Equinox Partners, L.P. - Q3 2019 Letter

Dear Partners and Friends,

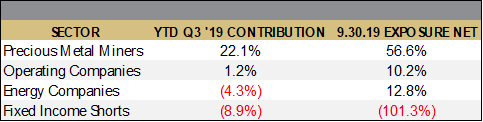

PERFORMANCE & PORTFOLIO

Equinox Partners, L.P. was down -3.4% in the third quarter of 2019. For the year to date through October 31st, the fund was up +7.8%.

the devaluation of common sense

"There's no place to go. You just have to ride it out. You invest even though you expect the price to decline."

—Robert Schiller, October 23rd, 2019

“The repo operations have…been effective at restoring calm in money markets…”

—Lorie Logan, senior vice president of the New York Fed’s Markets Group, November 4th, 2019

The U.S. stock market is making new highs as the Federal Reserve spends billions to calm markets. The coincidence of these events suggests a positive consensus view of the Fed’s intervention into the repo market. The purchases are evidence that our central bank stands ready to address whatever problems may arise in the plumbing of the financial system. As such, the Fed’s action does not raise concern but instead instills confidence about the Fed’s willingness to act preemptively.

This logic strikes us as overly simplistic and the accompanying confidence misplaced. Just because the Fed has taken $193 billion of repos onto its balance sheet since September 17th does not mean the Fed can or will do the same for other asset classes. Moreover, if overnight repo rates can jump almost five-fold without warning, it is reasonable to think that there are other problems lurking in our debt-laden financial system.

Two segments in particular strike us as potential flash points: auto loans and leveraged loans. Both sectors have more than $1 trillion in current credit outstanding, would be politically awkward to rescue, and evince warning signs despite their still contained delinquencies.

aUTO lOANS

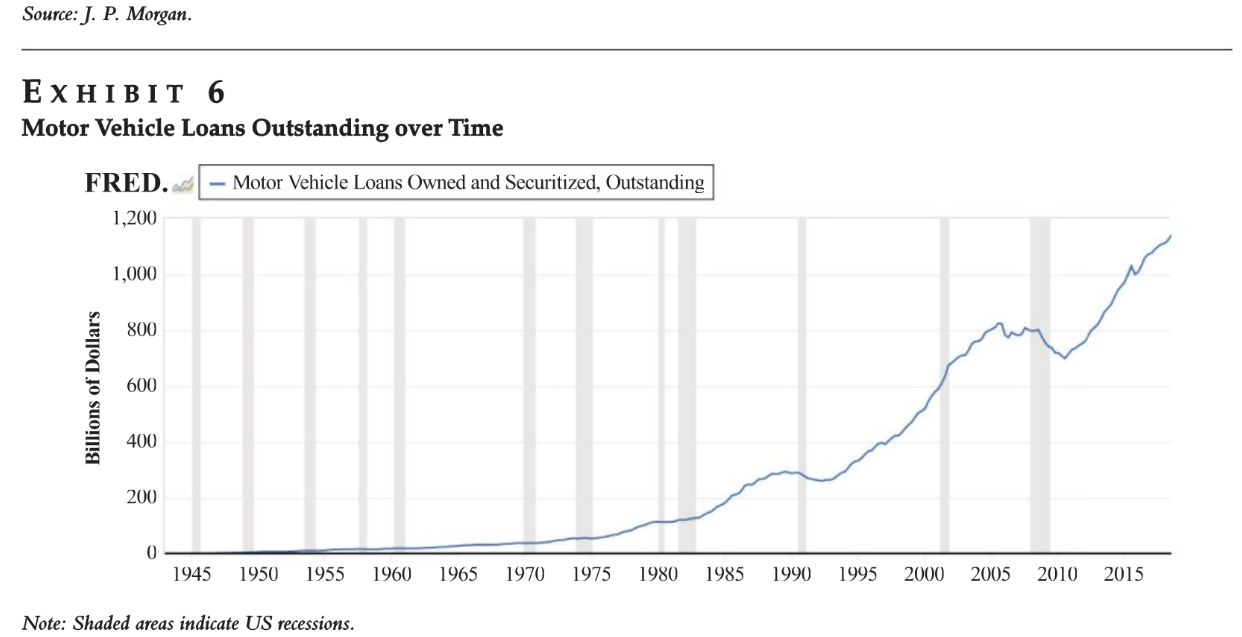

Since the global financial crisis in 2008, U.S. auto loans have nearly doubled. “U.S. consumers held a record $1.3 trillion of debt tied to their cars at the end of June, according to the Federal Reserve, up from about $740 billion a decade earlier.”

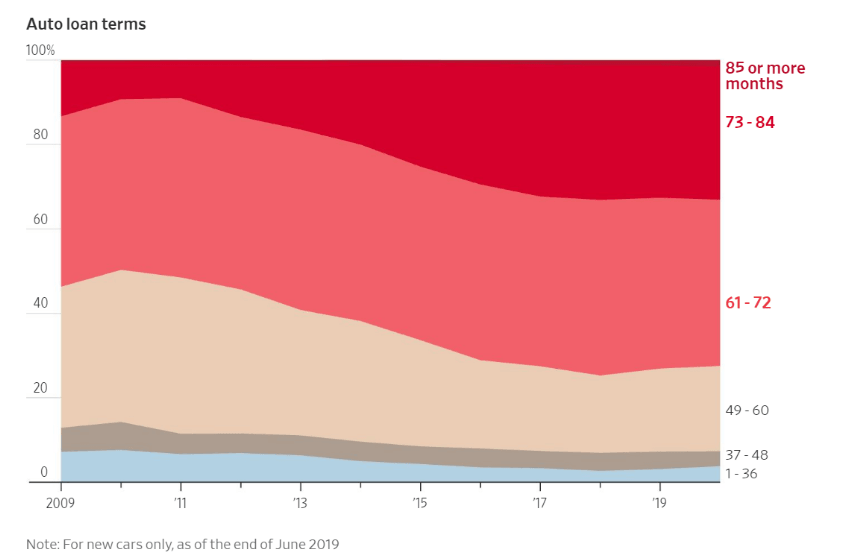

Such impressive credit growth is typically accompanied by an easing of some sort, and booming U.S. auto loans are no exception. Rather than lowering FICO score requirements—although this has happened at the margin—lenders have radically extended the tenor over which they are willing to make auto loans. As a result, “[a]bout a third of auto loans for new vehicles taken in the first half of 2019 had terms of longer than six years, according to credit-reporting firm Experian PLC. A decade ago, that number was less than 10%...”

The increased tenor of auto loans has been necessitated by a combination of rising car prices as well as the growing need of borrowers to roll-over negative equity from their previous car loan into their new car loan. About a third of consumers trading in their car to purchase a new car had negative equity. Sensing that such auto loans are a train wreck waiting to happen, we shorted the corporate debt of Ally Financial, America’s largest auto finance company, earlier this year. We subsequently covered the short at a slight loss and hope to reestablish the position when the sector’s delinquencies begin to actually tick up.

lEVERAGED LOANS

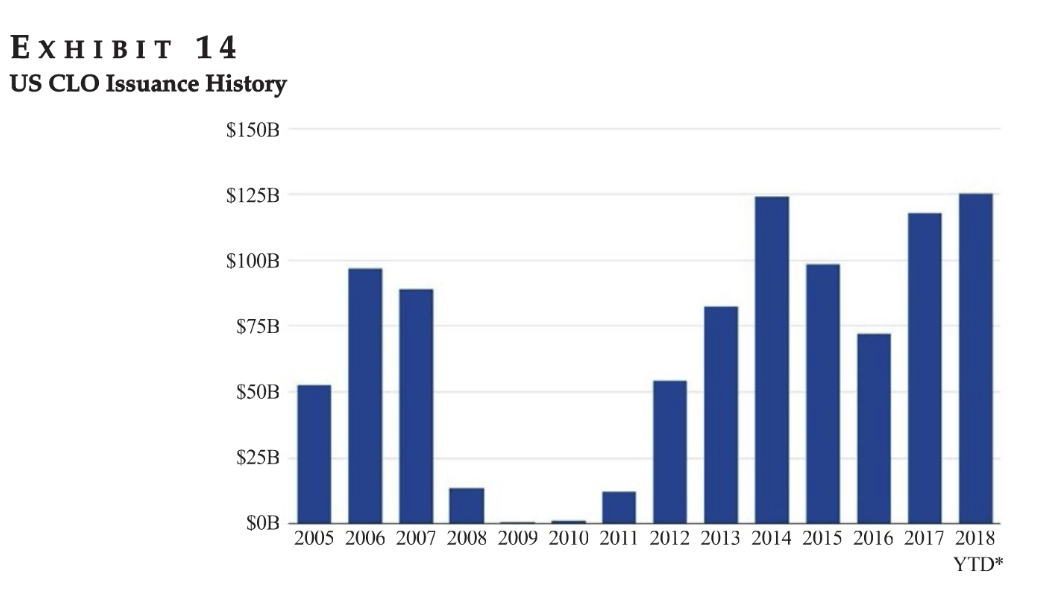

We see a similar problem in the leveraged loan market. Like the auto loan market, the quality of leveraged loans has deteriorated in recent years. This deterioration is captured by two data points: the rapid rise in covenant-light loans, which now account for more than 80% of leveraged loans outstanding, and the rising debt to EBITDA ratios of newly issued leverage loans, which now stand at over 5.5x. Both metrics are cause for concern. But what we find most disturbing about the leverage loan market is the growing dollar value of these loans that are held by CLOs.

CLOs performed better than other structured-products in the 2008 downturn. Accordingly, they have been embraced with gusto in this cycle, with new issuance above $100 billion annually. The thinking underpinning these flows mirrors the logic that caused so much trouble in 2008. While slicing and dicing a credit with good historical performance does not necessarily create a problem, problems do tend to arise when investors behave as if history and structure have made them immune from the systematic risk inherent in the underlying credits. In the case of leveraged loans, we believe that we crossed this threshold some time ago.

don’t throw in the towel like schiller

Despite the obvious valuation problem with conventional asset classes, the Robert-Schiller-throw-in-the-towel mentality is just wrong. A wide variety of assets have not participated in the current bubble. These out-of-favor investments are no longer widely held by alternative investment vehicles, including hedge funds. Many hedge funds, like just about everyone else, are now heavily invested in large tech stocks. As such, our persistence in owning underappreciated and even maligned assets in advance of a market correction is increasingly unique.

While it has admittedly been a long wait, our recent results suggest that our strategy may finally be about to bear fruit. After declining for the first ten months, our E&P portfolio has risen sharply in November. Our gold miners are up 43% for the year to date. And, our emerging markets portfolio has just turned positive for the year after ten months of sideways trading. Moreover, despite their recent upticks, our E&P, mining, and emerging markets companies trade at incredibly low valuations. Based on our estimates for next year, our E&P companies trade at 5.0x cash flow, our gold and silver miners trade at 4.1x cash flow, and our emerging markets companies trade at 5.5x earnings.

don’t expect a repeat of 2008

When the current bull market in financial assets eventually turns, we expect the experience to be very different than the last crash. Investment decision making has changed radically over the past decade. 80% of equity trading is now based on passive flows and algorithms. It is therefore completely unclear how equity markets will behave in a stress test. It is equally unclear how the bond markets will behave if dealers are unwilling to take on inventory. While impossible to predict with any precision, it stands to reason that the massive reduction in prudential judgement guiding investment decisions will not result in less volatility. Rather, we expect more volatility, and consequently more upside, in the contrarian sectors in which we’ve invested. We believe that owning an actual alternative to today’s most overvalued financial assets in advance of a correction is more important than ever.

Sincerely,

Sean Fieler

[1] Sector exposures shown as a percentage of 9.30.19 AUM. Performance contribution is derived in U.S. dollars, gross of fees and fund expenses. Interest rate swaps notional value and P&L are included in Fixed Income. P&L on cash is excluded from the table as are market value exposures for derivatives. Equity short positions of operating companies are netted out against long positions. Unless otherwise noted, all company data is derived from internal analysis, company presentations, or Bloomberg. All values are as of 10.31.19 unless otherwise noted.

[2] The Seven Year Auto Loan. WSJ, Eisen and Roberts, October 1, 2019.

[3] Ibid

[4] A $45,000 Loan for a $27,000 Ride. WSJ, Eisen and Andriotis, November 9, 2019

[5] Source: Arena Investors, LP.

[6] Emerging markets companies exclude operating companies trading in developed markets. Valuation as of November 13, 2019.

[7] Source:

CNBC.