Equinox Partners, L.P. - Q1 2016 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

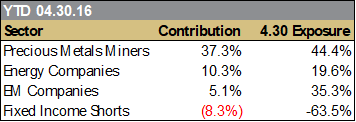

Equinox Partners gained +14.5% in the first quarter of 2016 and +38.5% for the year to date through May 25.[1]

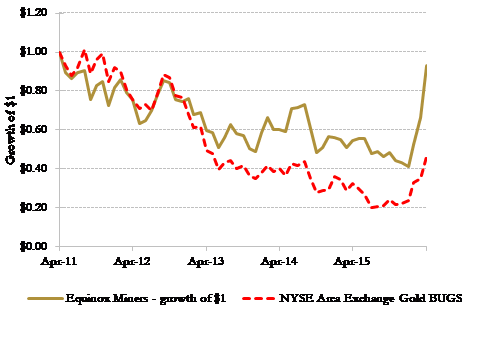

Given our ownership of disciplined capital allocators with superior economics, it is not surprising that our gold and silver mining companies fared much better than the precious metal indices during their recent five year bear market (see adjacent graph). Our continued outperformance during the sectors’ sharp rally this year, however, has surprised even us given the market’s preference for very liquid and leveraged companies during such moves.

There are a variety of possible explanations for our relative success in both up and down markets, but we believe that no factor has been more important than our focus on the quality of board-level decision making—a characteristic that the equity markets have consistently overlooked.

The board-level decision to invest or divest is of overwhelming importance in capital-intensive industries such as mining. But, given the severity and length of the mining industry’s cycles, good capital allocation can only be accurately measured over many years, if not decades. With the luxury of such measurement often impossible, soft measures of decision making, such as reputation, become particularly valuable and are often a better indicator of future value creation than simple economic alignment.

Take, for example, Virginia Mines’ decision to sell to Osisko at a lofty multiple in late 2014, a relevant case in point for us given its size at the time in our portfolio. We knew that CEO, Andre Gaumond, owned a meaningful equity stake in the company and had a track record of delivering exceptional returns to shareholders. However, what really got us excited about investing in Virginia was his philosophy of governance and capital allocation. Andre was neither in a rush to flip the company nor too entrenched to sell at the right price. This insight into his thinking was the key to the success of our investment. At the time of our initial purchase—five years before the sale of the company—we could not have predicted the circumstances of our exit. But, our confidence was rewarded by both the timing of Andre’s decision to sell and the price he was able to negotiate.

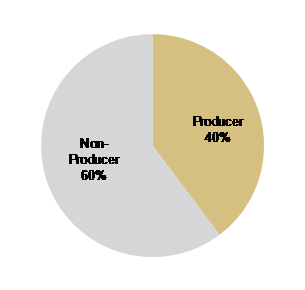

Of course, understanding board level decision-making in the mining industry is only useful to long-term value investors when coupled with sound fundamental analysis. Accordingly, we thought it would be useful to review the most salient features of our portfolio, beginning with the split of our holdings between companies that are currently producing and those that are not yet producing (left graph below). Our heavy weighting in economically robust pre-production companies is a result of our value-oriented response to the market’s myopic (borderline irrational) distaste for even the highest-quality projects that still require financing. Importantly, we were able to invest both in these pre-production companies and reduce the risk of our portfolio as demonstrated by our consistent out-performance in a down market.

While somewhat counterintuitive to non-mining investors, economically robust development-stage companies, such as MAG Silver, can be significantly less risky than marginal assets that are already in production. MAG’s high-grade, capital discipline, and joint-venture relationship with Fresnillo—the largest silver company in the world—have worked together to de-risk the process of financing and constructing an underground mine. Even at current silver prices of $17 per ounce, the Juancipio Joint Venture will generate a 45% internal rate of return based on our estimates. These sound economics offer a far greater margin of safety than an existing operation with a 10% rate of return would.

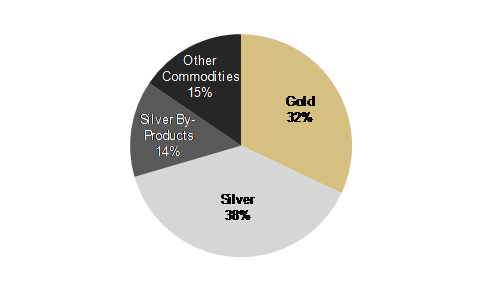

Our silver overweight is another characteristic of our portfolio that jumps off the page (right chart above). On a look-through basis, our portfolio is 38% silver. Our logic is simple: Silver has a far greater upside in percentage terms than gold does. So, while we expect gold and silver to trade together directionally, the more limited supply of above-ground silver bullion implies a much greater upside potential. There is at most a few years of silver demand in bullion ready for delivery. This compares to roughly fifty years of gold mine supply currently above ground. This radical difference in metal available for physical delivery makes the current silver equilibrium price far less stable and the upside for silver far greater.

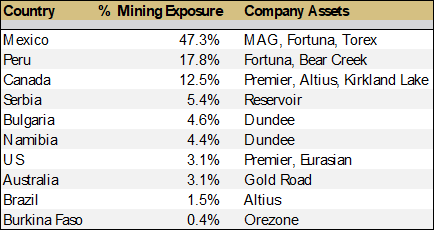

With respect to geographic diversification, as the table on the next page shows, we keep the bulk of our investments in countries with a well-bounded political discussion. That said, the evaluation of jurisdictional risk in the mining industry is rarely straightforward and can even diverge significantly within a particular country. For example, British Columbia and Quebec are night and day from a permitting perspective despite both being in Canada. Having lived through a wide variety of political problems, we have a depth of experience in managing geographic risk. It is also worth noting that our understanding of countries gleaned from investments outside the mining industry has been particularly helpful in informing our views.

Finally, we are pleased to announce that in April we accepted a sizable separately managed account with a two year lock-up that is dedicated to the precious metals mining industry. Over the past fifteen years, we’ve acquired a depth of expertise in this area. Please feel free to contact us should you be interested to learn more about this opportunity.

Short Sovereign Debt

First world government bonds are substantially overvalued by almost any fundamental measure, but bond bears remain on the sidelines, fearful of further central bank manipulation. This investor paralysis reminds us that there is always an apparently compelling reason not to make a sound investment decision. Ironically, the fear of central bankers is peaking just as central banks are beginning to face more obvious political and market constraints. As these constraints grow, we expect a meaningful decline in the first world’s bond markets—an outcome for which we remain well positioned.

A supply and demand calculation is a useful starting point to gauge the extent of central bank manipulation of the bond market. For example, by simply reinvesting the proceeds as their existing bond portfolio matures, the Federal Reserve will buy roughly $200 billion in Treasuries this year—a significant amount in the context of the Treasury’s $400 billion of net new issuance. Moreover, the Fed could lengthen their maturities and buy more than half of the net issuance of this year’s longer dated Treasury bonds, thereby giving the Fed ample firepower to manage the long end of the curve. Grasping the Bank of Japan’s control over the Japanese government bond market requires no such nuance. The Bank of Japan is on pace to buy several multiples of the net issuance of Japanese Government Bonds (JGB) this year.[2]

While this central bank manipulation clearly affects the price of government bonds in the short-term, it does not alter their long-term investment return. At a yield of 1.86%, the 10 year U.S. government bond is already offering investors less than current core CPI. Add to this unattractive starting point a U.S. unemployment rate of just 5.0% and two presidential candidates advocating for a massive increase in government financed infrastructure spending, and you have the makings of poor real returns in U.S. treasuries.

The fundamental case for a bear market in Japanese government bonds is even more overwhelming. For starters, at a -0.00108% yield to maturity, the Japanese 10 year bond yields almost a full 2% less than its American counterpart. Moreover, Japan has a much lower unemployment rate, at just 3.2%, strong first quarter growth, and the prospect of renewed fiscal stimulus.

The considerable divergence between sovereign bond pricing and sovereign bond fundamentals is a clear indication that a hefty dose of central bank manipulation is already in the price. In fact, even the extensive direct central bank purchases do not capture the full extent of their current influence. The rhetorically heavy handed talking points of the Bank of Japan, for instance, have enticed sizeable foreign speculation into the market for JGBs.

This speculation can, in part, be seen in the growth of foreign purchases of Japanese sovereign debt. Foreigners have bought trillions of Yen worth of JGB’s as the yields have gone lower and lower despite knowing full well, that over time, these bonds, by definition, will be money losers. Foreigners are simply getting ahead of the central bank, expecting further appreciation as the Bank of Japan expands quantitative easing and doubles down on negative rates.

That such speculation on future central bank policy has increased just as central bankers are facing increasingly obvious political and economic constraints is somewhat surprising. As has been widely chronicled in the financial press, the blowback from negative rates has been widespread and vigorous: from the German Finance Minister to the Japanese bank trade unions. But, far more important, in our estimation, than the public criticism, has been the inability of negative rates to deliver the desired effect.

The transmission mechanism for negative rates comes almost exclusively through the currency markets. But, with the Yen and Euro strengthening on the back of the Bank of Japan’s and the European Central Bank’s latest moves into negative territory this spring, it appears that the currency markets are no longer the transmission mechanism they once were. While this surprising result could simply reflect a currency market that had already discounted a larger policy move, we suspect that an effort on the part of central bankers to slow down the zero sum game of currency devaluation is partly to blame.

Following the G20 meeting at the end of February, many central bankers dutifully asserted that there had been no deal on currency manipulation. While this is presumably true, it is equally true that the costs of pursuing a policy of currency devaluation have been increasing for some time. We see the strength in the Yen and Euro on the back of incremental easing by the Bank of Japan and the European Central Bank as a strong signal that the rules have changed and that we are at the end of an era in which the FX markets could function as a massive shock absorber for central bank policy.

More importantly still, in Japan, another limit with meaningful implications for central banks across the first world is fast approaching. Since Abe’s election in 2012, the Bank of Japan has been among the most aggressive of the first world’s central banks. Whether or not the Bank of Japan’s governor, Haruhiko Kuroda, lowers rates again this summer, the increasingly sensible conclusion will be that he has exhausted the scope of Japan’s monetary policy—a result that Japanese legislators are already anticipating with hints of new fiscal stimulus.

With the Bank of Japan approaching exhaustion and the Fed approaching a further rate hike, we believe that the extreme bull market in bonds is behind us. The extraordinary experiment in monetary policy appears to have confirmed that central bankers can postpone reality but not fundamentally alter it. Perhaps, central bankers can still translate this policy exhaustion into preservation of the status quo. But, we are skeptical that the outcome will be so benign. As central banks are increasingly hemmed in by political and economic reality, we expect more volatility in the first world’s bond markets, less faith in central banks, and a long-awaited tailwind for our bond shorts.

Organization

Earlier this month, William Strong, our longest serving partner, resigned. More recently, Andrew Ewert, our newest partner, informed us of a new opportunity he will pursue this June. We wish them well in their respective endeavors. We have added one new analyst to our roster who will join us this summer, bringing our investment professional team to seven.

Sincerely,

Sean Fieler Daniel Gittes

END NOTES

[1] Performance contribution and mining performance as stated uses fund’s dollar-weighted gross internal rate-of-return calculations derived from average capital and sector P&L. Sector performance figures derived using monthly performance contribution calculations in US dollars, gross of fees and fund expenses. Interest rate swaps notional value included in Fixed Income exposure and contribution. P&L on cash and U.S. equity options excluded from the table as are market value exposures for derivatives. Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, or Bloomberg. All values as of 4.30.16, unless otherwise noted.

[2] Net new issuance of JGBs in 2016 is expected to be 22.7 trillion yen, while net new purchase of JGBs by the BoJ is expected to be 112 trillion yen. Source: Bank of Japan and the Ministry of Finance