Equinox Partners, L.P. - Q4 2007 Letter

Dear Partners and Friends,

recession

As the credit contraction progresses, our working hypothesis of a significant reduction in American corporate profitability that will quickly spread abroad is looking increasingly accurate. If, however, the American economy continues to deteriorate rapidly from here, a real possibility according to economists Jay and David Levy, our working hypothesis could prove too optimistic.

“Never have such broad and severe credit-quality problems preceded a recession. Recessions cause burgeoning credit problems to intensify, not recede. Credit problems lag the business cycle, not the other way around.” (Jay & David Levy as quoted by Alan Abelson in Barrons, March 10, 2008)

“The financial damage accompanying the recession will be unprecedented in modern history and the economic consequences dire.” (Ibid)

$100+/barrel

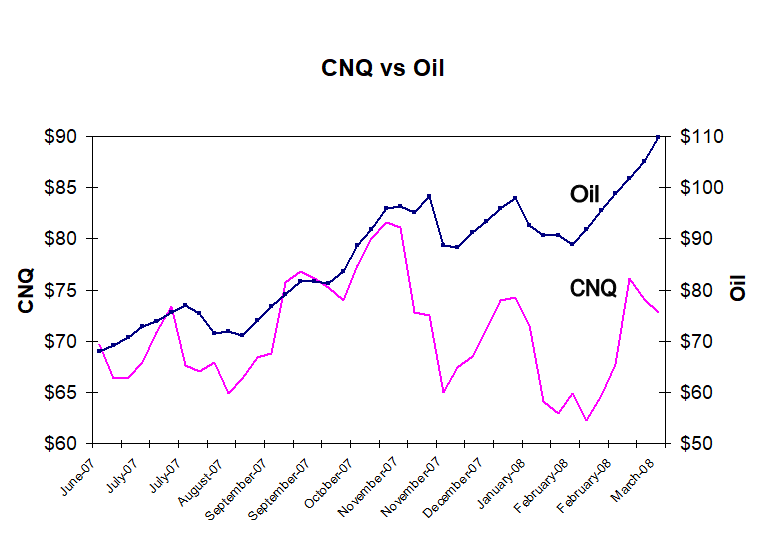

On the first business day of the new year, once again the price of West Texas Intermediate crude oil surprised experts and analysts (including Equinox) to the upside, breaching the century mark for the first time. Despite spot and future prices over $100, oil analysts’ consensus expectations for near term oil prices remain far lower. In fact, after a year of vastly underperforming the oil price itself, oil companies such as Canadian Natural Resources, pictured below, are discounting much cheaper future petroleum prices.

Last year Equinox was a substantial net seller of Canadian oil and gas stocks as their prices in US dollars rose and their economic fundamentals using their estimates of long-term oil prices deteriorated. Not only, our thinking went, would an economic slowdown reduce global demand growth, but Alberta’s higher royalty taxes and the stronger Canadian dollar would also squeeze company profit margins. That said, as data supporting the “Peak Oil” hypothesis mounts, we’ve been questioning the wisdom of last year’s sales.

The “Peak Oil” debate, as you may recall, centers on the earth’s ability to supply the world with ever increasing amounts of crude oil. While no one asserts that such a peak isn’t inevitable someday, the proximity of the peak is a hotly debated subject. Proponents of a near term peak in oil output often point to the pioneering work of King Hubbert, a geologist who successfully calculated the timing of maximum petroleum production in continental US. How, they ask, can we dismiss similar calculations which imply that world oil production is almost at its limit? Several years ago, a Houston petroleum investment banker, Matt Simmons, raised a related alarm, specifically that Saudi oil production will not only peak soon, but also is about to begin a rapid decline. While Hubbert and Simmons have long been considered alarmists by conventional oil experts, the work of these two individuals has started to gain more purchase with established oil industry players.

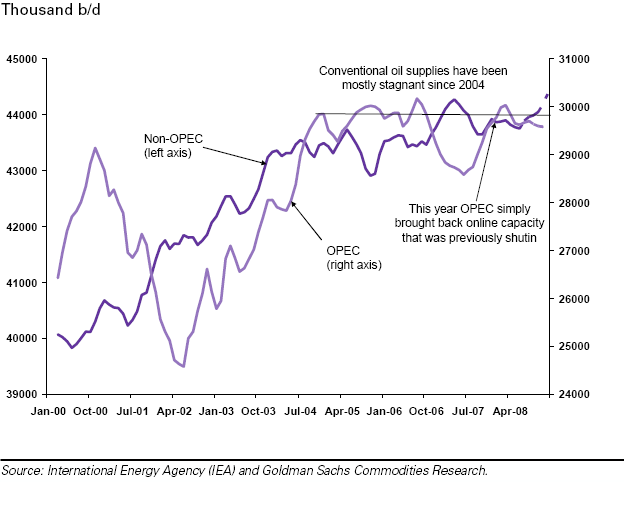

In 2007, the global petroleum supply/demand watchdog, the International Energy Agency (IEA), an institution which has traditionally embraced a positive perspective on oil supplies, began to hedge its projections. Last summer in its annual “Medium Term Oil Outlook” the IEA said “oil looks extremely tight in five years time…. Despite four years of high prices, this report sees increasing market tightness beyond 2010.”[1] Late last year the IEA also announced a new study that will revise its long-term projections for oil reserves. Admitting that the Agency’s focus on oil demand, “is wrong, and that supply factors should be looked at more closely,” the new report will look examine specific components of their supply forecasts. First, the IEA’s estimates of decline rates on existing fields, which are considered by some to be far too low, will be reviewed. The decline rates on existing reserves determine how long they will last and how much new production will be required to replace the declines. Second, the IEA will revisit its reliance on the US Geological Survey’s assumptions for modeling long-term reserve growth outside OPEC. In fact, the US Geological Survey is reassessing it own estimates of 1995-2025 reserve growth because, so far, they have been considerably too optimistic.

Another straw in the wind is the changing tone of oil company executives. The usually optimistic Lee Raymond, former CEO of Exxon, headed a study by the National Petroleum Council entitled “Hard Truths About Global Energy.” In their press release, the Council states, “Over the next 25 years the United States and the world face hard truths about the global energy future” that will require “all economic, environmentally responsible sources to assure adequate reliable supply.” Chevron pointed out that ‘oil production is in decline in 33 out of the 48 largest oil-producing countries, yet energy demand is increasing around the globe.’[2] Christophe de Margerie, CEO of the large French oil company, Total, says that he doubts global oil production will reach 100MM bbls/day (demand next year should be 89MM bbls/day rising at 1-2MM bbls/day per year) - far below the more sanguine conventional forecasts. Mr. de Margerie says, “It is not my view: it is the industry view, or the view of those who like to speak clearly, honestly, and not… just try to please people.[3]

The late Milton Friedman was reported to have made the observation that the cure for high prices is high prices. While we agree with Friedman on this point, we suspect that in the long-run petroleum’s geologic limits might prove the exception to his point (and might explain why oil prices are behaving more like gold prices—as a long-term store of value). Accordingly, Equinox has chosen to maintain a partial position in our favorite exploration and production companies despite the run up in the oil price. While a fraction of our current investments are weighted toward growing producers of cheap natural gas, the bulk of our investments are focused on the very long-term oil sands reserves in Alberta, Canada and the most efficient of alternative fuels, renewable Brazilian sugar based ethanol.

[1] Financial Times, 7/9/07, “IEA warns on global oil shortage”

[2] Financial Times, 11/9/2007, “Energy 2007: How will we cope when the oil runs out?”

[3] Ibid.

With the demise of Bear Stearns focusing renewed attention on the financial soundness of primebrokers and other counterparties to hedge funds, we thought it appropriate to reprint the last paragraph of our 2007 second quarter letter. We’ve also enclosed an updated “Summary of Operations” report that details our current custody and prime brokerage relationships.

“At Equinox Partners, we’ve long taken a deliberate approach to counterparty risk management, carefully analyzing prospective counterparties and choosing to distribute our exposure across several firms if none stands out as a materially better risk. This past quarter, we took the additional step of segregating our custody assets from our prime brokerage assets. As we employ only modest amounts of leverage, we've been able to move a meaningful fraction of our long securities into a ring-fenced bank custody account at Northern Trust. While no account is completely free of counterparty risk, this, we believe, is as close as it comes. To the extent that we sell short and invest on margin, we will continue to hold a significant portion of our portfolio at Goldman Sachs and Royal Bank of Canada. That said, the fund’s counterparty risk is now limited to a minimum given the portfolio structure.” (Equinox 2007 2Q letter)

The improper allocation of operating expenses to limited partners led to the closure of a prominent New York-based hedge fund last month. In light of the high degree of discretion that fund managers have in this regard, we’re surprised that more examples of expense misallocation haven’t been uncovered. For our part, we allocate very few costs to our funds and provide a line-by-line accounting for all expense in our “Summary of Operations” report.

With respect to liquidity, Equinox’s quarterly openings and ninety day irrevocable redemption notification are appropriate given the liquidity of the securities which we own and short. We take the fund’s liquidity terms very seriously and will never give preferential treatment to any limited partner.

Sincerely,

Sean Fieler

William W. Strong