Equinox Partners Precious Metals, L.P. - Q3 2018 Letter

Dear Partners and Friends,

Central Banks and Gold

For decades, Western central banks have been careful not to demonstrate any enthusiasm for their gold holdings. Throughout the 1990s, they aggressively reduced their physical stockpiles of gold and pronounced themselves eager to divest from this ‘non-earning’ asset. In 1999, the group of sixteen central banks who accounted for the vast majority of the official sales in the 1990s, even entered into a joint agreement to cap their annual divestiture to 400 tonnes per year ostensibly to ensure an orderly exit from the yellow metal. When gold threatened to rise, however, central bankers quickly shifted their focus to gold as potentially unwelcome monetary competition. In his 1998 Congressional testimony, Chairman Greenspan famously quipped that, “[c]entral banks stand ready to lease gold in increasing quantities should the price rise.”

By 2005, Western central bank selling had slowed significantly, and they largely stopped discussing their gold reserves. It was clear that there was simply not the appetite to support further official sales of any size. And, while the Washington Agreement on Gold was extended for a second five-year term in 2004, the signatories failed to meet this supposed cap. By 2009, it was clear that central bank selling had exhausted itself.

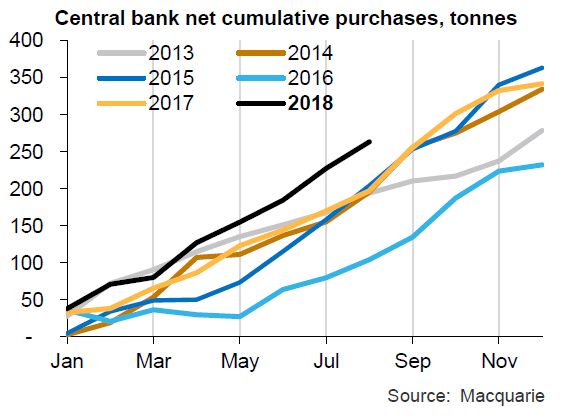

Beginning in 2010, central banks became official net acquirers of gold. Initially, Russia and China were the only buyers of any size. But, in recent years they have been joined by Turkey and Egypt. Moreover, this year, India, Poland, and Hungry have joined the ranks of countries building their official gold reserves. At last count, central banks had bought a total of 264 metric tons of gold for the year to date, “by far the most at this stage of the year of any period in the last six years”. The question is, why now?

As a rule, central banks are not helpful in answering this question. They typically reference “asset diversification” as their underlying motivation for purchasing gold, and some central banks, like China, don’t even necessarily report their purchases. The Hungarian Central Bank, however, when purchasing gold for the first time in 32 years, broke with this practice. In their August 11, 2018 press release, the Hungarian Central Bank flat out rejected asset diversification as the reason for their recent purchases and stated that “…there were not investment considerations behind holding gold reserves.” Instead, The Hungarian Central Bank noted “The importance of gold in national and economic policy strategy has increased recently,”

While we don’t see central banks as particularly astute investors in general, and we don’t know any more about the Hungarian Central Bank’s motivation than what they’ve put in their press release, we believe their press release is important. It is significant that an increasing fraction of central banks are once again buyers of gold and for reasons that transcend narrow economic interests. In our opinion, the decisions of countries like Poland and Hungry to buy gold reflect an uneasiness with the permanence of today’s dollar, euro, yen centric monetary system, and an effort to prepare for the future they see on the horizon. We also suspect that Russia and China’s effort to acquire gold more aggressively in recent years is beginning to provoke a response.

The best and the worst

The balance of this letter highlights two of our best performing and two of our worst performing stocks since April 2016 as a way of providing insight in what types of companies are doing better and worse in the current environment.

Our Worst Performers

- Tahoe Resources (-72.3%)

In July of 2017, the Guatemalan Constitutional court forced Tahoe Resources to shut down its Escobal mine, and in November of 2018, Tahoe announced the sale of the entire company to Pan American Silver. This sale brings to a close the long road for Tahoe shareholders and recognizes a victory for anti-mining activists. Interestingly, the Guatemalan Constitutional court never found Tahoe guilty of any wrongdoing. Rather, they based their decision on the Guatemalan Mining Ministry’s failure to consult an indigenous tribe that does not live anywhere near the mine site. Pan American, seeing the quality of Tahoe’s flagship asset Escobal, pounced on the opportunity. They paid an upfront 55% premium to the Tahoe’s price, with an additional 32% to be paid out when Escobal resumes operations. While we believe that the Escobal saga was going to resolve in Tahoe’s favor within six months to a year, we think it reasonable to embrace Pan American’s offer, as we expect the market to do as well.

- Premier Gold (-51.3%)

Premier owns a 50% of a joint venture in Ontario with Centerra, 40% of a JV in Nevada with Barrick, and a handful of 100% owned assets in Nevada and Mexico. The company trades at just 4x cash flow in 2019, and is poised to grow their attributable production 100,000 oz per year to over 300,000 oz per year over the next three years. We like the capital and G&A light joint venture approach that management has taken, and we think the market is seriously misvaluing the company. This oversight is largely due to the current year’s decline in ounces produced.

Our Best Performers

- Gold Road Resources (+40.4%)

Gold Road’s main asset is a 50/50 JV with one of the largest and most experienced gold companies in the world, Gold Fields. Their JV is expected to begin commercial production in the second quarter of 2019, ramping up to 270,000 ounces of gold per year with a 13 year mine life. Given the minimal execution risk going forward—largely due to Gold Fields operating the mine, and the fact that Gold Road is currently net cash itself—the project should generate substantial amounts of cash which can and should be returned to shareholders. In addition, former CEO and current Board member Ian Murray’s $6 million stake should align management with shareholders. With the project being fully funded and on track for production in the near term, the market has begun to value Gold Road more as a producer than an exploration company.

- Dundee Precious Metals (+44.4%)

With its second mine in commissioning this December and no significant capital investment obligations going forward, Dundee is poised to generate $150 million USD in free cash flow per year on average for the next five years. With a market capitalization of $470 million, Dundee trades at a free cash flow yield of 32%. Assuming no multiple expansion, no return on exploration investment, and the deployment of the company’s free cash flow evenly amongst dividends, share repurchases, and exploration, the company would yield 10.6% and shrink its shares outstanding by 10.6% per year. We have no assurance that the board will take this path, but management did make it clear on their most recent quarterly conference call that they are comparing all new investment opportunities against the incredible opportunity to reinvest capital back into their own shares. That’s a 32% current free cash flow hurdle against which new investments must compete for capital.

Sincerely,

Sean Fieler