Equinox Partners, L.P. - Q3 2004 Letter

Dear Partners and Friends,

Oil II: Why Aren’t They Drilling?

“investors need to fundamentally change the way they look at oil and gas companies if the economy is to get the fuel needed for strong growth. Energy, he argues, has replaced ‘new economy’ businesses as the biggest long-term growth story now after a decade in which investors favored ‘every cockamamie idea in the tech industry.’” Rich Bernstein, Chief U.S. Strategist at Merrill Lynch & Co. (Wall Street Journal, 8/26/04)

As rising oil demand bumps up against world production capacity, prices have remained strong. Economic theory suggests that such high prices should elicit a capital expenditure response that would result in an increase in productive capacity. To date, this response has not occurred:

- John S. Herold, Inc. forecasts that this year, the world’s six major oil companies will spend $25 billion of their record $138 billion cash flow buying back stock. In aggregate, these buyback are twice as large they were last year. Capital spending to develop the oil reserves of these same companies is expected to only rise 8% this year, to $68 billion.

- In Canada, liquidating royalty trusts sell at such large valuation premiums to conventional exploration and development companies that more of the latter continue converting to the former. The conversion to royalty trusts, which payout most of their cash flow as dividends instead of reinvesting in drilling new wells, reduces industry capital expenditure on replacing/expanding production.

- According to Deutsche Bank, only six of the world’s 15 leading oil companies claim to have even replaced reserves between 2001 and 2003.

- Despite sustained very high U.S. natural gas prices, drilling activity in the Gulf of Mexico was so weak in first quarter of 2004 that Diamond Offshore Corporation, one of the largest Gulf drillers, lost money that quarter.

- Despite an almost five fold increase in oil prices since their lows in 1999, excluding the pickup in US natural gas drilling, the international rig count is almost flat.

With petroleum prices at their best levels in decades and interest rates at record lows, why aren’t the oil and gas companies investing heavily in developing hydrocarbon reserves? Without a doubt, the energy industry remains deeply skeptical about today’s higher oil and gas prices. A September corporate strategy presentation from Shell Oil illustrates the point: “Shell said it had seen a fundamental shift in the long term price of oil and would change the way it made investments to meet this.”(Financial Times, 9/23/04). Then, the oil giant threw caution to the wind: “Malcolm Brinded, head of exploration and production, said that while Shell would continue to use $20 a barrel as a way to screen out undesirable projects, it would assume prices of more than $25 to decide which would be best pursued.” This year’s more ‘aggressive’ capital budget is set at $15 billion, up from last year’s $14.3 billion; and, over the next five years Shell hopes to merely replace hydrocarbon production—not to grow it. As one observer noted, “You would have expected a bolder statement.”(Financial Times, ibid.) Bolder indeed! With the five year oil futures strip averaging almost $40/bbl., ‘reserve challenged’ Shell Oil is not exactly leading the charge to increase world oil production capacity.

Shell is not alone in its lack of drilling investment. According to Mr. Rodgers of the PFC[1], “Despite the fact that we’re in the highest oil-price era, the level of exploration is not increasing.…” “Over the past decade, he says, the percentage of major oil companies’ exploration-and-production budget that has gone to exploration has dropped to about 12% from about 30%. That, he reasons, is because they have concluded that there aren’t many more large caches of oil for them to profitably find.” Mr. Rodgers says oil production is either reaching a plateau or declining in 33 of 48 major oil producing countries, including six of the 11 OPEC countries. (Wall Street Journal, 9/21/04)

Equinox does not have a good explanation for this perplexing lack of exploration and development investment. Assuming normal oil price inelasticity (in September the gasoline-guzzling Cadillac Escalades and the Hummer had their best new car sales month ever!) and only modest Asian consumption growth, such a lack of drilling should ensure continued high energy prices. Ironically, persistent skepticism about the sustainability of these higher oil prices makes the continuation of this favorable price environment much more likely. But not everyone is as bearish as the E&P companies are on their own product. Goldman Sachs’ research department just raised their assumed oil prices to $40/bbl in 2005 and 2006. Furthermore, their analysts stated that “We continue to see at least a 50% chance of seeing “super spike” conditions sometime this decade corresponding to a multi-year period of $50-$80/bbl WTI oil prices, $8.5-$13/MMBtu Henry Hub spot natural gas...”

We submit that Goldman Sachs’ bullish forecast, if it spreads, represents the first inklings of a fundamental change in the world’s view of this heretofore plentiful fuel source. Equinox certainly does not possess a crystal ball to see oil prices in five years. However we have watched the growing difficulty oil and gas companies have had just replacing their reserves over the past decade. A sell-side analyst we know was recently joking with the top management of an oil company about “environmentally sensitive” celebrities buying cars fueled by alternative fuels when the executive admitted to buying one himself. “‘If you knew how hard it is to find the stuff, you would buy one too,” said the corporate CEO.

For years Equinox has believed that consumers and investors alike have been unduly complacent about the scarcity value of this critical fuel supply. Our energy stocks position, replete with sizable upside optionality, is a reflection of our conviction that such a revaluation of petroleum was almost inevitable. The revaluation we foresaw is no longer theoretical. With AECO winter month natural gas prices now pushing C$8/mcf, the price of this critical fuel has risen almost tenfold over the last decade. Equinox’s investment is not grounded in an expectation of further natural gas price appreciation, though we would not be shocked if such were to occur. Instead, it is our contention that in light of intense investor skepticism about current hydrocarbon prices, the market valuation of energy companies still has yet to reflect petroleum’s fundamental scarcity.

[1] PFC is a Washington based energy-consulting firm.

The long awaited depreciation of the US dollar against Asian currencies has finally begun. As of the writing of this letter, the US dollar’s decline against Asian currencies alone has already added about three percent to Equinox’s fourth quarter performance. We remain convinced that the prolonged undervaluation and pending revaluation of Asia’s currencies will rank as one of the most important economic events of our financial era.

We are stockpickers at heart and do not pretend to understand all of the economic and geopolitical consequences of the continued mispricing of the US dollar. That said, we insist that the effects of the US dollar’s present sizable overvaluation vis-à-vis America’s Asian trading partners should be front and center in any sensible investor’s strategy. The prevailing exchange rates between America and Asia have:

- fueled large and persistent external imbalances in US and Asian economies

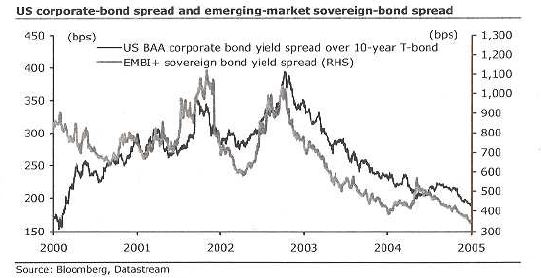

- kept a lid on US interest rates

- forced Europe to bear a disproportionate share of the US dollar’s recent adjustment

- encouraged expansionary monetary policies in Asia

- over-stimulated investment in Asia and subsidized over-consumption in the US

Given the size and scope of these economic imbalances, the pending appreciation of Asia’s currencies, particularly against the US dollar, is certain to ripple through the vast majority of the world’s financial markets (think “wave” not “ripple”).

As investors in Asia, we have devoted considerable time to pondering the best method for profiting from the changes envisaged above. Equinox has long trumpeted our significantly net-long exposure to assets that should appreciate in US dollar terms. We have also largely avoided owning Asian export businesses, recognizing the difficulties they would face should the US dollar decline substantially. Instead, our portfolio is concentrated in local businesses with local brands and franchises that are selling their products and services to locals in local currency terms. Lastly, we’ve considered our fund’s vulnerability to a possible disorderly adjustment in China’s economic and financial structure that may ensue from the eventual change in that country’s foreign exchange rate policy.

China, with its pegged currency and large current account surplus with the US, is very much at the center of Asia’s dysfunctional currency markets. In his book, The Dollar Crisis, Richard Duncan makes a compelling case for the long-term connection between a country’s capital inflows via large current account surpluses (with their attendant rapid growth in credit) and the investment bubble that they ultimately create. As his book makes clear, “…the [Asian] countries that built up large stockpiles of international reserves ($) through current account or financial account surpluses experienced severe economic overheating and hyperinflation in asset prices that ultimately resulted in economic collapse.”

China enjoyed extraordinary economic performance during the last decade, and much of this growth was dependent upon China’s large and growing trade imbalance with the world’s leading manufacturer of US dollar liabilities, America. As Duncan predicts, China’s growing external imbalances coincided with an extraordinary Chinese capital investment boom. This connection between China’s external imbalances and domestic capital investment begs several questions: What would happen to China’s economy were the renminbi to appreciate enough to correct these external imbalances? Would, as a result, China’s monetary policy necessarily turn contractionary? Would the Chinese capital investment cycle be likely to turndown? How severe might China’s post boom hangover be? Would China’s rickety banking system be able to cope with the resulting deterioration in the credit quality of its borrowers? We do not know the answers to these questions, but clearly the degree to which China successfully navigates a currency rebalancing could have a meaningful impact on the extent to which Equinox benefits from the appreciation of Asia’s other currencies.

For a multitude of reasons, most of them company specific, Equinox has no long positions in the People’s Republic of China. We are, however, looking for compelling short investments ideas that would have the effect of hedging Equinox’s portfolio against a large decline in Chinese economic activity.

In conclusion, Equinox continues to look forward to the eventual adjustment of our currency versus those of our Asian trading partners. In the next few years, we expect currency appreciation to significantly compound the gains we anticipate generating from our ownership of outstanding Asian businesses trading at discount valuations.

Sincerely,

Sean Fieler

William W. Strong