Equinox Partners, L.P. - Q4 2012 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

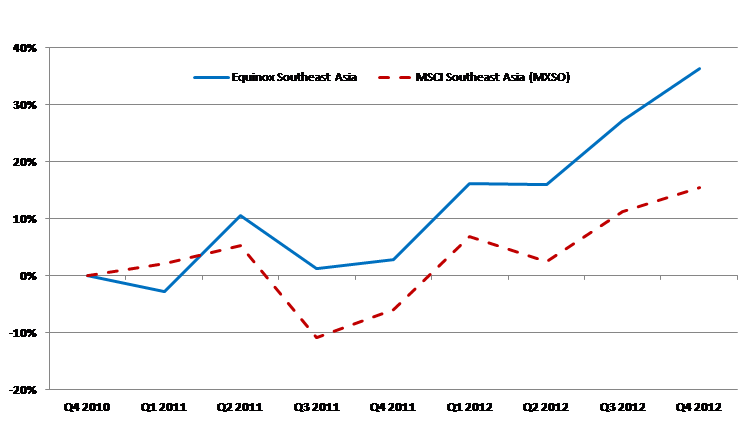

Equinox Partners rose +1.4% in the quarter ended December 31, 2012. For the full year 2012, the fund was up +17.3%. Following positive performance in January and negative performance in February, the fund was down -2.5% for the year to date through February 28, 2013.[1]

New Website: equinoxpartners.com

Through our quarterly letters, monthly fund summaries, in-person meetings and phone conversations, we do our best to keep our partners and prospective investors well informed about our investment strategy and organizational development. As part of this continuing effort, we have developed a website that provides a comprehensive view of Equinox Partners, short of divulging all of our holdings. The site also includes a detailed financial disclosure about our management company as well as our due diligence questionnaire. We believe management company disclosures are relevant to investors’ decision making, and we have sought to provide this information in an easily understandable format.

All written materials that we provide (excluding client account statements and K-1s), including several new items, are accessible on the site for your review. You’ll receive a registration email in the coming days from Daniel Schreck – please log on and give us your feedback.

Thinking the Unthinkable: High Inflation

“Inflation is always and everywhere a monetary phenomenon.”

—Milton Friedman, 1963

“My inflation record is the best of any of the governors in the post-war period."

—Ben Bernanke, 2013

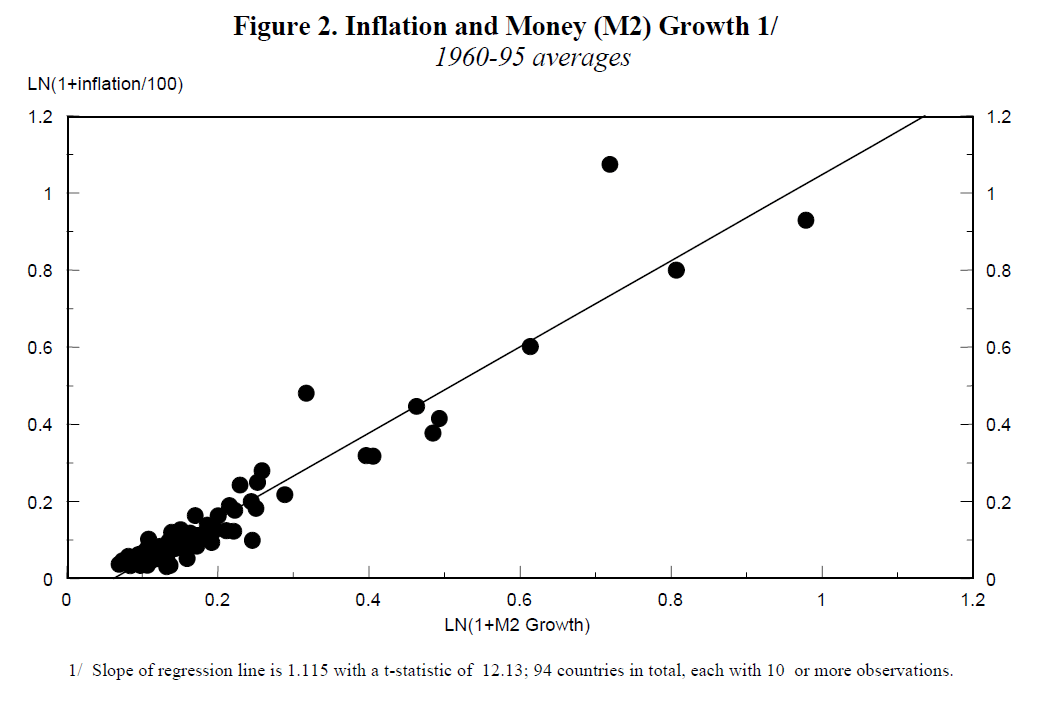

The ongoing disconnect between America’s massive monetary expansion and the subdued annual increase in consumer prices suggests that Friedman’s fifty-year-old quip about the strict causal relationship between money and inflation is not entirely accurate. That said, the data “show a very strong relationship between money growth and inflation” according to the work of Chairman Bernanke’s own thesis advisor at MIT, Stanley Fischer. In a 2002 paper entitled “Modern Hyper- and High Inflations,” Fischer points out that monetary growth will lead to higher prices even in countries that have historically enjoyed persistently low rates of inflation. In these countries, however, money growth tends to take more time to set inflation and inflationary expectations onto a higher trend level.

For long-term investors such as Equinox Partners, the serious divergence between inflationary expectations and monetary expansion in America has produced a historic investment opportunity. Bernanke’s decision to continue to ease aggressively even as the economy and credit growth strengthen is making us more and more optimistic about our sizable gold investments and bond shorts. Gold mining company stocks, many of which have been cut in half from their 2011 peaks, reflect an almost total absence of fear about broad-based price inflation. Similarly, the ten-year US bond continues to yield less than the annual increase in the consumer price index, implying an expectation of a falling rather than an increasing future rate of inflation.

An inflationary spark large enough to unmoor inflationary expectations and set them on an upward trajectory could come from any number of sectors. Perhaps, the growing Chinese focus on living standards and domestic consumption will begin to drive the price of tradable goods higher. Perhaps, with the housing market turning up and the S&P and Dow at record levels, rising asset prices will provide an inflationary spark. Or, perhaps, Japan’s newfound monetary extremism will prove that developed world countries are not immune to the dangers of money printing.

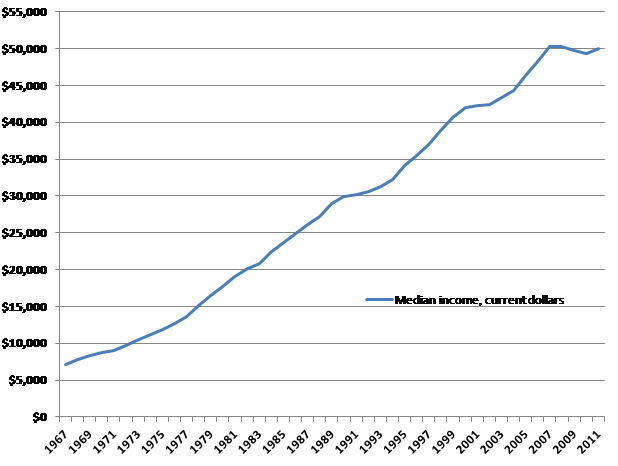

If we do get a spark that leads to higher inflation, we think effective wage rates are poised to adjust upwards despite the continued slack in the labor market. While American workers cannot spend money they don’t have—and indeed stagnant wages have had a dampening effect on consumer prices—the landscape of private sector compensation in America is evolving rapidly.

Elected officials have awoken to the political opportunity to be had by offsetting the average household’s almost ten percent loss of purchasing power since the 2008 financial crisis. From increases in the minimum wage to ever more mandated private sector benefits, politicians are addressing the declines in take-home pay experienced by the average American family. Forty-five out of our fifty states already have minimum wage laws in place, and mandated private sector benefits are gaining political support across America.[2]

This growing political focus on declining real wages is creating a context in which a truly self-sustaining form of inflation could take hold. Moreover, with American public and private debt still over 350% of GDP, the Federal Reserve would be constrained in its ability to slow down the inflationary forces once they get going. It is simply hard to imagine that the Federal Reserve will implement the recessionary real interest rates that would be required to reign in accelerating price increases. Needless to say, we do not share Chairman Bernanke’s “100% confidence” in his own ability to stop inflation were it to start.

Equinox’s portfolio remains aligned with these underlying economic and monetary forces through investments that will benefit asymmetrically if inflation rises. Specifically, over one-third of our portfolio is invested in extremely undervalued, well-managed gold miners, and we hold a 60% short exposure to low-yielding sovereign bonds.[3] If the Federal Reserve does get behind the inflationary curve, as we believe is likely, we could experience another 1970s-like environment in which gold and deeply-discounted gold miners handsomely outperform other sectors and enormously overvalued government bonds finally decline.

Southeast Asian Valuations: High, But Not Yet Manic

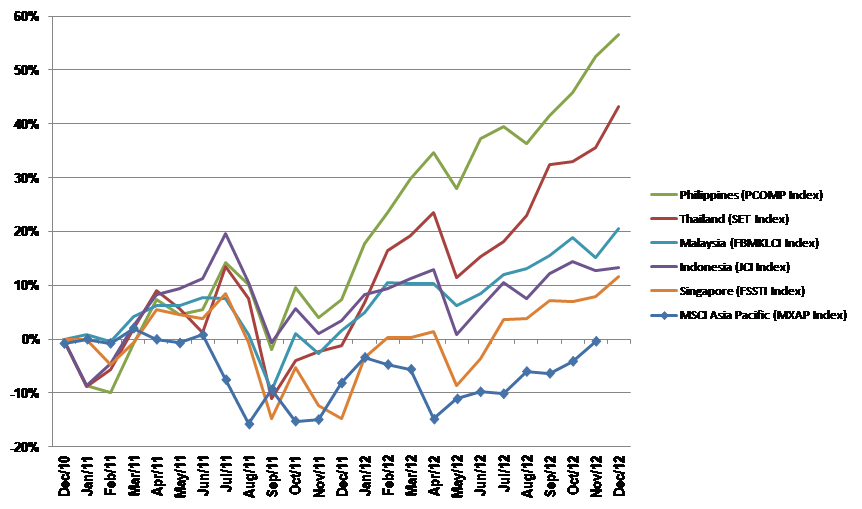

Southeast Asia’s stock markets have been on a tear. For the two-year period ending December 31, 2012, the Philippines was up 57%, Thailand was up 43%, Malaysia was up 20%, Indonesia was up 13%, and Singapore was up 12%. These impressive two-year increases stand in clear contrast to the flat performance of the MSCI Asia Pacific Index over the same period.

Foreign capital has been a driving force behind the dramatic appreciation of these markets, especially last year. The reasons for the foreign capital inflow are straightforward: Southeast Asia is not over indebted; its GDP is growing; its population is expanding; its currencies have been held down against the dollar; and, for the most part, its political environment remains unexceptional.

Moreover, this influx of foreign capital has been concentrated in the kind of higher-return businesses that Equinox favors—our “bread and butter” investments. Such companies’ ample profitability allows them to self-fund their rapid growth. This dynamic makes them classic growth stocks which we believe makes them very valuable. While the companies we own in the region have appreciated dramatically in recent years, we do not believe that they are overvalued—at least not yet.

History, however, shows that the “past” is rarely “prologue to the future” in the investing business. Therefore, we remain mindful of the dangers of rising valuations, even for rapidly growing Asian companies. As a result, we have been selling, and will continue to sell, a number of our holdings as they trade north of 20x future earnings. This includes our single largest consumer-branded company in the region which has just broached the 20x multiple. The net result of these sales can be seen in the 6% year-on-year decline in exposure to Indonesia and our exit of all non-resource companies in the Philippines.

Sincerely,

Sean Fieler

Daniel Gittes

William W. Strong

END NOTES

[1] Returns stated for Equinox Partners, L.P. Returns will differ for Equinox Fund International, Ltd.

[2] http://www.ncsl.org/issues-research/labor/state-minimum-wage-chart.aspx

[3] Short exposure to sovereign bonds includes the market value of bonds plus the notional value of Japanese Government Bond interest rate swaps.

[4] MSCI Southeast Asia includes Indonesia, Philippines, Singapore, Malaysia, and Thailand. Equinox Partners did not have holdings in Malaysia or Thailand during this period. Performance of the Equinox Southeast Asian sector derived from internal accounting system. Returns are dollar-weighted internal rate of return calculations. The numerator consists of realized gains, unrealized gains, and interests and/or dividends for the quarter. The denominator is based on the gross, quarterly average capital balances, adjusted for capital contributions and withdrawals. Bloomberg information is total return.