Equinox Partners Precious Metals Fund, L.P. - Q4 2023 Letter

Dear Partners and Friends,

PERFORMANCE

Equinox Partners Precious Metals Fund, L.P. rose +16.94% in the fourth quarter and finished +0.17% for the full year 2023.

A breakdown of the fund’s exposures and contribution can be found here.

The Politics of Oil & Gold

The price and supply of oil and gold were central to American foreign and economic policy for much of the twentieth century. FDR’s meeting with Abdul Aziz ibn Saud on the deck of the USS Quincy in 1945 secured a long-term oil supply from Saudi Arabia. And, the Bretton Wood’s conference in the summer of 1944 tied the world’s currencies to the dollar and the dollar to gold.

By 2000, the political relevance of oil and gold had ebbed. At the turn of the millennium, oil traded at $25 USD per barrel and gold traded at $288 per ounce. There appeared to be more oil and gold than the market needed, and it was not obvious what America had to gain from actively managing the price or supply of either. So, while American policymakers remained engaged in the oil and gold markets, they understood that the price movements of these two commodities didn’t threaten the world’s security or macro economy.

As market forces asserted themselves and the world's economy boomed, the price of oil increased to $140 per barrel and gold rose to $970 per ounce by the summer of 2008. Rising oil prices were inflationary but not problematic as their effect was more than offset by the deflationary tailwind created by China’s 2000 accession to the WTO. Similarly, gold was gaining appeal as an investment but did not threaten the dollar’s role as the world’s reserve currency. That was then, this is now.

With the return of inflation and the obvious use of the US dollar as a tool of American foreign policy, the supply and price of oil and gold are again clearly political. The $3-trillion-dollar oil market is the largest commodity market in the world, and the price of oil is highly correlated with inflation. Accordingly, in an inflationary environment, the US government is incentivized to actively manage the oil price. Similarly, the world’s $16-trillion dollars of above-ground gold is the only asset class large enough and deep enough to seriously threaten the dollar’s role as the world’s reserve currency. Accordingly, the federal government has an interest in preventing gold price action that makes US Treasury look insolvent or the Fed look impotent.

It is broadly understood that the Biden administration has attached enormous significance to the oil market and is willing to use the power of the American government to suppress the oil price. This suppression helped the Federal Reserve get inflation down and denied Russia a foreign exchange windfall. It is also worth noting that low oil prices should help Biden’s reelection efforts if they can be sustained through November. To achieve the oil price suppression, the Biden administration cut the US strategic petroleum reserve in half and facilitated increased oil production in Iran and Venezuela.

While not explicitly, the federal government also cares about the gold price. In a break with precedent, the New York Fed is refusing to answer basic questions about its participation in the gold market . Importantly, this refusal comes as foreign central banks are buying more than 1,000 tonnes per year in an effort to diversify away from the US dollar. In the case of Russia and China, these purchases clearly reflect a political desire to challenge the dollar. But, in the case of the central banks of the Netherlands and Poland, the gold purchases are driven by growing discomfort with the US fiscal position rather than geopolitics.

Investing in markets that the US government is intent on keeping quiescent has been frustrating over the past eighteen months. Since a spike in the summer of 2022, the oil price has fallen 45% and the gold price is up just 2%. While the past eighteen months have been painful, there is good reason to believe that we are nearing the limits of the US government's ability to suppress these markets.

In the case of oil, the US strategic petroleum reserve has already disgorged 280 million barrels . These barrels can’t be released again. And, support for Iran and Venezuela’s oil production is becoming more of a political liability. The Biden administration pulled out all the stops to suppress the oil price when the Fed's credibility was on the line and there was a possibility that Russia would lose the war in Ukraine. Those moments have both passed.

With respect to gold, not only are the Chinese and Russians done accumulating dollars, but a broad swath of central banks are now committed to acquiring gold. According to a recent World Gold Council survey, 24% of central banks intend to acquire gold over the next twelve months. And, while the US government can easily participate in the market for paper gold, foreign central banks are accumulating physical metal, a much more difficult market to manage. There are also signs that U.S. retail investors are developing a taste for physical gold which they can actually hold. The popularity of one ounce gold bars at Walmart and Costco merits close attention. In the fourth quarter, these two retailers each sold several tonnes of gold. These figures pale in comparison to the 1,000 tonnes foreign central banks bought last year but raise the possibility of growing Western retail demand that would be very hard to manage.

The politics of commodity price suppression are central to the investment opportunity we see in both oil and gold. The American government’s effort to manage the price of oil and gold, while painful at times, is part of a process that produces the opportunity to invest in oil producers and gold mines at prices that don’t reflect the underlying market fundamentals. When the fundaments of the market eventually assert themselves, as we believe they will, we expect the upward revaluation of the companies we own will be substantial.

investment Thesis Review for the TOP 5 POSITIONS BY PORTFOLIO WEIGHT

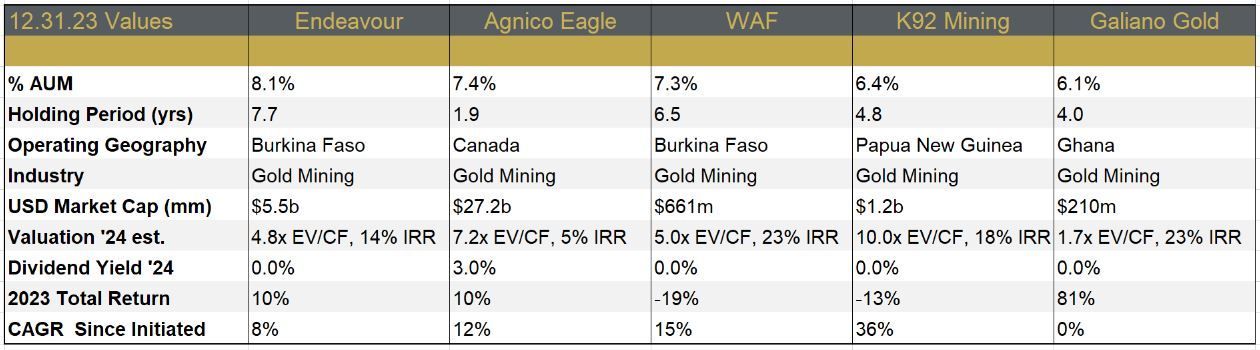

Endeavour Mining

Endeavour Mining is West Africa’s largest gold miner, forecast to produce 1.2m ounces of gold in 2024 from its mines in Burkina Faso, Cote d’Ivoire, and Senegal. The company recently improved the quality of their asset base in 2023 by divesting of two older assets and discovering an exciting greenfield exploration target that could be their next mine. 2024 will be a pivotal year for the company as it brings on two new projects and shifts from a heavy capex spending cycle into a new period of FCF generation. Specifically, we expect Endeavour to generate $1.2b in cash flow and $800m in free cash flow this year assuming a $2,000 gold price.

As long-term investors, we’ve benefited from Endeavour’s countercyclical investment strategy. The company made two highly accretive acquisitions in 2020 when its peers were paralyzed by the Covid crisis. More recently, Endeavour’s exploration has also become an important value creator. In 2023, Endeavour announced their first greenfield exploration success with the discovery and delineation of Tanda-Iguela in Cote d’Iviore. The Tanda-Iguela resource now stands at 4.5Moz, and the deposit continues to grow. With the Tanda-Iguela discovery, the company is on track to meet their ambitious 5-year discovery target of 12-17Moz by 2025.

Despite the company’s track record of quality execution and growth, Endeavour trades at a 13% free cash flow yield. This modest valuation reflects a very pessimistic view of the jurisdictions in which the company operates and concerns about the recent termination of Endeavour’s longtime CEO, Sébastien de Montessus. While the circumstances surrounding Sébastien’s departure are regrettable, we do not believe that his departure will impact the company’s ability to achieve its near-term goals. We expect Endeavour to continue compound intrinsic value and throw off free cash flow while growing production.

Agnico Eagle Mines

Agnico Eagle is the third largest gold miner in the world, producing 3.3m ounces of gold per year, with 75% of that production coming from Canada. For decades, Agnico has pursued a high-quality, low-risk strategy. With the consolidation of the Canadian Malartic asset and the acquisition of Detour Gold complete, the company is focused on leveraging their large regional infrastructure in Ontario and Quebec, underpinned by 65Moz of resources in the region. (Equivalent to 20 year of future production.)

We believe that Agnico’s regional focus and scale combined will continue to deliver bottom quartile cash costs for many years to come. Specifically, the company’s geographic focus lowers both capital intensity and operational execution risk. We think that the full extent of these benefits is still not properly appreciated by the market.

While Agnico’s massive greenstone belt in Ontario and Quebec is the obvious center of gravity for the company, the company also has substantial operations and exploration projects in Australia, Mexico and Finland. At the moment, Agnico trades in-line with its large cap peer group. In our opinion, the company’s high liquidity, superior jurisdiction, long mine life, and excellent management merit a substantial premium to peers.

West African Resources

West African Resources (WAF) is a gold miner in Burkina Faso in the process of doubling its production. The company’s current producing asset, the Sanbrado mine, has meet its operational targets and FCF expectations, placing the company in a strong position to build its second mine, Kiaka, which is expected to start producing in 2025. Despite the company’s demonstrated track record of operational excellence, WAF trades at just three times last year’s cash flow. This low valuation is due purely to the heightened risk associated with operating in Burkina Faso.

WAF has committed US$500 million to the construction of its Kiaka mine. According to our estimates, at $2,000 gold, the Kiaka project generates a ~30% after-tax IRR. With the M5 pit and ore from Toega extending the mine life at Sanbrado through 2030, the additional production from Kiaka is adding to, not replacing production at Sanbrado. When both Kiaka and Sanbrado are in production, we expect WAF to become the largest gold producer in Burkina Faso, producing over 400,000 ounces per year.

We believe there has been additional selling pressure on WAF stock this past year due to concerns around the financing of their Kiaka build, which has since been resolved. WAF drew US$100 million of its US$265 million loan facility in December. At $2,000 gold, we expect WAF to fund the remaining Kiaka capex through cash on their balance sheet and future free cash flow. Leveraging their FCF without any additional equity dilution is a significant accomplishment we expect to be re-rated once the market has the same degree of confidence.

K92 Mining

K92 operates a high grade, underground gold mine in the highlands of Papua New Guinea. With more than five million ounces of gold equivalent at a grade of more than 8 g/t, K92’s Kainantu mine is indisputably world class.

In 2023, K92 produced ~117,000 ounces of gold equivalent at an estimated All-In Sustaining Cash cost of $1,100 per ounce. Going forward, K92 is projecting annual gold equivalent production will rise to 296,000 ounces 2026 and 470,000 in 2027. At these higher rates of production, All-In Sustaining costs should fall to $900. In 2027, assuming $2,000 gold, the company should generate free cash flow of $330 million and generate an IRR of 17% for the current shareholders.

K92’s attractive valuation is due in large part to the challenges the company has faced ramping up its production in the highlands of Papua New Guinea. The highlands, while offering high geological prospectivity, are notoriously difficult to operate in for both logistical and cultural reasons. Accordingly, the market is heavily discounting the company’s projection of 470,000 ounces in 2027.

For our part, we believe that K92’s almost complete large twin incline together with the raise bore ore and waste pass system represents a step change in the company’s ability to access high grade ore. We are also encouraged by the overwhelming support the company continues to receive from the government and local communities. Accordingly, while we agree that the company’s timeline and ultimate production target will likely slip, we remain confident that K92 will be a large scale, low cost producer of gold for much longer than our current 17-year mine life estimate.

Galiano Gold Inc.

Galiano Gold Inc. is a single asset gold producer that operates and manages the Asanko Gold Mine in Ghana. The Asanko Gold Mine went into production in January 2016 and had historically been a 45%/45% joint venture between Galiano and Gold Fields, with the Government of Ghana owning the remaining 10% equity interest.

On the 21st of December 2023, Galiano announced a binding agreement to purchase Gold Field’s 45% interest in the Asanko Gold Mine for US$20 million in shares, a 1% royalty on up to 447,000 ounces, and future cash considerations of up to US$85 million. This transaction is immediately accretive to Galiano on a cash flow basis and puts a 2.1 million ounces of proven and probable reserves on Ghana’s highly prospective Asankrangwa gold belt entirely under the control of Galiano Gold. Pro-forma, the company has no debt, ~$130 million in cash and a market capitalization of ~$230 million – a valuation which still doesn’t remotely capture the value of the asset.

While this transaction has been discussed for years, it appears that the internal politics at Gold Fields dictated the final timing of the deal. It is noteworthy that this agreement was struck just prior to Michael Fraser’s accession to Gold Field’s CEO role on January 1st, 2024. With this deal now inked, Michael will be free from time consuming JV decision-making process that the historic ownership structure produced.

The transaction is structured to ensure Galiano’s successful expansion, with the timing of future cash payments coming after the cash flow of the asset increases. We expect Galiano’s technically strong management team will waste no time increasing the company’s production to ~240,000 oz per year.

Organizational Update

In December, we parted ways with Daniel Schreck and Stephen Saroki.

Daniel joined Equinox Partners in 2009. Over the past 14 years he worked closely with our clients, cultivated new prospects, and oversaw a significant upgrade in our client communications. Daniel’s client responsibilities have been assumed by Kieran Brennan, who joined us in January 2021 and has been working with Daniel for the past 3 years.

Following a summer internship in 2016, Stephen Saroki joined our team as a full time research analyst in 2018. While a generalist by training, Stephen spent most of his time analyzing gold and silver miners. His company coverage has been picked up by Coille, Alfredo, and Sean.

We wish both Daniel and Stephen well in their next endeavors. Our team of 11 professionals now consists of six investment professionals and five in operations.

Sincerely,

Equinox Partners Investment Management

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 12.31.23, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.