Equinox Partners, L.P. - Q1 2011 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Equinox Partners fell –3.3% in the quarter ended March 31, 2011. For the year-to-date through May, our fund was down –6.9%. Thus far in June, the fund has declined an additional -3.8% bringing our year-to-date return as of June 23rd to -10.5%.

This year’s underperformance is attributable to sizable declines in our mining companies as well as weakness in our principal emerging market holdings. On average, the shares of our mining companies have declined 10% so far this year despite the fact that gold and silver are both up sharply for the year. Adding to these losses, our investments in Brazil and India have declined in line with those markets. In response to this sell off, we have begun to edge up our long exposure and are poised to increase it further if these declines persist.

Value Investing in the Middle East

While only a few percent of Equinox Partners is currently invested in the Middle East, we have traveled to the region repeatedly in hopes of identifying exceptional businesses that we would own at the right price. As a result of these trips, our impressions of the Middle East are not framed solely by the politics that make headlines but also incorporate the economic dynamics that have underpinned the regional uprisings. This additional perspective has helped us more clearly see the link between the region’s economic problems and political unrest. Specifically, the very forces that make the region desirable as an investment location (i.e. attractive demographics, undervalued currencies, corporate reform and a desire to reduce corruption) are the same forces causing severe political friction as incumbent political regimes struggle to preserve the status quo.

Our previous experience investing as sclerotic regimes struggle with calls for greater economic and political freedom, though limited, has been broadly positive. The Indonesian President Suharto’s fall from power is a case in point. Following his hastily arranged resignation in the face of massive but largely peaceful protests, Indonesia descended into an extended period of political uncertainty. Shortly following his resignation, regional independence movements from Aceh to East Timor gained momentum and some foreign observers even began to wonder whether the country would literally fall apart. Instead of relying on journalistic opinion, we dug deeper into Indonesia’s political situation and met with several well run local businesses. Our on the ground work and network of local experts suggested that catastrophic political instability was unlikely and that strong economic growth was all but guaranteed if the worst form of political chaos could be avoided. As a result of this conclusion, we were able to make a meaningful investment in some of Indonesia’s best businesses at prices well below their intrinsic value.

Admittedly, the cycle of violence and perennial prospect of war in the Middle East significantly raise the cost of political uncertainty as well as questions about the applicability of Indonesia’s mostly peaceful transition to a representative government. Even an optimist would concede that Indonesia’s path is only relevant for countries enjoying largely peaceful uprisings, whereas countries undergoing violent transitions are almost certainly on a different path that is unlikely to lead to desirable forms of economic and political liberalization any time soon. Moreover, Indonesia’s struggles with unwanted foreign interference, Islamic nationalism, tribal divisions and serious secessionist movements look manageable if not trivial in comparison to the sectarian and tribal divisions in the Middle East. And, it should be noted that there is the real possibility of a larger conflagration that could engulf several countries in the Middle East.

Without diminishing these preceding disclaimers, we want to point out that if some countries in the region do manage to muddle through and emerge with a more representative, more sustainable political structure, as Indonesia did, owners of the well run, high return on capital businesses in the Middle East will be richly rewarded. In fact, absent a very bad outcome, there is good reason to be particularly optimistic about much of the region. The region’s fundamentals offer an ideal combination of macroeconomic strength and micro economic reforms—a combination that is the exact opposite of the economic forces at work in the developed world. More specifically:

Attractive Demographics:

A combination of high fertility rates and worker migration has resulted in some of the very highest population growth rates in the world. On average, populations in the Gulf Cooperation Council (GCC)[1] are growing at ~2% per year[2], and the region’s population is expected to more than double by 2050.[3] This growing population will drive consumption across the region even without rising per capita incomes.

Undervalued Currencies

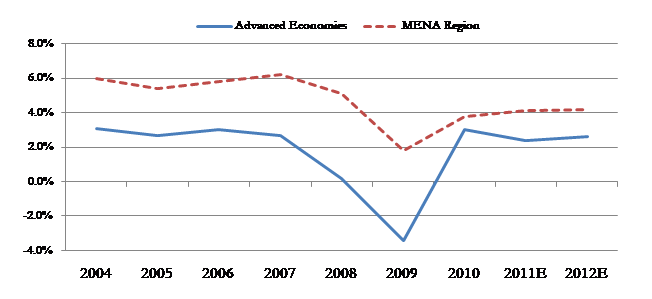

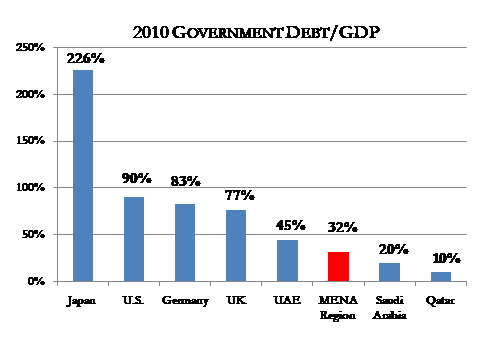

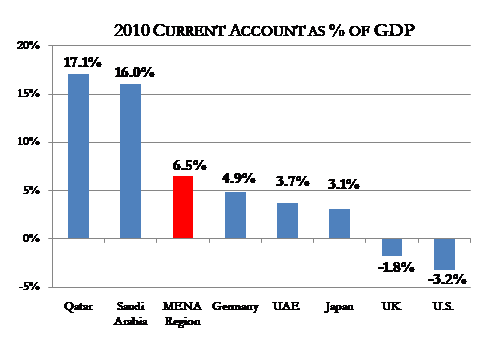

All of the currencies in the GCC are de facto pegged to the dollar. The combination of these dollar pegs and dollar depreciation has resulted in the sizable undervaluation of many currencies in the region. This undervaluation is particularly surprising given the region’s natural resources, fiscal and current account surpluses, modest debt to GDP levels, and strong real GDP growth (see graphs below).

Corporate Reform:

While we have only uncovered a handful of high-quality, well-managed businesses that we would own in the Middle East, we are impressed by the overall level of corporate behavior in the region. Capital allocation, transparency and corporate governance are good when compared to most other emerging markets. Furthermore, the combination of professionalized management and a large inside shareholder that typifies listed companies in the region has two principal benefits. Professional management reduces some of the execution issues and the risk of inside dealings, while the presence of a dominant shareholder prevents management from pursuing its own interests at the expense of shareholders. One happy outcome of this combination is high dividend payout ratios. The local stock indices in Qatar and Saudi Arabia, for instance, currently have dividend yields of 4.3% and 3.4% respectively.

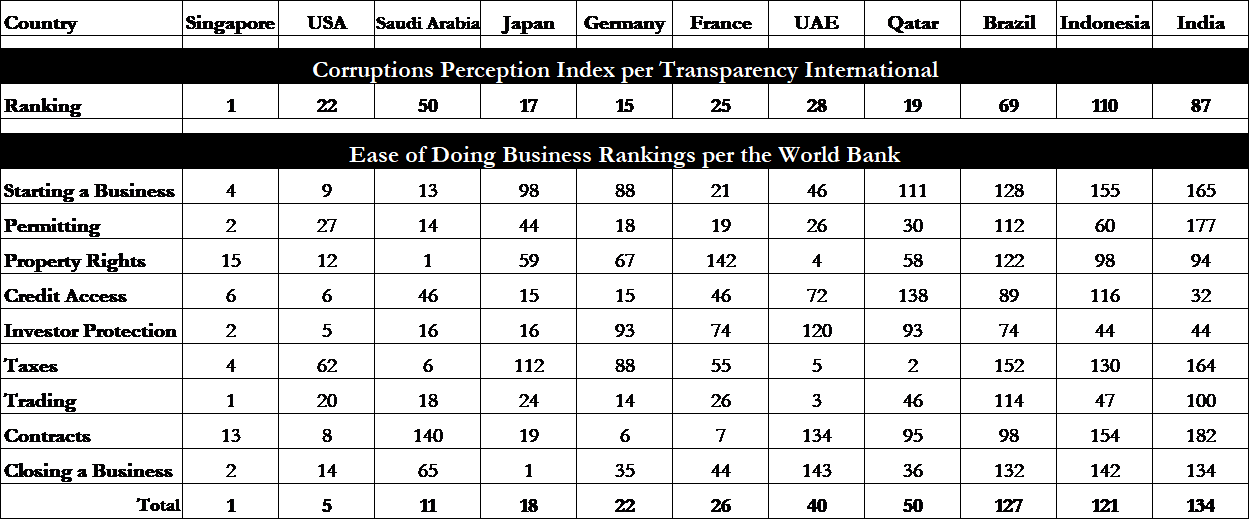

Unexceptional Corruption

While some markets in the region are hopelessly corrupt, endemic corruption looks unlikely to strangle development across the entire region. It might surprise you to learn that Saudi Arabia ranks 11th in the World Bank’s Ease of Doing Business list, a ranking well above both Brazil and India. And, anecdotally, in the more developed markets in the region, the UAE and Qatar in particular, we simply don’t hear the typical complaints about petty corruption that are so common in the developing world. That said, absent a free press and with lèse majesté laws still enforced, it is difficult to say too much on this front other than the level of corruption appears largely unexceptional (see tables below).[4]

A decade ago, hesitant to make an investment in Indonesia, we met with the management of Unilever Indonesia and, as a result, became much more confident in Indonesia’s future. At the time, Unilever Indonesia’s financials were indecipherable. In fact, the Rupiah was down so sharply against the dollar that the income statement did not even reveal if the company was growing or shrinking. Only by analyzing the business in terms of the tonnage of product shipped were we able to get an accurate sense of its operations. Surprisingly, this analysis revealed annual volume growth in many of Unilever Indonesia’s key SKUs during the worst years of the Asia Crisis. Similarly in the Middle East today, we are observing growing consumption despite the upheaval, and we are greatly encouraged by the strength of the underlying economies in the region. While valuations in the region aren’t flat-out cheap as they were a decade ago in Indonesia, if we do get a further correction and more political clarity, we could lift our weighting in well run businesses in the Middle East into the high single digits.

Sincerely,

Sean Fieler William W. Strong

President Chairman

END NOTES

[1] GCC countries : Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and United Arab Emirates

[2] IMF World Economic Outlook, 2011

[3] United Nations, World Population Prospects, 2008

[4] The Ease of Doing Business Index is created by the World Bank. It analyzes pertinent laws and regulations in order to develop a ranking based on the average of 10 subindices. The Corruptions Perception Index is reported annually by Transparency International. It ranks countries in regards to the misuse of public power for private benefit among public officials. It is a composite index of 13 sources released from 10 different institutions.