Equinox Partners, L.P. - Q4 2015 Letter

TOP-FIVE HOLDINGS

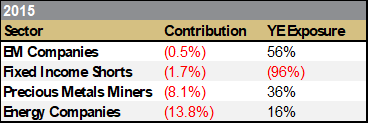

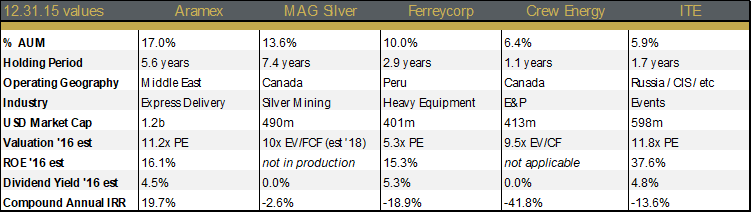

2015 was a difficult year for Equinox Partners. As detailed in the table above, more than half of the decline was attributable to our ill-timed investment in E&P companies. Our precious metals miners also performed poorly last year while our emerging markets companies and fixed income shorts were down slightly in the aggregate. In contrast to our third quarter letter, the purpose of this communication is not to rehash the macro trends and stock-specific decisions that buffeted our portfolio. Rather, in this top-five letter, we will review our largest holdings, which we expect will drive performance in the future.

Appropriately, our top-five holdings reflect the broader portfolio: three emerging market businesses, a Mexican silver mine, and a Canadian natural gas producer. While not a perfect representation of the portfolio, these five companies are an accurate reflection of our portfolio which at year end was 56% invested in emerging markets, 36% invested in gold and silver miners, and 16% invested in North American E&P companies.

Together these top-five holdings represent 53% of partners’ capital as of year-end. Their very sizable weighting highlights an intentional process of concentrating our portfolio in our best investments. Specifically, we’ve reduced the number of companies the fund owns from 29 to 24 year over year by exiting a handful of companies that were not truly exceptional in our opinion. Among those positions that we’ve exited, our sale of APR Energy during the first week of January merits a final mention.

Our disappointing investment in APR Energy concluded on a similarly frustrating note. Last year, a consortium of Fairfax Financial, ACON Equity Management, and Albright Capital Management effectively partnered with APR’s management in order to recapitalize the company and to take it private at roughly half of its book value. The company’s poorly designed sale process, which we believe failed to appropriately explore all viable alternatives, was particularly galling. Given our experience, it is ironic that Fairfax is a portmanteau of “fair and friendly acquisitions.”

In our opinion, the consortium opportunistically used the company’s violation of its debt covenants as leverage to pursue a deal that was only in the interest of a select few shareholders and management. We, of course, opposed it and voted against it. Unfortunately, not enough other independent shareholders joined us. Therefore, we had no real choice but to sell at the offer price.

The lessons learned from APR are multiple. But, the conclusion once again demonstrated that we not only erred in our assessment of the business and its short-term prospects, but we also erred in our assessment of APR’s management and board. We will redouble our efforts to only partner with superior managements. The concentration of our portfolio reflects a meaningful first step in this direction.

Aramex - 17.0% of the fund

Aramex is a UAE listed express delivery company similar to FedEx or DHL. The combination of the company’s reputable brand and the “network effect” inherent in express delivery forms a particularly durable barrier to entry. Aramex further differentiates itself by its ability to operate efficiently in the Middle East, its entrepreneurial culture, and its variable cost structure.

The company’s financial performance slowed somewhat last year as it revenues increased by 5% and earnings by 11% on a year-to-date basis through Q3. The slower growth was in large part due to currency translation, the lack of growth in Aramex’s freight forwarding business, and the general slowdown in the Middle East as a result of lower oil prices. Freight forwarding, in particular, has suffered from weak demand from oil-related customers and secular changes in its industry. The company’s profitability improved as a result of a mix shift to its higher-margin e-commence business in addition to lower fuel costs.

Despite last year’s slower rate of growth, we believe the company is an extraordinarily attractive investment. We estimate that the company’s adjusted returns on equity (excluding cash and goodwill) are more than 50%, making it one of the highest return businesses we own. The management is world class in every respect. And, importantly, despite two decades of success, the company still has a great long-term growth opportunity as e-commerce further develops in its core markets and as the company expands into new regions. Not surprisingly, Aramex remains our largest single position.

Mag silver - 13.6% of the fund

MAG Silver remains a top five position for the fourth consecutive year. Despite a steep decline in the price of silver, MAG’s shares are flat over the four year period. The company’s low-cost Juancipio joint venture, improved corporate governance, and a new discovery, have enabled MAG to weather the severe bear market with a strong balance sheet while keeping their world-class project on track.

More specifically, 2015 marked a year of significant progress at the Juancipio joint venture, the company’s flagship asset. The rate of development at this joint venture with Fresnillo has improved dramatically during the course of 2015 and the main ore body should be reached late this year according to the company. More importantly, even at today’s silver prices the JV generates an IRR better than 25% based on our analysis. With $77 million in cash and no debt, we expect that MAG will be able to fund their portion of the remaining capital expenditure with about 10% dilution.

When in production, we estimate that at the base case of 2,400 tonnes per day of ore processed, the Juancipio mine should produce 12.5 million ounces of silver equivalent annually at an all-in-sustaining cost of less than $4 per ounce.[2] 44% of this annual production, 5.6m ounces, is MAG’s on a pro rata basis. At $14 silver, we estimate that MAG would receive $45 million USD of annual, after-tax free cash flow from this long-lived asset. At a silver price of $23, the after-tax cash flow to MAG’s account would top $75m USD per year. Moreover, there is good chance that the JV opts for a larger operation. Should Frenillio and MAG choose a processing rate of 4,000 tonnes per day, we estimate MAG’s cashflow would jump more than 50%. With a year-end market cap of just $490 million USD, the joint venture’s cash generation provides both serious downside protection as well as tremendous upside to higher silver prices.

The consideration of a larger mine is based on the successful exploration results of the last year. We believe the JV has discovered a second high-grade gold and silver ore body directly under the known Valdecañas vein on the Juancipio joint venture. With only four drill holes testing this deeper mineralization, it is too early to determine how large this zone might be. That said, the JV is already evaluating the construction of a shaft to access this zone, so there is good reason to be optimistic.

Ferrycorp - 10.0% of the fund

Ferreycorp, Caterpillar’s exclusive dealer in Peru since 1942, remains a top-five holding for the third year in a row. As we have previously noted, Ferreycorp’s adherence to Caterpillar’s “Seed, Grow, Harvest” business model has allowed it to develop a strong service network. This service network is critical to its mining and construction customers, who need to maximize their equipment “uptime” and can’t afford operational delays caused by equipment failure and downtime. According to the company, Ferreycorp has a 70% market share in general construction in Peru, 58% in open-pit mining, and 83% in underground mining.

Despite the severe decline in commodity prices and the persistent lack of infrastructure investment in Peru, Ferreycorp was able to increase revenue by 10% and grow its operating profit by 38% on a year-to-date basis through September 30. This strong financial performance is primarily due to the parts and service business which we believe accounted for a majority of the company’s profits last year. In addition, management has instituted several cost-control initiatives over the past twelve months. Finally, even though fewer new mines are breaking ground in Peru, Ferreycorp has benefited from expansions at the existing mines it serves and further gains in market share.

Despite strong financial performance last year, the company’s share price has declined by 24% in USD terms; it currently sells for 76% of its Q3 ’15 book value. Importantly, that book value is largely comprised of liquid, saleable assets. Over time, we believe copper mining and infrastructure investment will grow at healthy rates in Peru and that the company’s parts and service business makes it a more recurring business than the current valuations would indicate. Ferreycorp’s board appears to share this view; they recently authorized the repurchase of 10% of the company’s shares.

crew – 6.4% of the fund

Crew Energy is a small Canadian E&P company with an enormous land position in the middle of the best resource play in British Columbia. With 474 sections across roughly 300,000 acres, Crew is the fourth largest landowner in the Montney Shale despite being a junior company with a market capitalization of approximately $540 million CAD.

Importantly, Crew’s land position is surrounded by larger, technically-advanced operators like Shell, Encana, and ARC Resources—all three of which have had success on that same land. The success of these large companies enhances Crew’s attractiveness in two principal ways. First, their competitors’ well data independently corroborates the attractiveness of Crew’s resource. Second, while we have no desire to see Crew sell out during this bear market, each of the sizable operators on abutting land is a potential acquirer.

Septimus—an area that forms the core of Crew’s production—is generating some of the highest-return wells in Canada. Specifically, at $40 USD WTI oil and $2.25 CAD AECO gas, Crew estimates that it can generate 43% IRRs on these wells. The company’s results in the Western portion of this acreage (i.e. West Septimus) are even better. On these wells the company is earning a 91% IRR using the same commodity-price deck. The company’s ability to tie in wells that are so economic at today’s depressed commodity prices will allow Crew to keep production flat or even grow slightly in this tough environment.

At the company’s current rate of production and spot energy prices, as of January 28, Crew now trades below 10x this year’s estimated cash flow. This unexceptional multiple indicates that the market is giving Crew no credit for their large, unexplored acreage position. While we worry that a competitor could bid for Crew in today’s distressed environment, we are comforted that their well-capitalized neighbors would not let such an exceptional asset get away too cheaply.

ite – 5.9% of the fund

ITE is a UK-based event marketing company with a global portfolio of leading trade shows, conferences, and exhibitions. The vast majority of ITE’s events are based in emerging markets, with Russia accounting for roughly 34% of revenue in 2016 according to the company. More importantly, ITE’s events are typically market leaders. Having a leading position in event marketing is particularly important given the industry’s winner-take-all and network effect dynamics. That is, attendees want to visit the event with the best and/or most exhibitors and vice versa. Hence, attendees and exhibitors will consistently attend and pay a premium for dominant events. Despite their strong portfolio of events and high returns (40%+ ROE) ITE sells for just 11.8x depressed 2016 estimated earnings.

Event-marketing businesses are asset light and have very favorable working capital terms. Exhibitors begin paying for their booth or floor space shortly after the previous year’s event, allowing organizers like ITE to operate and grow their business without much capital investment. This, in turn, allows well-managed event-marketing companies like ITE to use their excess free cash flow for acquisitions and dividend payments. ITE currently pays out approximately half of its earnings and has a 5% dividend.

Event marketing businesses also benefit from first-mover advantages as leading events are particularly difficult to displace. Anyone who has been to both good and bad industry events knows that the bad ones are a waste of time and money, and the good ones can be invaluable. Therefore, price tends not to be a primary consideration when attending an industry event. Trade halls also don’t need the risk of a bad event and almost always prefer to stick with proven winners. This makes it difficult for startup events to even get access to the best locations.

For several years, ITE has been expanding upon its strong position in Russia and the CIS countries with a series of acquisitions in Asia. Going forward, we expect that ITE will be able to leverage its multi-national sales contacts from existing successful shows into new markets in a way local competitors cannot. The company’s revenues shrunk in 2015 and we are predicting a further -5% revenue decline in 2016. That being said, we are confident that ITE will generate strong organic growth if and when their portfolio of emerging market countries stabilize and then begin to grow again.

off the top-five list: altius minerals & paramount resources

Altius Minerals

As precious metal mining companies continued their long decline during 2015, the relative attractiveness of more highly-valued royalty companies like Altius Minerals declined. Accordingly, we began selling a portion of our shares in Altius over the summer. These sales proved timely, as the shares of royalty companies—our remaining shares of Altius included—fell precipitously in the fourth quarter of last year.

Altius remains a 3% investment in Equinox, and we remain confident in its management and in the company’s prospects. The company’s present $330 million CAD market cap is largely supported by a portfolio of long-lived potash, coal, and nickel royalties that we estimate will generate $40 million CAD in royalty payments to Altius this year. The company’s substantial interest in iron ore, uranium, and other prospects in Labrador and Newfoundland, provide significant upside when these commodities return to economically sustainable prices.

Paramount Resources

With the share price of Paramount Resources down over 90% from a September 2014 peak and the company’s bonds presently trading at a 15% and 18% yield to maturity, the market is pricing the company’s equity like an option. We understand the market’s concern. With $1.8b CAD in debt and just above $200m CAD in cash flow at today’s energy prices, Paramount’s management has put the company in a very vulnerable position at a very inopportune time. While the company has no financial covenants on their debt, Paramount’s roughly $640 million CAD of bank debt is up for renewal in April. Rather than ask for leniency from the banks, we expect Paramount will sell non-core assets and joint venture some of their best acreage to repair their balance sheet.

Specifically, we believe that Paramount can cut its debt in half by selling their mid-stream assets and joint venturing their prime locations for a year or two. With the proceeds from these sales, Paramount could completely pay off their credit facility, leaving in place $450m CAD of bonds maturing in 2019 and $450m USD of bonds maturing in 2023. Furthermore, a JV would likely result in reduced capital spending requirements in the near future, putting the company in a strong position to weather an extended downturn. While the size of Paramount’s debt makes it impossible to dismiss the possibility of a creditor-driven liquidation, the likelihood of such a scenario remains remote in our opinion.

Though the company’s problems are in part attributable to the decline in energy prices, it is important to note that much of the damage is self-inflicted. Most notably, Paramount failed to start up their deep cut gas facility on time or on budget, thereby foregoing a critical stream of revenues early last year. With the E&P sector under stress and Paramount’s company-specific challenges obvious to everyone, it is easy to gloss over the full range of outcomes that its truly world-class resources afford the company. The company is extraordinarily undervalued and, consequently, remains a sizable position at 4% of partners’ capital.

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

END NOTES

[1] Sector exposures calculated as a percentage of 12.31.15 post-redemption AUM. Therefore, exposures stated herein will be higher than the December 2015 monthly summary which uses 12.31.15 pre-redemption AUM. Performance contribution as stated uses fund’s dollar-weighted gross internal rate-of-return calculations derived from average capital and sector P&L. Sector performance figures derived using monthly performance contribution calculations in US dollars, gross of fees and fund expenses. Interest rate swaps notional value included in Fixed Income exposure and contribution. P&L on cash and U.S. equity options excluded from the table (combined contribution is -1.5% of average capital) as are market value exposures for derivatives. Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, or Bloomberg. All values as of 12.31.15, unless otherwise noted. Valuation analysis as of 12.29.15.

[2] Converting gold to silver equivalent while taking lead and zinc revenues as a by-product.