Equinox Partners, L.P. - Q4 2010 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Equinox Partners appreciated 15.5% in the quarter ended December 31, 2010. For the full year, our fund generated a 44.9% return. As of February 28, 2011, our fund was down -7.1% for the year-to-date.

negative real interest rates and quantitative easing: where is the dissent?

“If it were to be possible to take interest rates into negative territory, I would be voting for that.”

—Janet Yellen, Vice Chairman of Fed, February 22, 2010

The new number two at the US Federal Reserve Board, Ms. Yellen, is undoubtedly aware that she and her fellow central bankers do not need to “vote” on taking “interest rates into negative territory.” Adjusted for even the government massaged inflation statistics interest rates are already there. Real interest rates (as opposed to the nominal kind) are substantially negative on the short end of the US yield curve. Thus, though perhaps unnoticed by some savers, they are being penalized for their parsimoniousness and are hemorrhaging wealth to the tune of at least a percent or two a year for depositing their cash in savings accounts and similar investments. Bill Gross, of the giant bond firm PIMCO, recently wrote:

A low or negative real interest rate for an “extended period of time” is the most devilish of all policy tools…This is the framework that has been created by modern-day policymakers who have innovated far beyond their biblical counterparts. To put it bluntly, they are robbing savers and taking money surreptitiously from longer-term asset holders... [1]

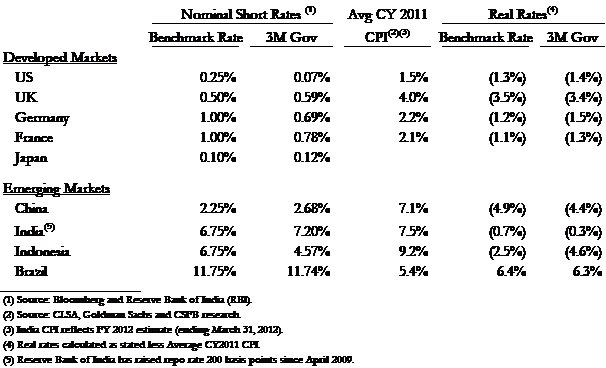

By the way, the US is not the only country with negative real interest rates:

With the notable exception of Brazil, negative real rates have become the norm the world over. But, in the developed world, even negative real rates are not seen as stimulative enough. Several countries’ central banks, including the US and UK, have adopted the unprecedented scheme of purchasing huge amounts of government bonds, and in doing so have created a gigantic overhang of money available to fuel inflation at some future date. By making credit extremely cheap and extremely plentiful in the short-term, these asset purchases known as “quantitative easing”, run the risk of seriously eroding confidence in fiat currency in the medium- to long-term.

In a recent, well reasoned, letter to clients entitled, “The Cognitive Dissonance of It All,” Kyle Bass of Hayman Capital writes, “We are currently in the midst of a cyclical upswing driven by the most aggressively pro-cyclical fiscal and monetary policies the world has ever seen. Investors around the world are engaging in an acute and severe cognitive dissonance.” Bass offers another rationale for the negative real interest rates of Ms. Yellen et al.—the need for government to borrow massive amounts of dollars cheaply. As he explains, “the problem of over indebtedness that is ameliorated [in the near-term] by ZIRP [a zero interest rate policy] is only made worse the longer a sovereign stays at the ZLB [zero lower bound rate]—with ever greater consequences when short rates eventually (and inevitably) return to a normalized level.”[2] In other words, current extremes in monetary policy are joined at the hip with current extremes in fiscal policy. We agree, but we would add that absent dramatic government spending cuts that no elected official is even talking about, a return to normalized short-rates do appear to be quite mathematically destructive for future government finances. For this reason, the persistent monetization of federal debt historically associated with countries like Argentina is now a becoming a serious possibility for America.

What astounds Equinox is the relatively subdued debate about these very radical policies. The import of this historically unprecedented confluence of exceptionally easy global monetary policies should not be lost on investors. What central bankers the world over are up to is no less than a massive, concerted effort to offset the deflationary forces of over indebtedness by discouraging saving and printing money. But outside of a few respected investment professionals (e.g. Gross and Bass) and policy wonks, we are scratching our heads at the apparent passive acceptance of these frenzied pro-inflation moves by most of the economic establishment.

There are, however, some cracks in the façade of monetary officialdom. In February of this year, Kevin Warsh, a forty year old Fed Board member whose term expired in 2018, resigned without giving a reason, but the continuation of the second round of quantitative easing (QE2) was presumably the proximate cause of his departure. Though he voted for QE2, he has been publically critical of its effect, stating, “I am less optimistic than some that additional asset purchases will have significant, durable benefits for the real economy.” We suspect the long-term effects on inflation, rather than the policy’s short-term lack of effect on the real economy, motivated his departure. At virtually the same time, Herr Axel Weber, the hawkish head of Germany’s Bundesbank resigned, forfeiting his chance to be the next head of the European Central Bank. He cited a “lack of ‘acceptance’ among euro-area leaders…over his opposition to the ECB’s program of buying government bonds.”[3]

Equinox has recently been asked to explain why we, investors who pride ourselves on our ability to select higher quality businesses, continue to devote a very large percentage (currently 34%) of our portfolio to companies that don’t fit this description—precious metal mining stocks. In light of the large run up these shares (not to mention the metal itself) have enjoyed, this is a very legitimate question.

Gross’s co-panelist at Barron’s 2011 Roundtable, Marc Faber, supplied an excellent response:

One more thing: Janet Yellen, vice chair of the Federal Reserve, said about a year ago that if it were possible to push interest rates into negative territory, she would vote for that. This is a very important statement because it implies that the Fed will keep real interest rates negative as far as the eye can see. Negative real rates amount to expropriation and destroy one function of money: to be a store of value and a unit of account. If you measure the stock market not in dollars but gold, it is down 80% since 1999. I no longer regard the U.S. dollar as a valid unit of account.[4]

The surprising level of complacency that currently greets the radical fiscal and monetary policy response to the 2008 crisis is a critical feature of the current investment environment. The consensus of normalcy that seems to have been so quickly re-established after the Credit Crisis ignores the potentially extreme consequences of those policies. Equinox, for one, cannot be characterized as “complacent.”

Operations

We spent much of the first quarter engaged in a search process to replace our departing COO, Brian Tsai. In his nearly 5 years with the firm, Brian ably strengthened and broadened the operations of our firm; we wish him the best in his new endeavor. We are very pleased to announce that Roger Anscher will be joining our firm effective March 31st. A lawyer, CPA, and COO with ten years of experience at a large New York based hedge fund, Roger will bring an invaluable depth of experience and sound judgment to our firm’s operations.

Sincerely,

Sean Fieler

William W. Strong

END NOTES

[1] William H. Gross, February 2011 Investment Outlook, “Devil’s Bargain”, http://www.pimco.com/Pages/Devils-Bargain.aspx

[2] Kyle Bass, Hayman Capital Management, L.P., “The Cognitive Dissonance of it all”, February 14, 2011

[3] Andreas Cremer, Bloomberg, “Bundesbanks’s Weber Says Lack of ‘Acceptance’ for Views Led to Resignation”, February 14, 2011, http://www.bloomberg.com/news/2011-02-12/bundesbank-s-weber-says-lack-of-acceptance-for-views-led-to-resignation.html

[4] Transcript of Barron’s 2011 Roundtable, Part One, as found at:

http://online.barrons.com/article/SB50001424052970204555504576075983972474462.html#articleTabs_panel_article%3D1