Kuroto Fund, L.P. - Q1 2016 Letter

Dear Partners and Friends,

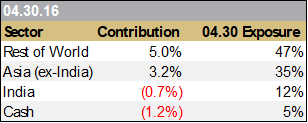

PERFORMANCE & PORTFOLIO

In the first quarter of 2016, Kuroto Fund increased +1.5% while the MSCI Emerging Markets index rose +5.7%. For the year to date through May 25, Kuroto Fund was up +5.9% while the EM index increased by +1.3%.[1]

Since our purchase of Ferreycorp in 2014, Kuroto has had meaningful exposure to Peru. Last August, we purchased more Ferreycorp and initiated another Peruvian position, bringing our total Peru weighting to 10.3% versus 0.45% for the MSCI EM index. At the time, Peruvian stock prices were discounting a falling copper price and a “hard landing” in China. Moreover, the Peruvian exchange’s lack of trading volume prompted the MSCI to review whether Peru should be reclassified from an emerging market country to a frontier country. Not surprisingly, investors responded by selling Peruvian stocks all the more.

By focusing on China’s impact on Peru and the country’s possible exclusion from the MSCI EM index, the market was ignoring Peru’s long-term economic potential and the quality of its public companies. The country’s natural rate of economic growth is nearly 4%. It also has a credible central bank and relatively low inflation. While small in number, Peru’s listed universe of companies includes some high-quality managers running sound businesses with generally good corporate governance. Since last August, we have been fortunate to own two of these businesses at depressed valuations. Following the first round of Peru’s Presidential elections last month, investors have finally begun to recognize the quality and value in Peru and its companies. Our two holdings have appreciated by 34% and 50% year-to-date, validating our decision to have such a large exposure to the country.

Other changes to the portfolio have been more incremental. During the quarter, we sold an Indian financial company as its asset quality proved to be worse than we had initially estimated. We also purchased a Russian retailer which we discuss later in this letter.

Russia

We seek to own the most attractive emerging market companies, disregarding the composition of the MSCI EM index. Such an approach can result in the fund having a high exposure to smaller countries like Peru, as previously discussed. It can also lead us to “overweight” a country like Russia, where the fund currently has an 8.6% exposure. Having invested in Russia at various times over the past two decades, we are not naïve about the various risks. We also recognize that, with the bottom in oil prices and the peak in economic sanctions likely behind us, this is an attractive time to increase our weighting in superior businesses. We will lay out our approach to Russia below and then detail the merits of the two Russian companies we own.

- The Bad News

Economic sanctions and low oil prices have drastically affected Russia’s already tepid economy. In fact, locals regularly refer to the last two years as a crisis. In 2015, real GDP fell by 3.7% and real incomes declined by 4% (its first decrease during Putin’s 15 years in power). Also in 2015, the number of Russians living in poverty increased at the fastest rate since the 1998-1999 crisis. [2] Moreover, pensions did not increase with inflation last year, while import substitution from the foreign food ban and the depreciating ruble resulted in high-teens food inflation. The ruble declined by 24% against the dollar in 2015 alone. Additionally, interest rates have increased by 5.5% since the start of 2014, and many local companies cannot access the international capital markets as a result of the sanctions. Finally, low oil prices have forced the government to spend reserves in order to fund its budget.

- The Good News

After the aforementioned drastic decline, the economy is likely to stabilize—albeit at a depressed level—rather than deteriorate further. The country’s largest bank, Sberbank, is solvent. And, broadly speaking, the Russian economy is dramatically under-leveraged. Accordingly, we think that the economy will not experience the protracted pain of deleveraging. Given the present economic constraints, Putin should be less likely to embark on any new, large-scale geopolitical adventures that might lead to increased sanctions. Meanwhile, the oil price rebound (which we think has longer to run) has yet to be fully reflected in Russian GDP.

- Our Strategy

Our Russian businesses are competitively advantaged and participate in either unconsolidated or underpenetrated industries. As such, they should do well even if the Russian economy remains depressed. We have avoided investing in politically-driven companies and those that are either led by or easily expropriated by oligarchs. While there always is a reason not to invest in a given Russian company, we are happy to take advantage of the current opportunities while they last.

Moscow Exchange

Moscow Exchange, a $3.7 billion company, owns the local, public market not just for equities, but also for bonds, derivatives, foreign exchange, and money markets. In addition to trading, they provide clearing, settlement, and depository services. Put another way, Moscow Exchange is the equivalent of combining the US operations of the NYSE, Nasdaq, Chicago Mercantile Exchange, Intercontinental Exchange, the bond, FX, and repo desks of all the large banks and brokers, and the Depository Trust & Clearing Corporation into one company trading at only 9x last year’s earnings.

The company’s largest shareholder is the Central Bank of Russia and the Chairman of the Board is the well-respected former Finance Minister, Alexei Kudrin. The company has brought in senior executives from other global exchanges to help them create robust systems. Along with those systems, Moscow Exchange’s conservative balance sheet makes it arguably the most trusted financial institution in the country. During the recent financial panic in Russia, local banks chose to leave excess liquidity in their accounts at the exchange despite not earning any interest.

Adjusting for the size of Russia’s economy, all of Moscow Exchange’s markets are underdeveloped. Attempting to accurately predict the earnings of such a diverse exchange is admittedly difficult. That being said, their markets should grow over time. While we wait, the company pays a 6% dividend.

Lenta

Lenta is a value-for-money grocery retailer with a differentiated hypermarket format, a valuable loyalty card program, and a strong growth opportunity. It sells for 15x 2016 estimated earnings, has a 20%+ earnings growth opportunity, and earns over a 20% ROE. The company’s largest shareholder is the U.S. private equity firm, TPG, and its CEO is French and has experience at multinational retailers like Aldi and Metro. Both characteristics make Lenta very different from the typical Russian company which is usually owned and managed by Russians with experience primarily in their home market.

The Russian food-retail market is still formalizing and remains unconsolidated. Modern retail still accounts for only 65% of the Russian food market. The largest company has just 7% market share, and the top 7 companies have only 22% market share. In many developed markets, the top food retailer has over 20% of the market, and the top 5 players have over 50% market share.

Lenta’s smaller store format is well suited for the Russian market: Its stores are close to people’s homes yet also provide enough goods for weekly shopping needs. Lenta has a narrow, focused assortment which allows it to leverage its buying power with suppliers and offer discounted prices to customers. The company aims to be 5% cheaper than its competitors. In addition, Lenta has a valuable loyalty card program which drives targeted promotions based on customers’ purchasing patterns. With its differentiated store format, Lenta has the opportunity to consolidate the market and generate strong growth. Finally, the company expects to double its selling space over the next 3 years.

Organization

Earlier this month, William Strong, our longest serving partner, resigned. More recently, Andrew Ewert, our newest partner, informed us of a new opportunity he will pursue this June. We wish them well in their respective endeavors. We have added one new analyst to our roster who will join us this summer, bringing our investment professional team to seven.

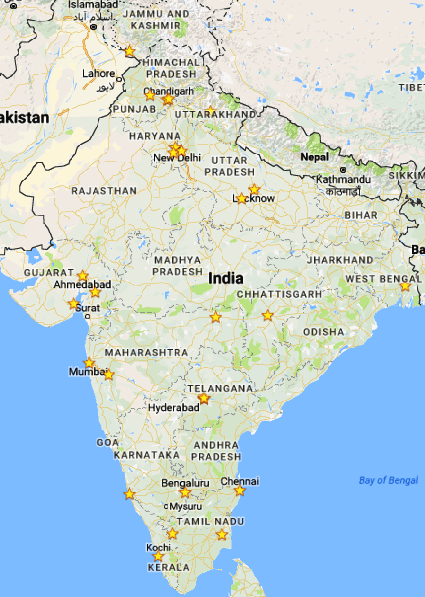

India: where we’ve been

The process of traveling to second and third tier Indian cities didn’t just generate good investments; it also helped us gain an appreciation for India’s diversity. To say “India is this” or “India is that” is indeed a wild simplification. As Gurcharan Das observed at the beginning of India Unbound, the most remarkable thing about Indian history is that it remained one country. Beyond India’s linguistic, cultural, and ethnic diversity, with more than 5,000 listed companies, India is also home to an amazing breadth of corporates. In fact, India has the most domestically listed companies in the world.[2]

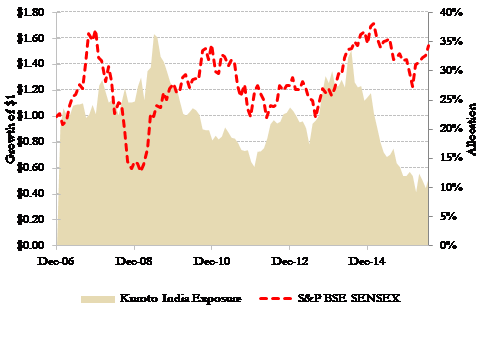

This diversity of companies coupled with the volatility in the Indian stock market has continued to yield opportunities in recent years. Since 2010, Indian stocks have declined by more than 20% in U.S. dollars on four separate occasions (graph below). In 2011, for example, when other markets were doing well, the Sensex declined 36% in dollars. This created a unique opportunity to invest in great businesses in India, when similar quality businesses were far more expensive in other emerging markets. And again, in 2013, the Indian market and currency declined, and we were able to take full advantage.

In both of those cases, macroeconomic and political concerns led many investors to ignore the underlying fundamentals of specific companies. Our history with these companies and the comfort with the earnings power and durability of their franchises gave us the conviction to adhere to our value discipline.

It is important to emphasize that as good as those opportunities were in early 2012 and the summer of 2013, they don’t exist today. Narendra Modi’s government is unfortunately living proof of the idea that anticipation is greater than realization, with much of the Indian stock market still discounting the expectations. That is, the hoped-for pickup in private investment and economic activity is still just that, a hope.

The markets are also still holding out hope on a range of politically-difficult economic reforms: land, legal, tax, political, and bureaucratic reforms. But, even if none of these reforms materialize, the infrastructure improvements under the Modi administration may themselves be sufficient to justify much of the market’s optimism. Our travels over the years have impressed upon us India’s desperate need for better infrastructure. Under this government, India has experienced a massive construction of roads and railways on a scale unprecedented in the country’s history. In our opinion, this policy alone could have a long-term benefit that should not be underestimated.

Given valuations at this point, we see the balance of risk higher than the likely reward of investing in most Indian companies. Accordingly, we have reduced our allocation to India to the low double digits. The benefit of having a global fund is that we are able to shift money from one country or region to another as the opportunity set changes. Our understanding of the companies, the politics, and the country more generally will tell us when valuations are giving us the opportunity to increase Kuroto’s exposure to Indian companies. In the meantime, we will patiently adhere to our discipline and only own the rare instance of a better business trading at a discount to its intrinsic value.

Sincerely,

Sean Fieler

Daniel Gittes

ENDNOTES

[1] Performance stated for Kuroto Fund, L.P. Class A on a net basis. An investor’s performance may differ based on timing of contributions, withdrawals, share class, and participation in new issues. Performance contribution as stated uses the fund’s dollar-weighted gross internal rate-of-return calculations derived from average capital and sector P&L. Sector performance figures are derived using monthly performance contribution calculations in US dollars, gross of all fees and fund expenses. P&L and exposures on cash and currency forwards included under Cash.

[2] World Bank