Equinox Partners, L.P. - Q1 2008 Letter

Dear Partners and Friends,

The “BearStearnization” of US Monetary Policy

“If you want to say we bailed out the market in general, I guess that’s true. But we felt that was necessary in the interest of the American economy.” Ben Bernanke

“With financial conditions fragile, the sudden failure of Bear Stearns likely would have led to a chaotic unwinding of positions in those markets and could have severely shaken confidence. The company’s failure could also have cast doubt on the financial positions of some of Bear Stearns’ thousands of counterparties and perhaps of companies with similar businesses.” Ben Bernanke[1]

The Federal Reserve’s bailout of Bear Stearns’ creditors and counterparties highlights two important extensions of our central bank’s financial domain. Firstly, the Fed has now made its discount window available to a whole new sector of the American financial industry, broker dealers. Secondly, and more significantly, by accepting assets of less than pristine quality as loan collateral, “mortgage backed securities and other asset-backed securities with an average rating of BBB-”[2] the Fed has broken with its longstanding policy of avoiding credit quality issues.

Considering the compounding of systemic risk by record levels of financial leverage and the intricate interrelationships between financial institutions, it is little wonder that Bernanke et al. felt they had no choice but to broker the Bear Stearns takeunder by JPMorgan. In doing so, they successfully extinguished the immediate financial wildfire before it could “crown.” To illustrate, we understand that Bear Stearns had no less than 14 million derivative contracts outstanding. In a corollary to the “too big to fail” doctrine, the Fed now appears to have a “too complex to fail” policy.

In the larger context, the Bear Stearns episode illustrates how dramatically the central bank’s policy options have narrowed in the current US financial context. The Federal Reserve’s unprecedentedly aggressive easing and innovative new practices have occurred in a period of higher than targeted and accelerating inflation. No less than Paul Volcker recently criticized his former employer’s actions “he said that the Fed’s main job is not to ‘take many billions of uncertain assets on its balance sheet,’ but rather as ‘custodian of the nation’s money, to protect its value and resist chronic pressures toward inflation.’”[1]

Recent Fed official jaw-boning about their inflation concerns notwithstanding, Equinox does not expect that our central bank will flip-flop into aggressive tightening in this environment. Given the Fed’s apparent predilection for keeping financial institutions afloat at any cost, we’ve been covering financial shorts at an ongoing business valuation - not hanging on for a potential bankruptcy. In several cases this risk-averse policy has left a lot of profit on the short table. We’ve covered our shorts of homebuilders, mortgage insurers, mortgage originators, commercial mortgage banks, and all but one of our positions in investment banks. Our remaining financial short exposure is centered in small local commercial banks, foreign banks, and commercial real estate businesses. On the long side of the ledger, our large weighting of valuation-compressed gold mining businesses looks especially attractive to us at this time. We believe not only that the Fed will continue fighting the credit contraction/recession in an election year, but that declining global mine production should compound into a continuation of the gold bullion bull market.

[1] “A Towering Disciplinarian, Man in the News Paul Volcker,” Financial Times, April 13, 2008, p.7.

[1] This second Bernanke quote is taken from the High Tech Strategist of April 4th, 2008.

[2] Walker F. Todd, “Federal Reserve Lending Authority and the Bear Stearns Rescue”, May, 9, 2008.

“If you want to say we bailed out the market in general, I guess that’s true. But we felt that was necessary in the interest of the American economy.” Ben Bernanke

“With financial conditions fragile, the sudden failure of Bear Stearns likely would have led to a chaotic unwinding of positions in those markets and could have severely shaken confidence. The company’s failure could also have cast doubt on the financial positions of some of Bear Stearns’ thousands of counterparties and perhaps of companies with similar businesses.” Ben Bernanke[1]

The Federal Reserve’s bailout of Bear Stearns’ creditors and counterparties highlights two important extensions of our central bank’s financial domain. Firstly, the Fed has now made its discount window available to a whole new sector of the American financial industry, broker dealers. Secondly, and more significantly, by accepting assets of less than pristine quality as loan collateral, “mortgage backed securities and other asset-backed securities with an average rating of BBB-”[2] the Fed has broken with its longstanding policy of avoiding credit quality issues.

Considering the compounding of systemic risk by record levels of financial leverage and the intricate interrelationships between financial institutions, it is little wonder that Bernanke et al. felt they had no choice but to broker the Bear Stearns takeunder by JPMorgan. In doing so, they successfully extinguished the immediate financial wildfire before it could “crown.” To illustrate, we understand that Bear Stearns had no less than 14 million derivative contracts outstanding. In a corollary to the “too big to fail” doctrine, the Fed now appears to have a “too complex to fail” policy.

In the larger context, the Bear Stearns episode illustrates how dramatically the central bank’s policy options have narrowed in the current US financial context. The Federal Reserve’s unprecedentedly aggressive easing and innovative new practices have occurred in a period of higher than targeted and accelerating inflation. No less than Paul Volcker recently criticized his former employer’s actions “he said that the Fed’s main job is not to ‘take many billions of uncertain assets on its balance sheet,’ but rather as ‘custodian of the nation’s money, to protect its value and resist chronic pressures toward inflation.’”[3]

Recent Fed official jaw-boning about their inflation concerns notwithstanding, Equinox does not expect that our central bank will flip-flop into aggressive tightening in this environment. Given the Fed’s apparent predilection for keeping financial institutions afloat at any cost, we’ve been covering financial shorts at an ongoing business valuation - not hanging on for a potential bankruptcy. In several cases this risk-averse policy has left a lot of profit on the short table. We’ve covered our shorts of homebuilders, mortgage insurers, mortgage originators, commercial mortgage banks, and all but one of our positions in investment banks. Our remaining financial short exposure is centered in small local commercial banks, foreign banks, and commercial real estate businesses. On the long side of the ledger, our large weighting of valuation-compressed gold mining businesses looks especially attractive to us at this time. We believe not only that the Fed will continue fighting the credit contraction/recession in an election year, but that declining global mine production should compound into a continuation of the gold bullion bull market.

[1] This second Bernanke quote is taken from the High Tech Strategist of April 4th, 2008.

[2] Walker F. Todd, “Federal Reserve Lending Authority and the Bear Stearns Rescue”, May, 9, 2008.

[3] “A Towering Disciplinarian, Man in the News Paul Volcker,” Financial Times, April 13, 2008, p.7.

$200/barrel?

At the risk of being tedious, we revisit the topic of an imminent peaking of global petroleum production, as significant new information supporting such a scenario has come to our attention since our last letter.

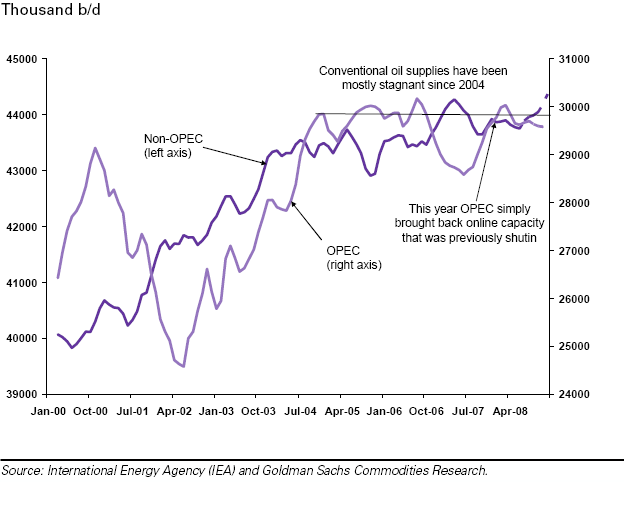

To begin, in a classic example of the need for sell-side research to stay ahead of the current facts, CIBC and Goldman analysts invoke a new interpretation of supply data to justify predictions of even higher oil prices, over $200/bbl. Their studies make the startling point that when natural gas liquids (not readily usable as transportation fuel) are stripped out from the International Energy Agency’s (IEA) global oil production figures it can be seen that world crude oil production hasn’t increased in two and a half years.

Global Crude Oil Production: OPEC and Non-OPEC

According to the Wall Street Journal, the IEA itself is also “preparing a sharp downward revision of its oil-supply forecast.” As pointed out in our last letter, the IEA has refocused its analysis on production decline rates. “We are of the opinion that the public isn’t aware of the role the decline rate of existing fields in the energy supply balance, and that this rate will accelerate in the future,” says the IEA’s Dr. Fatih Birol.[1]

One of the essential tenets of Dr. M. King Hubbert’s “peak oil” thesis is that once a reservoir’s petroleum production peaks, it goes into an irreversible decline. For peak oil adherents, it is noteworthy that Russia’s huge oil output has started to decline from its post-Soviet highs of last fall. This is a potentially alarming development for the world’s oil markets, given that Russia accounted for eighty-percent of the increase in non-OPEC oil in the last seven years.[2] To put a finer point on it, Russia’s oil production appears to have peaked at 9.9MMbbls/day in October 2007. April’s output, by comparison, was just 9.2MMbbls/day. While some believe that Russia’s production difficulties are only a function of its punitive tax on oil producers, others, including Lukoil’s Leonid Fedun, have stated flatly that Russian oil production will never surpass 10MMbbls/day.

The Arabian Peninsula, which has long been considered the single most fertile area for meaningfully increasing petroleum output, is also demonstrating its limitations. The Saudi national oil company, Aramco, is now investing $15 billion to develop an older field with a checkered production history and difficult geology. The huge Khurais field was once hoped to be another mammoth producer, but “Aramco geologists found the field had very little natural pressure … the oil bearing rock is deep underground and much tougher to tap than Ghawar’s.”[3] If Khurais, requiring massive injections of seawater to maintain pressure, is the Saudis’ best bet for increasing production modestly, then their potential to fill a future supply gap is disappointing, to say the least. Hence, it was not surprising that a few weeks ago, Ali al-Naimi, the Saudi Oil Minister, announced that the Khurais project, when it comes on stream in 2009, will be their last major expansion for now.

If Russian production is in decline and Saudi Arabia doesn’t intend to invest in further expansion of production after next year, where will the world get the future supply to offset natural declines elsewhere, let alone provide for growing Asian demand? Because there is no obvious answer to this question, oil is selling at over $130/bbl today - with future prices rocketing even higher into contango. With only 1.5MMbbl/day of excess capacity today (all of it in Saudi Arabia), according to America’s EIA’s report, we may well already be at the point where conservation bears all the burden of balancing supply and demand. But amazingly, concern about a long-term shortage is only now beginning to permeate investment mindsets. As the perception of the future of petroleum shortfalls gains credence, behavior (i.e. hoarding) and valuations may change radically.

For value investors such as Equinox, oil’s recent parabolic move is hard to embrace. Maybe the commodities markets growing supply concern is premature. Maybe a global recession, as evidenced by shrinking US oil consumption this year, could reduce demand enough to lower oil prices considerably. Maybe the reduction by emerging economies of subsidies for oil consumers will further reduce demand. Putting such short term issues aside, Equinox is increasingly persuaded that the world’s ever escalating production of crude oil is nearing its historic climax. Accordingly, we have significantly increased our exposure to cheap, long-lived hydrocarbon reserves, which, surprisingly still sell for just few dollars per recoverable barrel in the ground.

[1] Wall Street Journal, May 22, 2008, pp. A1 and A12.

[2] “Trouble in the Pipeline”, The Economist, May 10, 2008, p. 71.

[3] “Saudis Face Hurdle in New Oil Drilling”, Wall Street Journal, April 25, 2008.

Sincerely,

Sean Fieler

William W. Strong