Equinox Partners, L.P. - Q2 2013 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Equinox Partners was down -10.0% in the quarter ended June 30, 2013 and -6.3% for the year to date as of August 31.

For the year through August 31, our companies in mining and Asia cost us roughly -10.4% of partners’ capital, while our positions in the ‘rest of the world’ and sovereign debt shorts contributed +5.6% to partners’ capital. We bought miners aggressively in late June as they declined precipitously at the second quarter’s end, and we added to our Indian holdings in recent weeks.[1]

you can't eat relative performance, but...

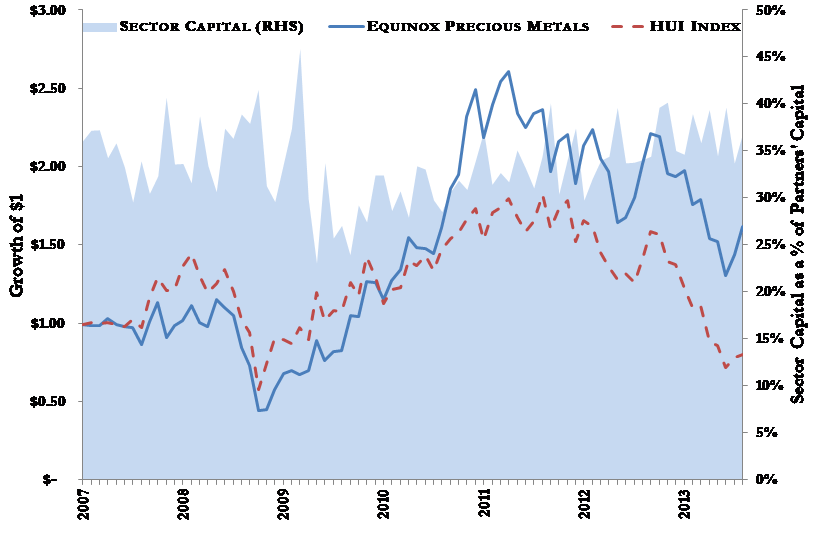

Our investments in gold and silver miners have dramatically outperformed the HUI gold miner index for two years running. During 2012, they appreciated 2% as the HUI lost 10% of its value. Similarly, for the year to date through August 31, they have outperformed the HUI by 25%. We attribute this significant back-to-back outperformance to one factor: the superior managements and governance of the mining companies we own. Not coincidentally, well-managed and well-governed mining companies also tend to have higher quality assets.

Though we have had long-term success investing in gold and silver mining, as the graph below shows, our relative returns during the recent market declines have been poor. We underperformed in both the 2008 and 2011 corrections.

Rather than chalk up our periodic underperformance to bad luck, we redoubled our efforts to understand the difficult business of gold and silver mining. A careful study of our failures over the years focused our attention on the propensity of managements in this industry to destroy value. While we were investing with managements that were better than most in the sector, we were not investing with managements that were actually good. In particular, our managements, like almost all managements in the mining industry, remained more fixated on growing production than on growing free cash flow per share.

To bring the managements of our mining companies in-line with the high standard we apply to managements in other industries, we set out to identify the rare gold and silver mining CEO and board intent on behaving differently from their peers. We carefully studied proxy statements and analyzed the behavior of board members as well as company executives, speaking with several board members at each of our larger holdings. Board dynamics, as we have painfully learned, are essential to predicting the likelihood that a mining company will consistently compound value for shareholders. Our recent experience at IAMGold provides a helpful case in point.

In 2010, IAMGold hired an outsider, Steve Letwin, as CEO. We had hoped that Steve, with his successful career in the pipeline industry, would bring capital discipline to IAMGold. But, rather than capitalize upon the company’s sizable cash position and low stock price, IAMGold acquired the large, technically challenging, low-grade Côté Gold project. The addition of this $1.5 billion dollar project with questionable economics clearly suggests to us that Steve was not able to bring the change that IAMGold needed. That said, the stewardship problem at IAMGold centered in the boardroom rather than the executive suite. Specifically, as explained to us, it was the board that pressed for an acquisition. Steve merely acceded to the board’s ill-advised growth strategy.

IAMGold is just one of many such examples that highlight for us the depth of conviction that management must have in order to reject the patterns of behavior that dominate the mining industry. After all, rejecting the norms of the Canadian mining industry has significant costs for the individual executive involved. Outlier managements are implicitly calling out their peers and shining a light on the industry’s practice of enriching executives and board members at minority shareholders’ expense. This rejection of the accepted pattern of behavior requires an extraordinary level of motivation. Accordingly, not only have we sought to identify managements and boards willing to do things differently, but we have also sought to understand why they are willing to do things differently. Our analysts identified a few reliable motivators which may indicate a truly exceptional mining company executive and board:

1) Many of the best-managed boards and executive suites are not physically located in either Toronto or Vancouver. Managements located elsewhere are more likely to have the critical distance to see that the industry’s common pattern of behavior is unacceptable.

2) There is no substitute for high levels of insider ownership. If management are owners, they are more likely to behave like owners. Stock options and restricted stock grants are not effective in aligning the interest of insiders with minority shareholders. In fact, large scale option and share grants are often used to enrich insiders at shareholders’ expense.

3) Our managers understand that just because a behavior is legal does not mean it is acceptable. Many have expressed disgust at the compensation and disregard for minority shareholders that typifies the industry, but few have gone on record with their opinions. Clive Johnson of B2Gold is a notable exception. (read: http://business.financialpost.com/2013/03/05/mining-industrys-dirty-little-secret-entrenched-management/).

Our decision to focus on management and governance does not mean that management teams and board members of the companies in which we are invested are flawless. In fact, their behavior regularly reminds us of their fallibility as well as our inability to accurately judge character and motivation. That said, our managers are determined to make money through mining and are not so cynical so as to be focused on enriching themselves at the expense of the owners of their companies.

Finally, while we recognized that our outperformance in 2012 and 2013 has still generated a substantial loss for our partnership, it has also given us an extraordinary opportunity. Importantly, we were able to be aggressive buyers of these companies at very attractive prices throughout the forced selling in May and June. Therefore, with only a modest increase in the gold price, we believe our gold and silver mining holdings will post significant gains. For example, an increase in the gold and silver price to $1,700 and $30 respectively would put our miners at just 4.4x 2014 cash flow. Moreover, in our opinion, the tightness in the physical gold market and persistence of easy money continue to make significantly higher prices in gold and silver likely.

India

We cannot create [financial market] depth by banning position taking, or mandating trading based only on well-defined ‘legitimate’ needs.”[2]

—Raghuram Rajan in his first speech as Governor of the Reserve Bank of India

“If I have one wish which the people of India can fulfill is don’t buy gold.”[3]

—Indian Minister of Finance P. Chidambaram

Raghuram Rajan’s first speech as RBI governor is important not just because of its free market orientation; it is important because it offers a clear alternative to India’s growing appetite for financial repression. Specifically, it offers an alternative to the policies of India’s Finance Minister, P. Chidambaram, who has not only sought to persuade his fellow countrymen to forgo gold ownership but has also engineered a series of aggressive measures designed to suppress gold ownership.

Indians’ propensity to save in both rupees and gold has made India the largest gold importer in the world. India has been importing on average 900 tons annually in recent years, or approximately one third of the world’s annual mine supply. Moreover, Indians hold an estimated 20,000 tons of gold privately. For comparisons sake, these gold holdings are almost equivalent to the value of all rupee-denominated bank accounts. In sum, the wide acceptance of gold as money in India makes India a de facto dual currency market.[4]

Dual currency systems such as India’s provide both a welcome choice for the individual saver and an unwelcome discipline for government. For example, when the Indian government effected a more than 60% reduction in the amount of capital that Indians could take abroad, from $200,000 to $75,000, Indians did not lose their ability to flee the rupee. While the restriction limited their ability to swap their rupees for dollars or euros, gold remained an effective substitute for domestic savers wishing for an alternative currency. This unimpaired ability of Indians to sell rupees for gold effectively deprived the Indian government of the ability to force domestic savings into rupee-denominated accounts.

Rather than respond to rupee flight with better policies that would improve the underlying fundamentals of the Indian currency, the Indian government attempted to silence the unwanted market signal. First, the Indian government sought to make gold less useful by making it harder to leverage. In March 2012, the RBI came out with a number of new regulations for non-bank finance companies which lend against gold. While these lenders posed no systemic credit threat, the government unilaterally reduced their loan-to-value caps, increased their capital requirements, and prohibited the use of gold bullion and coins for collateral purposes. This last action, which has no basis in credit risk supervision, suggests a desire to punish those holding gold.

Having already targeted gold ownership, the RBI put together a working group to study the issues related to gold imports and gold loans by non-bank finance companies. In the group’s report released at the end of 2012, their recommendation could not have been clearer, “there is a need to moderate the demand for gold imports. We need to opt for a series of demand reduction measures, supply management measures and measures to increase the monetisation of gold.”[5]

With the policy prescription clearly laid out, the moves became even more aggressive. Most notably, India hiked import duties on gold three times in eight months. Since the beginning of 2013, duties on gold imports more than doubled to 10%. The Indian Ministry of Finance also enacted simple restrictions on the import of gold. For example, they recently banned the import of coins and medallions.[6]

In addition to the aforementioned official measures, the Indian government has used its influence to “dissuade” regulated entities from facilitating gold ownership. Under direct regulatory pressure, India’s jewelers and banks have stopped selling gold coins and bars. The pressure in this case must have been overwhelming, as gold bars and coins represented over a third of the jewelry industry’s total revenues.[7]

Predictably, this series of attacks on the free movement of Indian domestic savings has produced a loss of confidence rather than a quick fix. This failure coupled with Rajan’s appointment makes it increasingly likely that the government will turn to more market-oriented policies rather than continue down the path of financial repression. On this basis, we have used the late summer declines in Indian stocks to buy several superior Indian businesses. We, of course, will be vigilant in monitoring India’s economic policy, but we remain hopeful that India will seek to address their relatively modest imbalances rather than suppress them. Mr. Rajan sums up the nature of India’s challenge perfectly:

For the most part, India’s current growth slowdown and its fiscal and current account deficits are not structural problems. They can all be fixed by means of modest reforms. This is not to say that ambitious reform is not good, or is not warranted to sustain growth for the next decade. But India does not need to become a manufacturing giant overnight to fix its current problems. [8]

Sec exam

In the past few years, recognizing that we were overdue for a substantive SEC exam, and knowing the regulatory scrutiny our industry faces, we allocated more capital to our compliance budget. In 2011, we hired a new Chief Operating Officer/Chief Compliance Officer with extensive compliance experience. In addition, last year, we hired Ascendant Compliance Management to examine our compliance program and flag any deficiencies. Ascendant and another outside consultant assist our CCO in the ongoing maintenance and testing of our compliance program. On July 31, 2013, after an extensive, routine examination which took about three months—three weeks of which SEC examiners spent in our offices—we are pleased to announce that we received a standard “deficiency letter” that presents minimal issues for correction. Our outside counsel, Ropes & Gray, has affirmed that the letter is an outstanding result. Specifically, the SECs comments related to constructive suggestions on some of our compliance policies as well as minor modifications to some language in our marketing materials and on our website. We have subsequently replied to the SEC’s suggestions and have already confirmed agreement with them on two minor points. Please contact us should you like to see copies of the SEC correspondence.

new partner and analysts

Equinox’s long run success rests upon the significance and endurance of our insights into the businesses we own. Over the past four years, our research analyst Andrew Ewert has produced a series of such valuable insights. He has an uncanny ability to sift through the noise and focus in on the factors that make a business special. Recognizing his talent and unique contribution to our team, we have made Andrew a partner, thus bringing our team of portfolio managers to four. We recommend that you make an effort to meet with Andrew during your next visit to our offices in New York. Additionally, our research team is now seven strong as we welcomed recent college graduates Scyrine De Veaux and Andrew Koger in August.

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

END NOTES

[1] Returns stated for Equinox Partners, L.P. Returns will differ for Equinox Fund International, Ltd. Sector and country returns are presented herein on a gross basis and use relevant period P&L and average capital in determining contribution and internal rate of return.

[2] Full text of speech: http://timesofindia.indiatimes.com/business/india-business/Full-text-of-RBI-governor-Raghuram-Rajans-maiden-speech/articleshow/22293598.cms

[3] The Times of India, Don’t buy gold, P Chidambaram urges citizens, June 14, 2013. http://timesofindia.indiatimes.com/business/india-business/Dont-buy-gold-P-Chidambaram-urges-citizens/articleshow/20582677.cms

[4] Gold figures from World Gold Council

[5] Report of the Working Group to Study the Issues Related to Gold Imports and Gold Loans by NBFCs in India: http://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/RWGS02012013.pdf

[6] Reuters, Timeline – India’s efforts to curb gold imports, August 19, 2013. http://in.reuters.com/article/2013/08/19/india-gold-timeline-idINDEE97I08O20130819

[7] The Times of India, Jewellers join government’s campaign to cut gold buying, June 24, 2013. http://articles.timesofindia.indiatimes.com/2013-06-24/india-business/40165327_1_world-gold-council-gold-imports-jewellery-trade-federation

[8] Raghuram Rajan, A case of India, live Mint, September 11, 2013. http://www.livemint.com/Politics/hrQfq1PT5wJdsNjMh2kL9K/India-can-and-will-do-better-says-Raghuram-Rajan.html?ref=mr