Equinox Partners, L.P. - Q4 2001 Letter

Dear Partners and Friends,

Performance

Last year not only were we long the best performing sector (precious metals), long the best performing country in Asia (Korea), and short the worst performing sector globally (technology), but our specific investments within all three of these sectors outperformed substantially. Simple arithmetic, the very same which prohibits the gold price from declining indefinitely, Korean companies from selling at fractional EV/EBITDA ratios persistently, and the NASDAQ from rising twenty percent a year perpetually, brought the unsustainable status quo of the 1990’s to a close. The resulting watershed period in financial markets will be one during which investment fundamentals matter! In this new environment where substance as opposed to hype drives prices, our stock picking will continue to benefit from a substantial tailwind.

Several years ago, at the height of the market mania, we wrote to our partners about the investment prospects that we saw: “The single most salient fact of today’s [1999’s] investment climate—simultaneous extremely anomalous securities pricing in several different world markets—compounds into a once in a lifetime opportunity for disciplined investors (albeit one that few investors will seize).” With the opportunity only having begun to unfold, Equinox’s portfolio is still laden with grossly mispriced securities.

Korea

The Korean shares owned by Equinox produced exceptional results last year--multiples of the returns generated by that market. With the sharp fall in Korean interest rates and the demise of local technology speculation, more investors are coming to see the attraction of the predictably growing free cash flows and very high earnings yields which we have long favored there.

Despite the significant appreciation of a few of our Korean stocks, spectacular gaps between intrinsic value and price persist on the Korean Stock Exchange. For each of our excellent companies that rose to a mid-single digit multiple, another remained mired in low-single digit territory. Consequently, we have been able to recycle some of Equinox’s capital from the “expensive” Korean companies into comparatively cheaper shares.

Our Korean holdings illustrate an important aspect of Equinox’s value approach. In theory, risk and reward go hand in hand; in Equinox, the relationship does not hold true. While we freely acknowledge that Asian markets are volatile and we are well aware that businesses in the region are subject to substantial macro-economic, political, and corporate governance uncertainty, we submit that the risk of permanent capital loss on our holdings in Asia is far less than modern portfolio theory would suggest. In our opinion, such stocks as our strong consumer nondurable franchises with good balance sheets and Westernized managers selling for outsized earnings yields embody the antithesis of risk.

The US Consumer: Spending Through the Recession?

The incredible resilience of the American consumer and his willingness to lever up during an economic slowdown is the defining feature of our most recent domestic recession.

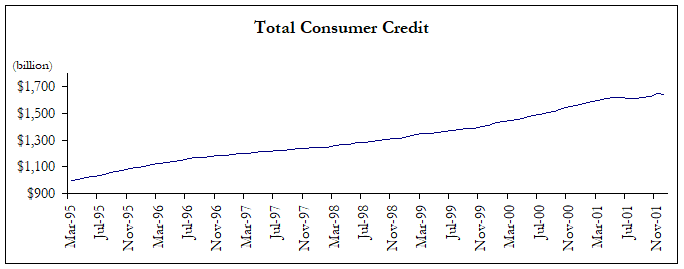

“During the first two quarters of the early 1990’s recession, the average American household reacted to those tighter credit conditions by paring its debt by an inflation adjusted $410 says Mark Zandi, chief economist at Economy.com. That helped leave consumers in shape to borrow anew when the economy ultimately turned the corner. By contrast, Mr. Zandi says that during the first two quarters of the current recession, which began in March, the average U.S. household took on $1420 of new debt.”(WSJ, 2 Jan. 2002)

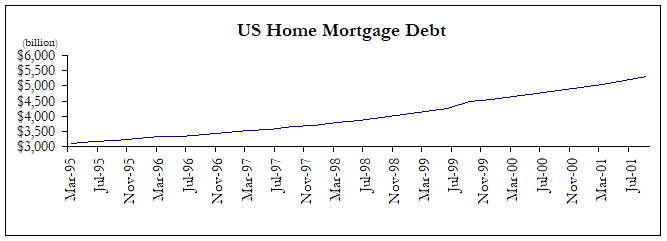

The American consumer’s willingness to continue to live beyond his means is worrisome to us, not because it is immoral, but because it is unsustainable. In categories ranging from new cars to new housing, records were set at the very nadir of the economic downturn. We find the ever growing appetite for the most levered of all assets, the home, an ominous sign.

The US consumer has not cut back because he has not been forced to:

“Despite the surge in layoffs accompanying the current downturn, credit card companies, led by Capital One Financial Corp. and MBNA Corp. are likely to have mailed out a record 5 billion new credit-card solicitations in the year just ended, up from 3.5 billion in 2000. That’s equivalent to about 20 solicitations for every man, woman and child in the U.S. No wonder, then, that Capital One, based in Falls Church, Va. is the nation’s largest single generator of mail.” (WSJ, 2 Jan. 2002)

And, will not cut back until he has to:

“[Credit counselors] say many consumers know that they are acting irrationally but are convinced that the rules of the game have somehow changed to keep them out of trouble.” “’I want to enjoy everything and not worry about cutting back’ says Mr. Stouder, who regularly gets solicitations for new credit cards.” (WSJ, 2 Jan. 2002)

We will admit to being surprised by the mildness of the economic contraction—but not reassured. The borrowing behavior described above, which has produced detrimental levels of indebtedness, strikes us as perverse. Accordingly, we maintain our concern about the health of the world economy as well as our outsized short positions in several troubled lenders exposed to the American consumer.

The 1990’s: Expectations Improperly Indulged

“Hope is itself a species of happiness, and, perhaps, the chief happiness which this world affords, but, like all other pleasures immoderately enjoyed, the excesses of hope must be expiated by pain; and expectations improperly indulged, must end in disappointment.” (Samuel Johnson)

That, the 1990’s are over, is a chronological fact. That, we have only begun to uncover the corrosive effect of the bubble era’s ethos, can withstand a few points of support: (1) the continued strength of the U.S. dollar in the face of enormous domestic trade deficits and low domestic interest rates, (2) the phoenix-like reemergence of speculative enthusiasm for still extravagantly priced technology shares, (3) the still high levels of domestic margin debt, (4) the near universal skepticism about precious metals stocks despite their outstanding recent performance, and (5) the recentness of the discovery that outside corporate auditors have let a few accounting shenanigans slip past them.

The compromising of accounting standards to accommodate bull market earnings projections is not exactly a “news flash” to Equinox Partners, L.P. The frequent and, at times, total lack of correspondence between financial reality and financial statements during the historic market rise of the past decade cost short sellers like us dearly. Enron’s mixture of fraud, obfuscation, and a levitating stock price was only possible in an era of unquestioning optimism. The tone of Enron’s first quarter conference call last year, which was symptomatic of the period, might be best summed by like this: “Our profits have soared twenty percent, but no, we will not provide a corporate balance sheet. So, you will just have to trust us.” And virtually everyone did trust them. We submit that Enron’s internal audit committee, Arthur Andersen, dozens of Wall Street analysts, Wall Street investment bankers, hundreds of institutional analysts and portfolio managers, rating agencies, and the SEC were all participants in an “excesses of hope” consensus—a consensus that went far beyond Enron in the 1990’s era of euphoria.

The fact that the financial world finally seems to be discovering the issue of accounting integrity two years after the peak of the speculative bubble attests to the deliberate pace at which the previous decade’s boom is turning to bust. Gratified by this long-delayed change of attitude, contrarian Equinox anticipates profiting as further revelations of financial “pleasures immoderately enjoyed” refocus investors’ attention on fundamental business verities.

Sincerely,

Sean Fieler

William W. Strong

Anthony R. Campbell