Equinox Partners, L.P. - Q4 2004 Letter

Dear Partners and Friends,

Equinox’s Portfolio 2005

The long period of extraordinarily low interest rates has worked its levitating effect throughout the global financial markets over the last several years. In a world awash with liquidity, the marginal buyer has been financed, the incremental asset has been purchased and the questionable creditor has been approved. But, this is yesterday's news. Record low interest rates and the steeply sloped yield curve they produced are currently regressing towards “normal” levels.

In America, the combination of rising equity valuations and unsustainably low interest rates (see “The Fed Sounds the Alarm” below) is generating a growing number of quality short ideas while at the same time making the risks of short selling more manageable. Over the past year and a half, as the attractiveness of shorting has increased, so too has our short exposure. Equinox Partners’ short exposure currently stands at sixty percent of partners’ capital -- its highest level since the bubble market of the late 1990’s.

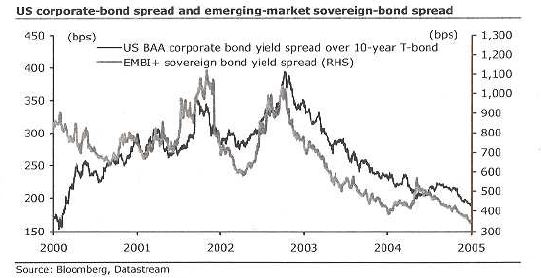

A substantial percentage, approximately one third, of our short exposure is currently in fixed income securities. While the potential return from shorting bonds tends to be modest, the somewhat reduced upside is more than offset by the greatly reduced risk that they pose. Take, for example, the basket of very low-rated but low-yielding junk bonds we are currently short. Junk bond premiums over treasuries are currently near all-time lows. Furthermore, the weakest credits are, on a relative basis, particularly expensive.

As often happens with our value driven investment ideas, we may well be early in shorting junk credits. We cannot know exactly when interest rates will rise or when credit spreads will widen. But, we believe it improbable that credit spreads will tighten much further or that interest rates will decline meaningfully from current levels. Consequently, we can afford to be early. With rates and spreads as low as they are, the cost of carrying these short positions is modest.

On the long side of our portfolio, we remain enthusiastic about our Asian and natural resource themes. Our Asian businesses continue to perform very well, posting impressive earnings growth rates. Our energy and precious metals companies are profitably growing production in a supply constrained/high price environment. Valuations on our longs remain attractive.

The Fed Sounds the Alarm

For those of us with a highly developed sense of irony, the words of caution emanating from the U.S. Federal Reserve Bank at yearend are especially poignant. It is not everyday that the world’s most important central bank cautions its constituents about the consequences of the very policies they themselves have pursued for years. With a new found vigor and forthrightness, Fed officials are pointing out the obvious:

“a number of participants [Fed Governors at the December meeting] voiced concerns about domestic and global financial imbalances.” …“more surprising, the minutes said that some policy makers worried that the prolonged strategy of low rates might be fostering ‘excessive risk taking’ in financial markets and in the market for houses and condominiums.” NY Times Sunday 1/23, Deficits May be Wearing Thin at the Fed, quoting minutes from Fed Minutes at December 14 Meeting.

To add further emphasis, the President of the New York Fed, Timothy Geithner, in a speech on risk management...

“…suggested that investors had become too complacent about the risks posed by global imbalances. Declaring that the current account deficit had reached an ‘unprecedented scale,’ even as investors continue to demand very low risk premiums, Mr. Geithner warned that they had little buffer for unexpected shocks.” Ibid.

After years of stimulative monetary policy intended to thwart the contractionary effects of the last bubble, the U.S. central bank is now voicing concern over the effects of that policy stance. Several U.S. markets are exhibiting excess. (In 2004, for example, U.S. housing prices rose dramatically yet again; 13% year-over-year in the third quarter and a record 18.5% in the second quarter.) An even more worrisome excess is the huge and growing imbalance in our external account -- Americans continue to live farther and farther beyond their means.

Perhaps the Federal Reserve is telegraphing important new policy considerations now that the U.S. economic recovery seems strong enough to be self-sustaining. Perhaps Mr. Greenspan, the master of expectation management, is only jaw-boning. Whatever the underlying reason, these utterances could well mark an important change in the heretofore long-running accommodative financial environment. In other words, we think it highly unlikely that U.S. interest rates (and, by inference, global rates as well) will remain at unnaturally low levels for much longer. It is in this context that we have increased our short exposure.

Risk/Reward of Asian Equities

A thoroughly parochial American view of investing in foreign markets was recently evinced by a well-known Wall Street strategist. She maintains that the ownership of emerging market equities is currently more risky than the ownership of domestic ones:

“It’s interesting. You worry about speculative U.S. stocks going up, and yet you’d rather invest in countries where you can’t know the economy. You can’t know the politics. You can’t know the possibilities of terrorism. You can’t know the currencies. I don’t see the consistency there in terms of riskiness.” Fortune Magazine December 27, 2004 p. 109 What’s Ahead for 2005 Roundtable Interview

Equinox respectfully disagrees with this appraisal. We have long argued that investing in Asia, while requiring a stout heart and a long-term investment horizon to weather the occasional market swoon, is not inherently more “risky” than investing in the States. In fact, from our perspective, Asia’s stocks are currently much less “risky” than their American counterparts. For starters, the types of superior businesses in which we invest continue to trade at low valuations in Asia, while their American counterparts continue to trade at very high valuations. Asia’s region-wide under appreciation of the best businesses has allowed the unusual option of maintaining our value discipline while concentrating our portfolio in companies with monopolistic returns on capital and predictable growing streams of free cash flow. While Asia’s currencies add an additional degree of volatility to our returns, over time this volatility quite clearly represents a huge long-term profit opportunity, not a risk factor.

Not believing that our holdings in Asia are particularly “risky,” we have never felt compelled to run a tightly hedged portfolio there. Others are gradually beginning to concur with us on this issue:

“[in Europe] there is the growing belief in the view…that it makes much more sense to invest in Asia ex-Japan on a long-only basis. This changing perception may in part reflect the fact that Asian stock markets have been rising and, thus, long-only is doing better. But it also reflects awareness that volatility is inevitable when investing in Asia and emerging markets, and that it nearly always makes sense to invest more money on sudden breaks down. The market reaction to last year’s Indian election provided a salutary lesson for many in this respect. There is also awareness that it is difficult, as well as risky, to short in Asia.” Chris Wood, CLSA Fear & Greed

While volatility is not the same as risk, it is important to realize that Asian capital markets are prone to bouts of manic enthusiasm and pessimism. At the moment, enthusiasm for stocks is growing region-wide. That said, the current low valuations of Equinox’s Asian long positions (nine times 2005 “look through” earnings) suggest that Asian equity markets are not yet expensive and that we have yet to reach a worrisome level of enthusiasm. When we cannot identify cheap Asian stocks, we will no longer invest there. In the meantime, we expect to profit from our superior businesses’ earnings progress and regional currency appreciation.

Sincerely,

Sean Fieler

William W. Strong