clients reside, have already significantly raised their top marginal tax bracket:

From To

New York City/State 9.8% 12.6%

New Jersey 8.97% 10.75%

California 10.3% 10.55%

For many high earners, the reduction or elimination of deductions may prove more important than the above nameplate increases. If, for example, the current administration’s tax proposals are signed into law, the higher state and local payments will no longer be deductable against Federal taxes, a change which would greatly magnify these local increases. Because few states anywhere distinguish long-term capital gains from other types of income, state taxes already account for a high fraction of the taxes our clients pay. With the proposed elimination of deductions, these higher state and local rates will directly translate into much larger tax bills for our taxable clients.

At the federal level, Kuroto’s lengthy investment holding periods may also become less tax advantaged. Rates on long-term capital gains and qualifying dividends that were 15% for the top rates will go to at least 20%. While not a low rate when combined with sizeable state and local taxes, long-term capital gains treatment will still be quite a bit better than ordinary income.

Federal tax rates on ordinary income are set to increase to 39.6% before state, local, social security, employment tax, etc. With all the add-ins, the top marginal rate will reach well north of 50% on ordinary income for a sizable fraction of our taxable client base, and these higher rates may very well be just the beginning of a trend. There has already been talk of removing the cap on the social security tax above a certain income level. The effect of this will be a large increase in marginal rates as income escalates. And Charlie Rangel, House Ways and Means Chair, has proposed a high income surtax of several incremental percentage points to pay for new Federal health care spending. He is also proposing a payroll surtax on top of that increase which would apply to all investment income. Add in state and local taxes—which will no longer be deductible—and 60% marginal rates loom for many Kuroto investors. Finally, and perhaps most frighteningly, if inflation takes hold, part of one’s nominal return becomes return of capital which de facto increases the tax rates on real returns.

We recognize that impending increases in US taxation are only relevant to part of our partner base. It is, however, worth pointing out that our favored long-term investment orientation is already one of the most tax efficient available. That said, going forward Kuroto will strive even harder to favor capital gains and qualified dividends to avoid the more punitive ordinary income taxes for taxable partners. For example, short selling profits are considered ordinary income and hence are worth less after tax. Thus, except in extreme market situations, we will do less short selling in favor of realizing profits that are taxed at lower rates. We will also be even more reluctant to recognize short-term gains. Moreover, higher capital gains rates will further motivate us to postpone realization of these returns longer.

China Sets a Course for Economic Mediocrity

Whether it is their seven percent GDP growth or record two trillion dollars of foreign exchange reserves, China’s recent macroeconomic statistics might be interpreted as not only confirmation of the Chinese development model but also as affirmation of government intervention in general. Common wisdom holds that the Chinese government stepped into the economic breach with a mammoth 4 trillion RMB stimulus package and forestalled a severe economic downturn that would have resulted from China’s collapsing export sector. The Keynesians have been proven right! A government that generates significant reserves in good times and spends them quickly in a downturn can smooth out the business cycle. The truth is, however, a bit more complicated.

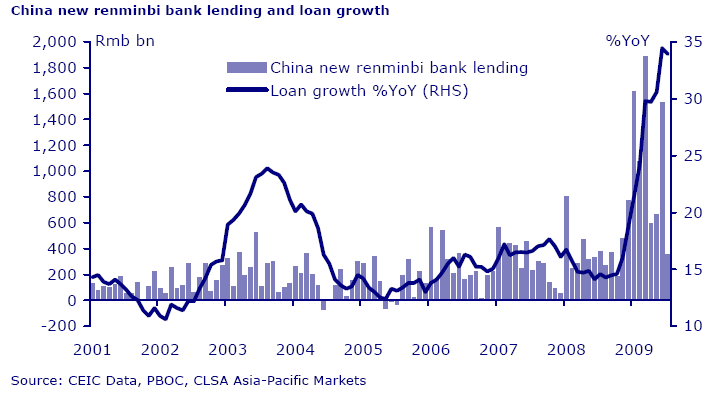

Through the end of April, the period when the fiscal spending was countercyclical, the Chinese government had only disbursed 18% of its share of the stimulus package, rendering the bulk of their direct fiscal spending somewhat less than timely. The more significant and immediate stimulus to the Chinese economy was delivered via the banking sector. Chinese banks grew their loan books by 7.4 trillion RMB in the first half of 2009. 7.4 trillion RMB equates to 19.6% total system loan growth and 24.6% of GDP! This outcome, unique the world over, was only possible through the government control of both lenders and borrowers.

Even if the entirety of this 7.4 trillion RMB was directed towards honest businessmen carrying out projects the government deemed desirable, there is no way that government officials had enough information to make wise investment decisions on this scale. And, of course, not all of the incremental credit is going where it was intended. 7.4 trillion RMB is a lot of money to keep tabs on, and you can be sure that more than a fair amount has wound up in unintended sectors. Just this summer, the largest ever Chinese IPO, China Construction, popped 56% on its first day of trading, and property prices have started to rise sharply across the country. Despite the Chinese ban on all negative domestic discussion of their stimulus package, there are already lurid anecdotes about some property development projects in Shanghai and Beijing. Clearly some of the money is falling into the hands of speculators, not to mention the sizable fraction that will simply be stolen.

Theft, speculation and malinvestment all but guarantee that a significant fraction of these 7.4 trillion of new loans will go bad. If 10% of the money is lost, China will be faced with a banking crisis of equal magnitude to America’s savings and loan crisis of the late 1980s. Of course, with 2 trillion USD of foreign exchange reserves on the sidelines, the Chinese government has lots of options. Seen in this light, the Chinese model seems more of a validation of neomercantilism than Keynesianism, i.e. if a country keeps its currency very undervalued, and persistently generates a sizable current account surplus, then it is truly impervious to foreign capital market discipline.

Given the size of the foreign exchange reserves at China’s disposal, Chinese growth may end with a whimper and not a bang. It is hard to see the forced devaluation of the RMB—the typical scenario whereby markets call a government directed model to account—because of the control the Chinese have over their capital account. But, there are limits to China’s development model; government direction over time tends to have a corrosive effect on the private sector. This is something we, as company specific analysts, see very clearly in China. Corporate transparency and management quality is often poor, and political connections are often more important than merit. In the long-run, these factors will severely restrain China’s economic potential.

If you doubt the importance of political connections and corruption in China, you need look no farther than the first family to see signs of the problem. Whether it’s Hu Haifeng, the current President’s eldest son, or Jiang Mianheng, the previous President, Jiang Zeming’s son, the scope and scale of the alleged corruption is staggering. In the long-run, an economy based on political connections, instead of merit, will not elevate the most industrious people and will instead foster endemic corruption—factors that can really hamstring an economy.

Investor Relations, Estimated Taxable Income, & Hard Dollar Research

In August, Daniel Schreck joined our team, taking over Jennifer Sentiwany’s investor relations role. As you’ve hopefully noticed, we’ve made a concentrated effort over the past year to improve the quality and timeliness of our communications with you, our current and prospective limited partners. Daniel will help us take this effort to the next level. Daniel’s direct line is 646-833-2783.

We are in the process of sending out estimates of taxable income through June 30, 2009. These estimates will be revised in early December when more information becomes available.

As we’ve made clear in the past, Kuroto Fund, L.P. does not use soft dollar brokerage relationship to buy research. Instead, when necessary, we spend the fund’s hard dollars to buy research and maintain brokerage relationships. While we have not made any hard dollar payments so far this year, such payments will become increasingly likely as a result of the modest commission expense that the fund generates (an average of 32bps per year over the past three years).

Sincerely,

Sean Fieler

William W. Strong

ENDNOTES

[1] Tax Policy Blog, “Tax Burden of Top 1%...” July 29, 2009.

[2] President Obama, “Speech to Joint Session of Congress”, February 24, 2009.