Equinox Partners, L.P. - Q2 2010 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Equinox Partners appreciated 2.2% in the quarter ended June 30, 2010. As of August 31, 2010, our fund was up 14.1% for the year-to-date.

Our Asian Businesses Remain Attractive

Despite trading well through their peak 2007 levels, our Asian businesses remain attractively valued—13.1x this year’s earnings and just 10.5x 2011 estimates. These low multiples are particularly surprising given the proven resilience of the superior, rapidly growing businesses that we own there. Even in a year like 2008, our current holdings were able to basically maintain their profitability. The look-through earnings of the Asian companies we now own declined by just 6% in 2008. Moreover, these companies rebounded quickly, posting 17% earnings growth in 2009 and are on track to post 31% earnings growth in 2010. While we realize that this rate of earnings growth is not sustainable in the long-run, we do expect our Asian holdings to again generate earnings growth of close to 23% in 2011.

A brief glance at the average PE multiples in the Asian region reveals just how exceptional our Asian holdings are. This valuation gap is even more impressive when you realize that our holdings are not concentrated in the low multiple, low growth markets. In fact, our largest country weightings are Indonesia and India—two of the most highly valued markets in the region—with the Jakarta Composite Index and the Indian SENSEX trading at 15.7x and 17.8x this year’s earnings respectively. Given the disparity between the average multiple of these indexes and the multiple of our holdings, it may become difficult for us to maintain our exposure in Asia if we exit any of our larger Asian positions. While we hope through diligence and company specific analysis that we will continue to uncover great values in the region, we concede that this process will become more and more trying if valuation levels continue to rise.

Equinox’s Oil and Gas Equities:

“When the facts change, I change my mind. What do you do, sir?” —John Maynard Keynes

Over the years, Equinox allocated a significant portion of our portfolio to petroleum stocks. We embraced the concept that accelerating demand for energy from emerging economies was colliding with the world’s geological limits of oil and gas production. This idea, popularly known as “peak oil”, highlighted the fact that the world’s aging giant oil fields were facing their “twilight”—the inevitable decline in their production. A parallel symptom was the apparent exhaustion of North American gas reserves (a close energy substitute for oil)—symbolized by the large scale construction of coastal terminals designed to import liquefied natural gas (LNG). It seemed that the decline of world-wide petroleum production was upon us and that the spiking of oil and gas prices prior to the global financial crisis was a reflection of this disturbing new reality. The only problem with this provocative hypothesis is that it may be incorrect. Technology, or more accurately, technique, has ridden to the rescue. A new well drilling technique that combines horizontal drilling into hydrocarbon charged rock with an aggressive, multi-staged fracturing technology (frac’ing) has significantly improved the production and recovery of energy from heretofore difficult or impossibly impermeable rock formations (i.e. shale and tight sands). The result is increasing production volumes and reserves with attendant lower finding and development (F&D) costs.

This new drilling approach was first evidenced in the development of natural gas from shale formations around the Dallas/Ft Worth area. The Barnett Shale natural gas play developed over the last decade has demonstrated the economic viability of this new technique (production is up fivefold since 2004). Subsequently, the Fayetteville in Arkansas, the Woodford in Oklahoma, the Marcellus and Haynesville shale regions in the US and the Montney in Canada began to be developed. New promising gas plays like the Horn River and Utica in Canada are also currently being explored.

First developed by pioneering mid-tier US independent gas companies like Mitchell Energy, Devon and Southwestern Energy, shale gas development became the principal business of other large North American independents such as Chesapeake, Encana and Talisman Energy. Recent purchases of shale gas plays by majors such as Exxon’s $41bn (including debt) acquisition of XTO, Shell’s $4.7bn takeover of East Resources and India’s Reliance Industries’ overtures into North American shale would seem to legitimize the long-term economics of this new technique.

Not surprisingly, the new exploitation technique is not limited to natural gas alone. The recent Eagle Ford Shale in South Texas not only has a distinct gas layer but also contains high grade condensate and oil reservoirs. The Bakkan area of Southeastern Saskatchewan and Northern Montana, once spurned as a non-productive tight oil play, is now one of the most profitable new oil developments in North America. And, the potential for both gas and oil shale in foreign lands has just begun to be developed as well: “Chevron, ConocoPhillips, ExxonMobil, Marathon, Talisman, among others, hold shale gas licenses in Poland”.[1] BP is looking to joint venture with Chinese energy giants to explore and develop shale gas in that vast and underexplored country.

To illustrate its appeal, consider the economics of developing a core Marcellus Shale gas well in northeastern Pennsylvania. The capital costs for drilling and completion are about $4.2 million per successful well, and industry experts forecast recovery to be 4 billion cubic feet (bcf). Assuming a 12.5% royalty rate, 3.5 bcf would be generated for the operator. Thus, the F&D costs are $1.18 per thousand cubic feet (mcf). With operating costs at about $1.90/mcf added in, the operator can generate a 15% rate of return on the well with a benchmark gas price of $4.14/mcf.

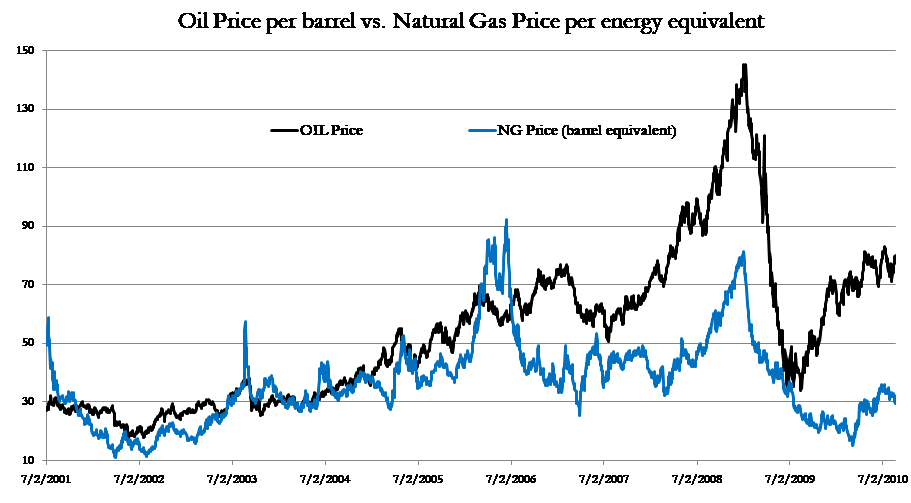

Equinox has monitored the progress of horizontal drilling and multi stage frac’s for a number of years. For a while it appeared that this new technique was limited to North Texas and a few other special formations. However, as the practice has spread beyond its early successes, we became concerned about its impact on North American natural gas prices. In the summer of 2008, when gas prices hit $13/mcf simultaneous to the announcement of major new shale gas plays such as the Haynesville, we bought puts on natural gas as insurance against its price collapse. In the ensuing months, we sold our puts at a substantial profit in the deflationary crash of the 2008 credit crunch. We also liquidated our gas stocks. Subsequent to 2008 the oil price has regained much of its decline while North American natural gas prices, impacted by large increases in shale gas production, have not (see graph below).

Today, our energy portfolio is considerably smaller and is composed almost exclusively of oil producing companies, as the investment implications of this new petroleum exploitation method seem bearish for hydrocarbon prices, particularly natural gas. But, we believe that oil prices might well be vulnerable too. With one barrel of oil energy equivalent to 6 mcf of natural gas, current depressed natural gas prices already threaten the current oil price structure (see graph above). If natural gas were to become more widespread as a transport fuel (this trend is already starting with trucking fleets in Canada, buses in New York, and taxis in New Delhi) natural gas would become a much more effective substitute for oil. Then the low capital cost of this technique, and consequent profitability at low natural gas prices, could be quite bearish for oil. Assuming the $4 per mcf sale price for natural gas implied in the examples above, and multiplying by the energy equivalency factor of 6, suggests that oil would need to be $24 per barrel to compete.

Equinox still sees the growth of global oil supplies as a herculean task. With annual decline rates of world oil production nearing 6 million barrels per day, global oil production may well be “peaking.” However, the potential for large increases in substitutable natural gas production, evidenced by the reversal of flows from import to export of LNG for the newly constructed North American terminals, has changed our view of global petroleum pricing. Our confidence in meaningfully higher hydrocarbon prices has been replaced by uncertainty. Hence, Equinox has significantly reduced our exposure to the energy industry.

Distribution of Securities to the General Partner

In response to potential changes in the taxation of hedge fund General Partner distributions, we are considering taking future redemptions in the form of securities as opposed to cash. We want to assure our limited partners that if we do make in-kind redemptions, we will do so in a way that does not alter the partnership’s portfolio nor impose extra costs on limited partners.

Sincerely,

Sean Fieler

William W. Strong

END NOTES

[1] Jeb Armstrong and Scott Stevens, CLSA Blue Books: Global Power & Gas, Page 25, May 28, 2010.